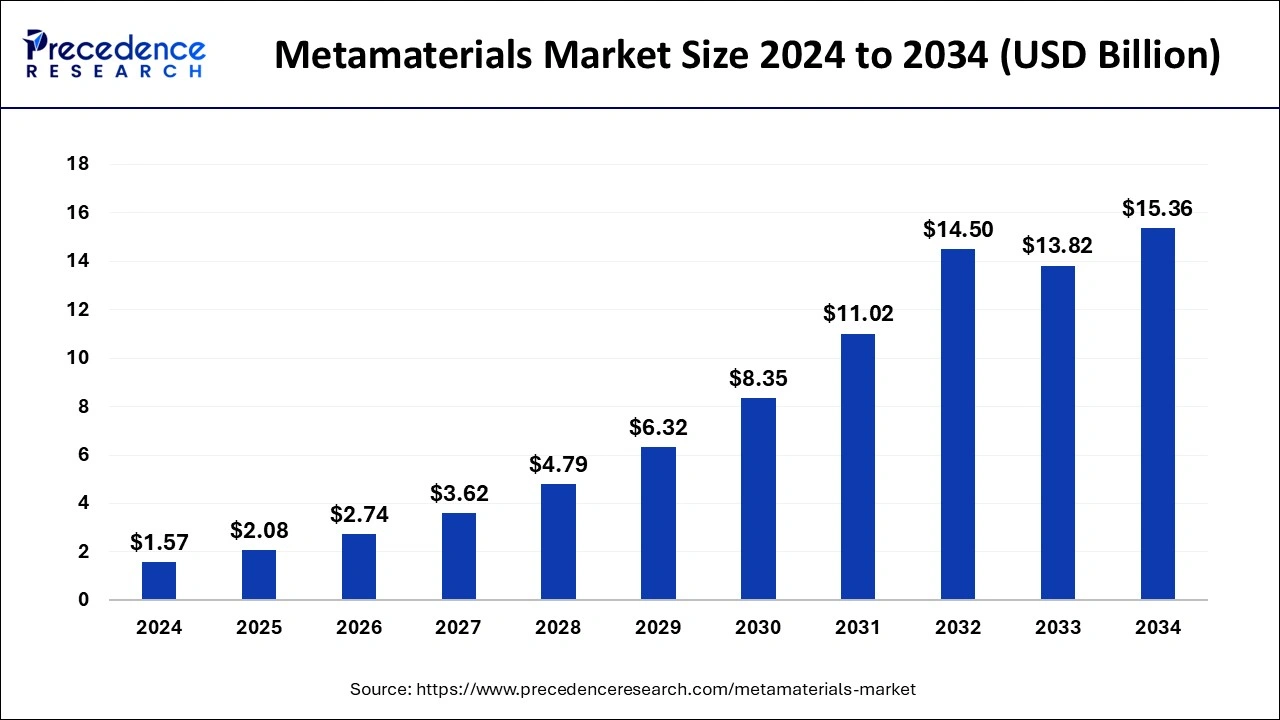

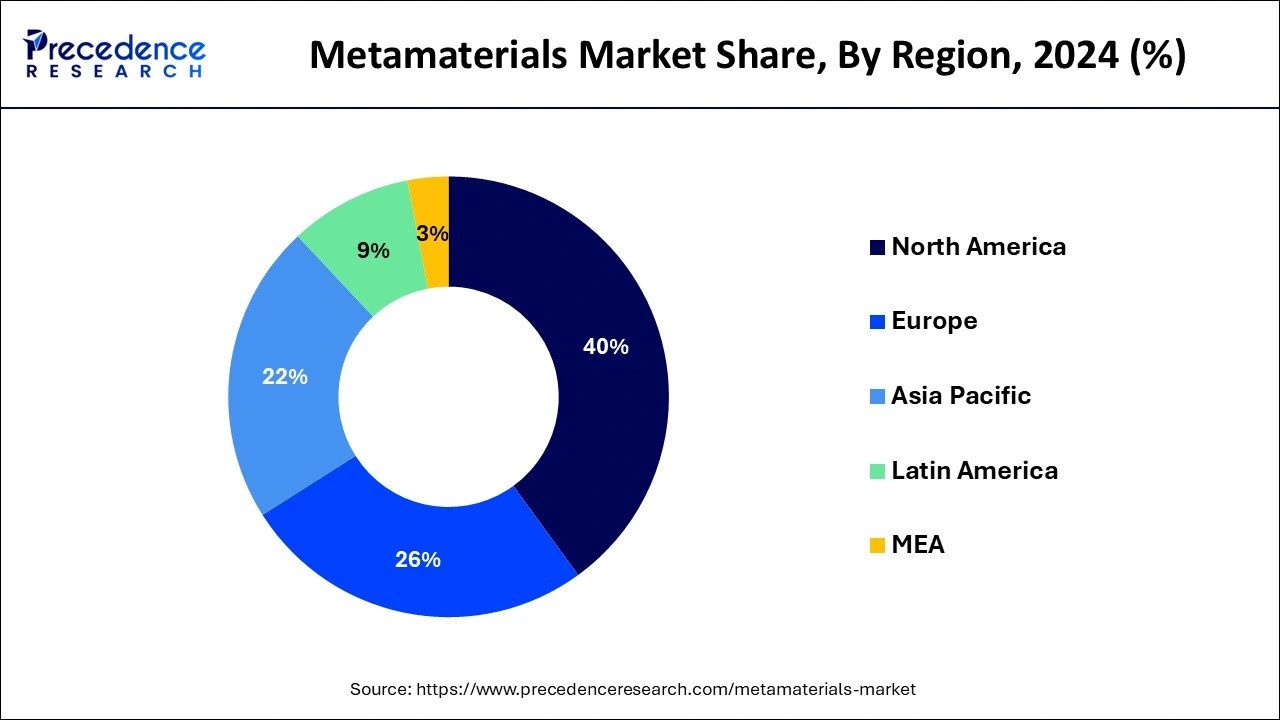

The global metamaterials market size is calculated at USD 2.08 billion in 2025 and is forecasted to reach around USD 15.36 billion by 2034, accelerating at a CAGR of 25.61% from 2025 to 2034. The North America metamaterials market size surpassed USD 630 million in 2024 and is expanding at a CAGR of 25.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metamaterials market size was estimated at USD 1.57 billion in 2024 and is anticipated to reach around USD 15.36 billion by 2034, expanding at a CAGR of 25.61% from 2025 to 2034. The Metamaterials market is growing due to technological advancements and demand in various industries.

In recent years, metamaterials have drawn interest because of their potential to transform a number of industries. In order to overcome design bottlenecks and investigate alternative disciplines, artificial intelligence (AI) may be included into metamaterial design optimization. The creation of new metamaterials can also be facilitated by AI-based metamaterial design, which optimizes design parameters that are impossible to do with conventional techniques. By using generative models, artificial intelligence (AI) may be used to improve the use of small data sets and speed up the study of large data sets.

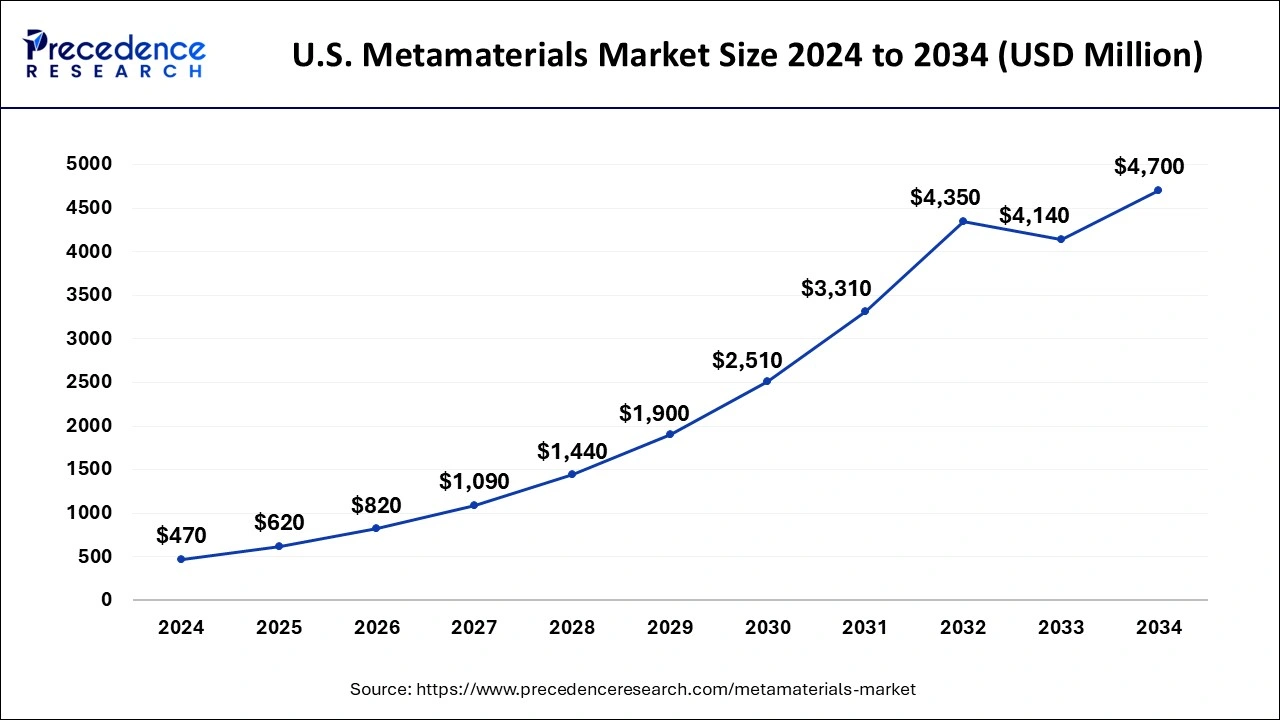

The U.S. metamaterials market size was evaluated at USD 470 million in 2024 and is predicted to be worth around USD 4700 million by 2034, rising at a CAGR of 25.89% from 2025 to 2034.

The Department of Defense's fiscal year 2024 spending plan allocates $824.3 billion, which is $26.8 billion more than the 2023 budget. For depot upkeep, the Army, Navy, Marine Corps, and Air Force departments will receive $32.5 billion, an increase of $1.8 billion over fiscal year 2023. The measure allocates $148.3 billion for fiscal year 2024, which is $3.4 billion more than the budget request for that year and $8.6 billion more than the amount approved for fiscal year 2023. In order to provide forces with the tools and systems they need to meet the challenges of the future, the law supports the research community and makes investments in fundamental and applied scientific research, development, testing, and evaluation of new technologies and equipment.

The Canadian government unveiled a new defense vision in response to the Budget 2022 pledge to review our security strategy. Over the next five years, the government will spend $8.1 billion more on the military, and over the following twenty years, it will spend $73 billion more.

In November 2024, the Indian Institute of Technology, Kanpur (IIT-K) announced a groundbreaking development in stealth technology with the launch of the Metamaterial Surface Cloaking System (Analakshya MSCS), which aims to provide revolutionary applications in defense, national security, and specialized industries, carrying forward PM Narendra Modi's vision of self-reliance in defense manufacturing. His ground-breaking camouflage technique is a daring step ahead in combating the widespread and accurate reach of contemporary intelligence, surveillance, and reconnaissance systems—one of the biggest operational issues forces confront today.

Metamaterials are a type of compound material structure, containing exceptional material parcels similar to aural, electrical, glamorous, and optic parcels. They include resonators manipulating electromagnetic swells or sound in ways not typically set up in nature. The physical parcel metamaterials parade is exceptionally similar as negative permittivity. The metamaterials permit masterminds to control the surge propagation by arranging the unit cells in colorful ways.

5G is a new-age technology allowing connecting the digital network in a flexible manner. 5G networks are anticipated to acclimatize to operations and will be acclimated to the requirements of end druggies. Metamaterial-based antennas or radars can perform exceptionally better than conventional systems in terms of effectiveness. As a result, metamaterial antennas will profit from the rapid acceptance of 5G. This will give tremendous openings to metamaterial requests in the coming future.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.08 Billion |

| Market Size by 2034 | USD 15.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 25.61% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Segments Covered | By Product, By Application, By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The electromagnetic segment contributed the highest market share of 34% in 2024 and is anticipated to hold the highest metamaterials market size during the forecast time period in terms of value. The growth can be attributed to the growing use of electromagnetic metamaterials for communications applications, including new forms of metamaterial-enabled personal communications radars and satellites.

The antenna and radar segment accounted for the biggest market share of 44% in 2024. Rising demand for communication antennas for applications such as satellite communications, Wi-Fi routers, radar communications, and 5G communications is a key factor driving the growth of the metamaterials market.

The aerospace and defense segment has held the highest market share of 36% in 2024. The defense industry needs customized solutions for communication. In the defense industries, the most widely used metamaterial devices are antennas, shields, windshields, EMC shields, and cloaking devices. Antennas can be used for secure communications in the defense sector, as they can be tuned according to required frequencies. The growth of the metamaterials market for aerospace and vertical defense is driven by the growing demand for bandwidth and the need for secure communications.

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client