May 2025

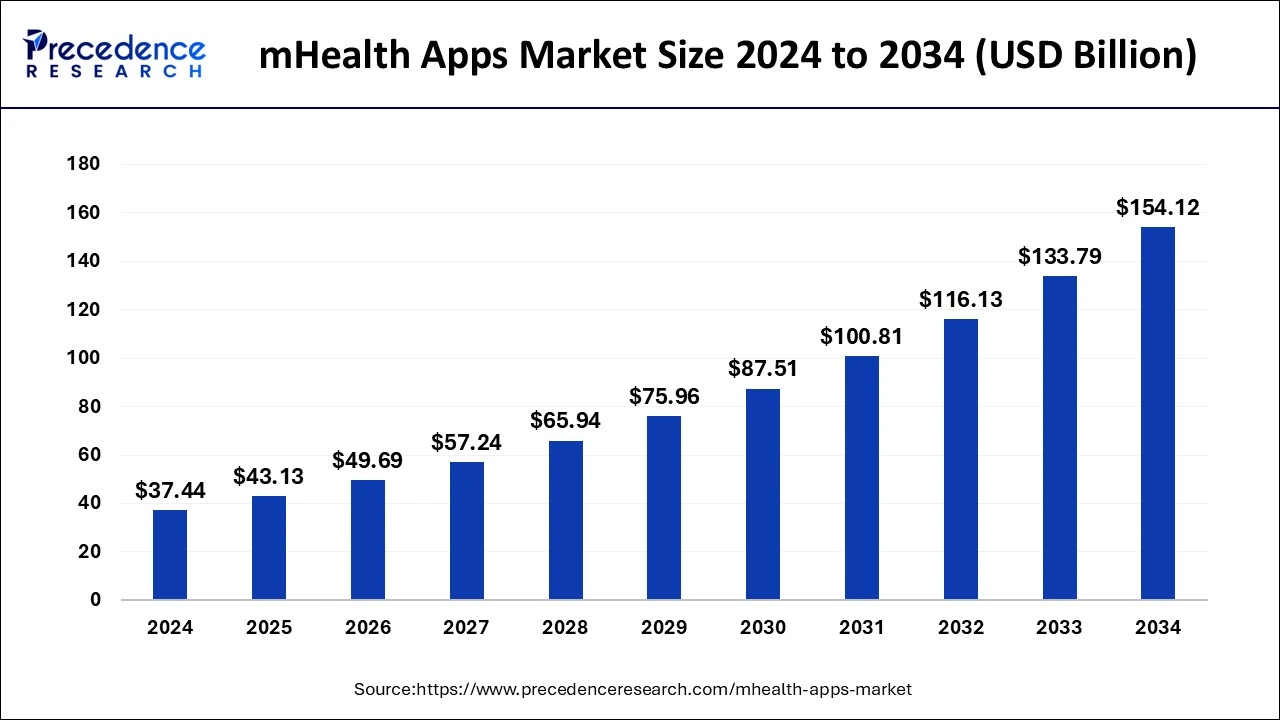

The global mHealth apps market size is calculated at USD 43.13 billion in 2025 and is forecasted to reach around USD 154.12 billion by 2034, accelerating at a CAGR of 15.20% from 2025 to 2034. The North America market size surpassed USD 14.23 billion in 2024 and is expanding at a CAGR of 15.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global mHealth apps market size accounted for USD 37.44 billion in 2024 and is expected to exceed USD 154.12 billion by 2034, growing at a CAGR of 15.20% from 2025 to 2034. The mHealth apps market is witnessing rapid growth due to the growing usage of mobile healthcare applications, especially among youngsters, to improve the quality of life. Moreover, the rising acceptance of mHealth among healthcare providers to enhance the delivery of healthcare services and the growing demand for remote monitoring contribute to the growth of the market.

AI has the potential to transform every aspect of the healthcare industry. Integrating AI features into mHealth apps enhances patient outcomes by providing personalized healthcare solutions. Predictive analytics capabilities of Artificial Intelligence (AI) analyze large amounts of user data and provide personalized recommendations. Furthermore, AI features make these apps more accurate and user-friendly. Thus, many mHealth app developers are incorporating AI features in their apps.

AI is being explored in the development of mobile healthcare applications to provide more personalized healthcare, prevent diseases, improve healthcare delivery, and reduce diagnostic costs and time. AI-driven mobile health apps are making health management simple and easy. AI-driven mobile health apps have the potential to address existing challenges, such as incomplete or non-standardized health records and communication flow.

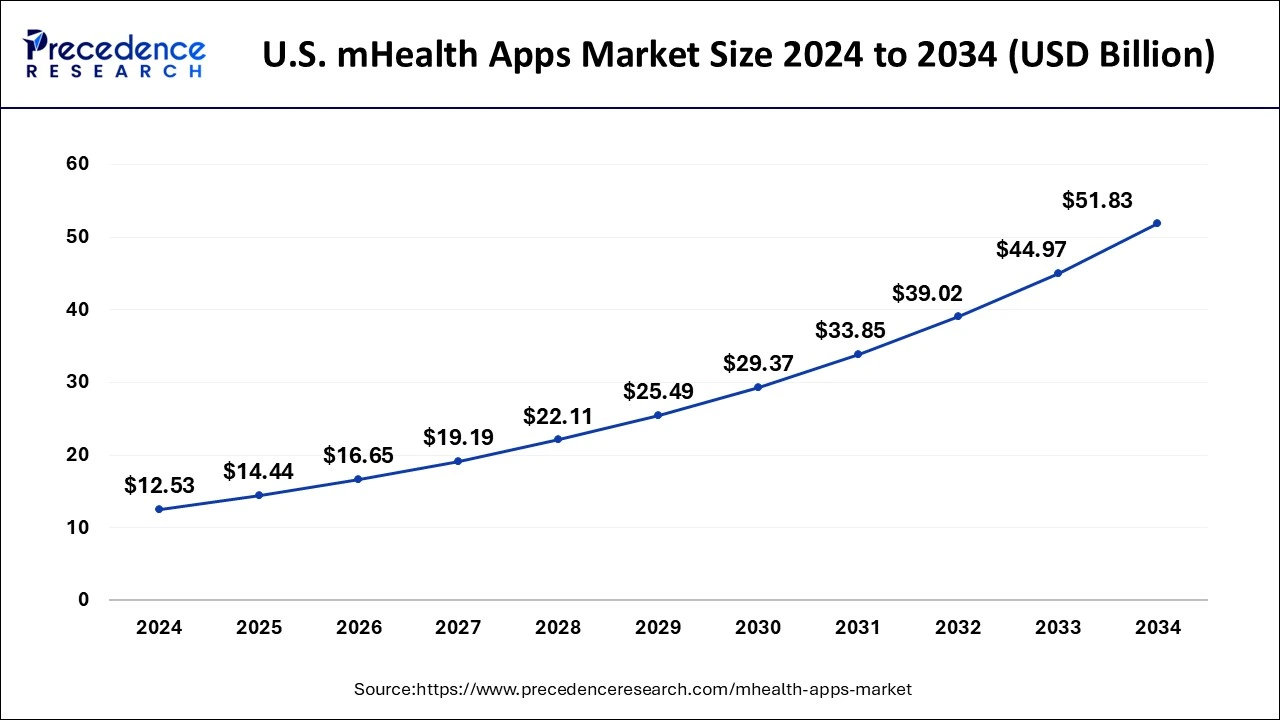

The U.S. mHealth apps market size was exhibited at USD 12.53 billion in 2024 and is projected to be worth around USD 51.83 billion by 2034, growing at a CAGR of 15.40% from 2025 to 2034.

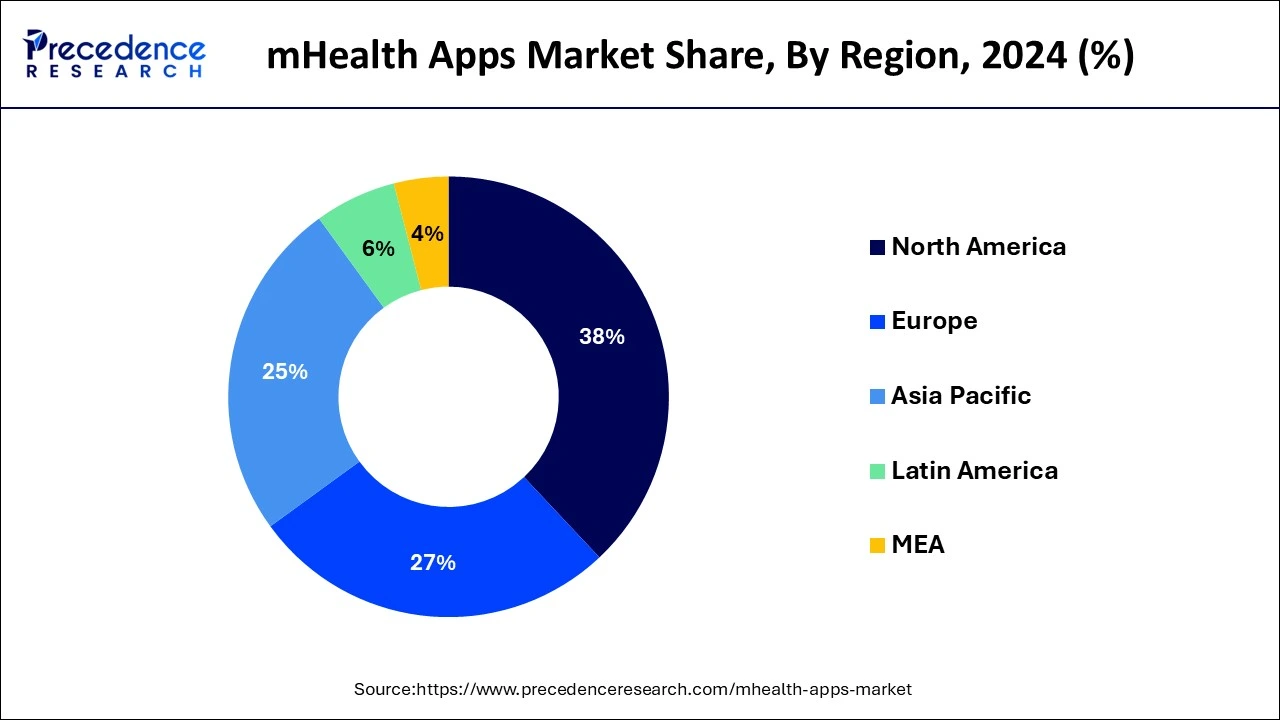

North America dominated the global market in 2024 due to its well-established healthcare infrastructure. The availability of advanced healthcare technologies, digital healthcare solutions, and healthcare reimbursement plans covering digital health solutions contributed to the market growth. The growth of mHealth applications also depends on economic factors, such as income levels, across the respective region. Moreover, the presence of a large number of healthcare solution companies in the region is making efforts to cater to population. For instance,

The market in Asia Pacific is anticipated to expand at a significant growth rate during the forecasted period. The proliferation of the internet and the adoption of smartphones have increased drastically in the region, which is boosting the demand for healthcare apps. In addition to this, many Asian countries are adopting advanced digital healthcare solutions to manage healthcare delivery and provide a customer-centric healthcare approach. Furthermore, rising government initiatives to expand healthcare services in the region are likely to contribute to market growth. For instance,

mHealth, also known as mobile health, refers to the adoption of mobile devices or smart devices in healthcare practice to enhance patient outcomes. It encompasses the delivery of healthcare services through wireless technologies. The mHealth apps market witnessed significant growth over the years due to the increasing digitization in the healthcare industry. Digitization has encouraged hospitals, clinics, and pharmacies to adopt digital technologies to provide healthcare services and streamline their operations. Moreover, the outbreak of COVID-19 encouraged the healthcare industry to turn to the online market. This forced people to adopt digital healthcare technologies to reduce unnecessary hospital visits, thereby boosting the adoption of mHealth apps over the past few years.

| Report Highlights | Details |

| Market Size in 2025 | USD 43.13 Billion |

| Market Size by 2034 | USD 154.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Prevalence of Chronic Disease and Increasing Usage of Wearables

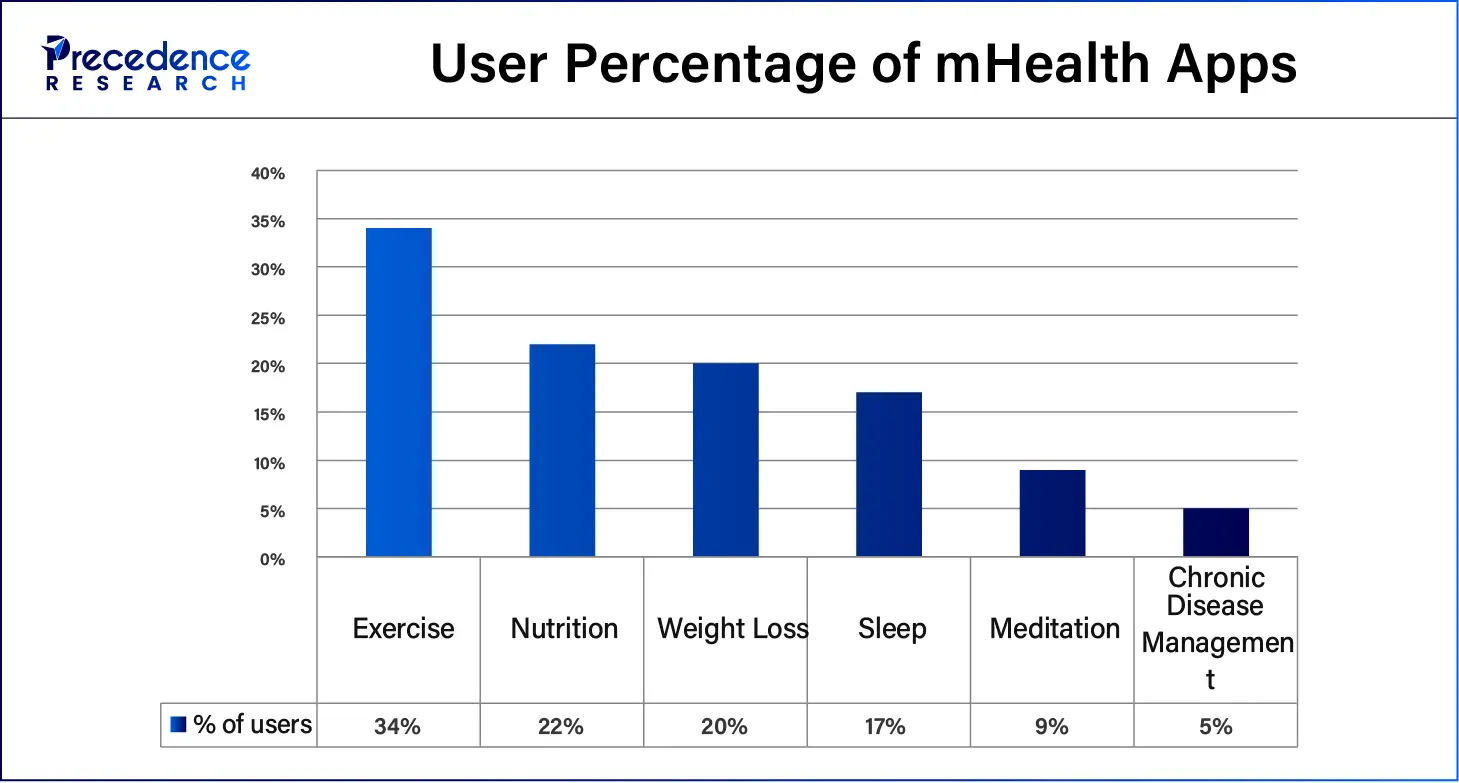

The rising prevalence of chronic condition is anticipated to boost the market. As per the National Library of Medicine, nearly one in three adults worldwide suffer from multiple chronic conditions. Some chronic conditions require continuous monitoring, encouraging people to use health monitoring apps. However, mHealth apps allow patients to communicate with physicians, thereby reducing the hospital visits. Moreover, increased adoption of mobile devices led to a significant increase in the number of mHealth apps users.

The increasing adoption of wearable devices contributes to the growth of the mHealth apps market. Traditional healthcare services have been replaced with patient-centric modules. Brands like Fitbit, Apple, and Sony are offering cost-effective and user-friendly wearable devices. Moreover, physicians are also encouraging patients to use wearable devices for remote patient monitoring. The rising approvals for wearables and support from international healthcare institutes, such as WHO, further propel the market. In complementary to this, increasing technological advancements and the introduction of highly updated healthcare modules boost the demand for mHealth apps.

Quality Challenges

The growth of the mHealth apps market is limited by some fundamental issues related to application quality. Changes in the functionality, accuracy, and compatibility of mobile devices and applications can affect the quality and reliability of mobile health apps. Additionally, design challenges such as customizability, interactivity, usability, and the ability to adapt to changing healthcare needs further complicate the development process. Many health apps do not adapt well to existing healthcare systems. This lack of interoperability hampers their usability and effectiveness, leading to high app uninstallation

Growth of mHealth Apps through Gamification

The popularity of gaming features is increasing, creating immense opportunities for market players. Integrating game mechanics into mobile health apps improves user engagement and experience. Game-like elements such as rewards, badges, and leaderboards have been shown to motivate users in disease management, physical activity, and mental health. By leveraging gamification-based interventions, mobile health apps can encourage users to adopt healthy lifestyles such as exercise and healthy eating. Gamification also provides instant feedback and rewards to users for their achievements. This further motivates users to be more likely to interact with apps regularly.

The medical apps segment held the largest share of the mHealth apps market in 2024 owing to the rising usage of medical apps among patients and healthcare professionals. Medical apps provide remote doctor consultation services, reducing the need to visit hospitals. These apps also offer services regarding medication. Moreover, the increasing number of pharmacy apps contributes to the growth of the segment. These apps offer discounts, free home deliveries, and easy replacement and refund policies, making medications more affordable.

The fitness apps segment is expected to expand at the fastest CAGR in the coming years owing to the increasing awareness about health and wellbeing and concerns about obesity among people. The rise in unhealthier habits and busy lifestyles has encouraged people to use fitness apps. Furthermore, the rising usage of wearable devices drives the segment. As the adoption of wearable devices increases, so does the demand for fitness apps.

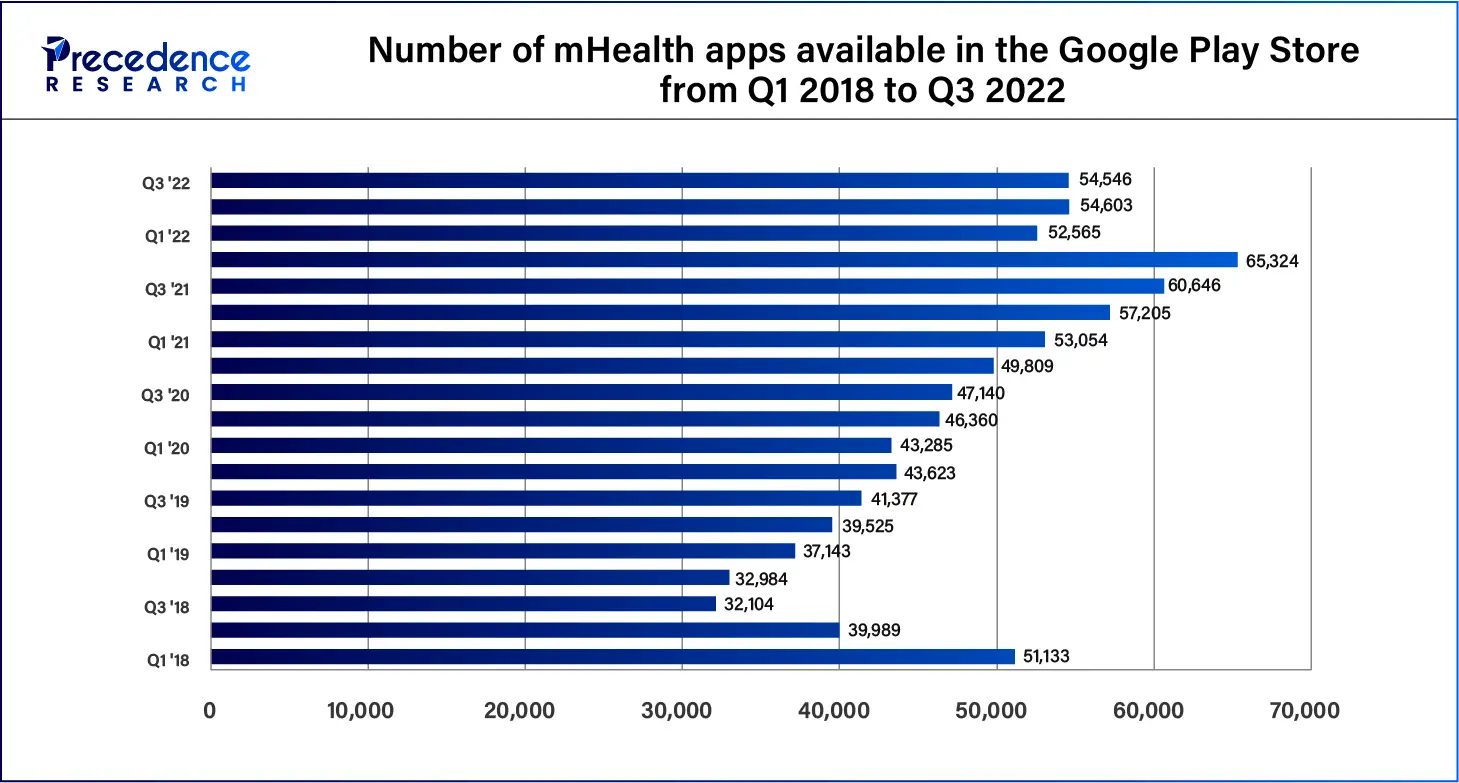

The android segment dominated the market in 2024 and is projected to continue its dominance during the forecast period. The growth of the segment is driven by the rising adoption of smartphones worldwide. In addition to this, the rising number of mHealth apps for Android is expected to boost the segment. For instance,

By Type

By Platform

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

January 2025

October 2023

January 2025