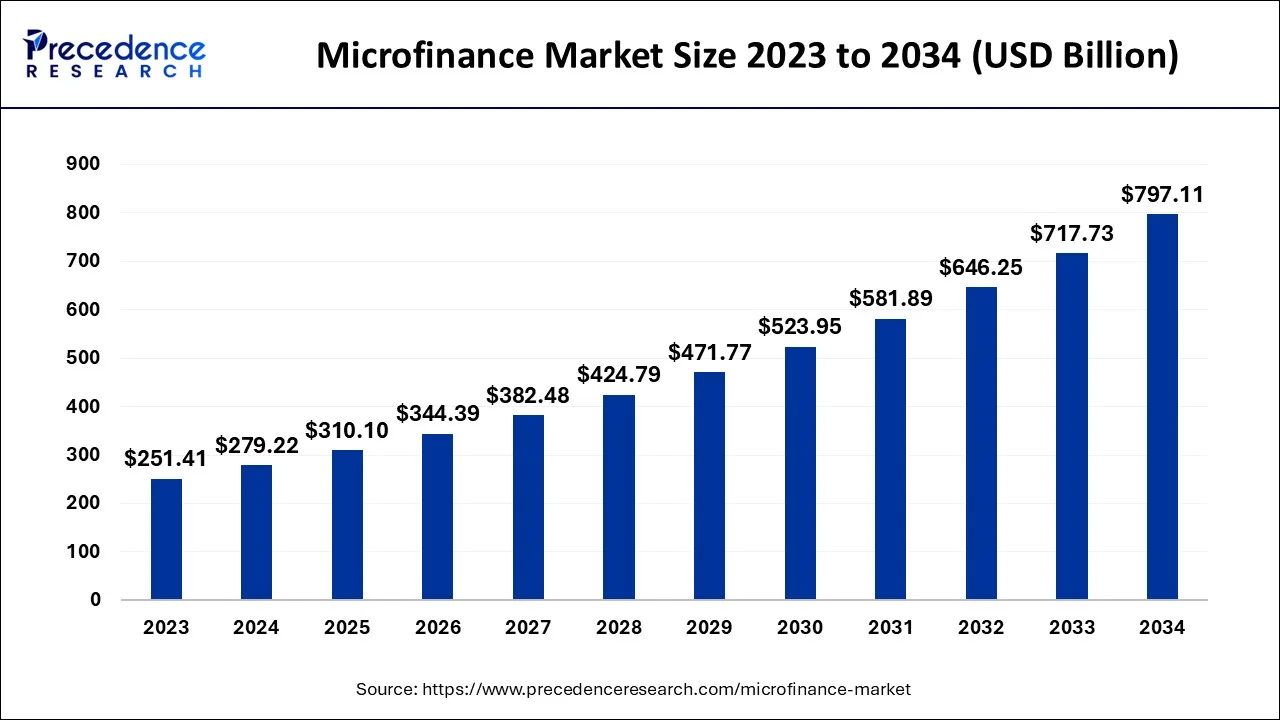

The global microfinance market size is predicted to increase from USD 279.22 billion in 2024, grew to USD 310.10 billion in 2025 and is anticipated to reach around USD 797.11 billion by 2034, poised to grow at a CAGR of 11.06% between 2024 and 2034.

The global microfinance market size accounted for USD 279.22 billion in 2024 and is predicted to surpass around USD 797.11 billion by 2034, expanding at a CAGR of 11.06% between 2024 and 2034.

In May 2024, the Accion Digital provided a $152.5 million funds to financial institutes in order to encourage micro, small and medium enterprises globally, which were looking for financial support in the year. The goal of this investment was to connect millions of MSMEs and people toward digital economy, to reduce poverty and develop future for underserved communities.

Microfinance and the Sustainable Development Goals (SDGs)

| Report Coverage | Details |

| Market Size in 2024 | USD 279.22 Billion |

| Market Size by 2034 | USD 797.11 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.06% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Provider Type and By Purpose |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for financial inclusion to brighten the market prospect

Financial inclusion aims to provide individuals and communities, especially those underserved by traditional banking services, access to affordable and inclusive financial products. Microfinance institutions (MFIs) play a vital role in meeting this demand by offering small loans, savings accounts, insurance, and other financial services tailored to the specific needs of underserved populations. The demand for financial inclusion arises from recognizing that access to financial services is a fundamental right and an enabler of economic growth and poverty reduction. Many individuals and small businesses, particularly in developing countries, lack access to formal banking services due to low income, limited collateral, or remote locations. Microfinance addresses these barriers by providing flexible and accessible financial solutions that empower individuals to improve their livelihoods and create economic opportunities.

The microfinance market is driven by its transformative impact on individuals and communities. By receiving microloans, individuals can invest in income-generating activities, education, healthcare, and housing, leading to increased economic stability and improved living standards. Microfinance-supported small businesses can expand operations, create jobs, and stimulate local economies. Technological advancements have further accelerated the demand for microfinance. Mobile banking, digital payments, and innovative financial technologies have facilitated the delivery of microfinance services, making them more efficient, cost-effective, and scalable. These digital solutions have enabled MFIs to reach remote areas where traditional banking infrastructure is limited and provide financial services to previously excluded populations. Thus, the increasing demand for financial inclusion has driven the growth of the microfinance market.

Growing adoption of entrepreneurship and small business development

Microfinance institutions provide access to credit, savings, and other financial services that enable aspiring entrepreneurs to start or expand existing businesses. By empowering individuals with financial resources, microfinance contributes to job creation, income generation, and overall economic development. It significantly impacts women's empowerment, allowing them to overcome traditional barriers and take control of their financial lives. Many programs specifically target women borrowers, recognizing their entrepreneurial potential and the multiplier effect of empowering women. By offering financial services, business training, and support, microfinance empowers women to start and manage their businesses, leading to greater gender equality and economic independence. For instance, in April 2023, FINCA Microfinance Bank Limited announced a collaboration with CIRCLE Women, a social enterprise dedicated to women’s economic empowerment and leadership development. The collaboration aims to empower women from low-income strata by promoting digital literacy and financial inclusion under CIRCLE Women’s Digital Literacy Programme (DLP).

As the adoption of entrepreneurship and small business development increases, the demand for microfinance is expected to grow. This enables individuals to generate sustainable incomes, build assets, and lift themselves out of poverty. Microfinance institutions often target marginalized and low-income populations, providing them with financial services to increase their living standards and break the cycle of poverty. Furthermore, governments and industries worldwide are investing heavily in developing entrepreneurship and small business development, which is anticipated to drive the growth of the microfinance market.

Government initiatives to promote product diversification.

Growing government initiatives for individual economy developments holding great market potential. Promoting supporting financial inclusions like Financial Literacy programs, Microfinance Infrastructure Developments (MID), and regulatory agencies for microfinance are developing new way for the microfinance success among developing regions. Encouraging innovations in agriculture finance, saving products, microinsurance, mobile financing, and digital payment options are supporting growth of market. government has supported to allow financial services access to population to enhance economical stability. Growing participation by government and regulatory frameworks are likely to boost microloan distributions, young employments, and novel entrepreneurships.

Growing awareness of the sustainable development goals

Awareness of climate risks, opportunities, concerns about water, soil conservation, and energy storage has increased rapidly since from past few years. Farmers has been aware about risk managements of environmental changes, which has increased participation of social and governess factors to reduce risk and improve productivity. SDG-enable microfinance products like green microloans for renewable energy, microinsurance for climate resilience, Women’s empowerment loas, education loans, agriculture microfinance for eco-friendly farming has impacting market expansion. Future of microfinance market is highly depended on SDG-aligned microfinance, promotion of sustainable financial products, cutting-edge technology innovations, increased climate and weather action focus and global cooperations. Adoption of SDGs and promotion of sustainability developments and economical inclusion for rural populations are the key trends of microfinance adoption in upcoming period.

The high cost of microfinance is causing hindrances to the market:

Serving marginalized and low-income populations involves inherent operational costs, including outreach, loan administration, and client education. These costs, combined with the perceived risks of lending to such clients, can result in higher interest rates. Balancing the need for affordability with sustainable interest rates is a constant challenge for microfinance institutions. High-interest rates and fees associated with microfinance loans make it difficult for low-income individuals and small businesses to afford and repay the borrowed funds. The high cost can limit the number of people who can access these services, defeating the purpose of financial inclusion. It creates a barrier for those who require credit but cannot afford the high borrowing costs.

However, with technological advancements, microfinance costs are expected to decrease over time. It can explore innovative practices and technologies to reduce operational costs and enhance efficiency. Governments can also play a vital role by providing helpful policies and regulatory frameworks encouraging competition, transparency, and responsible lending practices.

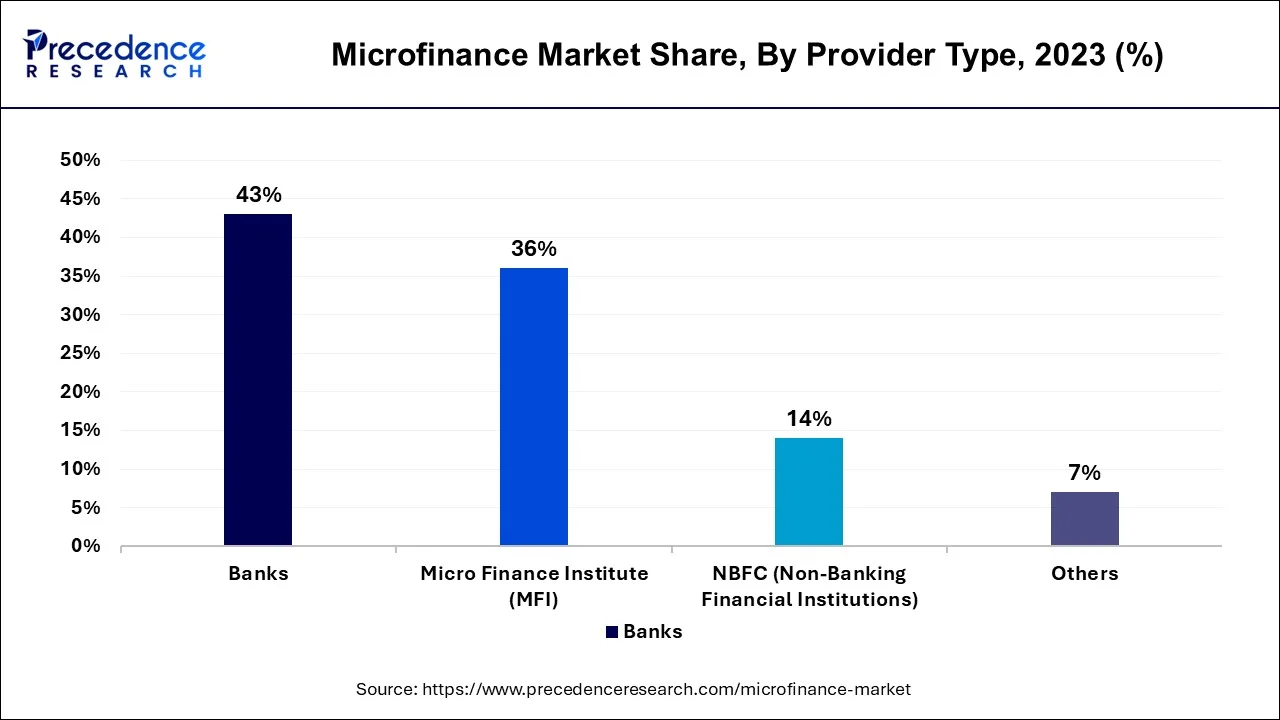

The microfinance institutes (MFI) segment is the fastest growing segment of market. region with less banking infrastructures are majorly adopting microfinance institutes. Asia pacific is the largest region for MFI adoption due to increased population and urbanizations. Growth in digitalization and technologies are boosting the segment to success. Rasing small-scale business are under leaderships of women empowerment are driving need of microfinance institutes. Economical growth, social awareness, need of tailored financial products like saving accounts and microloans, as well as increased digitalization are likely to empower segment to highest success in upcoming years.

However, in some regions, MFIs and NBFCs might play a more prominent role in the microfinance market, particularly in areas with limited banking infrastructure or where specialized institutions have been established to cater specifically to the needs of underserved populations

The manufacturing/production segment dominated the global microfinance market. Growing population are encouraging the small-scale manufacturers to develop their organizations. Rapid growth of microfinance institutes is helping manufacturers and producers for training and mentorship also offers the economical help for supply of raw materials and equipment’s. Microfinance products like Working Capital Loans, Inventory financing, Equipment Financing, Supply Chian Financing, and Business Loans are supporting small-scall businesses developments. This segment is expected to boost with growth in employment, enhance productivity and competitiveness of market.

The agriculture segment held the largest share of the microfinance market in 2023, due to its focuses on providing financial services and support to farmers, agricultural enterprises, and rural communities engaged in agricultural activities. Agriculture is a vital sector in many developing countries, and access to finance is crucial for smallholder farmers and agricultural businesses to invest in equipment, seeds, fertilizers, and other inputs necessary for production. Microfinance institutions targeting the agriculture segment offer tailored financial products, such as crop loans, livestock loans, agricultural equipment financing, and value chain financing, to support the entire agricultural ecosystem.

Asia-Pacific dominates the market. This growth can be attributed to the surge in government initiatives aimed at poverty reduction and improving the standard of living for the population, which has become a significant trend in the microfinance market. Furthermore, much of the population resides in rural areas with limited access to traditional banking services. As a result, microfinance plays a crucial role in providing financial services to this underserved population.

India is the major country supporting microfinance market with its vast population and growth of micro, small, and medium business, growing awareness of women empowerment driving government initiatives to support emerging institutes and enterprises of the country.

Europe is a significant market for microfinance, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is due to the rising importance of microfinance in promoting financial inclusion and supporting entrepreneurship, leading to the establishment of microfinance institutions and supportive regulatory frameworks. Various institutions, including microfinance banks, non-governmental organizations, cooperatives, and social enterprises, provide financial services to individuals and small businesses, focusing on social impact and sustainable development.

North America has numerous microfinance institutions, including community development financial institutions, credit unions, and non-profit organizations. These institutions provide microloans, business training, and other financial resources to small businesses and low-income individuals. The United States and Canada are the major countries driving the demand for microfinance in the North American region. The sector has grown steadily over the years, with the establishment of microfinance institutions and the participation of various stakeholders. Moreover, these countries invest heavily to empower underserved communities, reduce poverty, and support economic development. The focus extends beyond providing access to credit, including capacity-building programs, financial education, and mentorship.

North America to be significant growth

Segments Covered in the Report:

By Provider Type

By Purpose

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client