January 2025

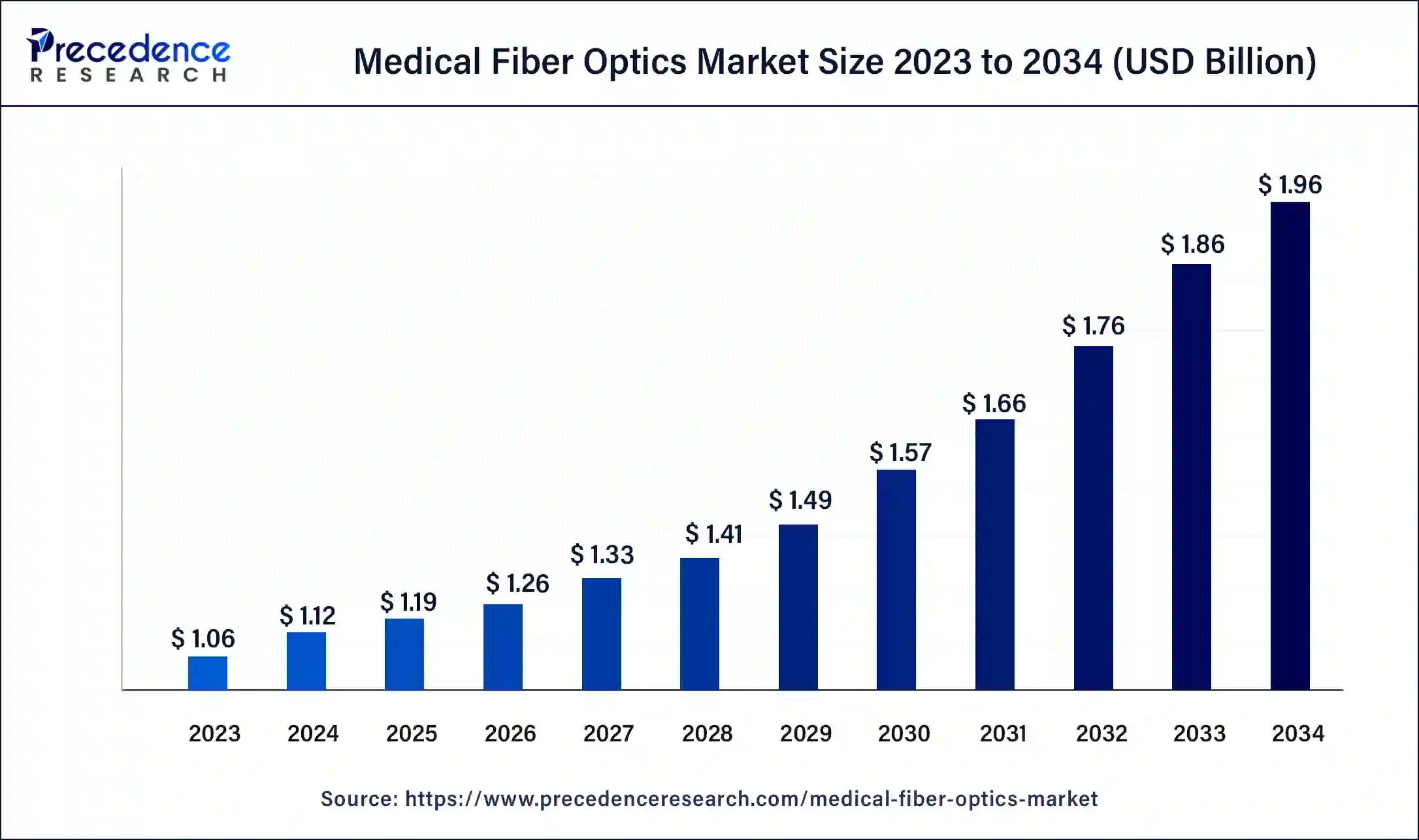

The global medical fiber optics market size was USD 1.06 billion in 2023, estimated at USD 1.12 billion in 2024 and is anticipated to reach around USD 1.96 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034.

The global medical fiber optics market size accounted for USD 1.12 billion in 2024 and is predicted to reach around USD 1.96 billion by 2034, growing at a CAGR of 6% from 2024 to 2034.

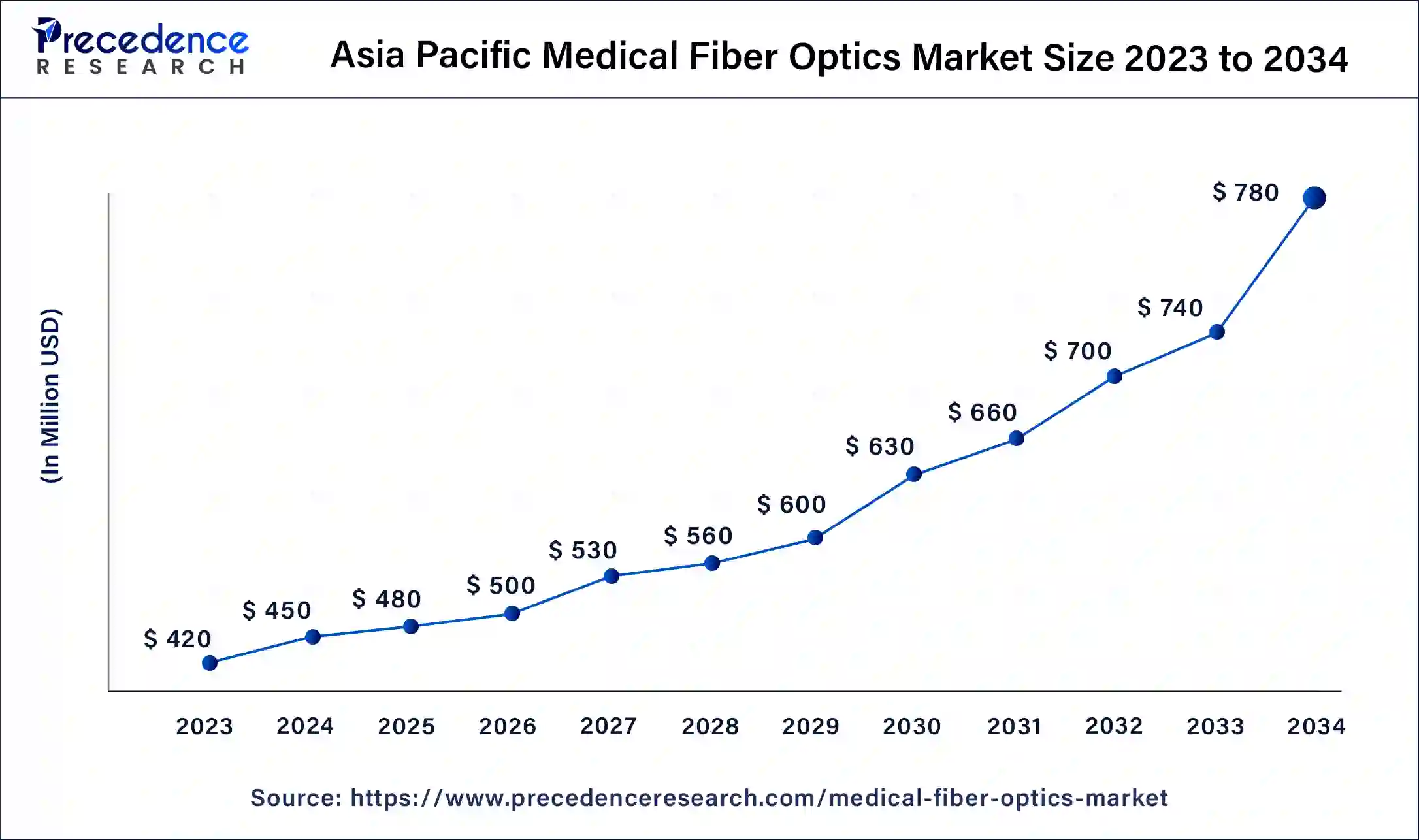

The Asia Pacific medical fiber optics market size was estimated at USD 420 million in 2023 and is predicted to be worth around USD 780 million by 2034, at a CAGR of 6.50% from 2024 to 2034.

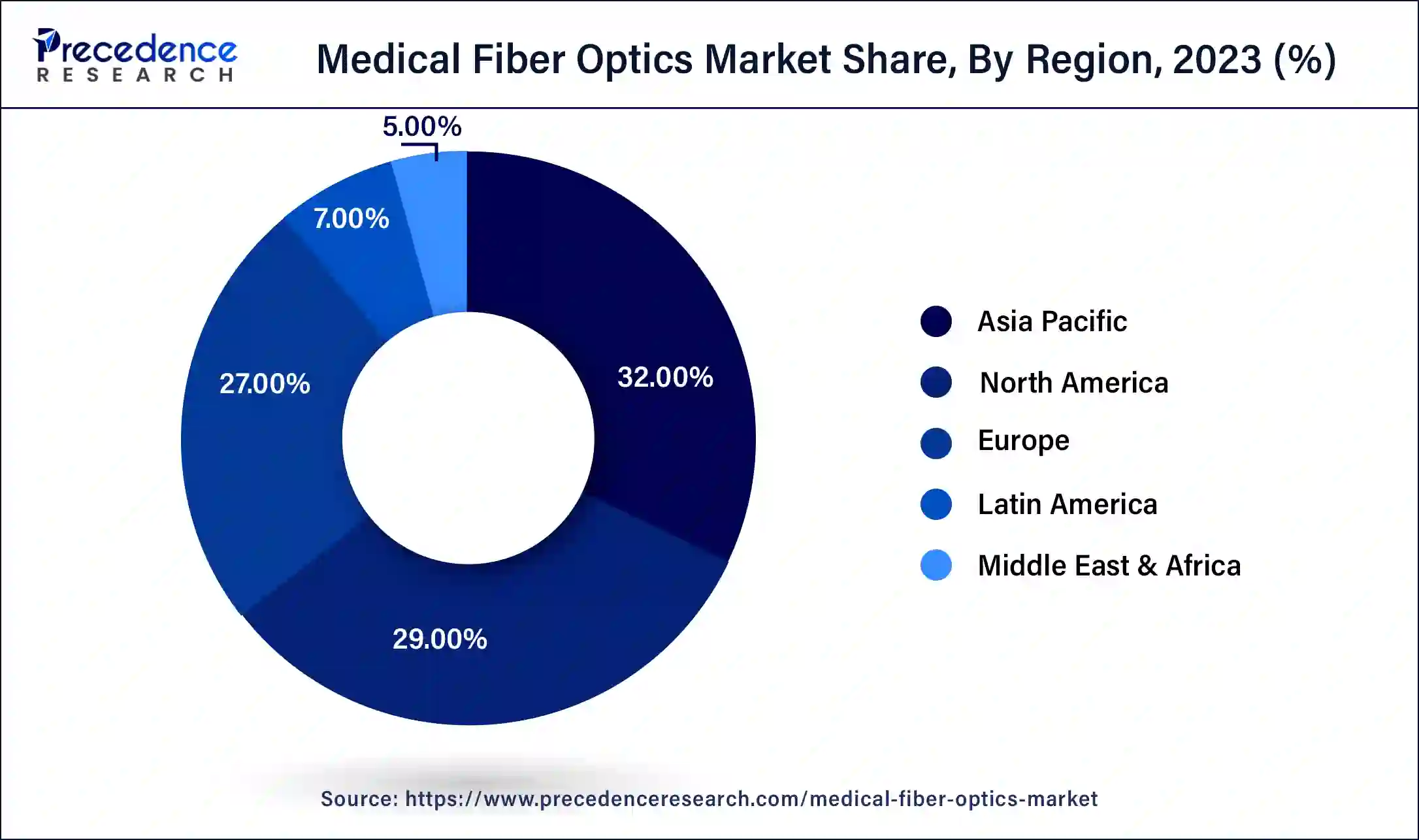

Medical fiber optics market is taken by Asia Pacific owing to rising awareness about the usage of medical fiber optics in emerging economies. Also, Most of the key players operating in the industry are investing heavily in order to get the competitive edge in the medical fiber optics market in Asia Pacific. North America is likely to list the noteworthy CAGR, on account of increased disposable incomes along with the innovatively advanced healthcare infrastructures, healthy medical delivery systems as well as greater healthcare expenditure, particularly in the U.S. of the North America. Addition to this, presence of leading players in the region along with strategies that are implemented by the major players in the countries of North America is expected to witness substantial growth in the target industry in the near future.

A higher demand for improved tools for diagnosis and surgeries for improving patient’s health, surgery has been generated by world population growth and extended life spans. The augmented usage of minimally invasive surgery to reduce hospital stays as well as to decrease costs has been one major advancement in healthcare. It's clear that in medicine, fiber optics are at this time to stay. Minimally invasive surgery is a surgical surgery conducted in small incisions rather than large incisions. These surgical procedures are gaining huge popularity in hospitals and clinics worldwide as there is decreased blood loss. In addition, minimally invasive surgery provides short stays in the hospital, less complications and low costs. Fiber optics are used for these operations because they are highly versatile, lightweight, and highly localized measurements can be mounted in tight spaces. Thus, during the forecast era, these factors are expected to drive the growth of the global market for medical fiber optics.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.06 Billion |

| Market Size in 2023 | USD 1.12 Billion |

| Market Size by 2033 | USD 1.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Largest Market | Asia Pacific |

| Segments Covered | Type, Application, Usage, End User, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

COVID-19 Impact on Global Medical Fiber Optics Market

The COVID-19 explosion has had an impact on world's primary markets. COVID-19 effect on the global industry is adverse. The North America is largest medical fiber optics market, but supply and demand for the medical fiber optics has decreased with spread of covid and lockout situations in the U.S.Because of COVID-19, instability of the supply chain, volatility in the supply of raw materials, inadequate manpower in the production facility and less demand for end-use customers have hindered the growth of the target industry in developed and developing economies worldwide.

Future of Global Medical Fiber Optics Market

Leading players of the global medical fiber optics industry are focusing on the strategic partnerships similar acquisitions, mergers in order to enhance their position in the global market and to get the comparative edge. Further companies are launching advanced products in order to fulfill the customized demands of the end-users. These trends are anticipated to continue and will fuel growth of target market over the forecast time-frame. For instance, the major company Fiber guide Industries Limited has introduced square core optical fibers in 2019. These fibers are designed in order to improve optical performance of production processes.

Illumination Segment Reported Foremost Market Stake in 2023

Illumination are expected to hold the largest revenue share by application due to the increasing numbers of endoscopic surgeries worldwide where the optic fibers are used as a light source. This factor is anticipated to drive growth of the illumination segment during the forecast period of time.

Hospitals are Projected to Dominate the End user Segment of Medical Fiber Optics Market Revenue

On the basis of end user segment hospitals segment is expected to dominate in terms of revenue over the forecast time frame. The growth is owing growing demand for medical fiber optics for minimally invasive surgeries that are carried out at hospitals in the developed regions across the globe.

Major Market Segments Covered:

By Type

By Application

By Usage

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025