April 2025

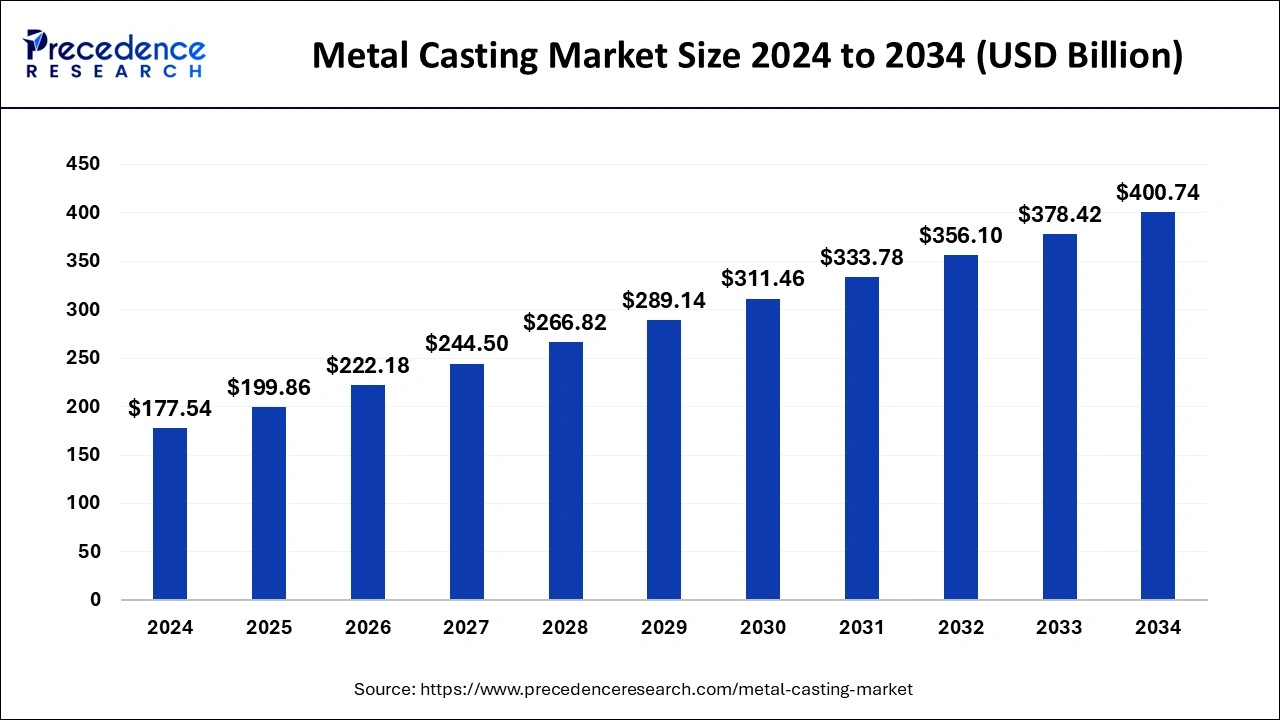

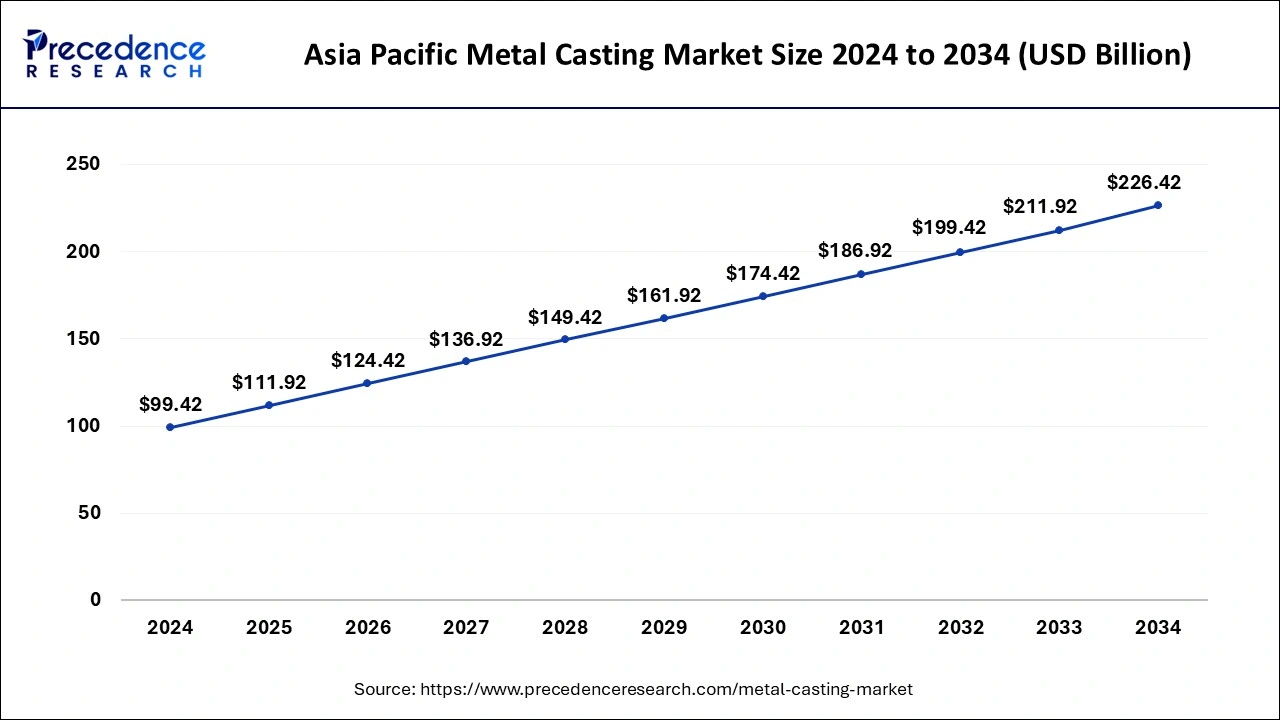

The global metal casting market size is calculated at USD 199.86 billion in 2025 and is forecasted to reach around USD 400.74 billion by 2034, accelerating at a CAGR of 8.48% from 2025 to 2034. The Asia Pacific market size surpassed USD 99.42 billion in 2024 and is expanding at a CAGR of 8.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metal casting market size accounted for USD 177.54 billion in 2024 and is predicted to increase from USD 199.86 billion in 2025 to approximately USD 400.74 billion by 2034, expanding at a CAGR of 8.48% from 2025 to 2034.

The Asia Pacific metal casting market size was exhibited at USD 99.42 billion in 2024 and is projected to be worth around USD 226.42 billion by 2034, growing at a CAGR of 8.58% from 2025 to 2034.

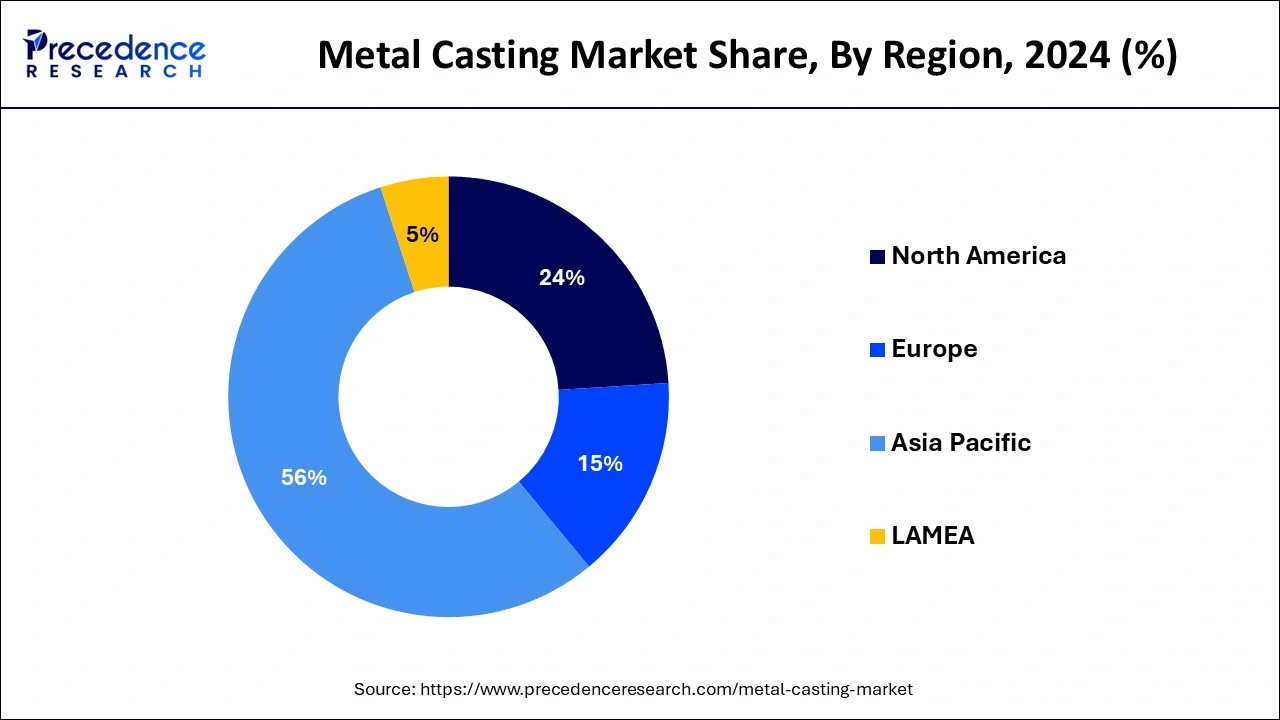

Asia Pacific had the largest market share of 56% in 2024 and will maintain its dominant position from 2025 to 2034. The metal casting market is due to robust industrialization, substantial automotive production, and rapid infrastructure development. The region's manufacturing prowess, particularly in countries like China and India, has fueled a high demand for metal castings across various sectors. Moreover, the growing emphasis on lightweight materials in automotive manufacturing further amplifies the significance of metal casting processes. The expanding industrial base, coupled with increasing investments in infrastructure, positions Asia-Pacific as a key player in the global metal casting market.

Europe is poised for rapid growth in the metal casting market, fueled by advancements in technology and increasing demand for lightweight materials.

The European automotive sector, a significant consumer of metal castings, emphasizes fuel efficiency and sustainability, driving the adoption of innovative casting processes. The European Foundry Industry alone contributes over EUR 40 billion annually. Additionally, initiatives like the European Green Deal promote sustainable practices, creating opportunities for eco-friendly casting methods. With a strong industrial base and a focus on environmental responsibility, Europe is well-positioned for significant expansion in the metal casting market.

Metal casting is a manufacturing technique where molten metal is poured into a prepared mold to create a specific shape upon solidification. This time-tested process, utilized for centuries, is adept at crafting a diverse array of metal components, from intricate parts to sizable industrial elements. The method entails crafting a mold, often composed of sand or other materials, and then filling it with molten metal. As the metal cools and solidifies, the mold is removed, unveiling the final product. Metal casting finds widespread application in industries like automotive, aerospace, and construction due to its cost-effectiveness and efficiency in producing intricate metal forms at scale.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.58% |

| Market Size in 2025 | USD 199.86 Billion |

| Market Size by 2034 | USD 400.74 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Infrastructure development boost

Infrastructure development serves as a potent catalyst for the surge in market demand for the metal casting industry. As nations globally embark on ambitious infrastructure projects, the demand for diverse and specialized metal components escalates. Metal casting plays a pivotal role in providing essential parts for infrastructure projects such as bridges, pipelines, and power plants. The versatility of metal casting processes allows for the production of intricate and custom components that meet the stringent requirements of modern infrastructure.

The projected trillions of dollars in global infrastructure spending over the coming years, as estimated by the World Bank, underline the pivotal role of metal casting in shaping the future of construction and development. The reliability, durability, and scalability of metal casting make it an indispensable solution for the intricate and robust metal components essential to the success of large-scale infrastructure initiatives worldwide.

Global supply chain disruptions

Global supply chain disruptions act as significant obstacles for the metal casting market, affecting both production and market demand. The metal casting industry heavily relies on a network of suppliers for crucial raw materials like metals and alloys. When disruptions occur in the global supply chain, be it due to geopolitical tensions, trade conflicts, or unforeseen events such as natural disasters, shortages, increased costs, and delays in production become prevalent. These uncertainties impede the ability of metal casting manufacturers to meet demand efficiently and in a timely manner. The interconnectedness of the global economy makes metal casting vulnerable to supply chain fluctuations.

When key raw material sources face interruptions, metal casting companies may experience challenges in maintaining consistent production levels and meeting contractual obligations. Consequently, these disruptions can create an atmosphere of uncertainty for consumers and manufacturers, impacting the overall demand for metal casting products in the market. Addressing these challenges requires strategic supply chain management, diversification of suppliers, and contingency planning to mitigate the impact of global disruptions on the metal casting industry.

Renewable energy targets

The surge in original equipment manufacturers (OEMs) has created significant opportunities for the metal casting market. With the automotive sector witnessing substantial growth, metal castings play a crucial role in meeting the increased demand for precision-engineered components. OEMs rely on metal casting processes to produce a wide range of automotive parts, including under hood components, engine parts, and interiors. The versatility of metal casting allows for the creation of intricate and durable components that meet the stringent requirements of modern vehicles.

The expansion of OEMs into other sectors, such as aerospace and industrial machinery, further broadens the scope for metal casting applications. As original equipment manufacturers seek reliable and cost-effective solutions for producing complex components, the metal casting market stands poised to capitalize on these opportunities by providing essential manufacturing capabilities that contribute to the overall growth and innovation in various industries.

The aluminum segment dominated the metal casting market in 2024; the segment is observed to continue the trend throughout the forecast period. Within the metal casting market, the aluminum segment pertains to utilizing aluminum alloys as the key material for casting processes. Aluminum's appeal lies in its lightweight properties, strong resistance to corrosion, and efficient thermal conductivity.

A noteworthy trend in metal casting involves the rising adoption of aluminum castings, particularly in the automotive and aerospace sectors. This preference is driven by the desire to reduce vehicle weight, improve fuel efficiency, and align with sustainable practices. The aluminum segment, thus, stands out as a favored choice in metal casting, meeting the evolving demands for lightweight, durable, and environmentally friendly components.

The steel segment is expected to grow at a significant rate throughout the forecast period. In the metal casting market, the steel segment refers to the production of metal components using various steel alloys. Steel, known for its strength and versatility, is a preferred material for manufacturing durable and high-performance castings. A prominent trend in the steel segment of the metal casting market is the increasing demand for specialized steel alloys, driven by the automotive and aerospace industries. These alloys offer enhanced properties, such as high strength-to-weight ratios, meeting the evolving needs of modern manufacturing and contributing to the overall growth of the metal casting market.

The automotive segment is observed to hold the dominating share of the metal casting market during the forecast period. In the metal casting market, the automotive segment pertains to the production of cast metal components used in vehicles. This includes under hood parts, engine components, interiors, and other critical automotive elements. A notable trend in the automotive segment of the metal casting market is the increasing demand for lightweight materials. As automotive manufacturers strive for fuel efficiency, metal casting processes are crucial in delivering high-strength yet lightweight components, contributing to the overall performance and sustainability goals of the automotive industry.

The industrial segment is expected to generate a notable revenue share in the market. In the metal casting market, the industrial segment encompasses the diverse applications of cast metal components across various industrial sectors. This includes the manufacturing of heavy machinery, equipment parts, and components for infrastructure projects. A notable trend in the industrial segment is the growing demand for precision-crafted metal castings to enhance the efficiency and reliability of industrial machinery. As industries worldwide invest in infrastructure development and machinery upgrades, the industrial application of metal casting continues to experience steady growth, driven by the need for durable and specialized components.

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024