January 2025

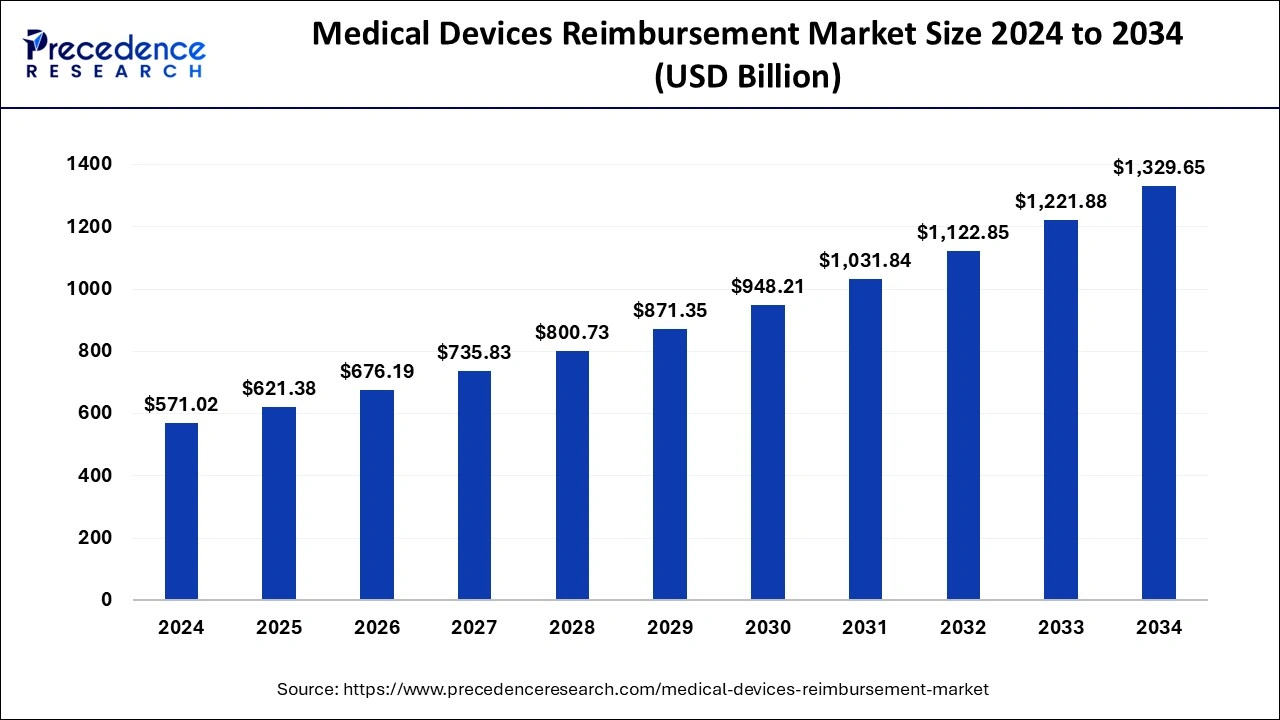

The global medical devices reimbursement market size is calculated at USD 621.38 billion in 2025 and is forecasted to reach around USD 1329.65 billion by 2034, accelerating at a CAGR of 8.82% from 2025 to 2034. The North America medical devices reimbursement market size surpassed USD 287.17 billion in 2024 and is expanding at a CAGR of 8.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical devices reimbursement market size was estimated at USD 571.02 billion in 2024 and is anticipated to reach around USD 1329.65 billion by 2034, expanding at a CAGR of 8.82% from 2025 to 2034.

Artificial intelligence holds potential to revolutionize healthcare with AI-enabled clinical services collaborated with patient care, assisting clinicians in diagnosing, treating patients. The strategies of financing and reimbursement for AI-based medical devices change across different countries. They are generally covered by public and private health insurance programs.AI powered medical devices could be reimbursed if they meet the coverage criteria of the insurance providers, fueling the technological facet of medical devices reimbursement market.

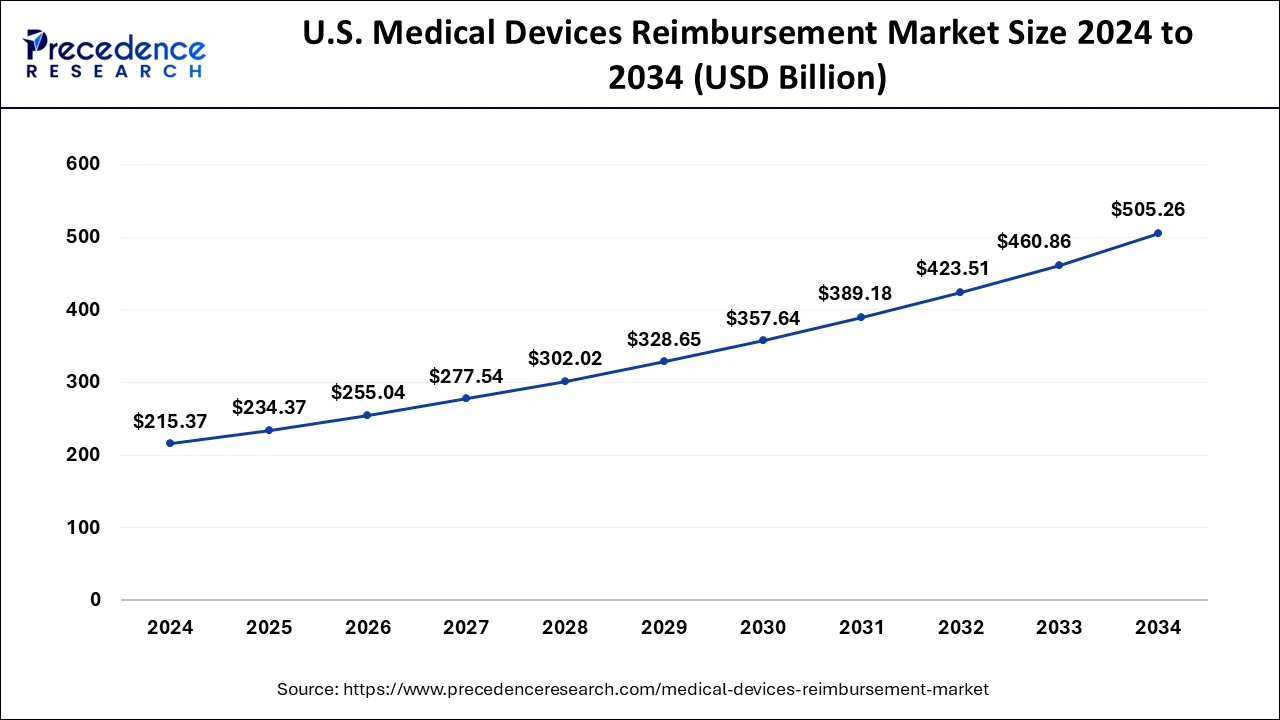

The U.S. medical devices reimbursement market size was evaluated at USD 215.37 billion in 2024 and is predicted to be worth around USD 505.26 billion by 2034, rising at a CAGR of 8.90% from 2025 to 2034.

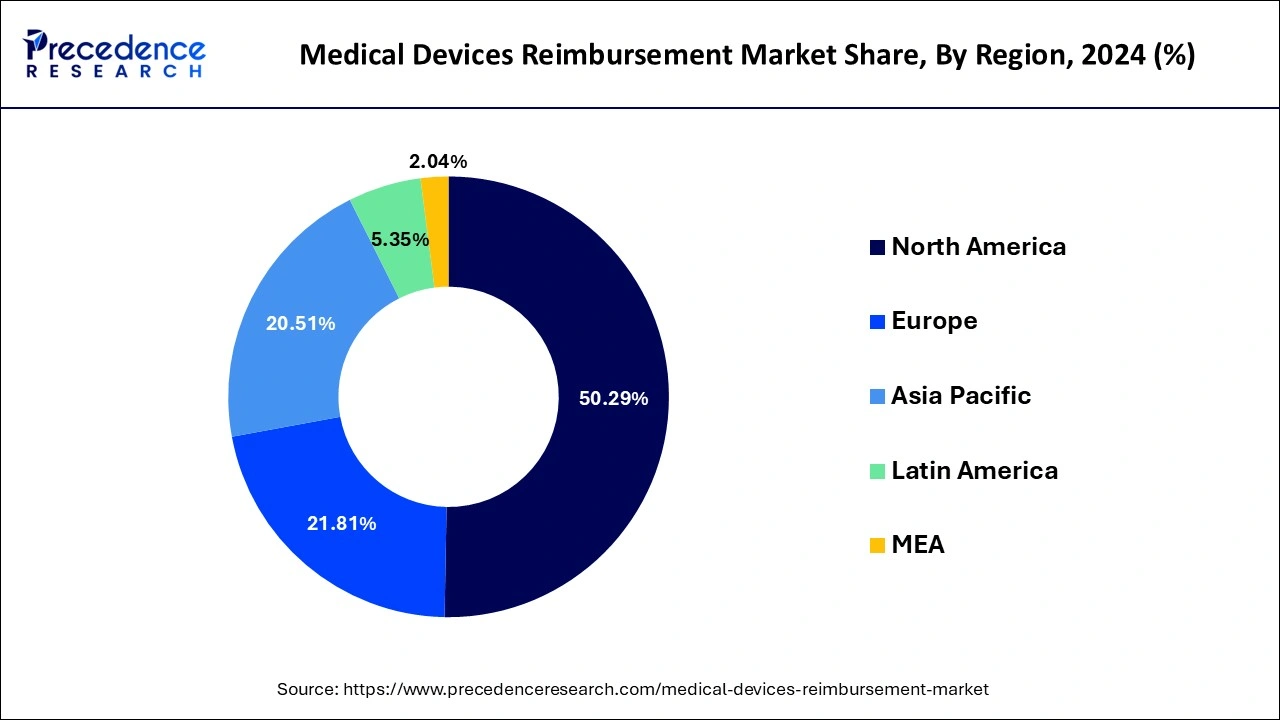

North America dominated the global medical devices reimbursement market with the largest market share of 50.29% in 2024. Over the forecast period, the medical devices reimbursement market is expected to be stimulated by rising cases of numerous severe diseases. Furthermore, in comparison to other regions, the reimbursement structure is the most advanced within the North America region.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. Due to increased healthcare expenditures, expanding resource demand, and increasing chronic diseases prevalence in emerging nations, Asia-Pacific is expected to rise significantly throughout the projection period.

The regulatory bodies across the globe are recognizing the value of medical devices reimbursement along with favorable healthcare policies. Regulatory bodies and government are collaboratively working to achieve a supportive reimbursement environment and providing clearer guidelines for device reimbursement. Thus, the rise in healthcare expenditure world widely in economically evolving countries is the key driving factor for the market.

However, lack of proper guidance, discontinuation of coverage, strict reimbursement policies along with reimbursement coding and documentation challenges are impeding factors for the market's growth. Though, advancement in healthcare for improved living status and better access for medical care holds potential to combat these Challanges, expecting to increase markets growth in the forecast years.

| Report Coverage | Details |

| Market Size in 2025 | USD 621.38 Billion |

| Market Size by 2034 | USD 1329.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Payer, Healthcare Setting, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The private medical devices payers segment contributed the highest market share in 2024. The presence of high number of private businesses in the industry is credited with the segment’s rise. Over the forecast period, the segment is expected to maintain its dominance. Furthermore, the rising prevalence of diabetes and cancer, as well as increased need for better treatment, are driving factors for the growth of the segment during the forecast period.

The public medical devices payers segment is expected to grow at a significant CAGR from 2025 to 2034. The rising acceptance of public payers in emerging and developed regions, as well as increased innovation in the production of new medical devices, are important factors driving the public medical device payer’s segment growth.

The hospitals segment captured the biggest market share in 2024. During the forecast period, the segment is expected to retain its dominance. Additionally, the segment is being driven by the growing ageing population and the rising prevalence of chronic disorders. In large scale settings such as hospitals, the rising frequency of chronic illnesses is boosting demand for medical devices reimbursement.

The outpatient facilities segments is estimated to be the fastest-growing segment during the forecast period. Due to increased research and development investments and the rising frequency of chronic diseases, the outpatient facilities segment is expected to grow at the fastest rate over the projection period. Furthermore, the segment is expected to be fueled by the growing need for pharmaceuticals and their cost-effective production.

The medical devices reimbursement market is relatively fragmented, with a few large-scale worldwide firms and several small-scale regional competitors. They have long term contracts with medical care organizations around the world and are forming strategic alliances and collaborations with other companies in different countries to expand their business. The significant market innovations will also fuel the global industry’s growth. To strengthen their position in the medical devices reimbursement market, major firms use strategies such as collaborations, mergers, acquisitions, and the development of new products. To create technologically improved products, key market players are heavily spending in research and development activities.

By Payer

By Healthcare Setting

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025