January 2025

Medical Fluid Bags Market (By Product: Blood Bags, Intravenous Bags, Drain Bags, Enema Bags, Biohazard Disposable Bags, Breast Milk Bags, Reagent Bags, Dialysis Bags, Others; By Material: PVC Compounds, Polyolefins, Thermoplastic Elastomers, Thermoplastic Polyurethanes, Others; By End-user: Hospitals, Blood Banks, Clinics, Homecare Settings, Diagnostic Centres, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

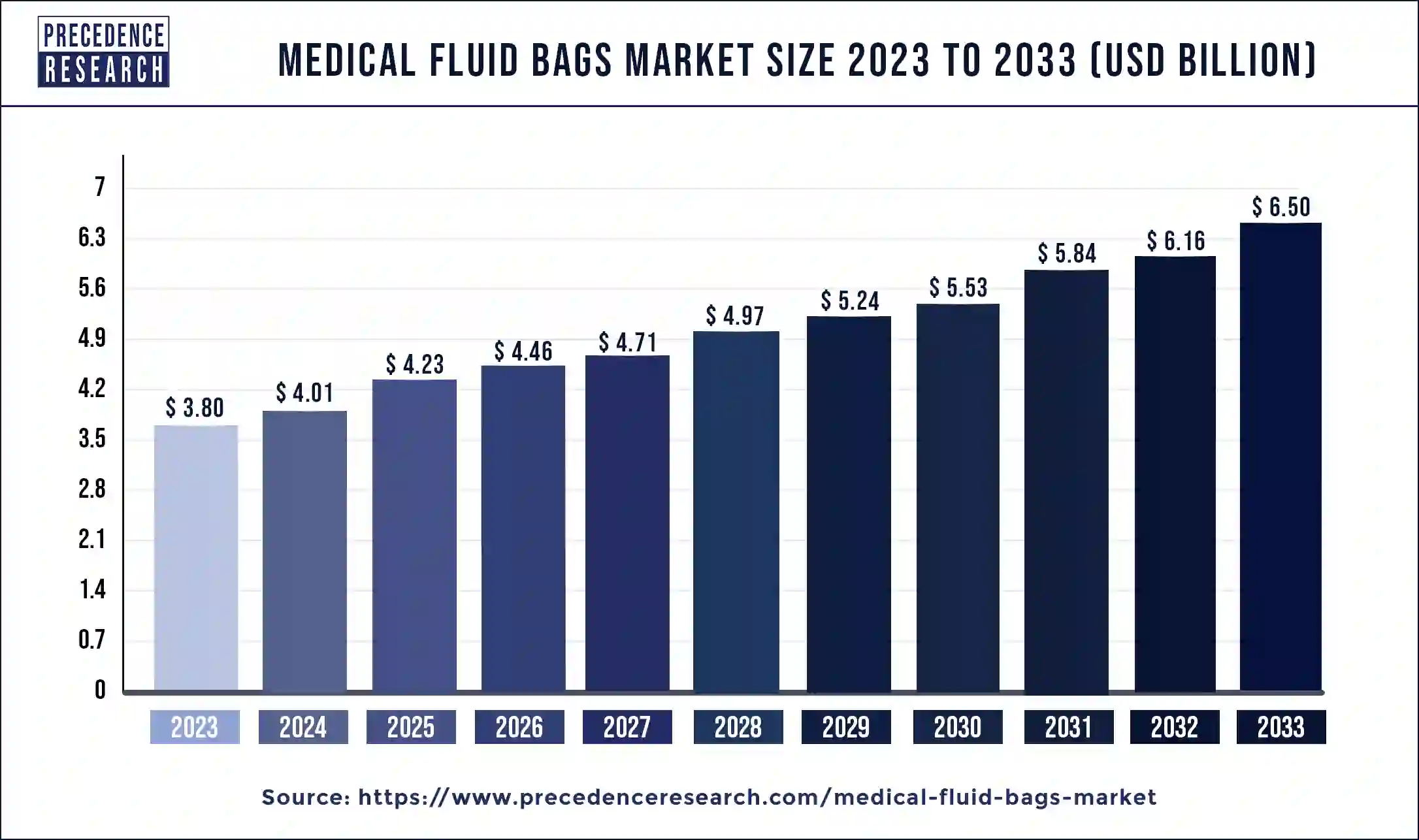

The global medical fluid bags market size was USD 3.80 billion in 2023, calculated at USD 4.01 billion in 2024 and is expected to reach around USD 6.50 billion by 2033, expanding at a CAGR of 5.52% from 2024 to 2033. The growing prevalence of chronic diseases globally focuses on health awareness among individuals to drive the growth of the medical fluid bags market.

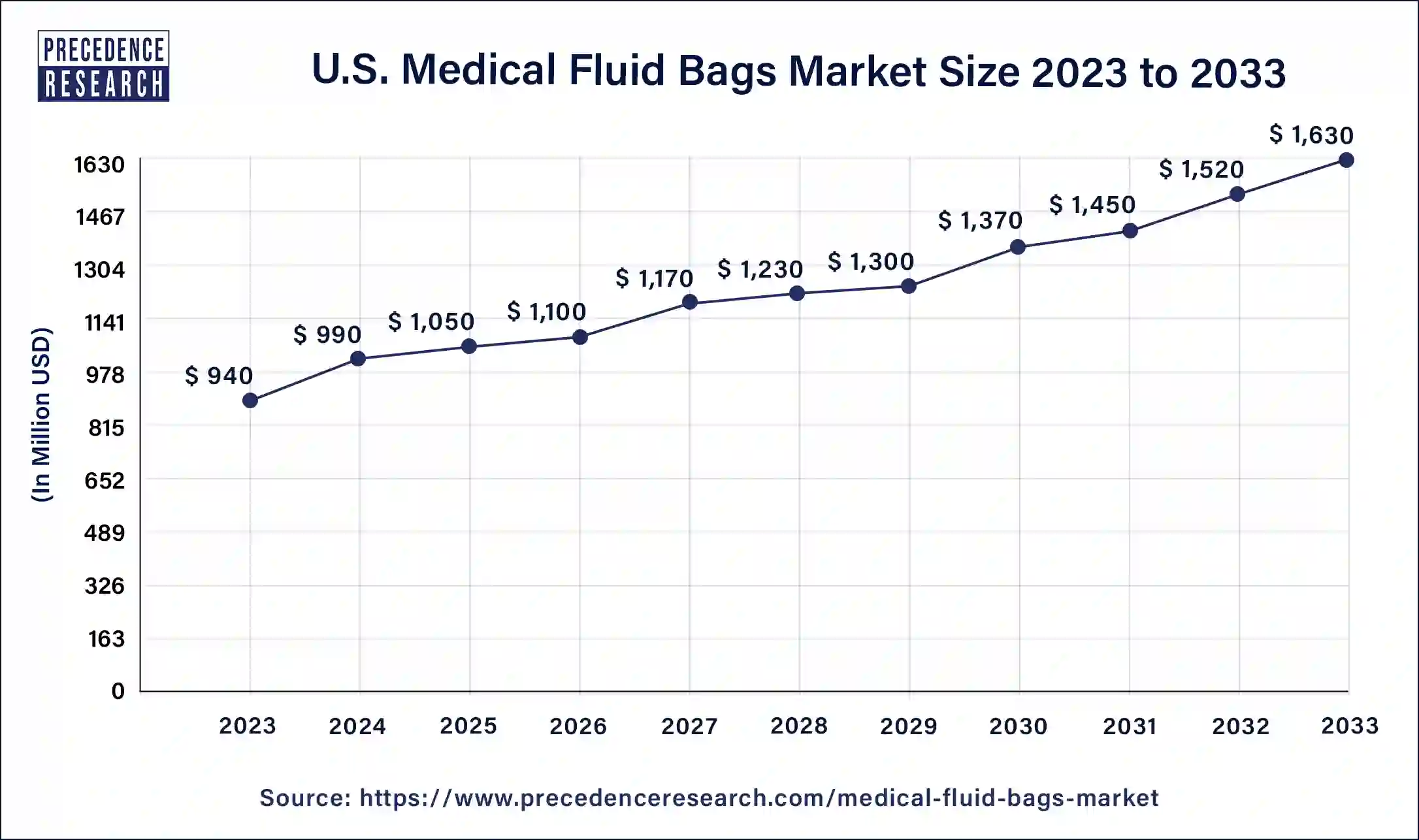

The U.S. medical fluid bags market size was exhibited at USD 940 million in 2023 and is projected to be worth around USD 1,630 million by 2033, poised to grow at a CAGR of 5.65% from 2024 to 2033.

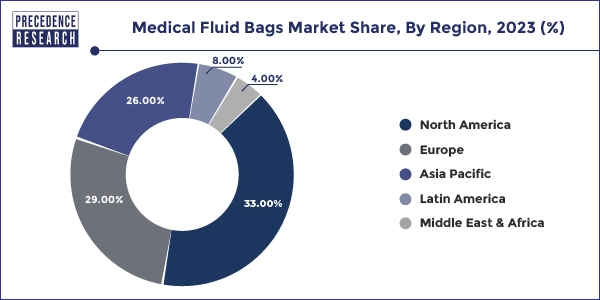

North America dominated the medical fluid bag market and is expected to grow continuously in terms of share revenue. Canada and the U.S. are the main areas that drive the growth of the medical fluid bags market. The significant investments in the healthcare sector because of the large patient population is one reason for growth. Healthcare sectors require large amounts of fluids, reagents, and parenteral nutrition, which directly demands medical fluid bags. This demand drives the market, and manufacturers also benefit by producing these products in the region. Hence, it makes the country a top contributor to the medical fluid bag market.

Asia-Pacific holds the title of the fastest-growing region in the medical fluid bags market. The region is expanding quickly and is expected to hold a significant revenue share very soon. The most important cause of the growth is the presence of growing healthcare networks and growing awareness among individuals regarding their health. Apart from this, the various initiatives and steps taken by governments globally to provide better services in terms of health also uplifted the growth in the market. Hence, trying for advancements in the market of medical products.

Medical fluid bags store fluids such as blood, reagents, etc., and can be used in various applications, including healthcare and home care. These fluid bags are necessary for quick resuscitation, blood transfusions, and other critical procedures. The global medical fluid bags market has been analyzed based on different market segments, including product type, material, end-user, and geographies or regions. An increase in the prevalence of chronic diseases and higher admission rates in hospitals are also driving the growth of the global medical fluid bag market.

Medical fluid bags differ and are available in the market in various sizes, including an interior pouch and an outside plastic covering. The separation of these bags into an inner pouch and an outer covering acts as a protector to protect the contents of the bag till its expiry date.

Medical device improvements, such as drug delivery systems and dialysis machines, may expand the use of medical fluid bags as a component of these systems. The market of these fluid bags has experienced a significant expansion. With technological advancements in the medical industry, fluid bags are gaining more attention and are expected to hit the market in the forecasted period. Nowadays, the main focus is to adopt safe and efficient technologies for limiting errors.

Major key players in the market are driving growth through attractive advancements and launching new technologies.

Expansion in the healthcare sector globally promotes the growth of medical devices, pouches, and bags needed during treatments and surgeries.

Recycling of various medical fluid bags and pouches as they cause harm to the environment and the individual itself. Many industries are focusing on adopting these practices to maintain safety and minimize the concern of health-related issues because of the waste generated from these products.

| Report Coverage | Details |

| Market Size by 2033 | USD 6,50 Billion |

| Market Size in 2023 | USD 3.80 Billion |

| Market Size in 2024 | USD 4.01 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Material, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in the number of surgeries and medical procedures

The most prominent factor responsible for the growth of the medical fluid bag market is the global increase in cases of surgeries and other medical activities. The surgical procedure often requires the administration of fluids needed for the body of a patient. It further drives the demand for reliable and hygienic fluid storage solutions and bags or pouches.

Innovative advancement in the medical fluid bags market

Globally, manufacturers of medical fluid bags are focusing on the development of innovative products that are more durable, leakproof, and biocompatible. The availability of more innovative technologies in fluid storage bags, such as tracking with RFID and continuous monitoring of temperature, is gaining attraction and also promoting a safer transfusion of fluids into the body. It also helps in tracing the infusion of fluids throughout the entire process.

Increase in the number of geriatric and aged people

The growth rate of the medical fluid bags market is driven by the increase in the geriatric and aged population. Some of the common conditions that arise in older age are chronic obstructive pulmonary diseases, obesity, diabetes, and heart diseases. The conditions in the older age population, such as urinary incontinence, frailty, and cancer, lead to the emergence of complex health problems. These factors play an imperative role in the growth of the medical fluid bags market, as medical fluid bags are essential for storing blood, drain, glucose, and other liquids.

Environmental concerns increasing from medical fluid bags

The medical fluid bags market faces obstacles due to environmental and health concerns associated with PVC-based medical bags. The main challenge is the improper disposal of these bags, which poses a threat to the environment. In particular, long-term exposure of patients to hormonally damaging substances commonly present in PVC is associated with significant health risks.

Advancement toward the production of eco-friendly medical bags

An increasing emphasis is on using eco-friendly materials to manufacture unique medical fluid bags is observed to offer a sustainable opportunity for the medical fluid bags market in the upcoming years. It favourably influences the market growth in the coming years. Since PVC medical bags have a negative impact on human health and the environment, to avoid these impacts, PVC-free medical bags have been developed. Several government and private groups encourage using environmentally friendly materials in medical disposables to protect caregivers and patients from contamination from PVC production and disposal.

To limit the amount of waste generated during ostomy treatments, manufacturers are also focusing on producing washable and biodegradable pouches, one of the main trends in the global medical fluid pouch market. The continuous growth of the medical fluid bag market requires innovative solutions and ecological alternatives to promote a healthier and more eco-conscious healthcare environment.

The drain bags segment led the medical fluid bags market in 2023. Drain bags are crucial in preventing fluid accumulation that can lead to infections or other complications in surgical wounds and chronic wounds. Effective wound management protocols in healthcare facilities rely heavily on the use of drain bags. Drain bags must meet stringent regulatory and safety standards to ensure patient safety and efficacy. The adherence to these standards by manufacturers leads to the production of high-quality, reliable products that are widely used in clinical settings.

The blood bags segment is expected to grow at the fastest rate in the medical fluid bags market during the forecast period. The surge in patients suffering from diverse medical conditions related to blood, kidney, metabolic, and neurological issues propelled the rising demand for blood bags. In addition, diseases such as cancers that affect the bone marrow, blood cells, lymph nodes, and the more comprehensive lymphatic system, including leukemia, lymphoma, myeloma, and myelodysplastic syndromes (MDS), have increased the need for blood transfusions.

The PVC compounds segment dominated the market and stood out among the other available segments. They are designed for providing nutrition intravenously, packaging of dehydration solutions such as sodium chloride, glucose, lactated Ringer's solution, and certain antibiotics and analgesics. Their widespread popularity is due to their efficiency in collecting and preserving blood and blood components, which provides the 42-day shelf life essential for the preservation of rare blood groups if and when required in emergencies. In particular, PVC intravenous bags are best for hospital and veterinary usage. PVC blood bags offer optimal sterilization and, if necessary, flexible freezing.

Baxter is a proud manufacturer and supplier of PVC bags that are ubiquitous in hospital care. Recently, In December 2023, it announced the scaling up of the PVC intravenous bag recycling program. The first pilot phase of recycling successfully demonstrated proof of concept, with more than six tons of plastic IV bag waste diverted from a Northwestern Memorial Hospital landfill.

The hospitals segment led the medical fluid bags market in 2023. The segment is further observed to continue its growth in the upcoming period. The growing prevalence of chronic diseases such as diabetes, hypertension, and cancer has led to increased hospital visits and admissions. Chronic disease management often involves the administration of IV medications and fluids, contributing to the higher demand for medical fluid bags in hospital settings. There has been a notable increase in elective and non-elective surgical procedures as healthcare systems recover from the pandemic-induced delays. Hospitals, being the primary providers of these surgical services, have seen a corresponding rise in the usage of fluid bags for perioperative care.

Segments covered in the report

By Product

By Material

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025