List of Contents

Medical Laser Market Size, Share and Trends 2026 to 2035

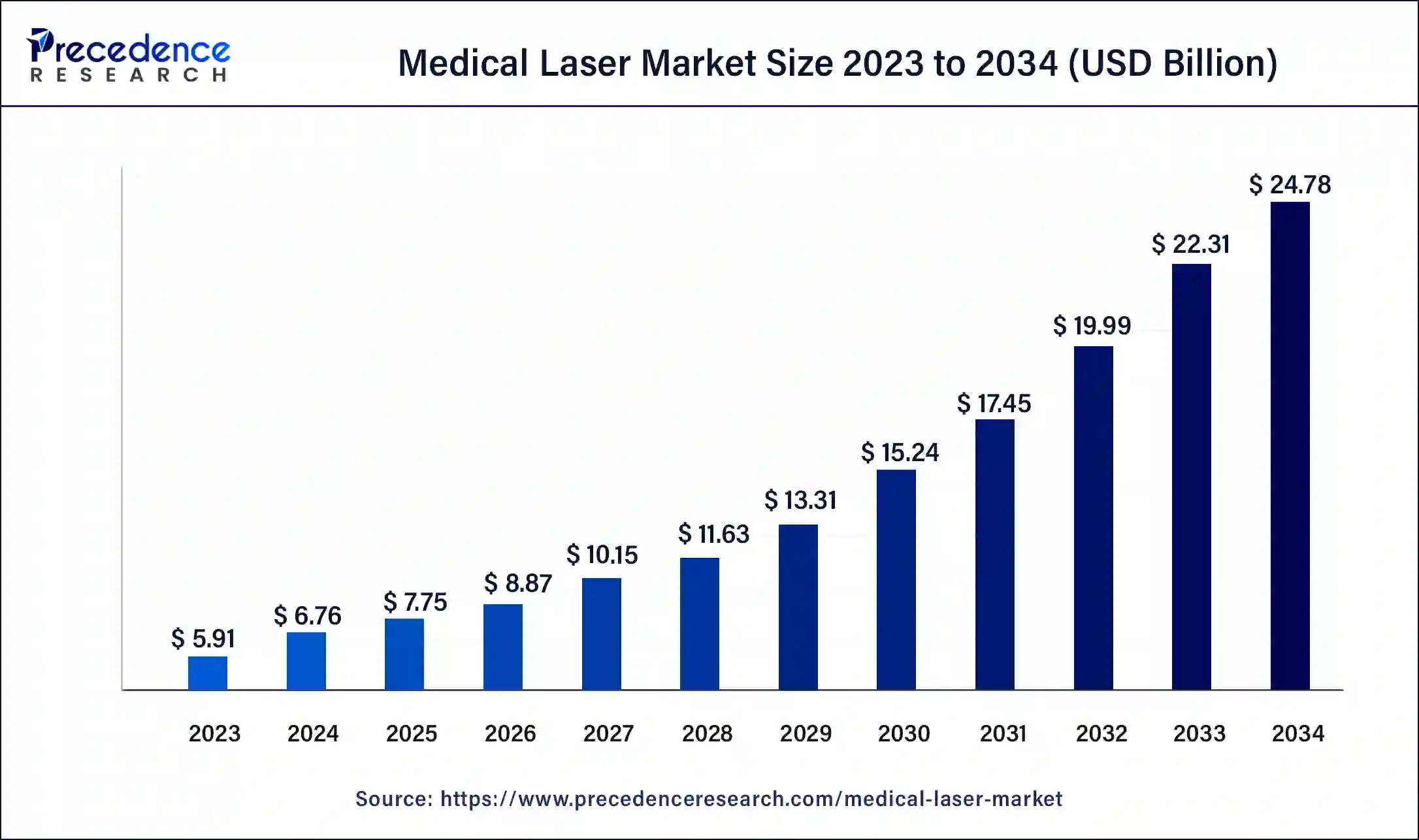

The global medical laser market size is accounted at USD 7.75 billion in 2025 and predicted to increase from USD 8.87 billion in 2026 to approximately USD 27.15 billion by 2035, representing a CAGR of 13.36% from 2026 to 2035.

Medical Laser Market Key Takeaways

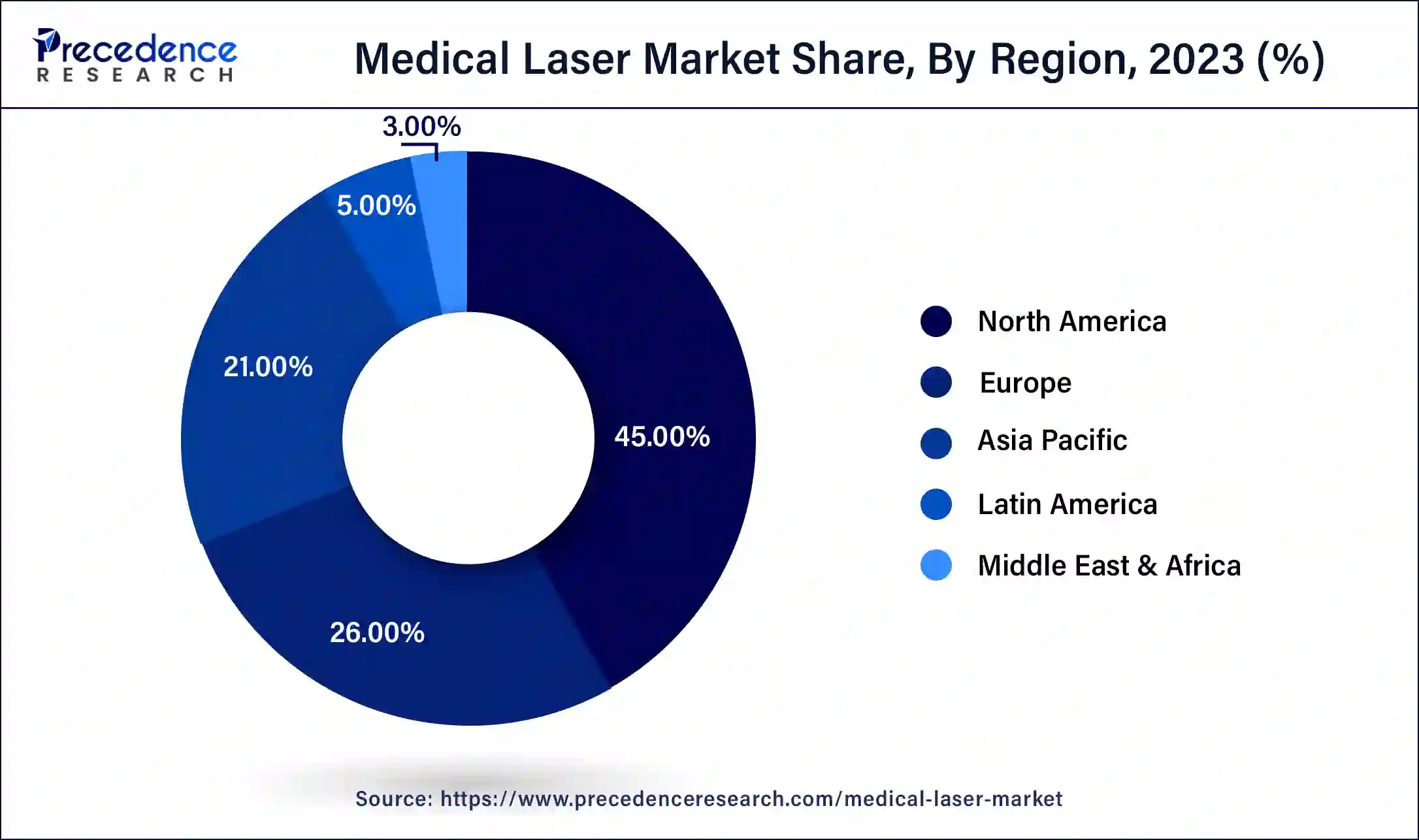

- North America dominated the medical laser market in 2025.

- By type, the surgical laser segment held the largest share of the market in 2025.

- By product, the consumable segments dominated the global market in 2025.

- By end-use, the specialty clinics segment led the global market in 2025.

Market Overview

The use of an intense light beam in order to cut burn or destroy a tissue is the medical treatment is called laser therapy it is a non-invasive yet intensive light source in order to treat issues which also heal quickly without scarring the body. There is an increasing demand for laser procedures in developing as well as in developed countries due to the aesthetic aspect.

The use of intense light beam in order to cut burn or destroy a tissue is the medical treatment is called laser therapy it is a non invasive yet an intensive light source in order to treat issues which also heal quickly without scarring the body. There is an increasing demand for laser procedures in developing as well as in the developed countries due to the aesthetic aspect.

Medical lasers are extensively used in dermatology, surgical intervention, ophthalmology, and dental procedures. The growing demand for non-invasive medical treatments has influenced the development of this market.

How AI Works in Medical Lasers

AI integration in this sector has influenced the market to grow as it enhances the delivery system, increasing efficiency, and improving precision. The incorporation of such technology helps to understand the market demand and provides scope for improvement to the market players who are working progressively to increase the influence of the market.

Growth Factors

- Growing Usage of Non-Surgical Cosmetic Procedures Expand the Market Development

- In many developing and developed nations there is a demand for minimally invasive cosmetic procedures and this demand is expected to boost the market growth.

- As people are being aware about these surgeries which cause less damage, these surgeries have good recovery rate the demand for the market is growing. Growing technological advancements are expected to drive the market growth.

- The rising trend for laser hair removal, anti-ageing therapy, tattoo removal, and skin resurfacing is driving the medical laser market drastically. In developed regions, people prefer low-invasive processes which deliver speedy recovery and result in natural-looking skin.

- This ongoing trend for self-care and enhancement of body features has fueled the demand of the market. Growing consciousness about laser technologies and their effect on skin and solving dermatological issues rate drive the market to grow.

- Easy accessibility of such treatments also encourages people to choose them to resolve their dermatological issues.

- With the progression of technology, laser treatment is becoming more popular among people and is predicted to upsurge profoundly in the upcoming time.

Opportunity

Rising Medical Tourism

With continuous growth in the medical tourism sector, it has increased the growth opportunities of this market tremendously. After travelling becomes easy for all the customers and the healthcare sector is growing progressively with cost-effective solutions which increase their demand. Due to the growth in international patients, the demand for this sector has risen significantly and increased opportunities for market players to introduce more advancement in this sector. The healthcare sector is continuously researching and providing enhanced solutions for laser treatment which can reduce the side effects of such treatment to enhance the adaption among people.

This market is associated with risk which creates hindrance in the growth of the medical laser market. High charges for such treatment make it difficult for people to choose it to resolve their issues and restrict the market from growing.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 27.15 Billion |

| Market Size in 2025 | USD 7.75 Billion |

| Market Size in 2026 | USD 8.87 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.87% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2036 |

| Segments Covered | Product, Type, Application, End User, System, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Solid State Laser Systems in Limelight

The global medical laser market is classified as solid state laser systems, gas laser systems, dye laser systems, and diode laser systems by system. Among these classified systems, solid state laser systems are anticipated to acquire the highest share of the medical laser market in the years to come. Solid state lasers have various benefits. They are highly efficient in comparison with others, its structure is simpler than others, and these lasers are economically affordable. These benefits are the fueling factors in the growth of this market. The wide usage of these lasers is done in several medical applications to perform studies related to laser radiation in cardiology, ophthalmology, dermatology, and dentistry. These lasers are helpful in the treatment of melisma, removal of scars, and reappearing of skin. These factors have motivated healthcare organizations to make use of these lasers for performing various treatments.

Solid state laser systems are further sub-classified intoholmium yttrium aluminum garnet laser (Ho:Yag) systems,erbium yttrium aluminum garnet laser (Er:Yag) systems, alexandrite laser systems, potassium titanyl phosphate laser systems, ruby laser systems, and Q-switch lasers.Neodymium yttrium aluminum garnet lasers (Nd:YAG),neodymium yttrium aluminum garnet laser (Nd:Yag) systems are able to undergo more levels of tissue in comparison with others, as it contains a wavelength of 1,064 nanometer (nm). These lasers are employed to a big extent of eye and skin diseases. For the treatment of eyes, skin, tattoo and hair removal, etc., healthcare professionals make use of these lasers. These lasers even are a solution for the removal of hairs permanently. Collaborations of numerous organizations with private and regional organizations to glorify the usage of Nd:Yag solid state lasers for diverse medical applications. For example, Harrods Wellness Clinic announced the partnership with Lumenis Ltd. to adorn its aesthetic medical center.

Medical Lasers had a balance of Contrary Forces during the Pandemic

Due to imposed lockdowns across the globe as a precautionary measures for the outburst of the novel coronavirus, there was a monitory downfall for almost all the industries worldwide. Healthcare industry was not an exception to this. Due to lockdowns, supply chains were totally disturbed. Manufacturing plants were temporarily closed, or those which were opened didn't have enough workforce. Prominent players were concentrating more on R&D operations to supply the certain amount of medications, vaccines, medical equipment. These players were also concentrating on introducing new and inventive products.

Individuals affected by this virus were on priority list in terms of healthcare resources. However, regular services were kept on hold to impede the outbreak of this virus. Various governments across the countries declared lockdowns allowing only necessary services. From the time of lockdowns, hospitals and clinics providing laser services were shut. The global medical laser market did not experience a sharp downturn in comparison with others markets.

On the other hand, populace started rushing towards conducting their laser surgeries. The demand for aesthetic treatment was robust at the time of COVID-19 pandemic. These treatments witnessed an exponential growth. As per the survey done by Aesthetic Society, individuals in America have spent more than $9 Billion over the aesthetic surgeries in the year 2020. In addition, on the basis of the survey dine by the Advanced Cosmetic Surgery & Laser Center located in the U.S., aesthetic procedures like fillers and Botox grew approximately by 90% in the year 2020. The global laser market witnessed a downfall in the revenue growth trajectory, though a few of the segments got a hike in their demand.

Medical Laser Market Segment Insights

Type Insights

The surgical laser market segment accounted revenue share 54% in 2023 and it is also expected to grow at a higher here during the forecast. Increase technological advancements growing implementation of minimally invasive surgeries awareness regarding the availability of surgeries prevailing chronic diseases and the prevailing ophthalmic diseases are all the reasons that have led to a growth in the medical lasers market the surgical laser segment shall grow owing to all of these reasons.

The aesthetic laser market segment is also expected to grow it shall have the second largest share during the forecast. The aesthetic labor market segment accounted 35% market share in 2023. There is an increase in the number of this aesthetic laser treatments or surgeries due to it being minimally invasive with a good recovery rate the dental laser treatment segment is also expected to grow well during the forecast period as an increased awareness amongst the people regarding oral hygiene and increasing dental disorders.

Product Insights

On the basis of the product, the consumable segment is expected to have the largest market share during the forecast period in the recent years the consumables medical laser market had a good growth as an increased demand for consumables used poor laser system it is expected to help in the growth of the consumable segment during the forecast period. Every airport system about 100 to 140 consumables are used and this number shall keep on increasing every year. Due to an increasing demand for various surgeries there's an increase in demand for the consumables which shall help in the growth of the market during the forecast. Many growth opportunities for this medical laser will be provided in many developing nations during the forecast. Different types of lasers are in great demand across the nations these are solid state lasers diode lasers gas lasers dye lasers and other types of lasers.

End Use Insights

On the basis of the end user, the hospital and specialty clinics shall have to largest on wages of end users of this medical lasers the specialty clinic shall have the largest market growth during the forecast. Previously in the recent years specialty clinics had accounted for the largest market share in many developing countries as there's an increase in the per capita income and the demand for aesthetic appeal the market for lasers is expected to grow developing nations are also focusing on hospital infrastructure and improving the health care conditions of these regions all of these factors are expected to drive the laser market in developing nations The specialty clinics Future totally devoted to various surgeries that are related to laser are growing well.

Medical Laser Market Regional Insights

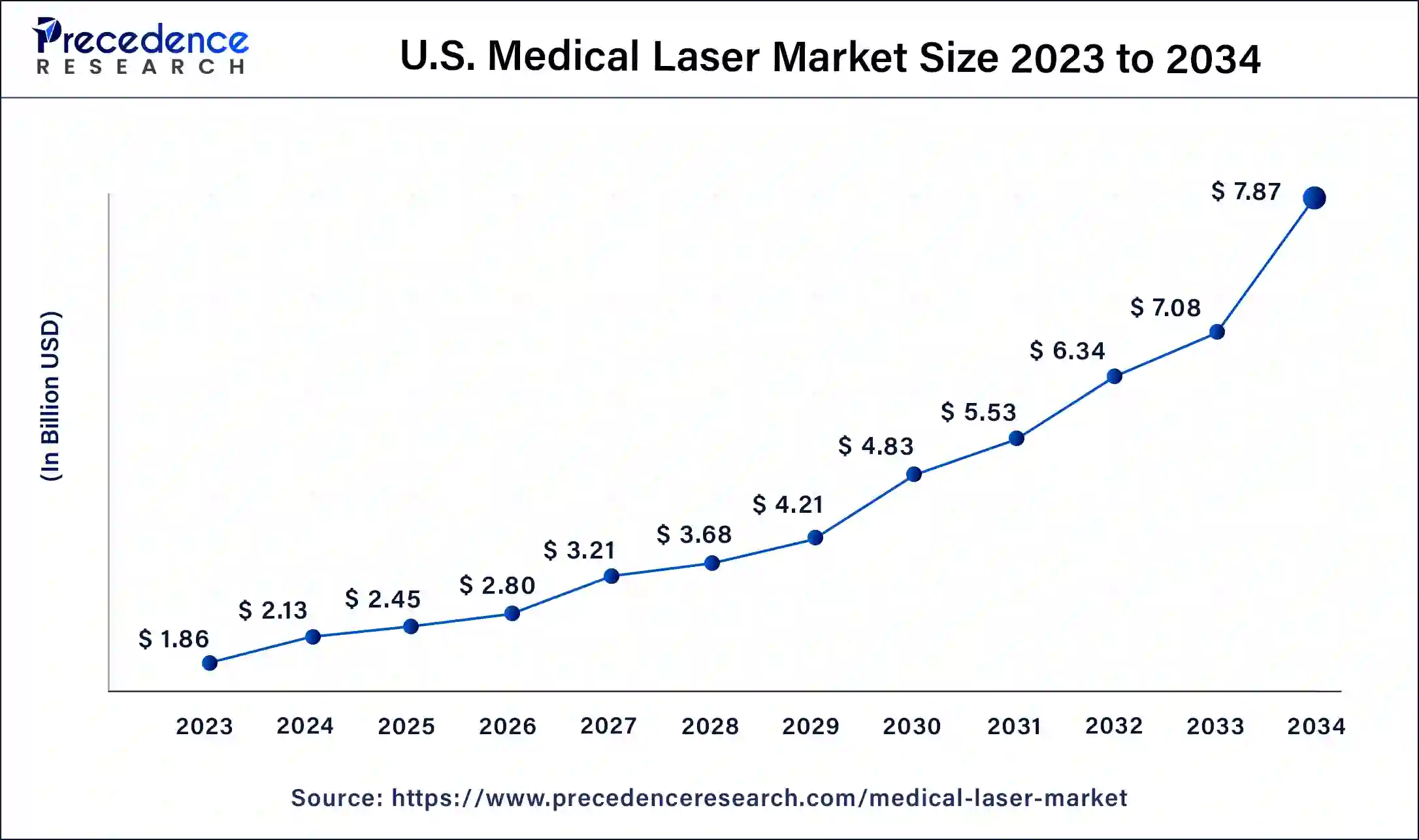

The U.S. medical laser market size is valued at USD 2.45 billion in 2025 and is expected to be worth around USD 8.63 billion by 2035, at a CAGR of 13.42% from 2025 to 2036.

The North American region accounted largest revenue share of 46% in 2025 and it is expected to grow well during the forecast. As in high preference for cosmetic surgeries and minimally invasive medical procedures there is great demand for these technologies in US and these are the factors that are responsible for the growth of the medical laser in the North American region. For vision correction the laser treatments are extensively used in various regions across North America. There was an expenditure of about 20 billion in US for cosmetic surgeries. Followed by North America Europe is also expected to have a good growth during the forecast period as an increased use of laser treatment for ophthalmic disorders. There is an increased demand for lasers in many countries across Europe especially in Germany.

The Asia Pacific region is also expected to have a great growth during the forecast period as there is development and health care infrastructure and there is increasing number of laser centers in this region. The demand for hair removal procedures andaesthetic lasers are driving the market in the Asia Pacific region.

The Asia Pacific region is making rapid strides forward as a result of an increase in medical tourism, increased demand for dermatological and aesthetic care services, and increased use of ophthalmic and surgical lasers. The rapid growth in healthcare investments, large patient populations, and rapid penetration of technology into markets such as China, Japan, India, and South Korea will further accelerate growth.

China is the country with the highest estimated growth of laser technology in the Asia Pacific region due to the development of cosmetic clinics, rapid growth of domestic production of laser equipment, growing investment in healthcare, and the growing demand for laser corrective vision procedures and cosmetic services are driving continued growth in this market.

Europe has seen steady advancements in laser technology adoption backed by a commitment to clinical standards, an expanding culture of aesthetic treatment, and an increased demand for laser products in anesthetic, ophthalmic, and gynecological applications. Additionally, there is an increasing level of investment in hospital modernization and an increase in patient preference for minimally-invasive surgical methodologies contributing to growth in this market.

Germany is currently the leader in Europe for Medical Laser Technology due to its very strong and advanced medical engineering, a high level of laser usage in surgery and dentistry, and a robust clinical infrastructure. Furthermore, Germany is continually innovating and training more practitioners to use laser technologies and, as a consequence, will see widespread use of laser technology.

Latest Announcements by Market Leaders

- In February 2024, John Beaver, President and CEO of Biolase Inc. expressed, "We believe the launch of the Waterlase iPlus Premier Edition represents a pivotal moment in the evolution of laser dentistry and sets a benchmark for innovation and accessibility in dental technology."

Medical Laser Market Companies

- BiolaseInc

- Candela corporation

- Top corn corporation

- Lumenis limited

- Sisram Medical Limited

- Iridex Corporation

Recent Developments

- In May 2025, The LA&HA and Fotona have opened two new medical-laser training centres in Bogotá (Colombia) and Mexico City, offering hands-on workshops in aesthetics and gynecology.

https://www.fotona.com - In April 2025, Acclaro Medical launched its new cold-fiber laser system AuraLux, promising skin-health and anti-aging treatments with less discomfort, minimal downtime and broad applicability across skin types.

https://thedermdigest.com

Medical Laser Market Segments Covered in the Report

By Product

- Laser Systems

- Consumables

By Type

- Surgical Lasers

- Dental Lasers

- Aesthetic Lasers

- Others

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By System

- Solid State Laser Systems

- Holmium Yttrium Aluminum Garnet Laser (Ho:Yag) Systems

- Erbium Yttrium Aluminum Garnet Laser (Er:Yag) Systems

- Neodymium Yttrium Aluminum Garnet Laser (Nd:Yag) Systems

- Potassium Titanyl Phosphate Laser Systems

- Alexandrite Laser Systems

- Ruby Laser Systems

- Q-Switch Lasers

- Gas Laser Systems

- CO2 Laser Systems

- Argon Laser Systems

- Krypton Laser Systems

- Metal Vapor (Copper and Gold) Laser Systems

- Helium-Neon (He-Ne) Laser Systems

- Excimer Laser Systems

- Dye Laser Systems

- Diode Laser Systems

By Application

- Ophthalmology

- Refractive Error Surgery

- Cataract Surgery

- Glaucoma Surgery

- Others

- Dermatology

- Skin resurfacing

- Pigment treatment

- Tattoo Removal

- Hair Removal

- Others

- Gynecology

- Vaginal Rejuvenation

- Others

- Dentistry

- Urology

- Lithotripsy

- Tissue Ablation

- Cardiology

- Coronary Artery Disease

- Ventricular and Supraventricular Arrhythmias

- Hypertrophic Cardiomyopathy

- Congenital Heart disease

- General Surgeries

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client