January 2025

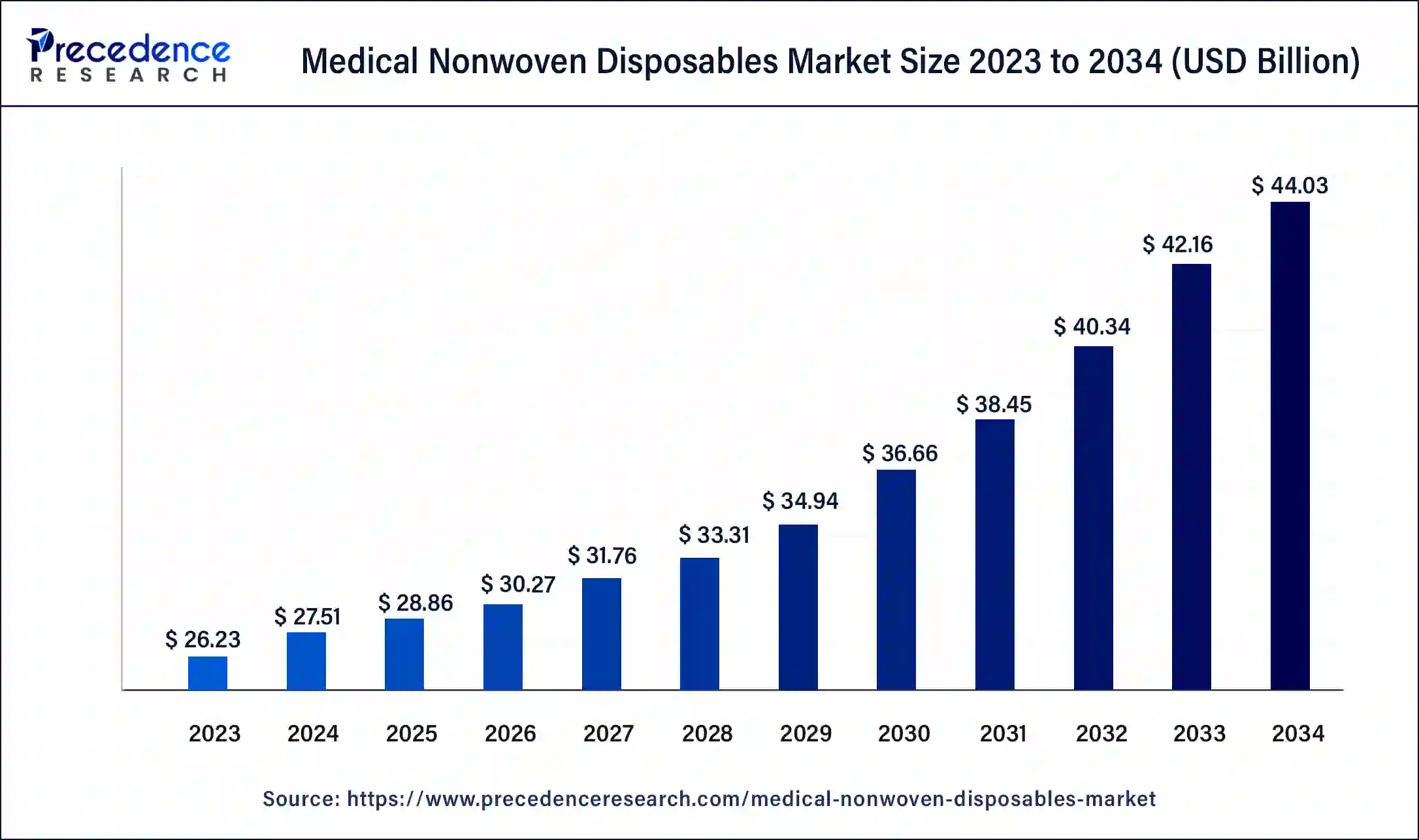

The global medical nonwoven disposables market size was USD 26.23 billion in 2023, estimated at USD 27.51 billion in 2024 and is anticipated to reach around USD 44.03 billion by 2034, expanding at a CAGR of 4.82% from 2024 to 2034.

The global medical nonwoven disposables market size accounted for USD 27.51 billion in 2024 and is predicted to reach around USD 44.03 billion by 2034, expanding at a CAGR of 4.82% from 2024 to 2034.

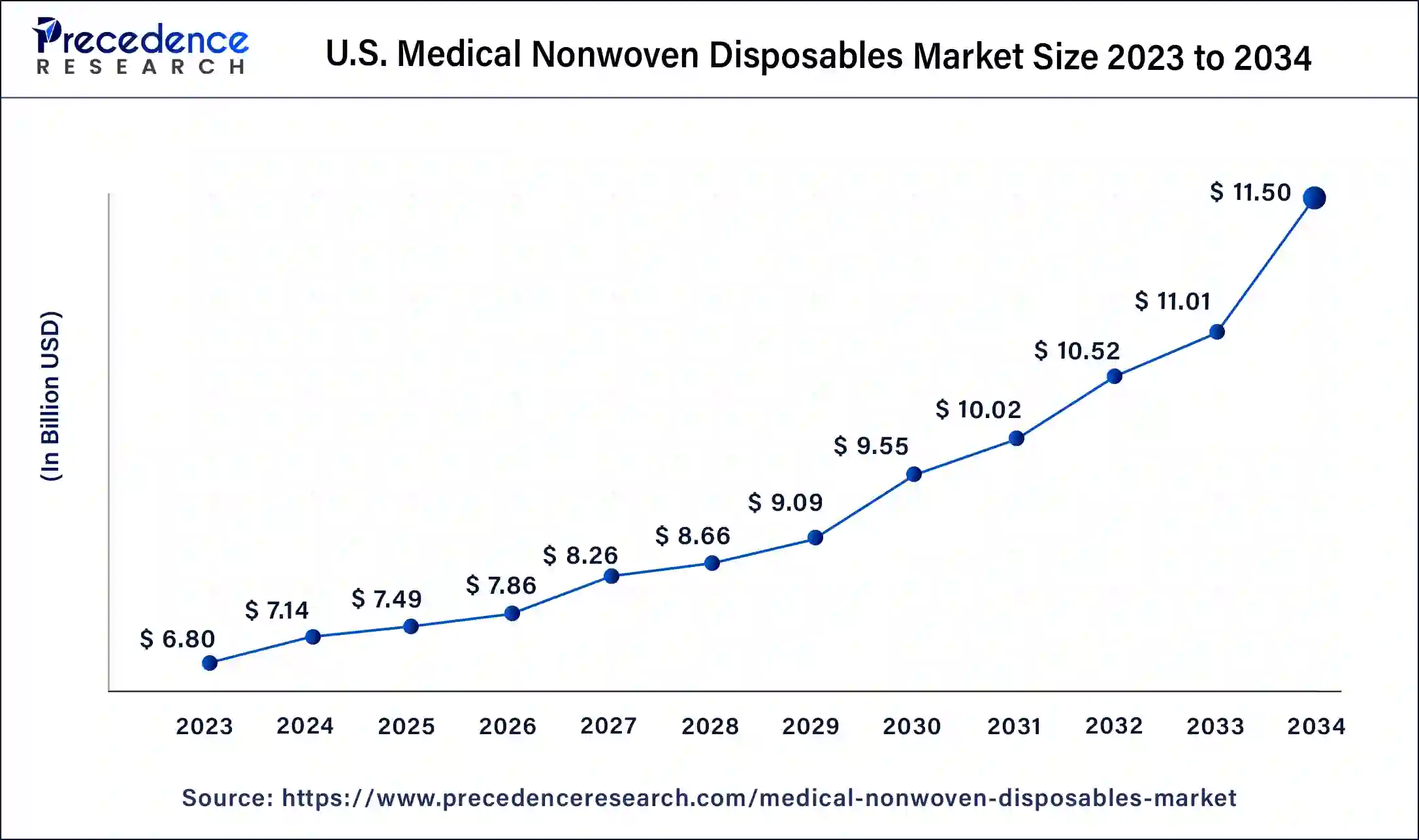

The U.S. medical nonwoven disposables market size reached USD 6.80 billion in 2023 and is expected to be worth USD 11.50 billion by 2034, at a CAGR of 4.50% from 2024 to 2034.

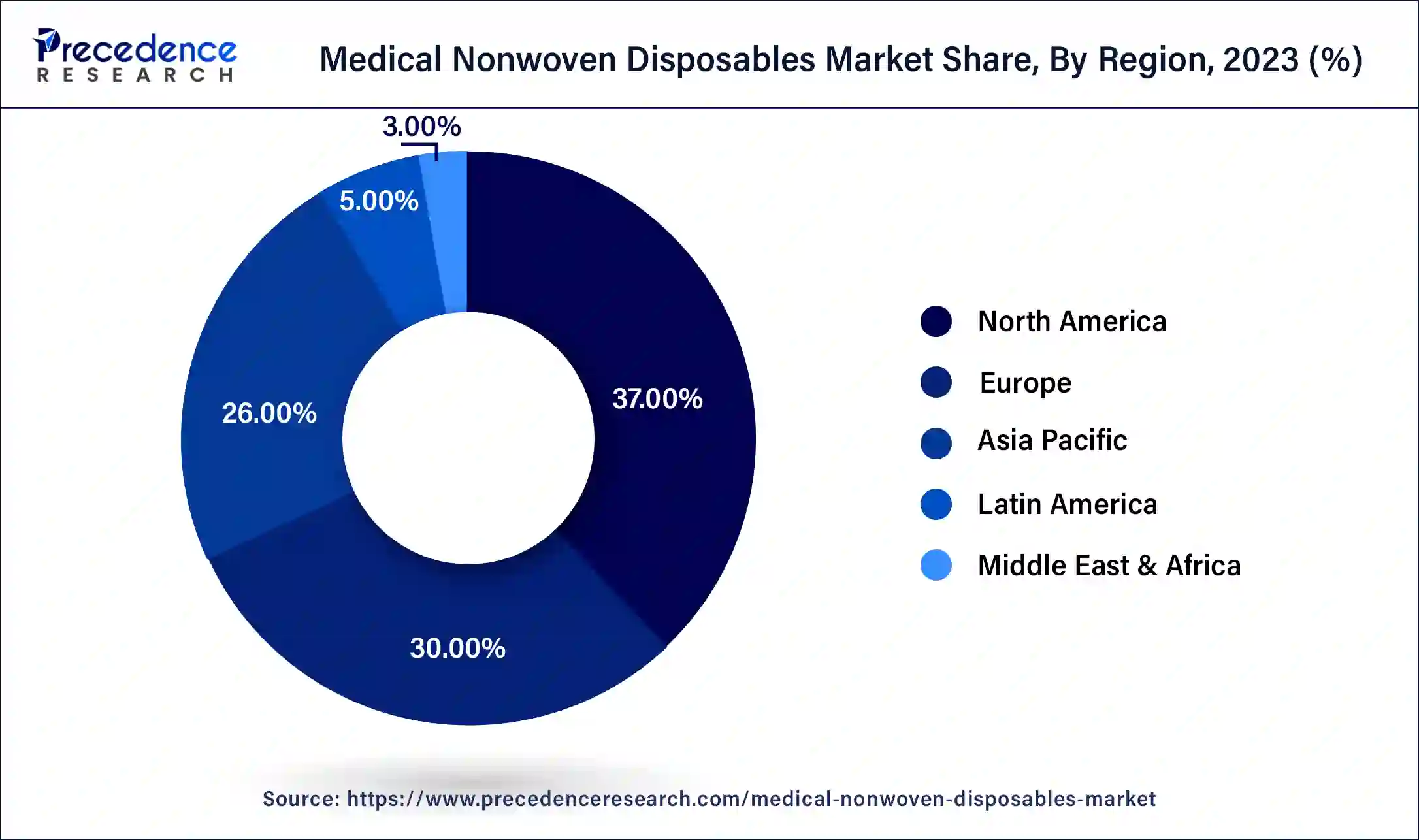

North America dominated the global medical nonwoven disposables market in 2023. The increased awareness regarding the hospital acquired infections among both the patients and the healthcare professionals has exponentially driven the demand for the various medical nonwoven disposable products in North America. Moreover, the presence of high geriatric population and the increased prevalence of urinary incontinence among them is augmenting the growth of the market. According to the Urology Care Foundation, around 33 million people in US are suffering from overactive bladder. According to the US Census Bureau, the 65 years and older population in US has grown by 34.2% in the past decade and by 3.2% from 2018 to 2019. Therefore, the rapidly growing geriatric population in US is expected to foster the demand for the medical nonwoven disposables in the upcoming years and hence, North America is expected to sustain is dominance in the market.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. The rising birth rates in the region is expected to spur the demand for the disposable diapers. Moreover, the improving gender balance in the emerging nations like China and India is expected to fuel the demand for the female hygiene products. Furthermore, the geriatric population in Asia Pacific is expected to grow rapidly. According to the United Nations, 80% of the global geriatric population will be living in the low and middle income countries by 2050. Therefore, the rising population of the old age people is expected to drive the growth of the market.

The growing prevalence of hospital acquired infections and rising awareness regarding it are the major growth drivers of the global medical nonwoven disposables market. According to the World Health Organization, around 7% of the hospitalized patients in developed countries and 10% of the hospitalized patients in the developing countries acquires at least one hospital acquired infection. According to the European Centre for Disease Prevention and Control, around 4,131,000 patients are affected from hospital acquired infection in Europe every year. Therefore, the surging prevalence of the hospital acquired infections among the global population is expected to drive the demand for the medical nonwoven disposables. Moreover, the growing geriatric population across the globe and rising prevalence of dementia among them is further fueling the demand for the nonwoven disposables in healthcare settings. According to the World Health Organization, around 10 million new cases of dementia is recorder across the globe each year. Furthermore, the growing prevalence of urinary incontinence across the globe is expected to spur the demand for the medical nonwoven disposables in the forthcoming period. According to the Global Forum on Incontinence, urinary incontinence affects the lives of around 400 million people around the globe. Urinary incontinence is majorly prevailed among the geriatric people aged 60 years and above, as per the WHO.

The developments in the technology of manufacturing nonwoven disposables is driving the production. The increased adoption of the nonwoven disposables across the surgical units has driven the demand. The medical nonwoven disposables prevents cross contamination by restricting the spread of the microorganisms, particulates, and fluid in a surgical process. The sterile, antibacterial, soft, and liquid absorbing nature of the nonwoven disposables provides an ideal solution for preventing hospital acquired infections in a healthcare setting. The continuous engagement of the key market players in the development of innovative nonwoven products is expected to provide growth aspects in the upcoming future.

| Report Coverage | Details |

| Market Size by 2034 | USD 44.03 Billion |

| Market Size in 2023 | USD 26.23 Billion |

| Market Size in 2024 | USD 27.51 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End User, Material, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product type, the sterile nonwoven products segment dominated the global medical nonwoven products market, garnering a market share of more than 60% in 2023. The sterile nonwoven products are extensively used in the healthcare centers owing to its higher efficiency at preventing the penetration of the microbes and other organisms and prevent the cross contamination. Furthermore, the sterile nonwoven products have water repelling properties and are waterproof, which ensures the high safety of the healthcare professionals. These factors and benefits has made the sterile nonwoven products segment the dominant segment in the global medical nonwoven disposables market.

On the other hand, the incontinence hygiene products are estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising prevalence of the incontinence and growing geriatric population across the globe. The incontinence condition has an exponential effect on dignity of the individual. The incontinence may result in hygienic problems, depression, and social stigma. Therefore, the rising prevalence of incontinence is expected to drive the growth of this segment in the forthcoming future.

The hospitals segment dominated the global medical nonwoven disposables market in 2023. This is attributed to the growing prevalence of various chronic diseases among the global population and rising number of hospitals admissions across the globe. Moreover, the surging adoption of surgeries among the patients is boosting the demand for the nonwoven disposables across the hospitals. The increased awareness among the health professionals regarding the hospital acquired infections has further fueled the demand for the medical nonwoven disposables across the globe.

The home healthcare is estimated to be the fastest-growing market during the forecast period. This is attributable to the surging demand for the disposable diapers among the geriatric population. The surging prevalence of urinary incontinence among the geriatric people is the primary factors that drives the growth of this segment. Urinary incontinence mostly effects the old age people aged 60 years or above.

Key Market Developments

The medical nonwoven disposablesmarket is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

Segments Covered in the Report

By Product Type

By End User

By Applications

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025