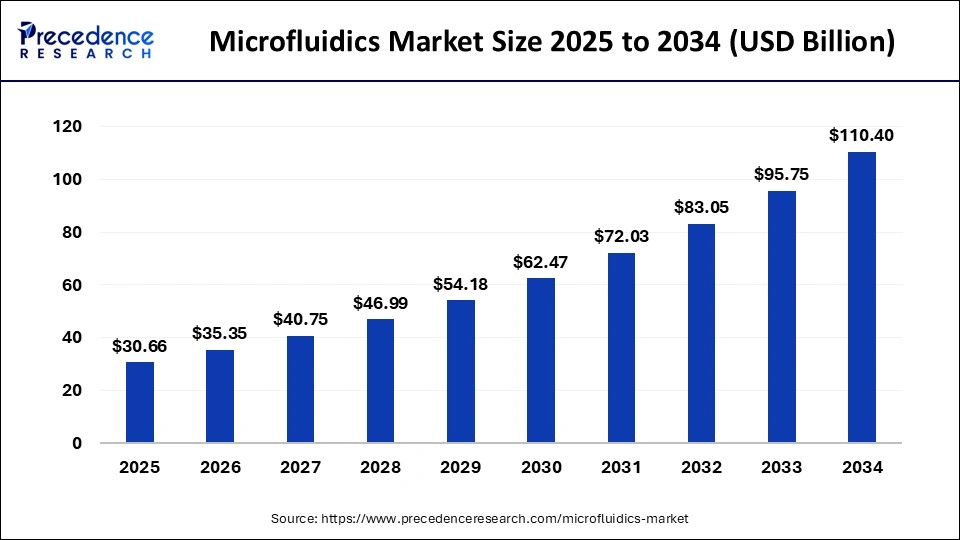

The global microfluidics market size is estimated at USD 30.66 billion in 2025 and is predicted to reach around USD 110.40 billion by 2034, accelerating at a CAGR of 15.30% from 2025 to 2034. The North America microfluidics market size surpassed USD 11.47 billion in 2024 and is expanding at a CAGR of 15.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microfluidics market size was estimated at USD 26.59 billion in 2024 and is predicted to increase from USD 30.66 billion in 2025 to approximately USD 110.40 billion by 2034, expanding at a CAGR of 15.30% from 2025 to 2034.

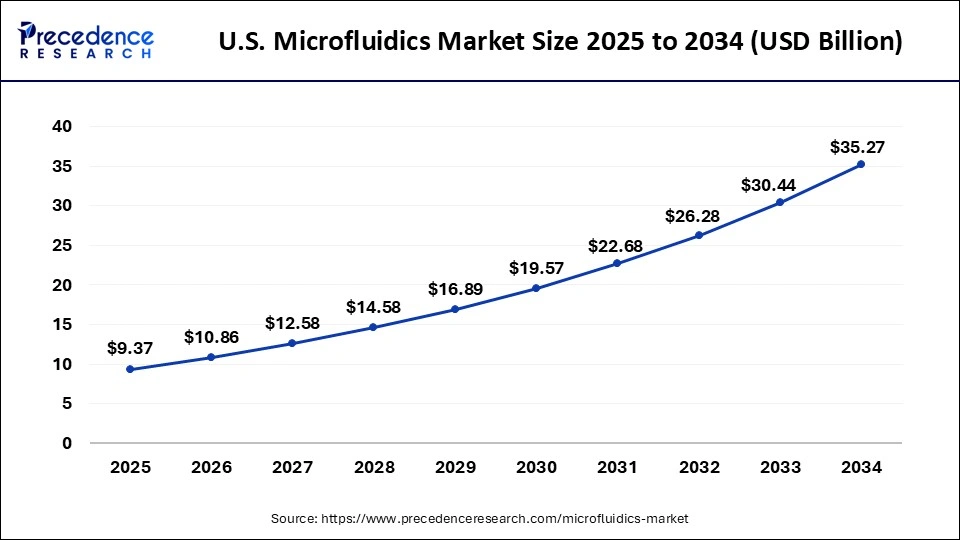

The U.S. microfluidics market size was estimated at USD 8.08 billion in 2024 and is predicted to be worth around USD 35.27 billion by 2034, at a CAGR of 15.87% from 2025 to 2034.

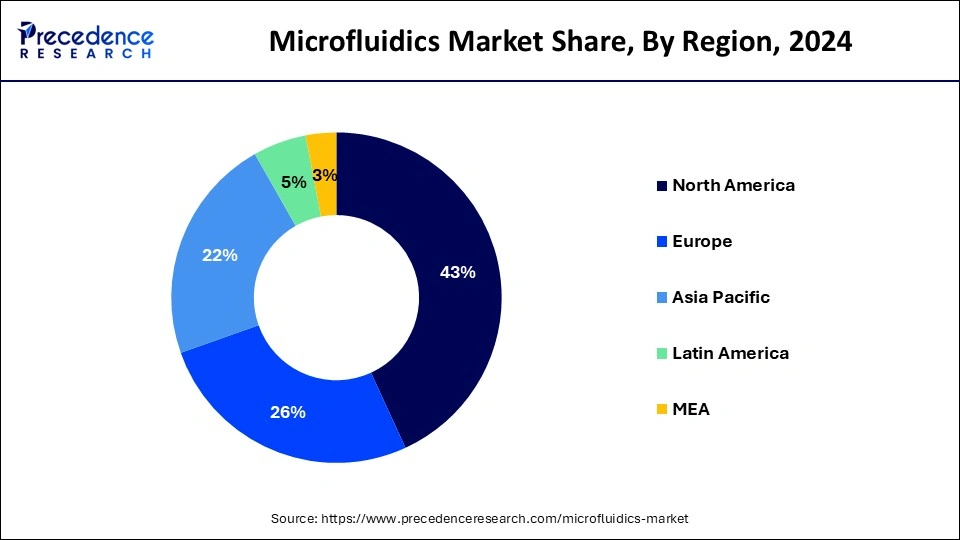

North America emerged as the largest shareholder around 43% in the global microfluidics market owing to the presence of well-established market players in the region, introduction of advanced technologies, an increase in the number of studies being opted to improve the samples optimization, and significant demand for POC diagnostics. In addition to this, the active participation of research institutes towards the development of novel microfluidic devices predicted to retain the dominance of the region over the upcoming years.

However, the Asia Pacific encountered to be the fastest growing market because of affordable labor, sophisticated research infrastructure, and adoption of microfluidic platforms. Furthermore, several international players have shown their interest for investing in this untapped market. For instance, in November 2019, Select BIO Microfluidics and Organ-on-a-Chip Asia organized a conference in Japan for addressing some novel technologies in the fields of Lab-on-a-Chip, Organ-on-a-Chip, and Microfluidics.

Increase in demand for point-of-care (POC) devices anticipated to prominently boost the market size in the upcoming years. Significant demand for low-volume sample analysis, demand for In Vitro Diagnostics (IVD), high-throughput screening methodologies, and development of advanced lab-on-a-chip technologies are further expected to propel the market growth of microfluidics over the analysis timeframe. Microfluidics provides a high return on investment along with it also helps in controlling cost by minimizing errors.

Other key factors propelling the market growth for microfluidics include increasing for microfluidics technology & devices in point-of-care diagnostics, rising technological advancements in diagnostic devices, and rising incidence of chronic diseases across the globe. Hence, the above mentioned factors augment the demand for molecular diagnosis and subsequently impact positively towards the market growth of the microfluidics.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.30% |

| Market Size in 2024 | USD 26.59 Billion |

| Market Size in 2025 | USD 30.66 Billion |

| Market Size by 2034 | USD 110.40 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Technology, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The polydimethylsiloxane (PDMS)-based microfluidic chips segment dominated the global microfluidics market in terms of revenue at 34.5% in the year 2024 and is anticipated to register the fastest growth rate over the analysis period. PDMS is a prominently used polymer in fast prototyping microfluidic devices. These are highly used by the academic community owing to their ease of fabrication along with their low cost. On the other hand, these polymers are hydrophobic which makes microchannels hard to operate in aqueous solutions. To combat this issue, new PDMS surface modifications are offered to address challenges due to hydrophobicity.

Besides this, polymer-based microfluidic devices proved as a better alternative to the glass and silicon-based microfluidic devices. Polymer-based materials are more affordable, robust, easy to access, and require rapid fabrication techniques as compared to silicon and glass materials. Polymers are one of the most important materials used in microfluidic chips for mass production by applying soft lithography, casting, injection molding, and hot embossing techniques.

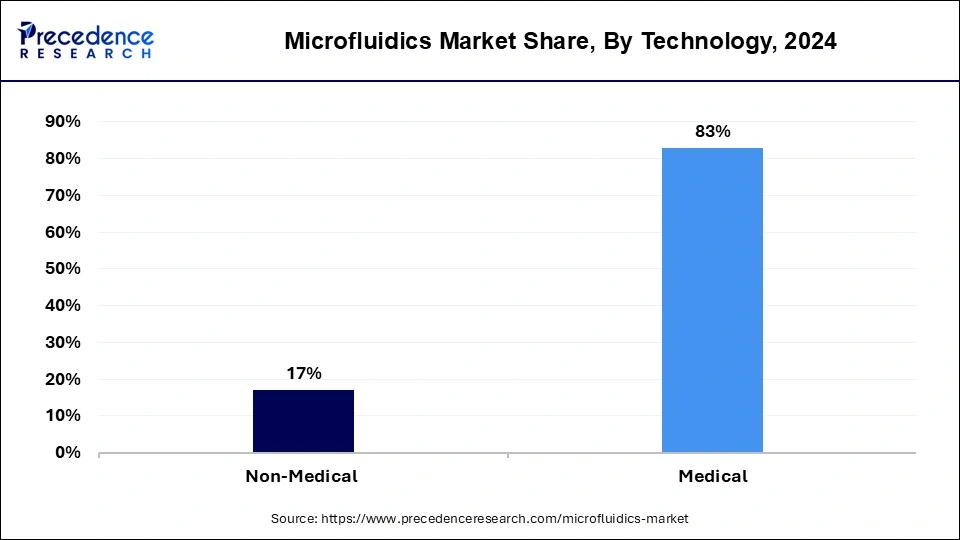

On the basis of revenue,the medical technology segment led the global microfluidics market with an 83% revenue share in the year 2024. This is mainly attributed to the three major benefits offered by the microfluidics for the POC diagnostics that include smaller sample volumes, faster turnaround times, and lesser test costs. These benefits are moderately being utilized for the development of POC devices for detection and diagnosis of a wide range of conditions from cancer to infectious diseases.

For example, the Laboratory of Integrated Bio-Medical/Nanotechnology & Applications (LIBNA) fabricated a microfluidic point-of-care sepsis chip that calculates CD64 expression on neutrophils as well as the overall WBC count in around 30 minutes, by just using 10 microliters of a blood sample.

The lab-on-a-chip application accounted revenue share of 38% in the global microfluidics market in the year 2024 and estimated to continue its position throughout the analysis period. In the field of molecular biology, lab-on-a-chip provides high detection speed despite of maintaining the same sensitivity level during RNA or DNA amplification along with their detection procedures. This application also permits the rapid sequencing of DNA.

Elveflow provides the fastest qPCR system named as Fast gene system that detects viruses and bacteria within 7 minutes. Furthermore, nanopore technology holds an excessive potential to facilitate the rapid genome sequencing of DNA than the lab-on-a-chip by implementing an array technique.

By Material

By Technology

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client