April 2025

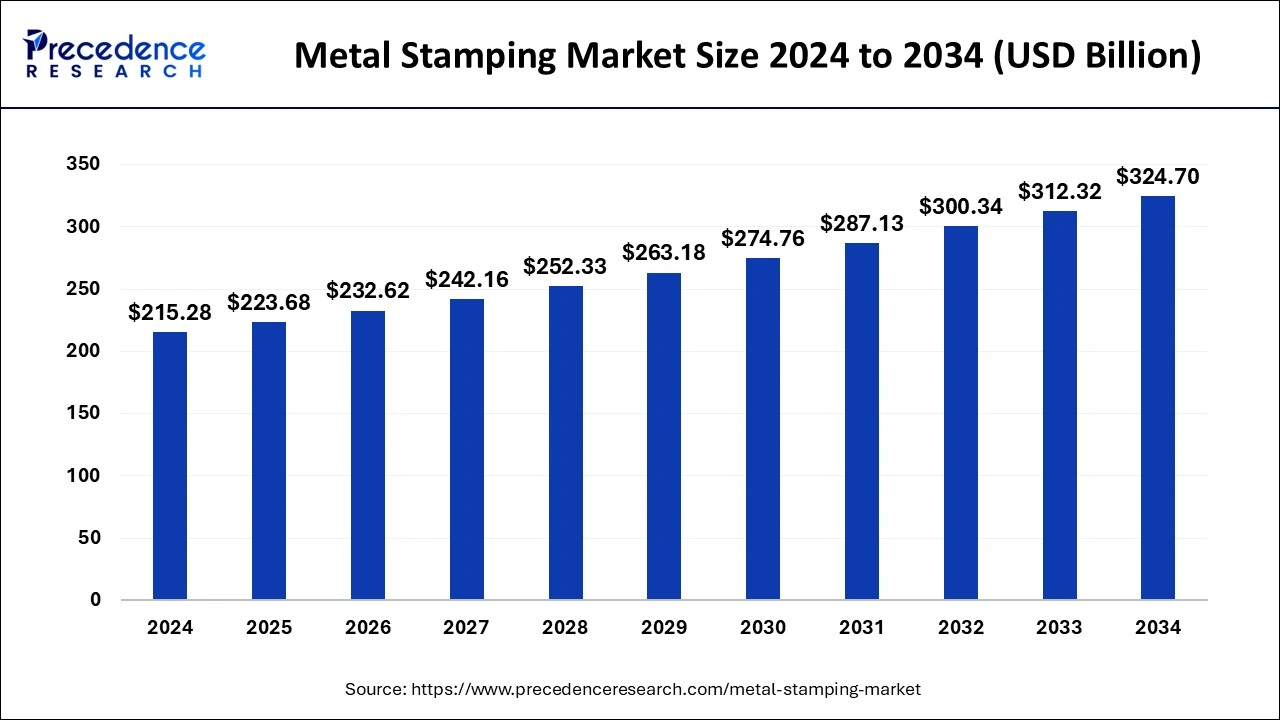

The global metal stamping market size is accounted at USD 223.68 billion in 2025 and is forecasted to hit around USD 324.70 billion by 2034, representing a CAGR of 4.20% from 2025 to 2034. The Asia Pacific market size was estimated at USD 77.50 billion in 2024 and is expanding at a CAGR of 4.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metal stamping market size was calculated at USD 215.28 billion in 2024 and is predicted to reach around USD 324.70 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034.

As technology advances, Artificial intelligence (AI) and machine learning (ML) are leading in advancing the metal stamping process by offering precision, efficiency, and innovation. AI and machine learning are significantly revolutionizing metal stamping and have guided an era of modern manufacturing. By combining AI and ML, these technologies hold great potential to reshape how metal stamping is approached and executed such as enhanced design, predictive maintenance for stamping presses, optimized tooling and die design, real-time quality control, material waste reduction, adaptive process optimization, supply chain optimization, and others. As manufacturers adopt Industry 4.0 and smart manufacturing, the integration of AI streamlines operations and paves the new way for innovative designs and more sustainable production methods.

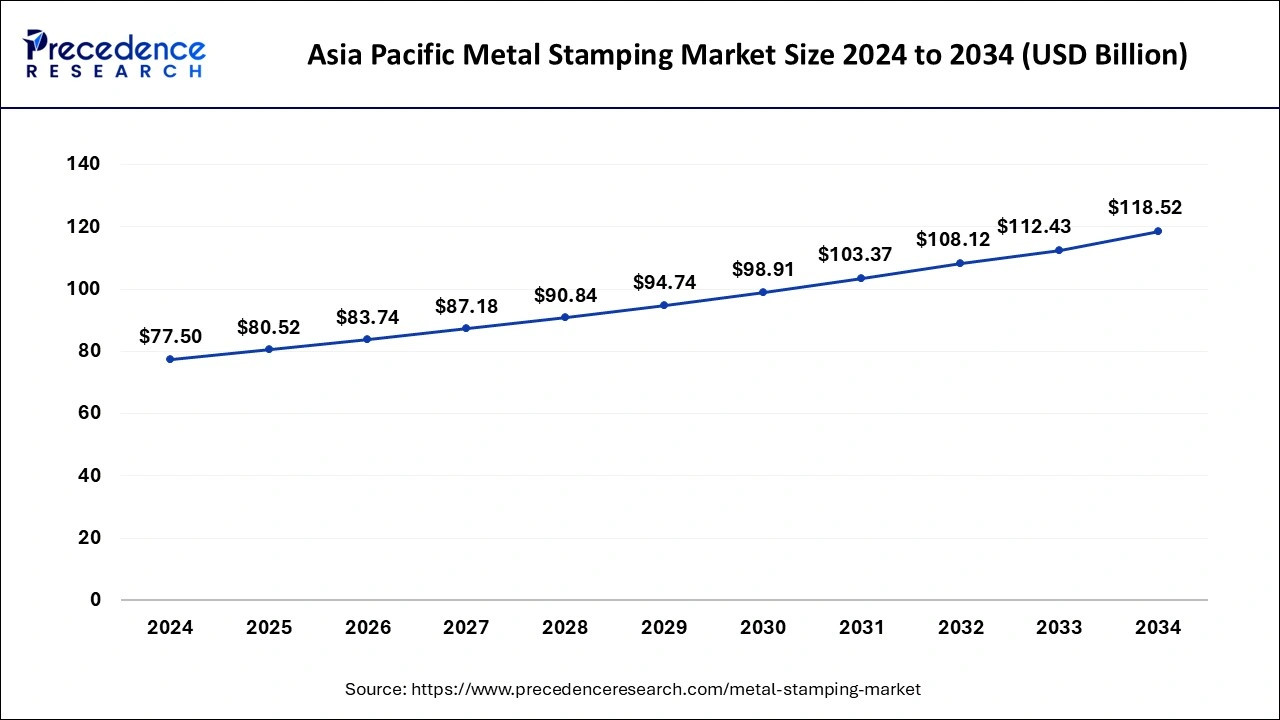

The Asia Pacific metal stamping market size was evaluated at USD 77.50 billion in 2024 and is projected to be worth around USD 118.52 billion by 2034, growing at a CAGR of 4.34% from 2025 to 2034.

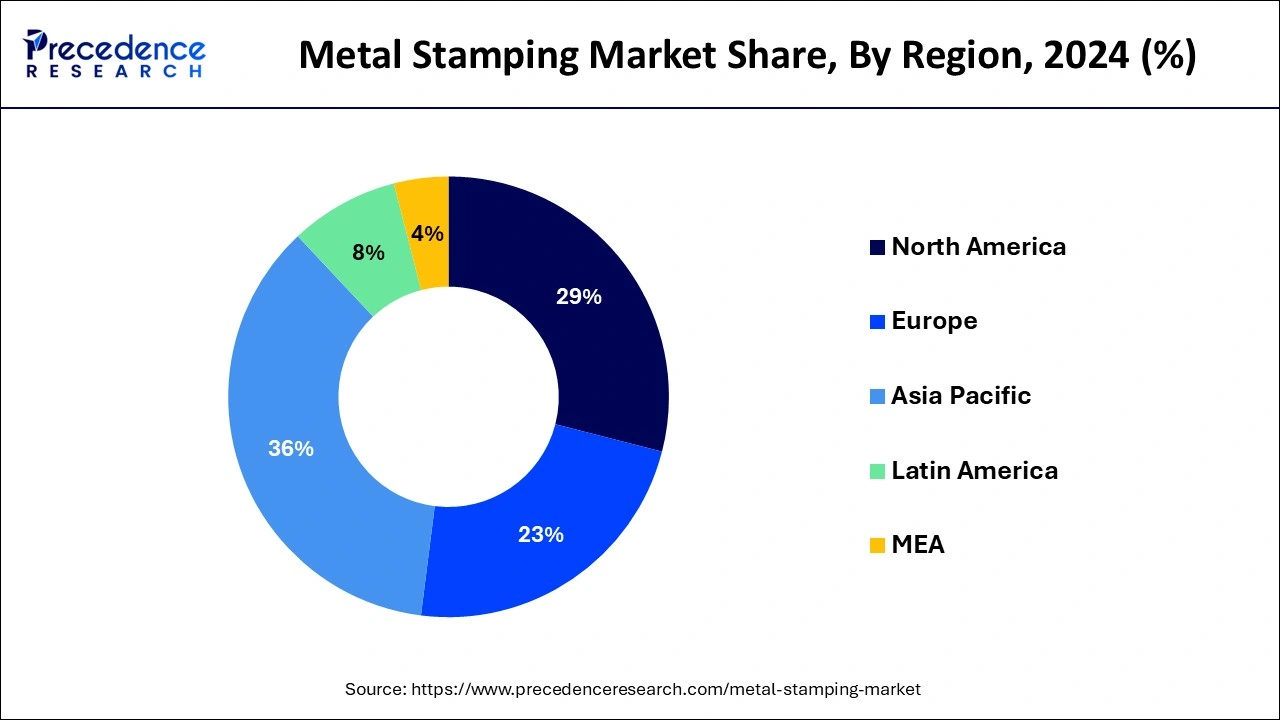

Asia Pacific accounted for the largest profit share of more than 36% in 2024 owing to the growing demand for cars and consumer electronics in the region and is anticipated to witness the fastest growth rate over the cast period. The growth is majorly driven by developing countries similar as India, China, Bangladesh, Pakistan, and Indonesia where the rising demand for phones along with other consumer electronics is anticipated to foster the growth of the market. Furthermore, growing industrialization coupled with structure development and growth in the defense industry is anticipated to have a positive impact on the demand for equipment and machinery in Asia Pacific. Countries similar as China and India are adding their investments in the defense industry. For instance, China increased its defense budget by7.5% in 2019 to upgrade the defense outfit, and launch advanced defense aircraft. The rising demand for defense outfit is anticipated to drive the market during the forecast period.

On the other hand, in North America, product consumption is likely to be driven by rising demand from the automotive industry. Automakers in the region are focusing on adding the product of lightweight vehicles by using metal similar as aluminum in various factors to reduce energy consumption. As of 2018, nearly 50% of the vehicles manufactured in the region comprise of aluminum hoods and this figure is anticipated to reach 80% by 2032. The adding product of aluminum hoods is anticipated to drive the market during the forecast period.

Metal stamping is a complex manufacturing process that converts flat metal sheets into a specific shape by keeping them in either blank or coil form in a stamping press. Various metal forming techniques can be used, including punching, blanking, piercing, bending, embossing, coining, and flanging. In addition, metal stamping can produce many identical metal components at a lower cost.

| Report Coverage | Details |

| Market Size in 2025 | USD 223.68 Billion |

| Market Size in 2034 | USD 324.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Base Year | 2024 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Application, Press Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for consumer electronics

The up-surging consumer electronics market will likely remain a major boost for applying metal frames in headphones, mobile phones, speakers, gamepads, and controllers. In mobile, metal stamping is utilized in manufacturing chassis, camera lens holders, and antennas, providing high corrosion resistance, tolerance, electrical conductivity, and a smooth finish. According to the secondary data, as of January 2025, an estimated 4.69 billion people own a smartphone. That’s an increase of 440 million new smartphone users over the past year alone (between 2024 and 2025). The number of smartphone users worldwide has grown by 38.38% since 2022, adding 1.3 billion new smartphone owners. Such factors will likely boost the demand for phones and metal stamping during the forecast period.

Rising demand for substitute products

The increasing demand for substitute products is projected to hamper the growth of the global metal stamping market. Several governments have implemented stringent regulations, such as Corporate Average Fuel Economy (CAFE) regulations, to boost the production of lightweight vehicles. This has increased demand for substitute products such as plastics and carbon fiber. Reducing vehicle weight significantly assists in fuel efficiency. Such factors are likely to limit the expansion of the market during the forecast period.

Growing demand from the automotive industry

The growing demand from the automotive industry is projected to offer lucrative growth opportunities for the metal stamping market in the coming years. The automotive industry, including light commercial vehicles (LCVs), passenger vehicles, heavy trucks, and buses uses metal stamping parts in manufacturing body panels to maintain the utmost safety standards and control end costs. In the automotive industry, metal stamping is widely adopted for body panels, interior and exterior structural elements, engine components, and suspension parts. Therefore, the growing automobile production is expected to drive the demand for metal stamping during the forecast period,

According to the data released by The Society of Indian Automobile Manufacturers (SIAM) in January 2024, the auto industry witnessed a massive 11.6 percent YoY increase in domestic sales in the calendar year 2024. During the year, the industry saw total domestic retails of 2,54,98,763 units compared to 2,28,39,130 units retailed in 2023. The passenger vehicle segment saw its highest-ever sales in 2024 with total domestic retails of 42,74,793 units, representing a 4.2 percent YoY increase. The total production of Passenger Vehicles, Three-Wheelers, Two-Wheelers, and Quadricycles in December 2024 stood at 19,21,268 units. Passenger Vehicles (PV) sold 3,14,934 units, up 10% compared to December 2023.

The blanking segment held the largest profit share of further than 30% in the year 2024. Blanking is an integral part of manufacturing motorcars on account of its precise and superior stamping capability. The technique involves the use of a die to gain the asked shape. The growing use of blanking in the machine industry on account of its capability to cater to mass product lines is anticipated to augment segmental growth over the coming times.

Embossing was the second largest member in 2020 owing to its advantages similar as the capability to produce different patterns and sizes, depending on the roll dies. This is performed by passing a metal sheet between rolls of the required pattern. Embossing a distance essence reduces disunion, enhances stiffness and severity, and enhances traction.

Based on material, steel stamping market captured the worldwide market in 2024. Attributable to high & easy accessibility of steel, minimal effort, high quality, and low cost. However, the market is estimated to foster a quick growth during the forecast period. The increasing growth of metal stamping market is exponentially attributed to the upsurge in interest from the automotive and aerospace sectors in order to keep fuel weight and expenses down.

By Process:

By Material

By Application

By Press Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024