January 2025

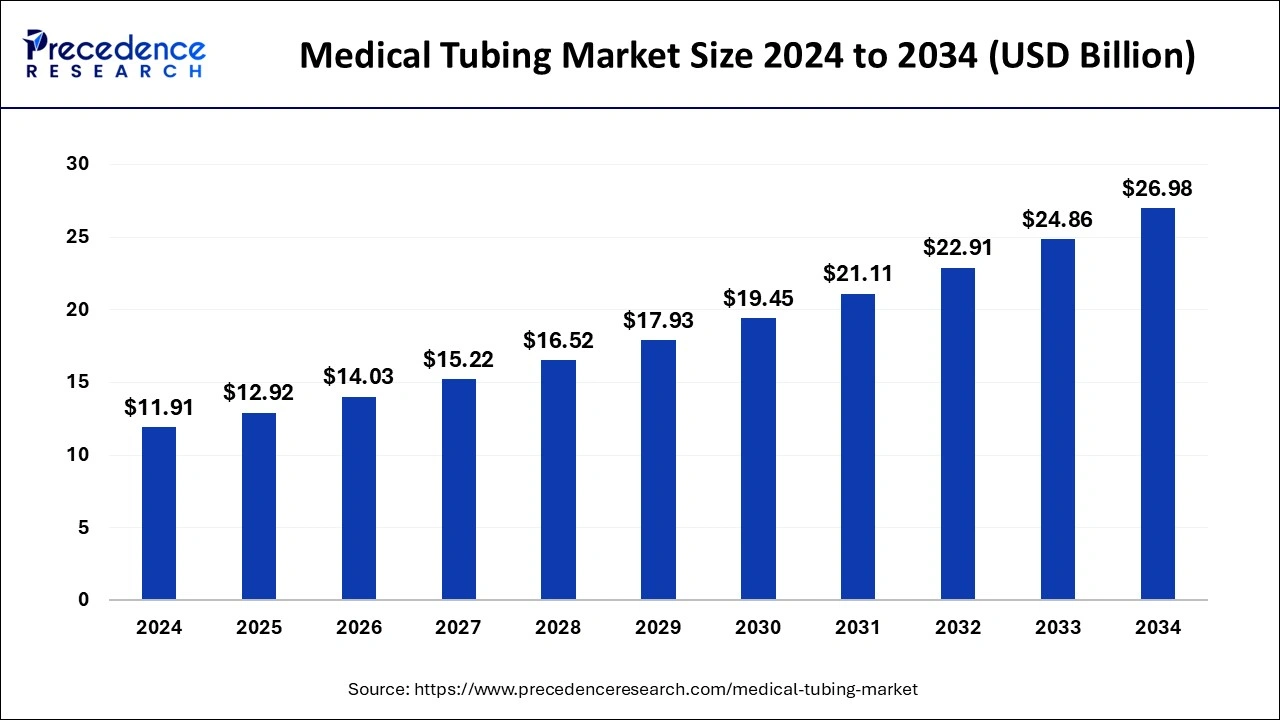

The global medical tubing market size is calculated at USD 12.92 billion in 2025 and is forecasted to reach around USD 26.98 billion by 2034, accelerating at a CAGR of 8.52% from 2025 to 2034. The North America medical tubing market size surpassed USD 4.22 billion in 2024 and is expanding at a CAGR of 8.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical tubing market size was accounted for USD 11.91 billion in 2024 and is anticipated to reach around USD 26.98 billion by 2034, growing at a CAGR of 8.52% from 2025 to 2034.

Medical tubing where AI can be implemented includes central venous catheters, nasogastric tubes, urinary catheters and endotracheal tubes. AI can be applied for various purposes in medical tubing such as for monitoring vital signs, detecting abnormalities in blood flow, predicting potential complications, early detection of infection and for optimizing fluid administration by analysing real-time data from the tubes which helps healthcare professionals to make informed decisions and responsive interventions.

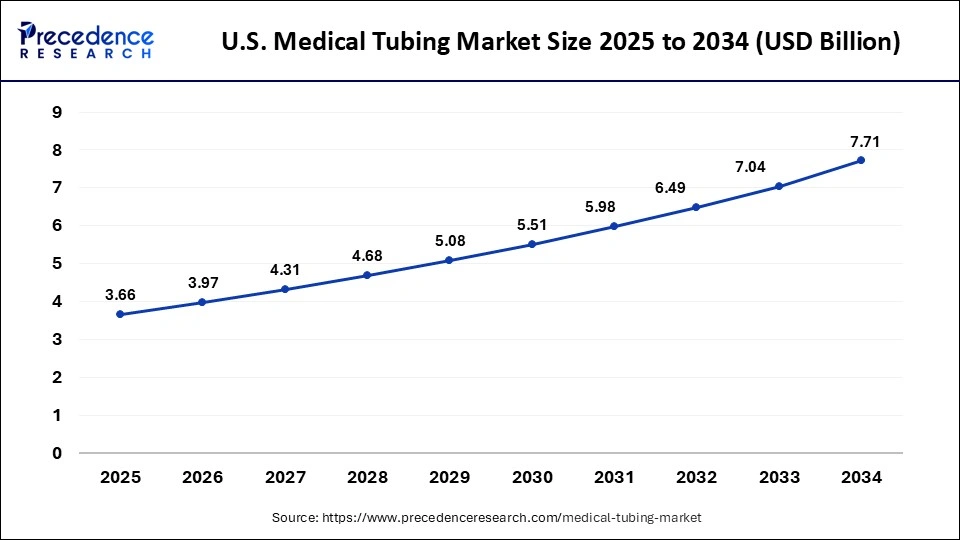

The U.S. medical tubing market size was evaluated at USD 3.37 billion in 2024 and is predicted to be worth around USD 7.71 billion by 2034, rising at a CAGR of 8.63% from 2025 to 2034.

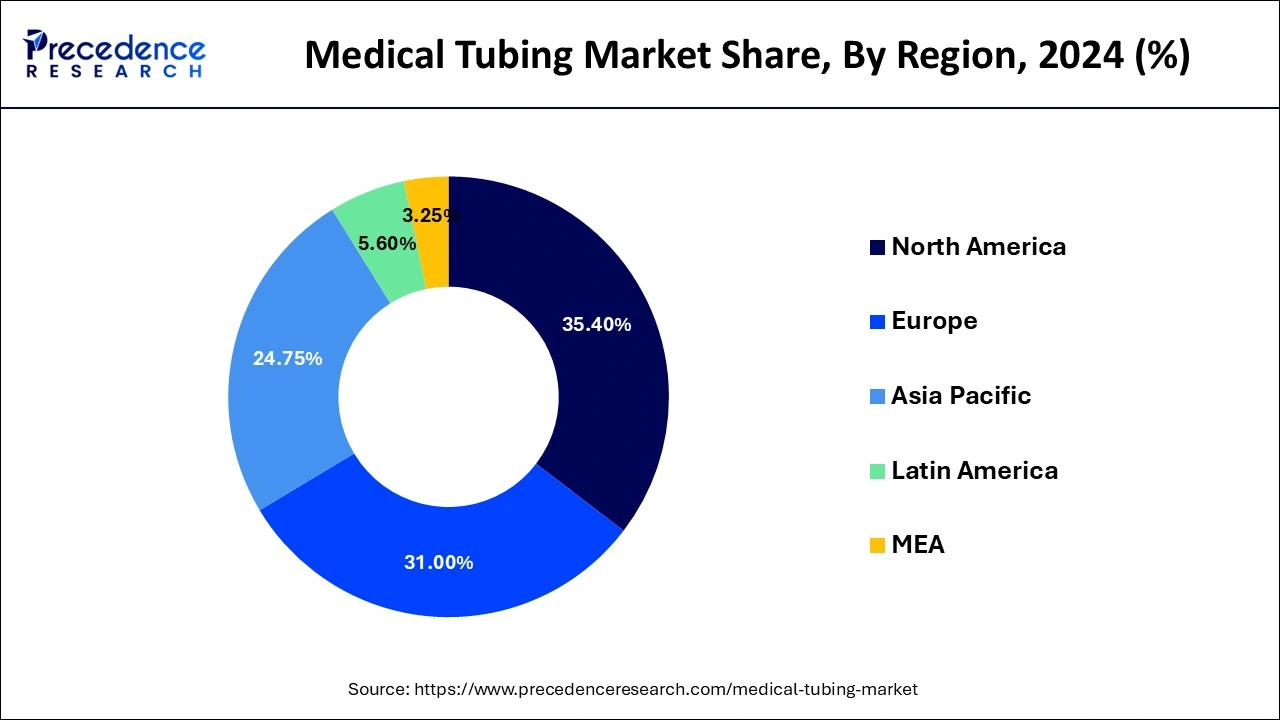

North America dominated the medical tubing market with the largest market share of 35.40% in 2024. The growth can be attributed to the rising innovations in developing minimally invasive procedures used for medical applications mitigating the risk of infection and decreasing discomfort in patients. Furthermore, the surging demand for medical tubing and medical devices in various medical fields for research and clinical study purposes, support from government authorities and use of sustainable manufacturing materials lessening the environmental impact are promoting the market growth of this region.

Asia Pacific region is expected to grow rapidly in the medical tubing market over the forecast period. The increased healthcare expenditure, rise in clinical trials, growing awareness among people about advanced medical procedures and support from government bodies in providing advanced medical devices as well as for setting up health centres is driving the market growth of this region. Moreover, the increased outsourcing of international companies for developing medical tubing manufacturing facilities in this region to increase access with regional partners and reducing import costs is expected to fuel the market growth of this region in the upcoming years.

Developments in manufacturing practices have led to the integration of bioactive constituents into extruded materials, together as a way to distribute drugs and to encourage healing. For instance, pharmaceutical elements can be blended with silicone to provide multiple benefits. Silicone has highly constant absorption characteristics. Ultraviolet light treatable silicones allow extruders to blend drugs into silicone and extrude drug entrenched tubing without affecting the efficiency of the medication. Such medications are predominantly antimicrobials or antibiotics that can be discharged at regulated rates. Medicinal tubing usage is used in multiple therapeutic procedures; therefore, the manufacturing of medical tubing requires some certifications and a standard technique. Distinct materials with chosen specifications are employed to produce medical tubing. Constant innovation in drug transfer systems is increasing the mandate for customizable medical tubes, which is expected to drive the need for medical tubes in medication delivery structures. Also, the preference for less invasive medicinal procedures over conservative surgical procedures is growing, as they offer benefits such as quick recovery period, low cost, and reduced length of hospital stays. Moreover, increasing modernizations in drug transfer systems such as photo-thermally triggered medication delivery, intra-cochlear medication delivery which employ nano-medical tubing, is likely to further propel industry growth over estimate period.

| Report Highlights | Details |

| Market Size in 2024 | USD 11.91 billion |

| Market Size in 2025 | USD 12.92 billion |

| Market Size by 2034 | USD 26.98 billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.52% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Medical Condition, Application, Material Type, End-User |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Rising Importance on Use of Sustainable Chemical Manufacturing

With the rising investments by industries in research and development as well as the integration of economic principles for transforming chemical manufacturing, reducing waste and for enhancing resource planning is promoting the utilization of sustainable manufacturing methods which will help in reducing environmental impact by reducing product carbon footprint.

Limited compatibility and discomfort

Materials used in medical tubing and medical devices for medical purposes can cause discomfort in patients leading to skin irritations, infections and allergic reactions. Certain considerations about availability and usage of suitable materials with specific properties such as biocompatibility, chemical resistance, flexibility, strength and lightweight in nature can limit the development of tubing in various applications.

Technological Innovations for Developing Minimally Invasive Procedures

The rising demand by patients for minimally invasive procedures for diagnosis, monitoring and treatment purposes is accelerating the development process of innovative methods for enhancing patient compliance and comfort.

The cardiovascular segment dominated the market with the largest share in 2024. Cardiovascular disease burden is rising in the world with the changing lifestyle habits, due to other medical conditions, environmental factors, psychological factors and biological factors which creates the demand for suitable and sustainable medical tubing and devices used for diagnosis, monitoring and treatment purposes. Furthermore, the application of medical tubing in various cardiovascular procedures such as cardiac catheterization, atherectomy and coronary angioplasty are driving the market growth of this segment.

The urological medical conditions segment in expected to grow rapidly over the forecast period. Medical tubes are widely used in urology for various purposes such as urinary catheters, urinary incontinence, urinary retention, for surgical purposes, during childbirth and in chemotherapy for bladder cancer in patients. Moreover, the rising innovations for advancing the applications of these medical tubes with increased efficacy and patient convenience are expected to fuel the market growth of this segment during the forecast period.

The bulk disposable tubing contributed the highest market share of 35% in 2024. Disposable tubing is applied for variety of medical applications such as blood transfusions, IV infusions, drug delivery, laboratory testing among other. Furthermore, they are widely used in hospital and clinical settings for medical diagnosis and treatment purposes which drives the market growth of this segment.

The polyvinyl chloride (PVC) segment dominated the market with the largest share in 2024. PVC is widely utilized in medical tubing applications including intravenous (IV) tubing, blood bags, catheters among others owing to its various advantages such as durability, flexibility, ease of sterilization and ability to be moulded in different shapes and sizes. Moreover, the biocompatibility and reduced manufacturing costs using PVC are fuelling the market growth of this segment.

The polyolefins segment is expected to grow rapidly over the forecast period. Polyolefins are easy to sterilize, highly flexible, chemically resistant and biocompatible making them a suitable material for various applications in medical field. Moreover, they can be easily customized as per their specific application and durable for fluid delivery which makes them a sustainable and convenient option for manufacturing of medical tubing thereby fuelling the market growth of this segment in the predicted timeframe.

Based on end-user, the hospitals segment dominated the market with the largest share in 2024. The market growth of this segment can be attributed to the medical procedures such as colonoscopy, endoscopy, myringotomy and ureteral catheterization among others which use medical tubes for diagnostic and treatment purposes in patients.

The companies focusing on research and development are expected to lead the global medical tubing market. Leading competitors contending in global medical tubing market are as follows

By Medical Condition

By Application

By Material Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025