October 2023

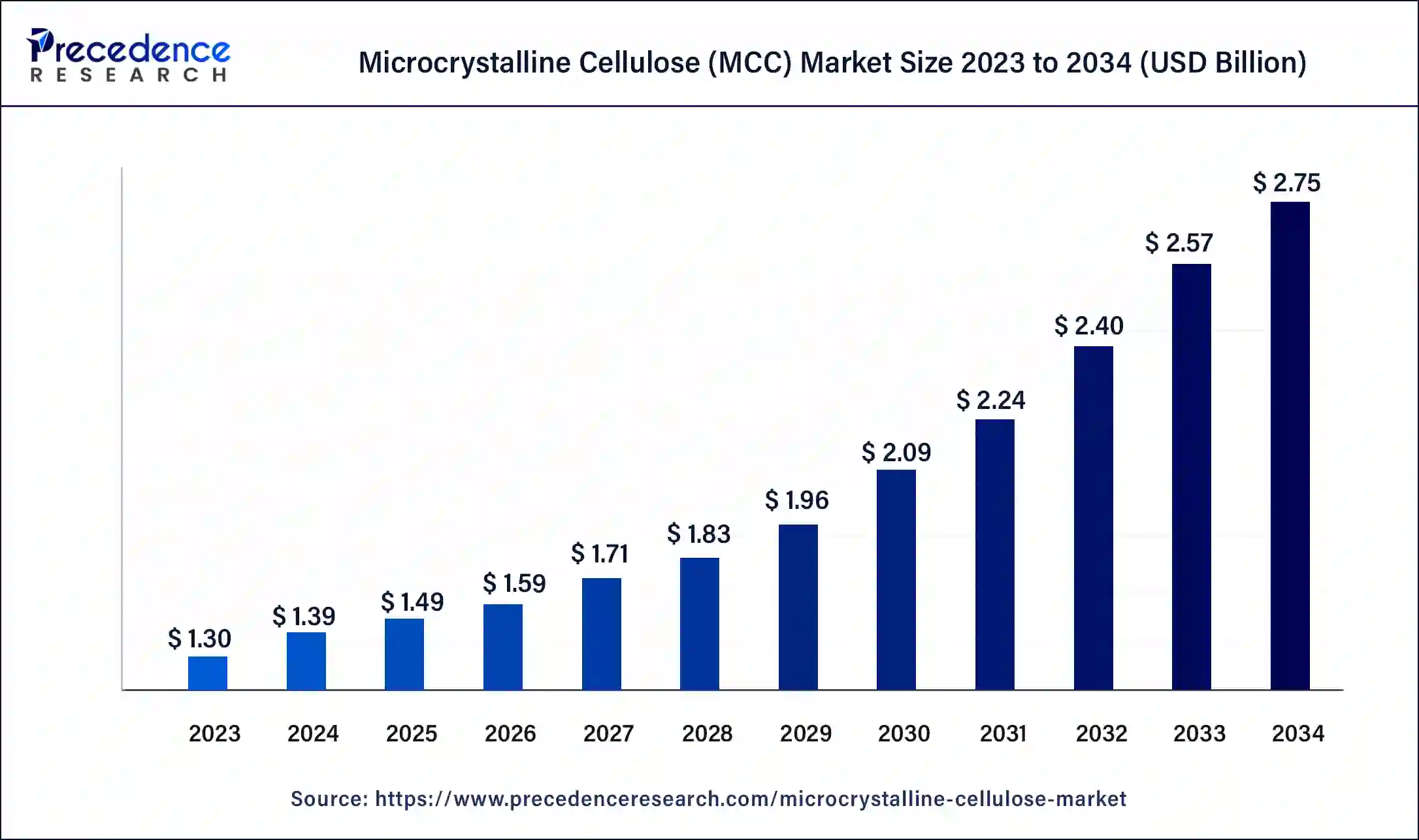

The global microcrystalline cellulose (MCC) market size surpassed USD 1.30 billion in 2023 and is estimated to increase from USD 1.39 billion in 2024 to approximately USD 2.75 billion by 2034. It is projected to grow at a CAGR of 7.04% from 2024 to 2034.

The global microcrystalline cellulose (MCC) market size is projected to be reach around USD 2.75 billion by 2034 from USD 1.39 billion in 2024, at a CAGR of 7.04% from 2024 to 2034. The microcrystalline cellulose (MCC) market growth is attributed to their surging use of processed food and beverages.

Increased demand for natural and eco-friendly raw materials across several industries boosts the microcrystalline cellulose (MCC) market. MCC, which is derived from plants, has numerous applications in the fields of pharmaceuticals, food and beverages, cosmetics, and other industries. The peculiarities of its processing, including high compressibility, good binding, and low-calorie values ensure its importance in these spheres.

The pharmaceutical industry remains important, especially, as MCC is essential in the formulation of drugs and improvement of the stability of tablets. The rising trends of green and clean-label recognition also contribute to the rising trends of adopting MCC. Additionally, advancements in 3D printing and environment-friendly manufacturing techniques are being adopted in the microcrystalline cellulose (MCC) market.

Impact of Artificial Intelligence on the Microcrystalline Cellulose (MCC) Market

In the microcrystalline cellulose (MCC) market, the use of artificial intelligence is helping to improve productivity through innovations and enhancements in production techniques, quality, and supply chain. Automated algorithms in manufacturing technologies include real-time calculation of working parameters, with estimations on failure probabilities of equipment, hence enhancing efficiency and cutting costs.

AI improves the microcrystalline cellulose (MCC) market’s quality assurance by alerting the company to cases of deviation from standard quality. Additionally, in supply chain management, through the use of artificial intelligence, the demand is accurately forecasted, the stock control is efficient, and requirements such as overstocking are eliminated, resulting in costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.75 Billion |

| Market Size in 2023 | USD 1.30 Billion |

| Market Size in 2024 | USD 1.39 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.04% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Source Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for pharmaceutical excipients

Increasing demand for pharmaceutical excipients is expected to drive the microcrystalline cellulose (MCC) market. The pharmaceutical industry uses MCC primarily as a direct compressing excipient because of its good compressibility, stability, and flow properties. Different ages require different treatments, and with the increased global population coupled with an increase in chronic diseases, there is a need for efficient medications. This need leads to the development of the pharmaceutical industry and, by implication, encourages the usage of MCC.

The current increased use of generics due to expiring patents fuels the use of MCC in the preparation of tablets and becomes indispensable during the preparation of high-quality drugs. Based on the FDA report, generic drugs whose production employs common excipients such as MCC constitute over 90% of the prescriptions that people take in the U. S. Furthermore, the growing need for novel medicine options to cater to persons suffering from chronic diseases is observed.

According to a report published by the National Health Council, a 2007 study revealed that seven chronic diseases - cancer, diabetes, hypertension, stroke, heart disease, pulmonary conditions, and mental illness - collectively have a USD 1.3 trillion annual impact on the economy. By the year 2023, this figure is projected to increase to USD 4.2 trillion in treatment costs and lost economic output.

Impede market expansion due to regulatory challenges

Regulatory challenges are likely to hamper the microcrystalline cellulose (MCC) market in the coming years. The manufacturing and application of MCC follow strict compliance rules in various fields, especially in the fields of medicine and food. Implementation of these regulations entails quality assurance and testing, hence the level of cost. The U. S Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) set standards for the use of essential excipients like MCC, and products that fail to conform to these standards are either delayed or withdrawn.

Regulatory barriers are likely to cause slow progress in the adoption of the microcrystalline cellulose (MCC) market, especially in emerging markets that are still developing their regulatory standards. Additionally, EFSA is concerned about health risks associated with the consumption of food additives, including MCC, and has stipulated that a long, thorough evaluation of these additives is required before they are approved. These factors prevent the growth of the MCC market as they contribute to the setting of barriers and increased costs of operating for MCC manufacturers.

Increasing applications in 3D printing

For materials that are used in additive manufacturing, MCC possesses some superior properties, including the ability to form strong and stable structures. The 3D printing industry is using MCC as eco-friendly feedstock. This is attributed to the increasing market interest in high-value manufacturing technologies and eco-friendly materials that are likely to foster the adoption of the microcrystalline cellulose (MCC) market in these novel applications. This versatility of MCC to blend with other processes, including coatings and composites, is also a boom for the company because manufacturers are always on the lookout for innovative materials that can perform and are also sustainable.

The 3D printing market size for the automotive industry is expected to reach USD 34 billion shortly globally, from USD 5.5 billion in 2018 to USD 8 billion in 2024, as stated by the International Trade Administration (ITA).

The wood-based segment accounted for a considerable share of the microcrystalline cellulose (MCC) market in 2023. MCCs of a wooden nature sourced from places including softwood and hardwood have the advantage of a well-developed supply chain and optimized processing. The wood pulp is comparatively easily available, and the basic infrastructure for its excavation and processing is well developed. Moreover, the wood-based MCC is characterized by its better mechanical properties and high purity, which are necessary for application in the pharmaceutical and food industries. The high-quality reputation and performance record of established wood-based MCC provided a competitive edge in the market.

The non-wood-based segment is anticipated to grow at the highest CAGR in the microcrystalline cellulose (MCC) market during the studied years due to rising environmental awareness and increased demand for green products. Several kinds of ECC, like non-wood-based MCC obtained from cotton linters and agricultural wastes, make them usable renewable and green materials. Moreover, the increasing demand for sustainable materials due to consumer and regulatory pressure is expected to strengthen the demand for non-wood-based MCC.

The pharmaceutical segment held a significant share of the microcrystalline cellulose (MCC) market in 2023 due to its properties, such as binding, compossibility, and stability. MCC has become an innovative component in the manufacture of tablets and capsules. The rising elderly population in developed countries in North America and Europe is increasing the consumption of medications. The growing number of generics due to the expiration of patents on high-revenue drugs and the rapid growth of the market of MCC in pharmaceutical industries also support the high demand.

The food & beverage segment is expected to grow at an exceptional rate in the microcrystalline cellulose (MCC) market during the forecast period of 2024 to 2034. MCC is used widely in the preparation of processed foods, so it serves as a fat substitute, as well as a bulking agent and texturizer. The shift of consumers towards healthier foods, along with the market demand for convenience foods and ready-to-eat foods, are expected to foster the growth of this segment.

Additionally, the trend in clean-label and plant-based products enhances MCC’s natural origin, thus making it suitable for food manufacturing. There is a high prediction of growth in this application in growth markets in the Asia-Pacific and Latin America, which help to increase the use of MCC in the food and beverage sector.

North America held the largest share of the microcrystalline cellulose (MCC) market in 2023 due to the presence of well-developed pharmaceutical and food processing industries. The high level of health care and increased use of processed foods in the region have driven the high demand for MCC. North America’s well-developed regulatory environment, along with its emphasis on high-quality MCC, also adds to its favorable use, especially in the formulation of pharmaceuticals where it serves as an excipient.

Asia Pacific is projected to host the fastest-growing microcrystalline cellulose (MCC) market in the coming years, owing to enhanced industrialization, urbanization, and increasing consumer demand within several industries. Growing pharmaceutical and food industry in the region, where manufacturers are in constant lookout for high-quality excipients to cater to the production of various products. Overall development in enhancing healthcare facilities and higher per capita income also leads to the growth of the pharmaceutical market, resulting in demand for MCC. Additionally, an increase in the consumption of processed and convenience foods in regions such as China and India for the GCC food and beverages sector is observed.

Segments Covered in the Report

By Application

By Source Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

July 2024

October 2024