January 2025

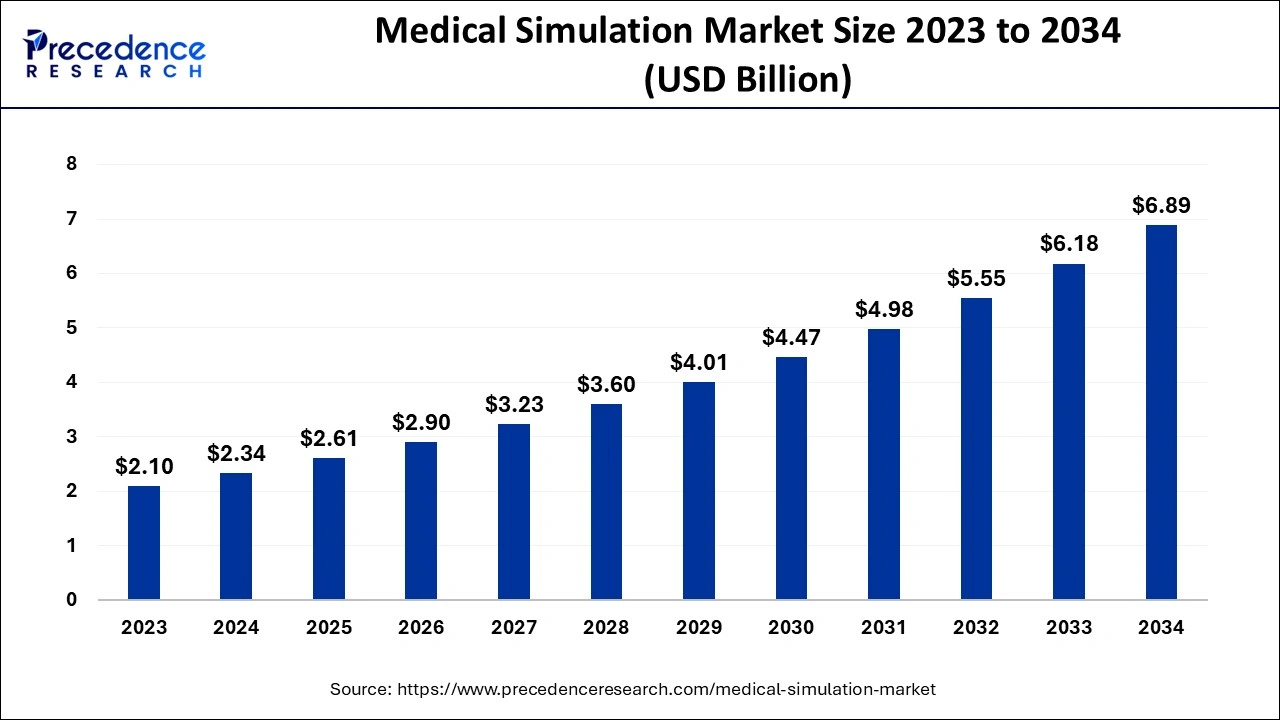

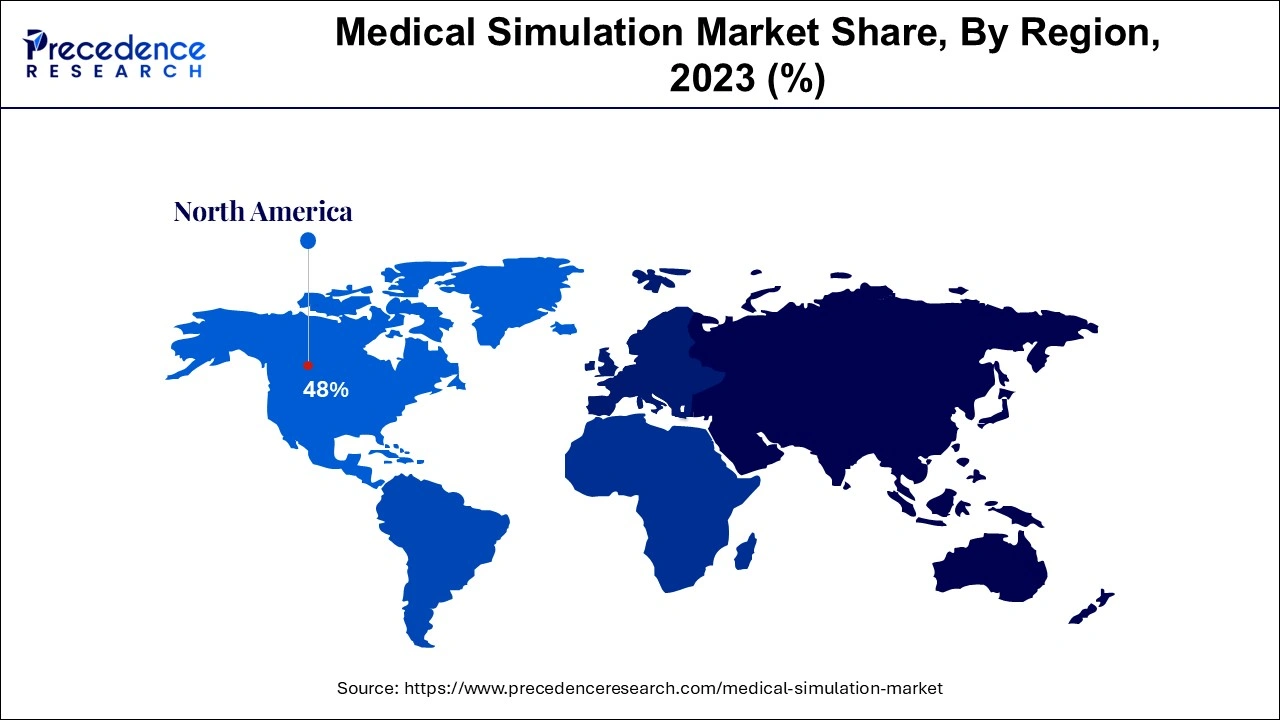

The global medical simulation market size accounted for USD 2.34 billion in 2024, grew to USD 2.61 billion in 2025 and is predicted to surpass around USD 6.89 billion by 2034, representing a healthy CAGR of 11.40% between 2024 and 2034. The North America medical simulation market size is calculated at USD 1.12 billion in 2024 and is expected to grow at a fastest CAGR of 11.49% during the forecast year.

The global medical simulation market size is estimated at USD 2.34 billion in 2024 and is anticipated to reach around USD 6.89 billion by 2034, expanding at a CAGR of 11.40% from 2024 to 2034.

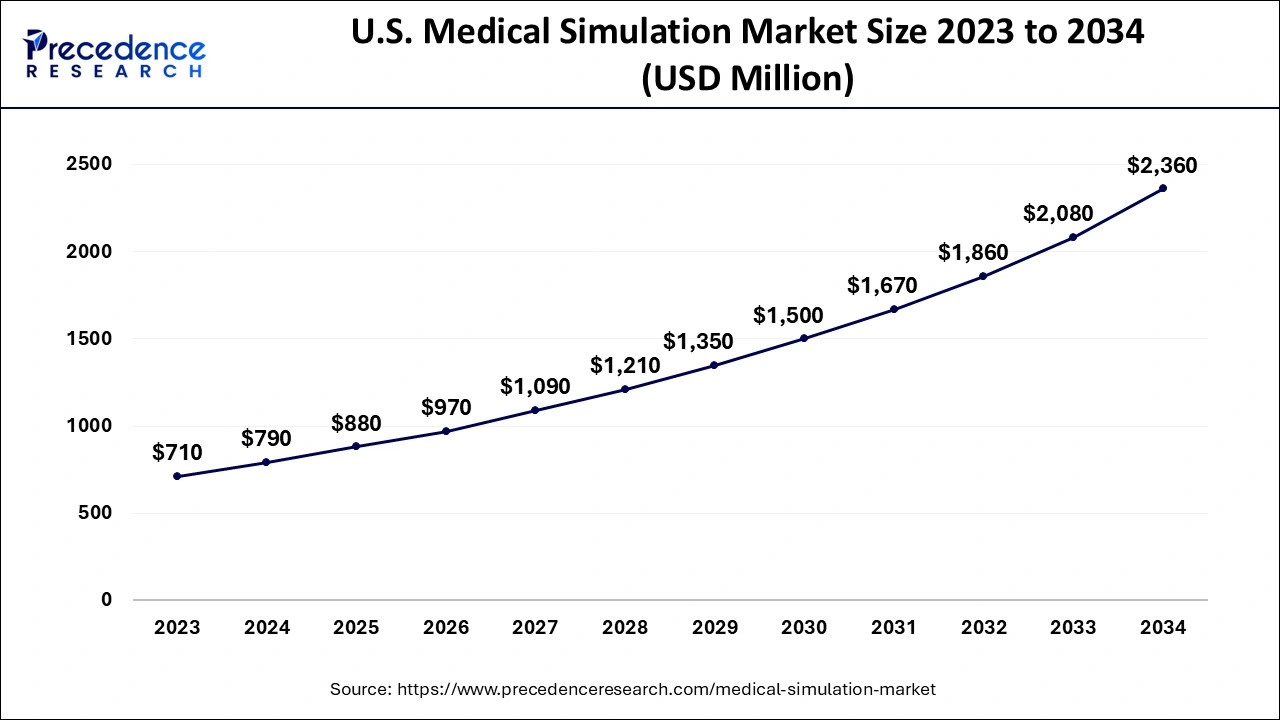

The U.S. medical simulation market size is evaluated at USD 0.79 billion in 2024 and is predicted to be worth around USD 2.36 billion by 2034, rising at a CAGR of 11.54% from 2024 to 2034.

In 2023, North America held the largest share of the worldwide medical simulation market, and it is expected to continue this position during the forecast period. This is due to an increase in medical mistakes, the presence of important actors, rising healthcare costs, technological improvements, and an increase in regional government activities. However, due to the region's growing population, the boom in institutions offering medical simulation services, and rising investments, Asia-Pacific is expected to experience significant development.

The need to uphold regulatory compliance, the rising need for healthcare cost containment and the requirement to increase patient-centricity are the drivers propelling market expansion. However, a lack of qualified IT specialists and security issues are in some ways limiting the growth of the worldwide medical simulation industry.

The functions and characteristics of a particular actual object or process are represented by a medical simulation, which is a virtual copy of genuine actions or events. It's a form of simulation that's used to instruct and prepare people for careers in medicine. Simulations can happen in a classroom, in real-world situations, or in venues designed specifically for them.

Medical simulation is a training technique that allows healthcare professionals to practice tasks and methods in actual situations using virtual reality or simulation models. Medical simulation enables the deliberate application of clinical skills as opposed to the apprentice model of learning.

The term "simulation" refers to an artificial model of a real-world process used to further educational objectives through experiential learning. Any educational activity that uses simulation tools to simulate clinical circumstances is referred to as simulation-based medical education.

The rise of the medical simulation market is being driven, in part, by an increase in the usage of simulation in the healthcare industry, an increase in mortality from medical errors, and the desire to improve patient safety outcomes. Growing in popularity, virtual and augmented reality have proven beneficial for communication and training in healthcare simulation programs. For instance, virtual reality (VR) may be used to help faraway students collaborate on procedures like operations. Students may use their knowledge in practice and correct their errors because of this. Virtual and augmented reality may be a great supplement to hands-on training that involves performing surgery and putting IVs in healthcare simulation.

Patient safety and outcomes can be improved by the expanded use of simulation-based training and certification of healthcare personnel. As a result, the addressable market would be substantially more than it is now, which is mostly dependent on education. In low- and middle-income countries, patient harm in healthcare is responsible for roughly 2.6 million deaths annually, ranking it as the 14th biggest cause of morbidity and mortality, according to a 2019 study released by the WHO. The most harmful mistakes include diagnosis and medical care. Clinicians who participate in simulation training may become more knowledgeable and confident.

Healthcare organizations throughout the world have made reducing medical mistakes and ensuring patient safety and high-quality treatment a top priority. 2019 WHO publication claims that roughly 25% of patients worldwide have difficulties as a result of hazardous surgical care methods. Additionally, the University Health Network reports that more than 28,000 Canadians died in 2019 as a result of avoidable medical mistakes. According to the Journal of Patient Safety, between 210,000 and 440,000 fatalities in the US occur each year as a result of avoidable medical mistakes; in 2019, they made up one-sixth of all annual deaths in the country. Each year, these mistakes cost somewhere around USD $1 trillion. In 2018, the market for reporting drug errors was valued $326 million. Of this, knowledge-based mistakes accounted for one-third.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.34 Billion |

| Market Size by 2034 | USD 6.89 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.40% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Growing technological advancements

Medical simulation in healthcare creates a safe learning environment

The use of simulation for training healthcare professionals helps them gain confidence, knowledge, and expertise

The market is divided into web-based simulators, simulation training services, healthcare anatomical models, and healthcare simulation software based on goods and services. Task trainers, patient simulators, ultrasound simulators, interventional/surgical simulators, endovascular simulators, dental simulators, and eye simulators are other categories within the healthcare anatomical model industry.

In 2022, the healthcare anatomical model category accounted for more than 33% of the market. These simulators are proven useful for conducting tests and combinations before settling on designs, procedures, or systems in the research and production sectors, particularly in the medical devices sector. Over the course of the forecast period, these variables are predicted to support the segment's expansion.

The medical simulation market is divided into the virtual patient simulation, 3D printing, and procedural rehearsal technologies on the basis of technology. In 2022, the procedural rehearsal technology market had the highest share, accounting for 41.6%. The need for process rehearsal technology is anticipated to increase as a result of the increased number of medical mistakes and the resulting demand for patient safety. Technology advances are being worked on by industry participants, and this is projected to drive market expansion.

During the projected period, the virtual patient simulation market is anticipated to grow at a profitable CAGR of over 19.3%. Technology has several uses in the academic programs of medical schools. 3D Systems, Simulaids, Simulab Corporation, and Surgical Science Sweden AB are businesses that deal in virtual patient simulation.

Military organizations, academic institutions, research facilities, and hospitals are the different end-use segments of the market. With a share of 31.7% in 2023, the academic institutes' sector had the majority. Due to the existence of several academic research groups engaged in the study of complex biological systems using computer models, the market for academic research institutions is predicted to continue growing. For instance, using PBPK modeling, the NIDDK investigated how medicines that are excreted from the kidneys through organic anion transporters are affected by decreasing kidney function.

Due to a gradual shift in emphasis toward advanced learning, the introduction of cutting-edge simulation-based technologies, the full utilization of simulation models in medical procedures, the growing emphasis on minimizing errors, and the cost-effectiveness of procedural training for medical doctors, the hospitals' segment is anticipated to experience the fastest growth rate of about 16.9% during the forecast period.

By Product and Services

By Technology

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025