January 2025

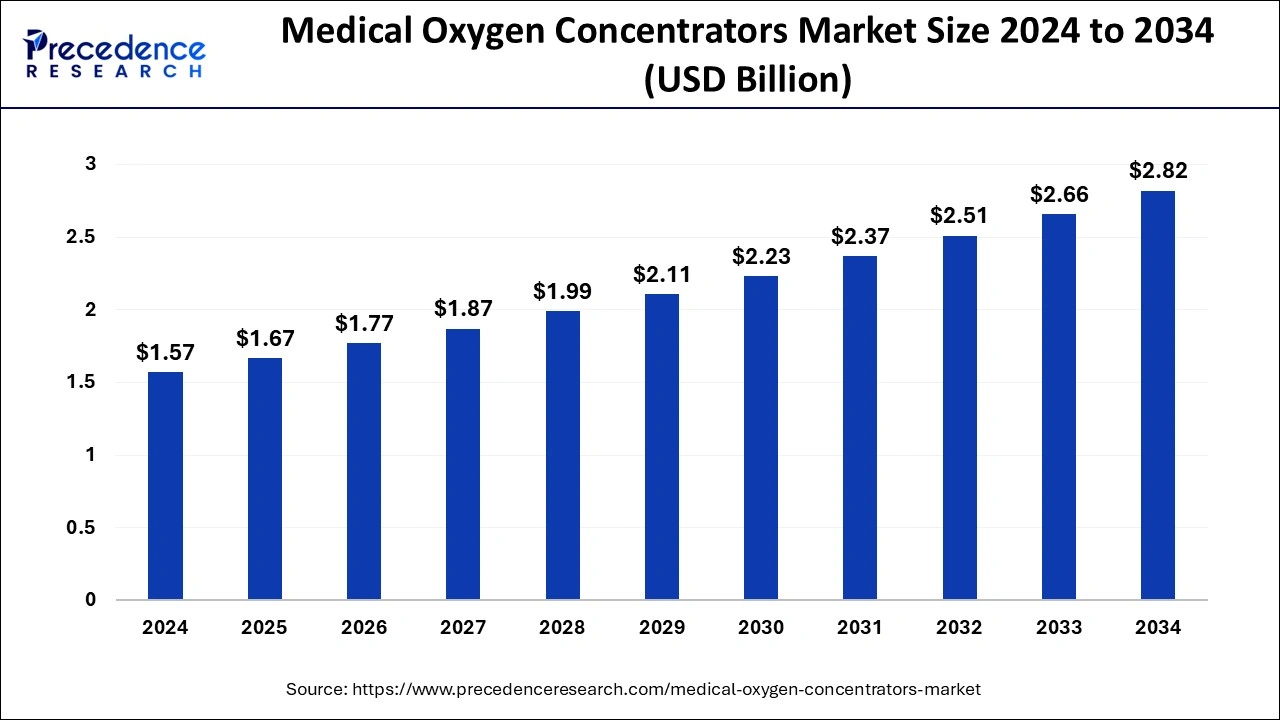

The global medical oxygen concentrators market size is calculated at USD 1.67 billion in 2025 and is projected to surpass around USD 2.82 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034. The North America medical oxygen concentrators market size reached USD 500 million in 2025 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical oxygen concentrators market size accounted for USD 1.57 billion in 2024 and is expected to be worth around USD 2.82 billion by 2034, at a CAGR of 6% from 2025 to 2034.

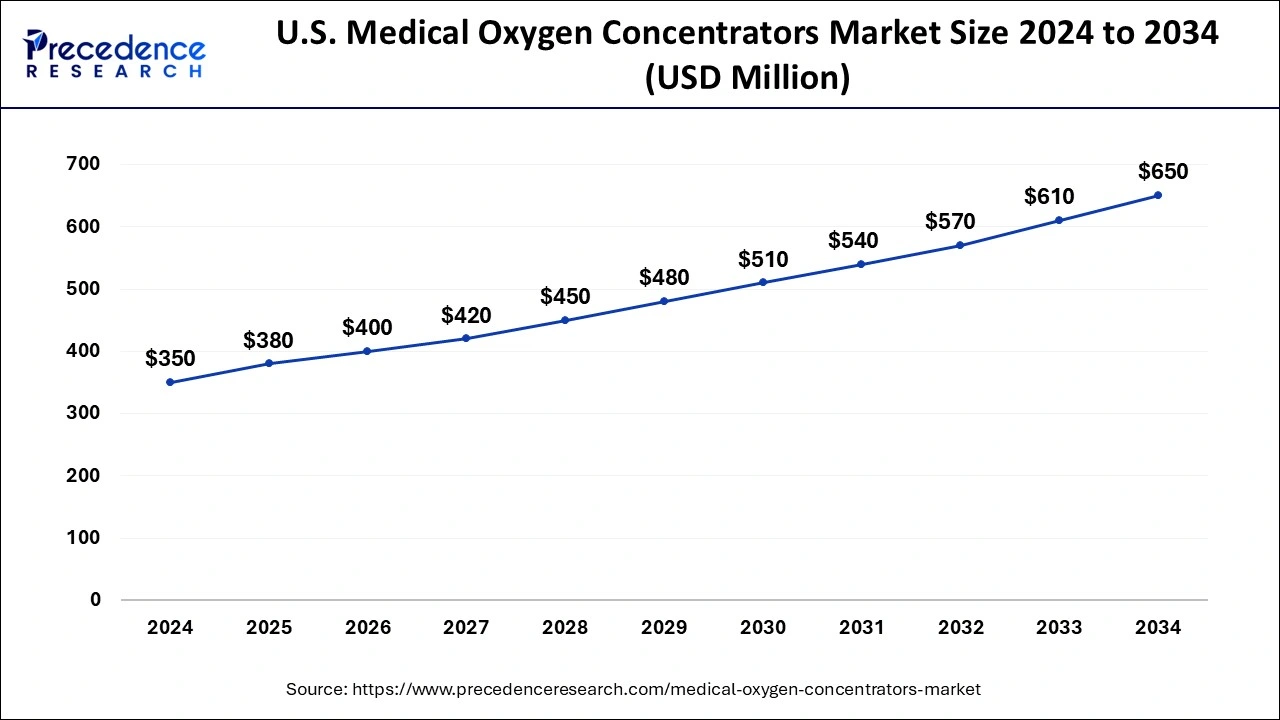

The U.S. medical oxygen concentrators market size was estimated at USD 350 million in 2024 and is predicted to be worth around USD 650 million by 2034, at a CAGR of 6.4% from 2025 to 2034.

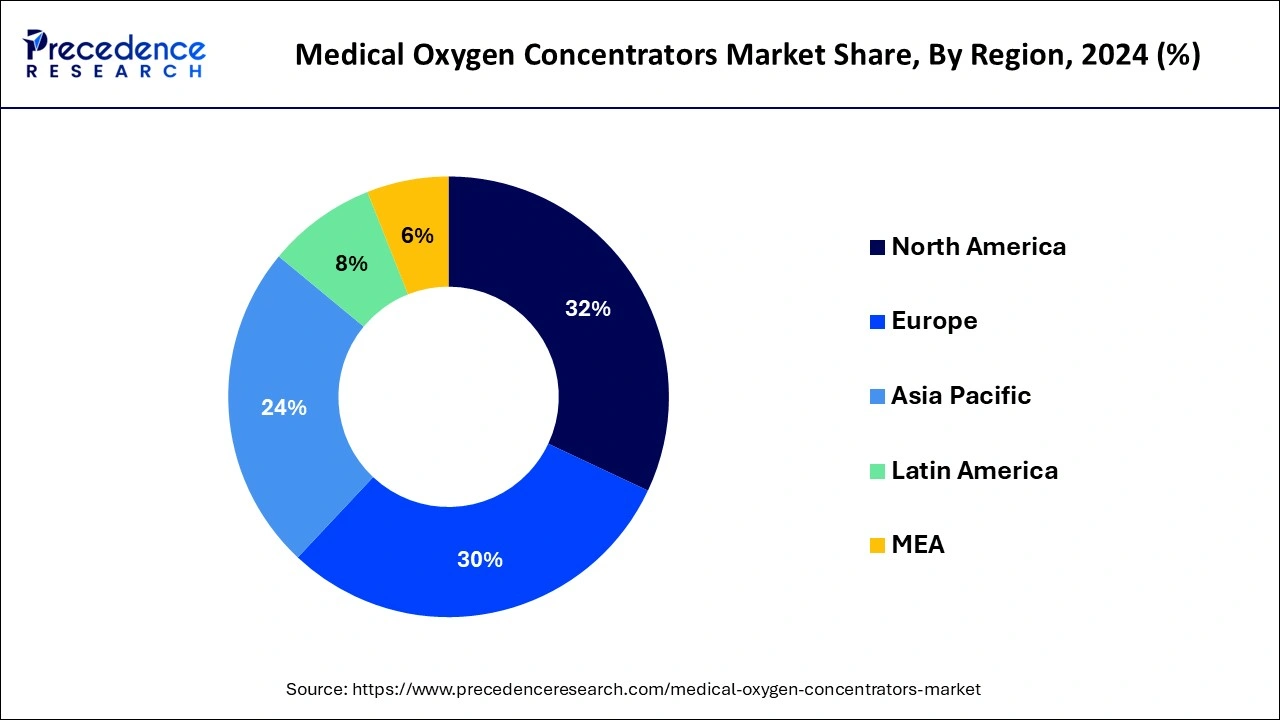

The research study covers key prospects and trends of medical oxygen concentrators products throughout different regions including Europe, North America, Asia-Pacific, Middle East and Africa, and Latin America. Regionally, the medical oxygen concentrators market is dominated by North America due to presence of skilled researchers and high prevalence of chronic respiratory ailments. Europe accounted for the second highest share majorly due to encouraging reimbursement scenario and high geriatric population. On the other hand, Asia-Pacific is anticipated to witness the rapid growth rate, on account of increasing investment by major manufacturers, high tobacco usage for smoking, and growing per-capita healthcare expenditure.

Medical oxygen concentrators refer to devices that deliver oxygen therapy. They are usually small in size, allowing users to carry. The medical oxygen concentrators market is driven by the rise in air pollution. Moreover, the increasing demand for cost-effective and sustainable medical oxygen devices is likely to boost the market. Stationary oxygen concentrators are widely used in hospitals and clinics, as they are safer and more cost-effective than compressed gas cylinders.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Market Size in 2024 | USD 1.57 Billion |

| Market Size in 2025 | USD 1.67 Billion |

| Market Size by 2034 | USD 2.82 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Increasing prevalence of respiratory disorders

The increasing prevalence of respiratory diseases, such as pulmonary edema, hypoxemia, sleep apnea, and chronic obstructive pulmonary disorder (COPD), is a key factor driving the global market. Oxygen therapy is needed for chronic obstructive pulmonary disease patients to control oxygen levels. According to the World Health Organization (WHO), COPD is the third leading cause of death worldwide, accounting for around 3.23 million deaths in 2019. With the increasing prevalence of smoking, COPD is increasing rapidly. Moreover, the increasing number of bedridden and geriatric patients is also expected to contribute to the growth of the market.

High cost and stringent regulatory process

The high cost of medical devices and stringent regulatory measures hinder market growth. Medical oxygen concentrators require regular maintenance to work properly. When oxygen concentrators generate oxygen, they may create noise. Moreover, stationary medical oxygen concentrators run on electricity. If there is no electric supply, they won't work and may create further challenges, thereby restraining the market.

Technological advancements

The rising technological advancements in medical devices, including oxygen concentrators, create immense opportunities in the market. Key players operating in the market are making efforts to increase their production capacities to fulfill the rising need for these concentrators. The rising research and development activities to develop rechargeable oxygen concentrators are likely to fuel the market. Furthermore, the increasing emphasis on providing medical oxygen concentrators and favorable government initiatives supporting the expansion of healthcare infrastructure are propelling the market.

The continuous flow segment held a large share of the market in 2024. Continuous flow technology delivers a steady oxygen flow, maintaining adequate oxygen levels in patients with severe respiratory conditions. Improvements carried out in the technology to make the equipment more efficient are the key factors contributing to the segmental growth. Additionally, multiple benefits over other technologies, such as reducing fatigue and providing better sleep quality, are expected to retain the dominance of the continuous flow technology segment in the near future.

The pulse dose segment is projected to expand at the highest CAGR throughout the forecast period due to rising technological advancements. Pulse dose oxygen concentrators deliver oxygen based on breathing and inhaling patterns, allowing users to customize their oxygen delivery according to their breath rate. This, in turn, improves health outcomes.

The portable segment accounted for the largest market share in 2024. The segment growth is attributed to the increasing adoption of portable oxygen concentrators in homecare settings. These concentrators are gaining immense popularity due to their ease of use and affordability. Portable medical oxygen concentrators are used in the treatment of multiple respiratory ailments, such as asthma and COPD. Thus, the rising incidence of respiratory ailments is expected to boost the demand for portable oxygen concentrators in the forecast time-frame. Moreover, market players are focusing on developing advanced portable concentrators to meet the increasing demand worldwide. For instance.

The home care segment dominated the market in 2024 and is anticipated to continue its dominance in the near future due to the rising trend of self-care. Home care services offer the convenience of treating chronic disorders at the patients' homes. The preference for home care is on the rise in developed regions majorly due to high geriatric population. Furthermore, using portable oxygen concentrators is extremely convenient for the elderly patients.

By Technology

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025