January 2025

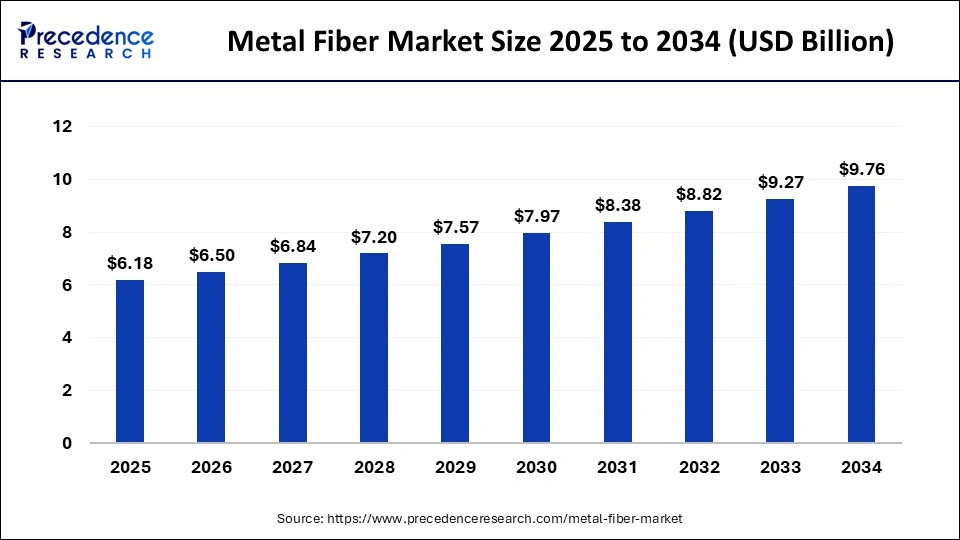

The global metal fiber market size is calculated at USD 6.18 billion in 2025 and is forecasted to reach around USD 9.76 billion by 2034, accelerating at a CAGR of 5.20% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metal fiber market size was estimated at USD 5.88 billion in 2024 and is predicted to increase from USD 6.18 billion in 2025 to approximately USD 9.76 billion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034.

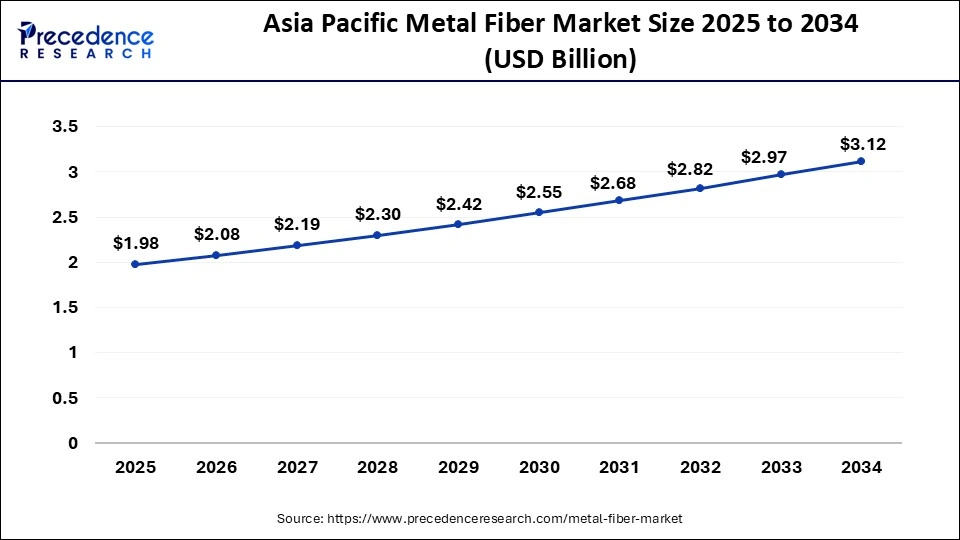

The Asia Pacific metal fiber market size was estimated at USD 1.88 billion in 2024 and is predicted to be worth around USD 3.12 billion by 2034, at a CAGR of 5.40% from 2024 to 2034.

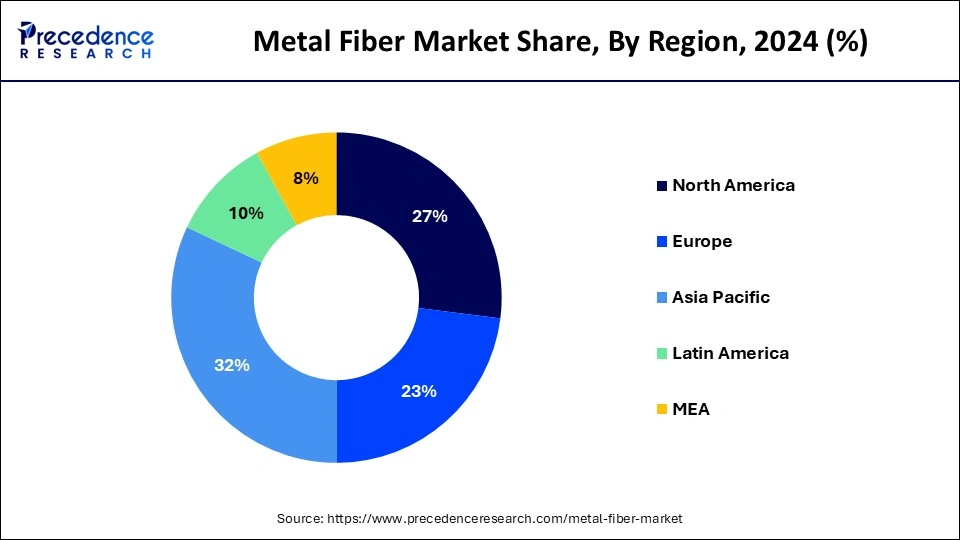

The Asia Pacific is the front-runner in the global metal fiber market and accounted for a revenue share of approximately 32% in 2024 because of prominent demand from India, China, and other Asian countries. In addition, India is an emerging nation and a lucrative market for automotive, textile, and other industries, thus the product demand for metal fibers projected to prosper in the region over the upcoming years. Further, multinational metal fiber manufacturers for example N.V. Bekaert S.A. has extended their manufacturing facilities and offerings in the developing countries that again favors the growth of the metal fibers market over the analysis period.

The metal fiber market in Europe is majorly driven by its significant demand from automotive industry. Europe is a hub of auto manufacturers and those are focusing notably towards vehicle advancement and feature upgradation to enhance the user experience along with meeting the strict government regulations.

However, the market in North America generated around 1.51 Billion in 2024 and projected to register a substantial growth over the forthcoming years because of high demand for lightweight fibers across various applications. The United States is a major market in the region and expected to exhibit prominent growth due to rapid development across various end-use industries such as electrical, defense, aerospace, and electronics.

Increase in demand for metal fibers across different industries that include aerospace and defense, automotive, textile,and many others expected to propel the market growth for metal fiber over the analysis period. Increasing production of vehicles predominantly across the developing regions such as Asia Pacific and Latin America estimated to fuel the demand for metal fibers in the upcoming years. Additionally, shifting trend for light weight vehicles because of stringent government regulations to enhance the fuel efficiency as well as reduce the overall weight of the vehicle also favors the demand for metal fibers in the industry.

Apart from this, the demand for metal fibers anticipated to gain significant importance from aerospace & defense sector in order to develop advanced devices that are lighter in weight and consume less energy over a fixed time. This approach in defense and aerospace industry forecast to achieve new milestones in the coming years.

| Report Highlights | Details |

| Market Size in 2034 | USD 9.76 Billion |

| Market Size in 2024 | USD 6.18 Billion |

| Market Size by 2024 | USD 5.88 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.20% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Steel fiber emerged as a leading product segment in 2024 with a revenue share of around 35%. High demand for steel fibers in non-structural applications owing to their ability to enhance strength and resistance are the major factors contributing towards the market growth for steel fiber. Increasing construction activities in developing countries along with renovations processes in developed countries is the other major factor that triggers the demand for steel fibers.

Additionally, aluminum is the other important product segment that follows steel fiber in terms of revenue and estimated to expand at a rate of nearly 5% over the forecast timeframe. Significant usage of aluminum fibers in aerospace and automotive industries for beams, body, chassis, and others is the key factor that contributes towards the market growth.

The automotive industry dominated the global market with more than 25% of total revenue in the year 2024, because of diverse applications in body parts, chassis, and car seats. The automobile manufacturers invest prominently in the Research & Development (R&D) sector in order to develop light weight and advanced materials for the vehicles. Furthermore, stringent government policies for improving fuel efficiency and reduce the carbon emission from vehicles has compelled automobile manufacturers to adopt materials that offer light-weight vehicle parts this in turn propels the demand for metal fibers over the forthcoming years.

The aerospace &defense industry emerged as a second largest end-use industry in the year 2024. Sound attenuation and hydraulic fluid filter media are the few areas where metal fibers are extensively used in the aerospace industry. However, metal fibers are largely used in the products that include apparel, bags, footwear, carpets, garments, gloves, home décor products, seats, and other industrial solutions.

The global metal fiber industry seeks intense competition among the market players as they are significantly involved in the R&D and upgradation of their existing product. In the wake of same, these companies invest remarkably in the R&D sector that expected to boost the demand for the product of the companies because of product differentiation. Further, these companies also focus prominently towards regional expansion and merger & acquisition to grab major consumer base in the global market.

By Product

By End-use Industry

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025