January 2025

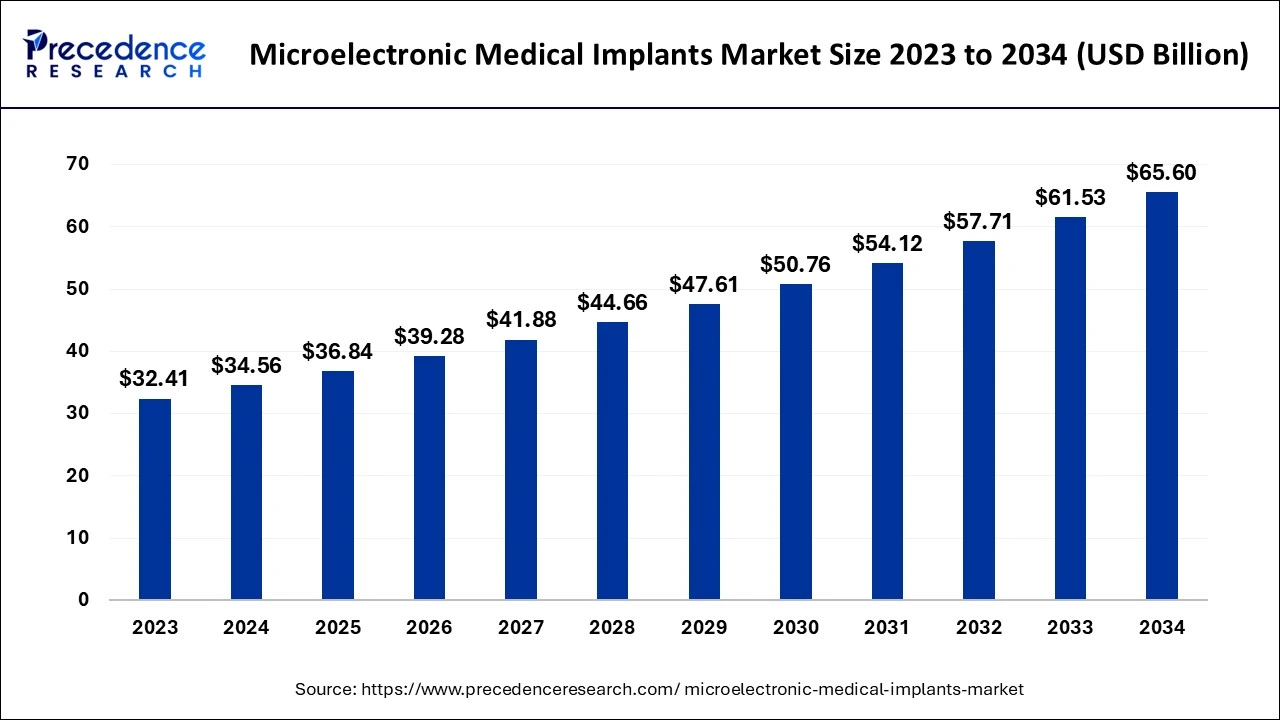

The global microelectronic medical implants market size accounted for USD 34.56 billion in 2024, grew to USD 36.84 billion in 2025 and is projected to surpass around USD 65.60 billion by 2034, representing a CAGR of 6.62% between 2024 and 2034.

The global microelectronic medical implants market size is calculated at USD 34.56 billion in 2024 and is projected to surpass around USD 65.60 billion by 2034, expanding at a CAGR of 6.62% from 2024 to 2034. The microelectronic medical implants market growth is attributed to the increasing prevalence of chronic diseases, technological advancements in implant design, and rising healthcare expenditures globally.

Contrasting traditional implants, microelectronic medical implants mainly consist of products used in the microelectronic treatment of various health problems, particularly chronic diseases, including cardiovascular disorders and diabetes. These microelectronic medical implants use miniature sensors and wireless technology to observe patients’ medical conditions closely and accurately, which makes them preferable among doctors. Furthermore, there is a growing fund of innovation in microelectronics implants for patient telemonitoring and individualized therapies.

Impact of Artificial Intelligence on Microelectronic Medical Implants Market

AI is facilitating the microelectronic medical implants market by improving the accuracy, speed, and individual approach. Technological advancement, such as the implementation of artificial intelligence algorithms, enhances diagnostic accuracy and real-time monitoring resources. This enhances the dynamic change of devices according to individual patient needs. Furthermore, AI enhances the production of these devices to be efficient and produce better technologies with more reliability.

| Report Coverage | Details |

| Market Size by 2034 | USD 65.60 Billion |

| Market Size in 2024 | USD 34.56 Billion |

| Market Size in 2025 | USD 36.84 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

A growing population suffering from chronic disorders

The specimens of chronic diseases, cardiovascular disorders, diabetes, and neurological disorders especially fuel the demand for the microelectronic medical implants market. This significantly high disease burden underscores the necessity for robust future asymptomatic chronic disease surveillance and management strategies, especially in developed countries and LMICs, where 77% of such mortality was, according to the global report.

Increased health conditions require profound monitoring and interventions that require the microelectronic medical implants market products to optimize the care of affected patients. Furthermore, higher healthcare expenditures also fuel the application of such implants, and manufacturers provide better precision care for diseases that need frequent alteration.

High manufacturing costs

The high manufacturing costs are expected to hinder the microelectronic medical implants market in the coming years. These enhanced devices entail complex materials and technology that demand capital in the manufacturing process. Manufacturers continue to work on incorporating features, including wireless connectivity and real-time monitoring, which further increases the costs. This increases the costs of products and services, further affecting the adoption of these types of technologies among consumers and healthcare. Additionally, the potential patients who prefer to use these advanced treatments may fail perchance, as they are expensive.

Increased R&D investment in microelectronic medical implants

The increasing investment in research and development (R&D) within the healthcare sector is expected to create immense opportunities for the players competing in the microelectronic medical implants market. Both the governments and private players are funding programs that improve patient care, which is achievable through the emergence of innovative technologies. This increase in funding helps to consider new materials and technologies that affect the operation and safety of the implants. Business entities that specialize in individualized therapy technology and the application of AI in implant development belong to market leaders.

The pacemakers & defibrillators segment held a dominant presence in the microelectronic medical implants market in 2023 due to the growing number of cardiovascular diseases. Consumers across the world are experiencing high cases of heart disease, which creates the need for these devices as they are associated with better performance in managing seriously ill patients. The presence of potentially large aging populations and the general increase in the frequency of cases of arrhythmias point to the growth of the segment.

The neurostimulators segment is expected to grow at the fastest rate in the microelectronic medical implants market during the forecast period of 2024 to 2034, owing to the increasing rates of neurological disorders, including epilepsy, Parkinson’s disease, and chronic pain. This has been propelled by the growing consciousness of people on the advantages of neuromodulation treatments. Pulse stimulation that is adjusted according to specific patient data increases the efficacy of the treatment. Furthermore, the market growth is supported by the increase in the demand for non- or minimal-invasive therapies in which neurostimulators are located.

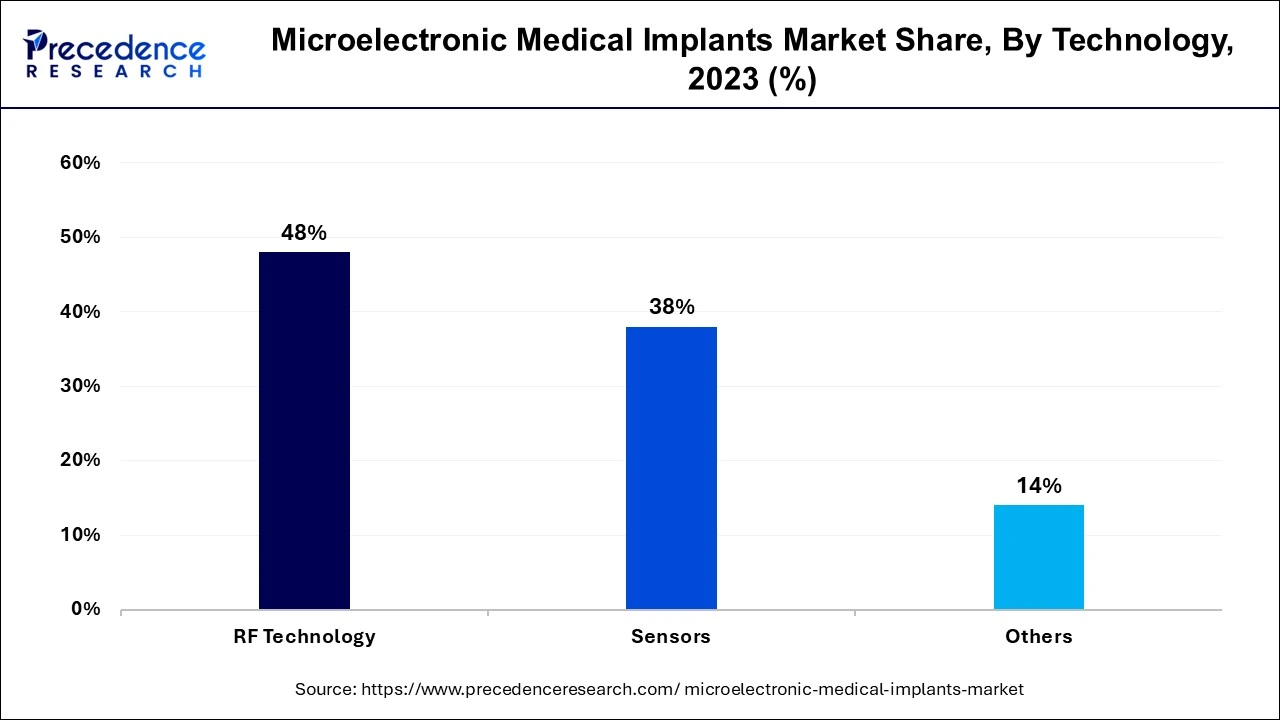

The RF technology segment accounted for a considerable share of the microelectronic medical implants market in 2023, due to the higher usage of RF-based communication systems in devices used in medical fields which supported data transfer and remote monitoring services. There is a growing need to monitor the state of patients in real-time and efficiently transfer data between healthcare instruments and officials. Furthermore, modern technological improvements in miniaturization and power consumption in RF components help the creation of compact and superior implantable devices.

The sensors segment is anticipated to grow with the highest CAGR in the microelectronic medical implants market during the studied years, owing to the great demand for developed sensors for individual physiological unknowns, including heart rate, sugar level, and neuronal activity, among others. The development of substitutes in materials used allows the sensors to be incorporated into the implant, improving functionality and comfort to the patient. Additionally, the increase in the incidence of chronic diseases and constant control over their condition further propels the segment.

North America led the global microelectronic medical implants market in 2023 due to the industry being populated by major players as well as extensive investments made in research and development, thus pushing technology. The cases of chronic diseases, notably among the elderly, create a market for implantable devices that constantly & effectively diagnose and treat the condition. Additionally, good reimbursement policies, government support towards healthcare advances, and the presence of leading innovating and manufacturing industries further fuel the market in this region.

Asia Pacific is projected to host the fastest-growing microelectronic medical implants market in the coming years, owing to the increased rates of urbanization, growing per capita revenues, and advancing healthcare spending. The governments of countries such as China and India have been targeting healthcare facilities to accommodate the increasing need for technologically refined products in this industry. Furthermore, the growing incidence of lifestyle diseases increases the demand for new implantation technologies.

Segments Covered in the Report

By Product

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025