January 2025

The global medical waste management market size is calculated at USD 14.06 billion in 2025 and is forecasted to reach around USD 26.08 billion by 2034, accelerating at a CAGR of 7.20% from 2025 to 2034. The North America market size surpassed USD 4.08 billion in 2024 and is expanding at a CAGR of 7.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical waste management market size accounted for USD 13.11 billion in 2024 and is expected to exceed around USD 26.08 billion by 2034, growing at a CAGR of 7.20% from 2025 to 2034.

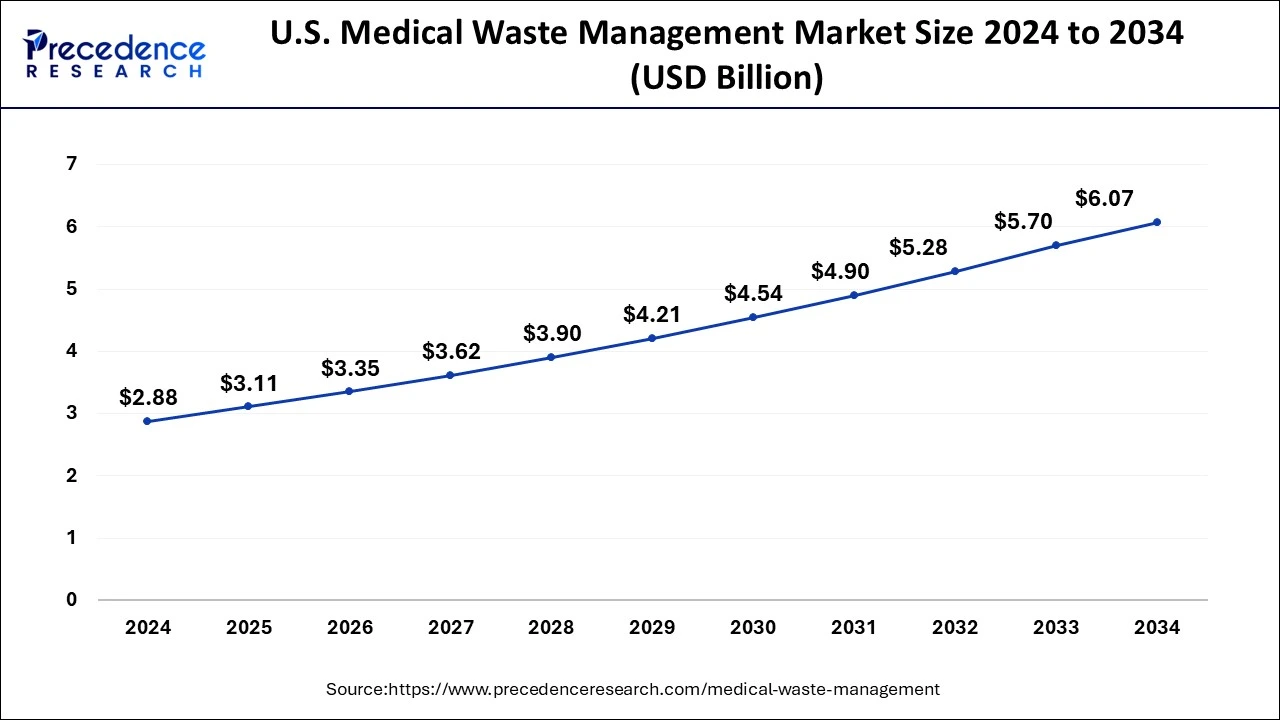

The U.S. medical waste management market size exhibited at USD 2.88 billion in 2024 and is projected to be worth around USD 6.07 billion by 2034, growing at a CAGR of 7.90% from 2025 to 2034.

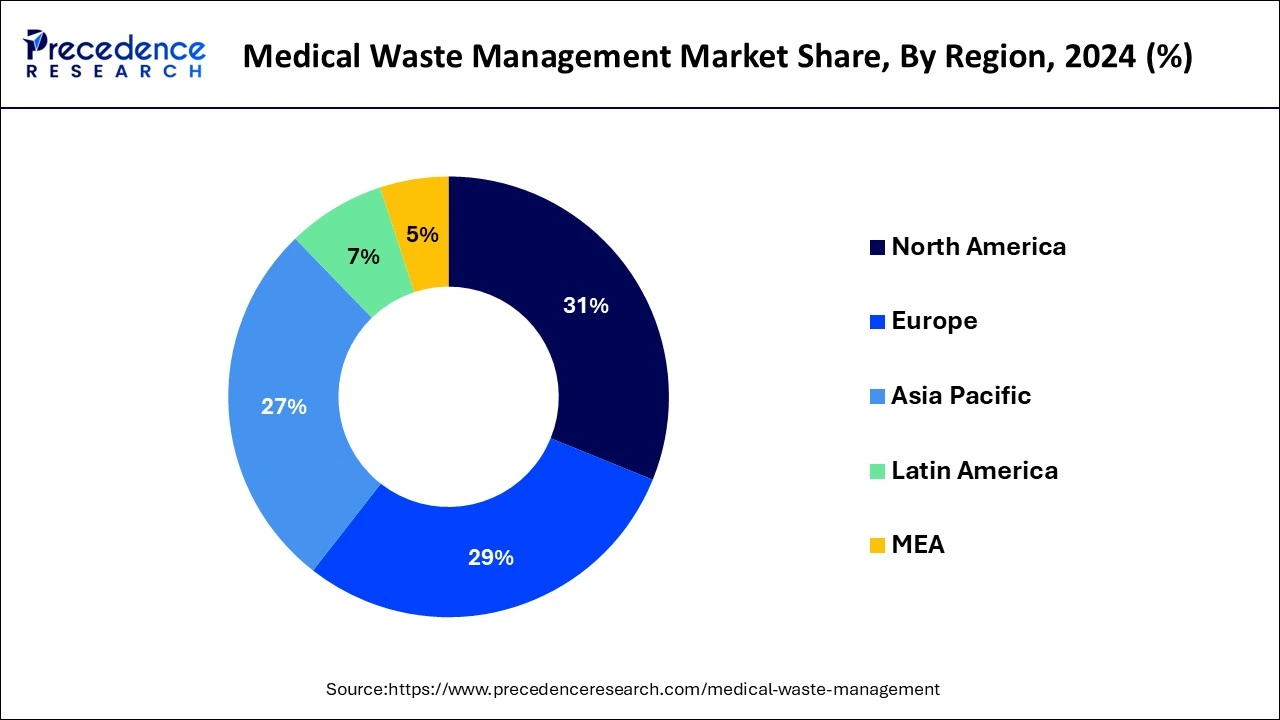

The detailed research report covers significant prospects and inclinations of medical waste management products throughout different regions including Europe, North America, Asia-Pacific, Africa, the Middle East, and Latin America. By region, the medical waste management market is led by North America due to the high incidence of cancer and early implementation of the latest medical waste management techniques. Europe reported the second maximum share predominantly due to the high geriatric population and positive reimbursement scenario.

The U.S. is a major player in the regional market, growth driven by the country's large healthcare industry, stringent regulations, and increased demand for effective waste management solutions. The growing demand for sustainable waste management practices is fueling innovation and development areas. The strict regulations, including the US Environmental Protection Agency (EPA), play a crucial role in regulating waste management, including medical waste disposal.

Asia-Pacific is also anticipated to witness a rapid growth rate, on account of increasing investment by major manufacturers and increasing per capita healthcare expenditure. India is a significant player in the Asian medical waste management market, driven by rising awareness of the importance of proper biomedical waste management, government regulations, investments in R&D, technological advancements, and the rise of third-party waste management service providers.

Medical wastes need careful containment and disposal before gathering and consolidation for handling. The measures for discarding controlled medical-waste substances are designed to shield the staffs who generate medical scrap and who tackle the wastes from generation point to disposal point. To avert injuries from needle sticks and other infected sharps should not be repeated, firmly bent, or cracked by hand. Centers for Disease Control and Prevention have broadcasted general rules for managing sharps. Healthcare amenities may need added precautions to avert the creation of aerosols during the management of blood-contaminated objects for some rare diseases or situations.

Storage and transportation of regulated medicinal wastes within the healthcare organization prior to termination of treatment are often essential. Healthcare organizations are instructed to clear out medical waste frequently to avoid buildup. Medical scrap requiring storing should be reserved in puncture-resistant, leak-proof, labeled containers under situations that lessen or avert foul smells. The storage area must be well-ventilated and be unreachable to pests. Every facility that produces regulated medical scrap should have a controlled medical waste management strategy to ensure well-being and environmental protection as per local guidelines.

Incineration of medical scrap has conventionally been the foremost medical waste managing technique globally. However, incineration results in the emission of numerous harmful fumes such as Sulphur dioxide, dioxins, and carbon monoxide which augment global warming. Thus, the development of other techniques is gaining popularity for sustainable medical waste management.

COVID-19 Impact on Global Medical Waste Management Market

The COVID-19 pandemic has resulted in an abrupt breakdown of waste management strings. Safe management of hazardous medicinal waste is critical to successfully limiting the pandemic. Mismanagement at any stage can lead to augmented environmental contamination. The world is anticipated to be loaded with medical waste material in the near future owing to the COVID-19 pandemic, and the consequences of this buildup of medical leftovers will have a deep impact on justifiable medical waste administration measures for years to come. To handle such a large worldwide influx of waste, the industry will have to respond by dispensing an increase in conservative management facility volumes and will require looking to fewer conventional portable units and RFID imprinting technology to guarantee sustainable healthcare waste administration.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.11 billion |

| Market Size in 2025 | USD 14.06 Billion |

| Market Size by 2034 | USD 26.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.20% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment, Waste Type, and Regions |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Incineration Segment Reported Foremost Market Stake in 2024

Incineration displayed the major share in the worldwide medical waste management market in 2024. Incineration is the lone method employed for pathological scrap such as identifiable tissue and body parts that augments the segmental share. The factors such as the generation of a high volume of medical waste due to the increasing prevalence of viral diseases and the low cost of incineration are expected to retain the dominance of incineration in the near future. The chemical treatment segment is anticipated to grow at the maximum CAGR through the forecast time frame mainly due to high anticipated demand.

Hazardous Waste Dominated the Market Revenue

Hazardous waste is generated in high volumes at hospitals and other healthcare facilities. Moreover, the implementation of stringent regulations for the safe disposal of hazardous waste by governments all over the world is expected to boost the demand for hazardous waste management in the near future.

By Treatment

By Waste Type

By Waste Generator

By Treatment Site

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025