October 2023

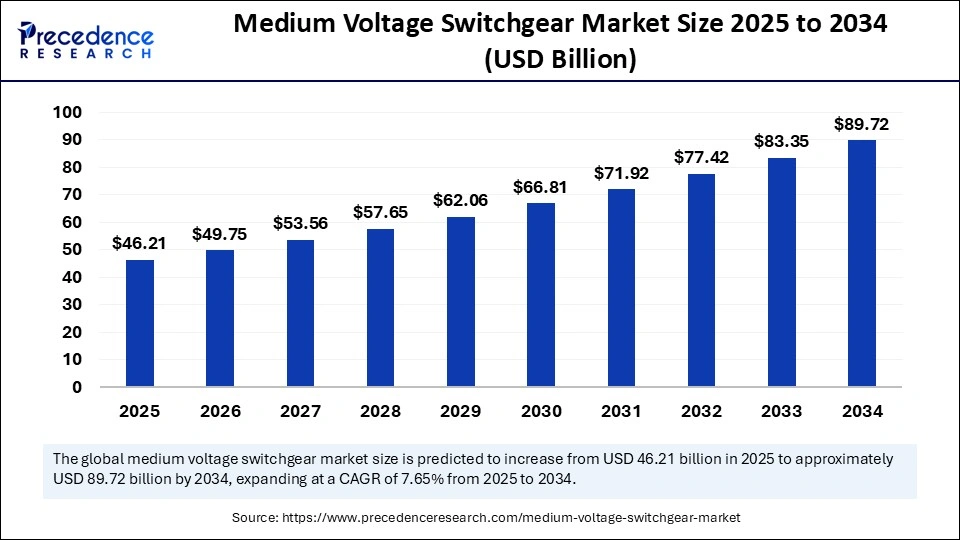

The global medium voltage switchgear market size is calculated at USD 46.21 billion in 2025 and is forecasted to reach around USD 89.72 billion by 2034, accelerating at a CAGR of 7.65% from 2025 to 2034. The Asia Pacific market size surpassed USD 15.03 billion in 2024 and is expanding at a CAGR of 7.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medium voltage switchgear market size accounted for USD 42.93 billion in 2024 and is predicted to increase from USD 46.21 billion in 2025 to approximately USD 89.72 billion by 2034, expanding at a CAGR of 7.65% from 2025 to 2034. The market is growing because of rising electricity requirements, modernization trends, and the adoption of intelligent distribution systems for secure power delivery.

The medium voltage switchgear market is undergoing substantial change through artificial intelligence integration, which improves operational efficiency and cuts down maintenance times. The implementation of proactive maintenance efforts enhances power system reliability, safety performance, lowers operational expenses, and reduces system disruptions. Energy efficiency increases through AI-powered smart switchgear because it enables the system to perform better with optimized load management. AI functions as a fundamental factor that influences market development because organizations consistently require better power management solutions for industrial and urban environments.

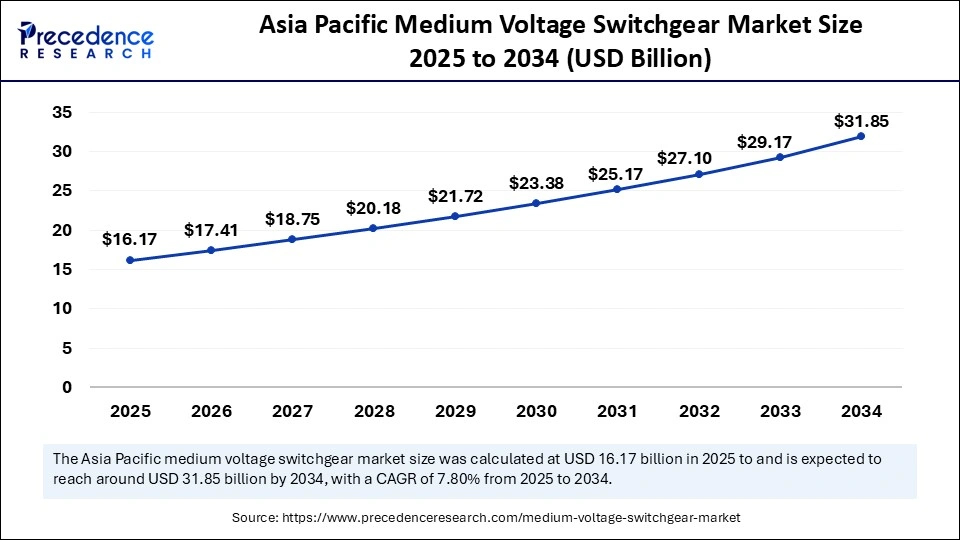

The Asia Pacific medium voltage switchgear market size was exhibited at USD 15.03 billion in 2024 and is projected to be worth around USD 31.85 billion by 2034, growing at a CAGR of 7.80% from 2025 to 2034.

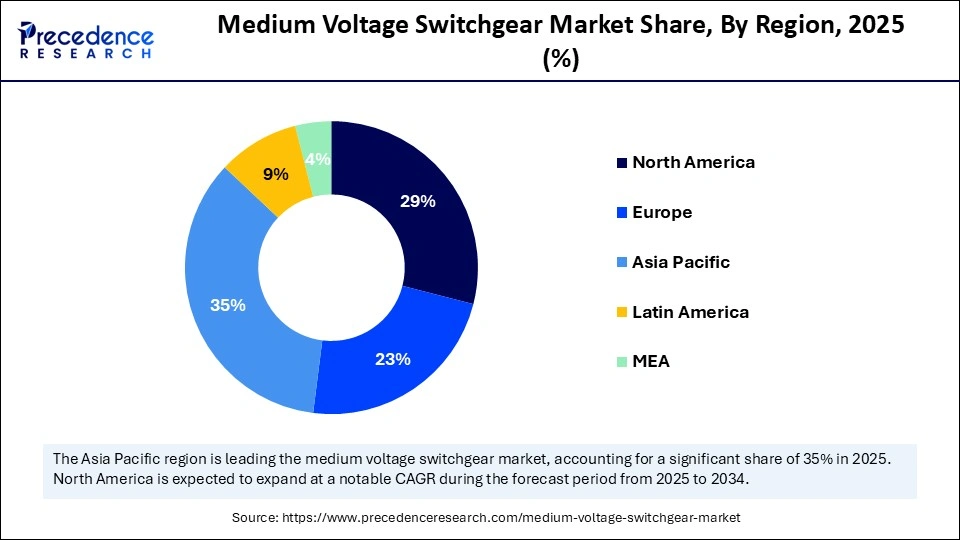

Asia Pacific held the largest share of the market in 2024 due to rapid power infrastructure development in China and India. These countries experience rapid industrialization, urbanization, and surging population numbers that drive the market. Renewable energy focus and ongoing smart grid developments drive the market need for medium voltage switchgear in this particular region.

The medium voltage switchgear market expansion rate increases because government initiatives both boost the product availability of electricity and enhance power grid performance and dependability. The Asia Pacific market will experience significant growth because of advancing infrastructure developments as well as increasing regional pursuit of efficient energy generation and reliable grids across evolving economies.

North America is expected to grow at the fastest pace in the medium voltage switchgear market during the forecast period. The enhanced North American power grid and energy networks need contemporary, efficient solutions because of their expanded development. North American utility companies make considerable investments in advanced medium voltage switchgear for building robust electrical grids with stability features. The U.S. utility sector gives priority to advanced medium voltage switchgear for power management and grid stability purposes because it focuses on integrating renewable energy technologies such as wind and solar power.

Europe has emerged as a significant player in the global medium voltage switchgear market. The urban transformation and rural network upgrades have driven market expansion because of increasing levels of electric power usage. The market continues to grow due to rising needs for strong infrastructure and renewable energy technology, thus driving higher demand for reliable medium voltage switchgear systems to distribute power efficiently. The expansion of the European market is expected because governments focus on energy conservation and smart grid implementation with sustainable energy generation policies.

Modern electrical distribution systems rely on medium voltage switchgear to control, protect, and disconnect equipment that functions within the voltage range from 1kV to 36kV. The essential components, including circuit breakers, switches, and transformers, as well as fuses, are contained within a metal-enclosed structure to ensure safe power distribution and reliability. The system becomes more efficient when control cabinets provide convenient access for better maintenance operations. Medium voltage switchgear provides high adaptability and reliability, which enables its use across automotive, construction, telecommunications, electrical, and electronic industries.

The medium voltage switchgear market plays a critical role in commercial and residential projects to assist with elevated power consumption needs. The increasing global expansion of infrastructure and proliferation of smart technologies increases the necessity of medium voltage switchgear for efficient energy management and system stability, together with operational protection against electrical failures or overloads in multiple operational environments. The urban development strategies resulting in residential and commercial construction become major drivers of switchgear requirements to ensure reliable power distribution systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 89.72 Billion |

| Market Size in 2025 | USD 46.21 Billion |

| Market Size in 2024 | USD 42.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.65% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Voltage Rating, Insulation Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for electricity

The worldwide need for electrical power creates conditions for the medium voltage switchgear market to show growth. Power distribution systems received better demand through urban population expansion as well as industrial growth, together with electric vehicle adoption and smart technology introduction. Utilities use medium voltage switchgear systems as essential components for network-wide electrical power distribution to deliver protective safety and optimized power system control. Modern electric power distribution needs depend on these systems because utility organizations incorporate renewable energy at a fast rate in their operations. Power grid stability and power transmission between varied energy sources can be supported by medium voltage switchgear, which promotes the modernization process for entire energy systems.

Slow adoption rate

The implementation of modern switchgear technologies faces delays due to insufficient development of infrastructure, expensive initial investments, and insufficient technical specialists. The execution of upgraded electrical systems faces delays because emerging regions with basic infrastructure prioritize different essential services instead of electric system improvements. Multiple regulatory issues and inconsistent policy standards act as barriers to adopting innovative switchgear technologies. The implementation issues create inconsistent market development, which slows down worldwide switchgear growth. Acceleration of switchgear deployment in developing markets requires solutions that overcome financial barriers, technical matters, and regulatory limitations, since such improvements would raise power distribution efficiency and grid reliability standards.

Rising need for renewable energy

Efforts to lower carbon emissions and build sustainable power systems have accelerated the adoption of solar energy, wind power, and hydropower. Such renewable energy systems provide power at medium voltage requirements, where advanced switchgear technology serves as an essential requirement for effective connection to the power grid. The medium voltage switchgear market receives ongoing support from international climate goals and clean power network development efforts triggered by supporting policies. This expansion opens new opportunities for development since regions are expanding their renewable energy infrastructure and requiring dependable power distribution networks.

The 6kv - 15kv segment held a significant medium voltage switchgear market share in 2024. 6kV - 15kV Voltage is employed throughout industrial plants, utilities, commercial buildings, and local power distribution networks. The distribution system relies fundamentally on 6kV - 15kV voltage for delivering power from substations to meet end-user requirements. Cities use 6kV to 15kV switchgear to power hospital constructions while also supporting residential developments, office developments, and transportation networks. The voltage range supports renewable energy infrastructure development because it enables the easy connection of clean power generation to the power grid system.

The 16kv - 27kv segment is anticipated to show considerable growth in the forecast period. The speed of urban development and rising infrastructure output trigger rising electricity distribution requirements that sustain switchgear adoption. The 16kV-27kV capability range enables increased operational ability to handle power demands in areas with large loading needs, as it facilitates solar parks and wind farms into the power network. The segment will experience growth due to modernization investments from government entities and private industries, increasing their dependence on reliable power sources.

The gas-insulated switchgear segment held the largest medium voltage switchgear market share in 2024 and is expected to be dominant throughout the projected period because of its small dimensions, safety upgrades, and operational reliability, which make it appropriate for dense urban applications as well as high-intensity applications with limited space. Governments worldwide and power utility companies invest in renewing infrastructure and grid integration of renewable systems, which boosts the demand for GIS technology. The power distribution sector will depend heavily upon GIS systems when global industries transition to sustainable power solutions.

The air-insulated switchgear segment is anticipated to show considerable growth over the forecast period. AIS proves cost-efficient because of its basic structure design and maintains high usability in indoor and outdoor environments, which maintains robust infrastructure networks. The high level of installation convenience, affordable operational expenses, and broad industrial applications in transmission, manufacturing, automation, transportation, and petrochemicals create significant market growth opportunities for AIS. Customers are interested in AIS systems due to their direct operation system and simplified maintenance requirements, and sustainability features.

The transmission and distribution utilities segment held a dominant share in the medium voltage switchgear market in 2024. Transmission and distribution utilities have a crucial function in generating power through non-renewable and renewable energy sources for distribution across electrical networks. Safe power distribution functionality of these switchgears and operational protection through component safeguarding against failures. The T&D utilities sector keeps boosting market growth because infrastructure development targets smart grids and renewable energy systems.

The commercial and residential segment is anticipated to show considerable growth over the forecast period. The power distribution framework, consisting of commercial buildings, residential complexes, and industrial zones, needs medium voltage switchgear as its primary element to ensure stability, operational efficiency, and a secure electricity supply. Modern switchgear solutions for infrastructure development support steady power operation as well as stable grids and protective safety measures for these sectors. The growing number of renewable energy devices installed within urban areas and residential regions leads to a higher market need for medium voltage switchgear systems.

By Voltage Rating

By Insulation Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

August 2024

January 2025