January 2025

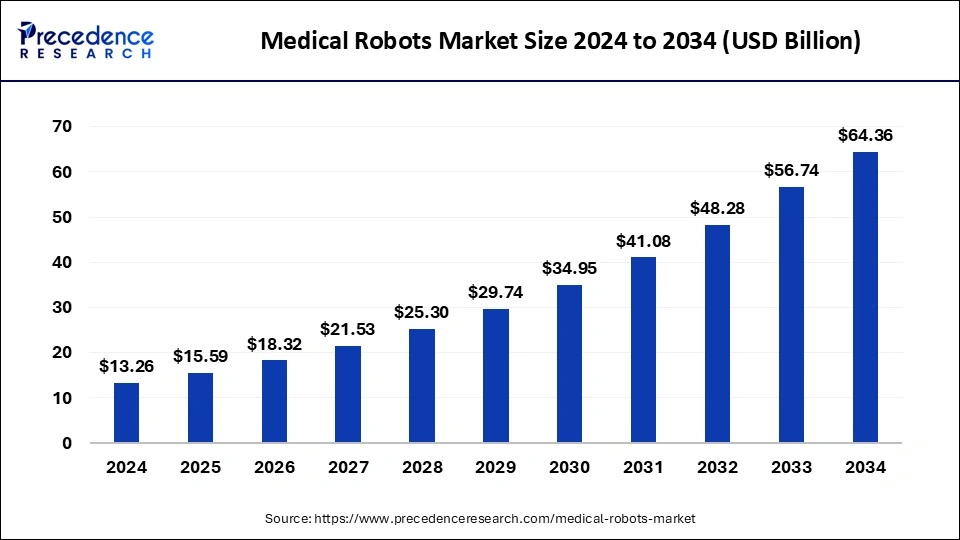

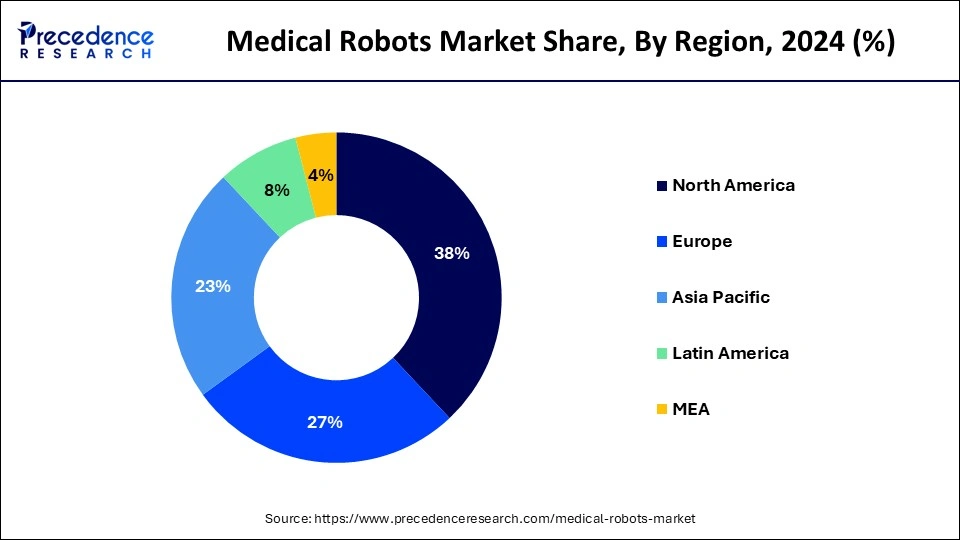

The global medical robots market size is calculated at USD 15.59 billion in 2025 and is forecasted to reach around USD 64.36 billion by 2034, accelerating at a CAGR of 17.11% from 2025 to 2034. The North America medical robots market size surpassed USD 5.04 billion in 2024 and is expanding at a CAGR of 17.26% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical robots market size was estimated at USD 13.26 billion in 2024 and is predicted to increase from USD 15.59 billion in 2025 to approximately USD 64.36 billion by 2034, expanding at a CAGR of 17.11% from 2025 to 2034. Medical robots are helpful for minimizing invasive procedures, improving workplace safety, and frequent and personalized monitoring for patients who suffer from the prevalence of chronic diseases.

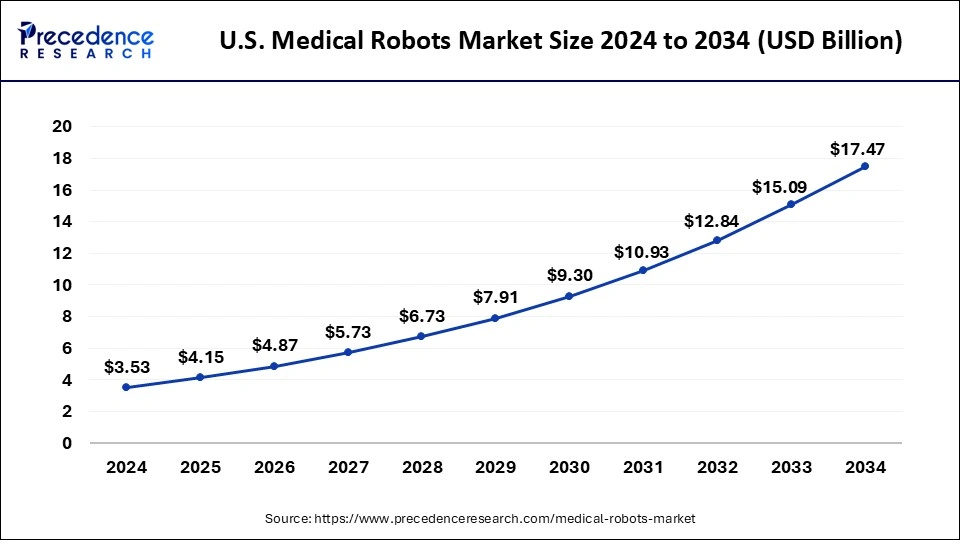

The U.S. medical robots market size was estimated at USD 3.53 billion in 2024 and is predicted to be worth around USD 17.47 billion by 2034 with a CAGR of 17.34% from 2025 to 2034.

North America dominated the medical robots market in 2024. The U.S. is the leading country for the growth of the market in the North American region. In the United States, there are many top surgical robot companies. The U.S. companies highly invest in robots. Apart from top companies, the region has technological advancements and government support, which adds up to advanced infrastructure and better facilities.

Europe also had a Increasing funding for medical robot research, increasing use of robot-assisted rehabilitation therapy, advanced technologies of medical robots, and increasing senior population are the main drivers of the growth of the medical robots market. Computer power, artificial intelligence, and miniaturization contribute to the use of medical robots for medicines. France is the leading country in the growth of the European market.

The medical robots market is the industry that focuses on the development, manufacturing, and use of robotic systems and technologies in healthcare. These medical robot devices are intended to help and enhance treatments, medical operations, and diagnoses. These medical robots help provide more affordable and safer medical procedures and help minimize invasive procedures. Medical robots help relieve medical personnel from boring routine tasks. It helps to assist with surgery and improve workplace safety. It helps to decrease the workload of the health staff.

It helps in the social engagement of elderly people and intelligent therapeutics. Medical robots are helpful for the frequent and personalized monitoring of patients with the prevalence of chronic diseases. It provides a safe work environment for healthcare workers and patients, effective processes in streamlined clinical workflows, and high-quality patient care. These benefits help to the growth of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 15.59 Billion |

| Market Size by 2034 | USD 64.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.11% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, End-use Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising necessity to minimize medication errors

Medical robots are highly used to minimize medication errors. By improving the precision of surgical techniques and performing procedures with minimal invasiveness, medical robots accelerate recovery times and enhance surgical outcomes. Medical robots are helpful to perform tasks with accuracy and precision and they help to minimize the risk of human error during the procedures. These medical robots help to shorten the recovery periods and lower the risk of complications. These factors help the growth of the medical robots market.

Rising use in the healthcare industry

There are many beneficial reasons to use medical robots in the healthcare industry. Medical robots are enough to assist surgeons during the surgical process. These are helpful for performing surgical operations without errors. It helps to enhance the success rates of surgical operations. Medical robots are highly used to improve workplace safety. Medical robots are helpful in systematic and controlled cleaning, which can help reduce the circulation of pathogens and prevent healthcare professionals from getting infected. In the healthcare sector, the use of medical robots decreases the workload of the health staff. These factors help the growth of the medical robots market.

Challenges of the medical robots

Challenges of the medical robots in the healthcare sector include safety risks, lack of skilled professionals, and lack of patient trust. There are some chances of failures and errors, and a single mechanical fault may cost human lives. In the surgical robots case, a small risk of bleeding and infections can not neglected. There are several disadvantages of medical robots, including cost, which leads to less use of medical robots in advanced hospitals, developed countries, and research centers. In the healthcare sector, medical robots may replace the health staff, leading to unemployment. These disadvantages may restrict the growth of the medical robots market.

Advanced technologies use

Implementation of advanced technologies in medical robots will help to grow the medical robots market. The use of AI (Artificial Intelligence) allowed data analytics and computer vision to transform medical robots. This helps to expand their capabilities into the many other healthcare sectors. Investment in the research and development for the development of medical robots, including autonomous and modular mobile robots and surgical assistance. The use of automation robots is helpful in the pharmacy and hospital sectors. These advanced technologies minimize the risk of human errors and help automatically label and package medications. These factors help to the growth of the market.

The surgical robots segment dominated the medical robots market in 2024. The surgical robots offer many benefits, including minimum scaring, help to reduce transfusion, post-surgery pains, and blood loss, reduced risk of infections, smaller and fever scars, rapid recovery time, and back to normal activities, reduced discomfort and pain, and shorter hospitalization stays. For surgeons, the use of surgical robots has major advantages, including greater precision, improved dexterity, elimination of the surgeon's hand tremor, less tiredness for the surgeons, and greater visualization because of the magnification of the camera.

The surgical robots have many applications based on their benefits, including wristed articulation, improved 3-dimensional visualization, superior tissue handling and instrument dexterity, and enhanced surgeon autonomy and control. These factors help the growth of the surgical robots product type segment and contribute to the growth of the market.

The pharmacy and hospital automation robots segment is the fastest-growing during the forecast period. The use of pharmacy and hospital automation robots has many advantages, including evidence-based care, improved clinical decision support systems, effective inventory management for reduced waste and stockouts, real-time patient vitals monitoring and response to the medication therapy, improved patient medication history management, and medication reconciliation, and improved medication safety through the error prevention and error identification.

Pharmacy automation robots are helpful in automatically labeling and packaging medications, and they reduce potential errors and manual labor errors. These are helpful for pharmacists' empowerment, improving patient safety, improving efficiency by increasing the speed of the service and reducing the waiting time of the patient. Automation robots minimize the risk of human errors in prescription filling and medication dispensing, which leads to accurate drug administration. These factors help the growth of the pharmacy and hospital automation robots type segment and contribute to the growth of the medical robots market.

The laparoscopic application type segment dominated the market in 2024. Medical robots are highly used in laparoscopic surgeries. This is because it works for many purposes, including providing training, assisting surgeons with precise movements, and holding laparoscopes. Surgical robots or medical robots are used in the laparoscopic application. Robotic-assisted laparoscopic surgeries can be a challenge to transform the performance with minimum invasive surgery. These factors help the growth of the laparoscopic application type segment and contribute to the growth of the medical robots market.

The hospital end-user type segment dominated the medical robots market in 2024. Medical robots are highly used in the hospital sector to support the minimum invasive procedures and frequent and customized monitoring for patients who suffer from chronic diseases. Medical robots provide more affordable and safer medical procedures, assist with surgery, improve workplace safety, and help with minimally invasive procedures. Frequent and personalized monitoring for patients with a prevalence of chronic disease. These factors helped the growth of the hospital end-user type segment and contributed to the growth of the market.

By Product Type

By Application Type

By End-use Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025