November 2024

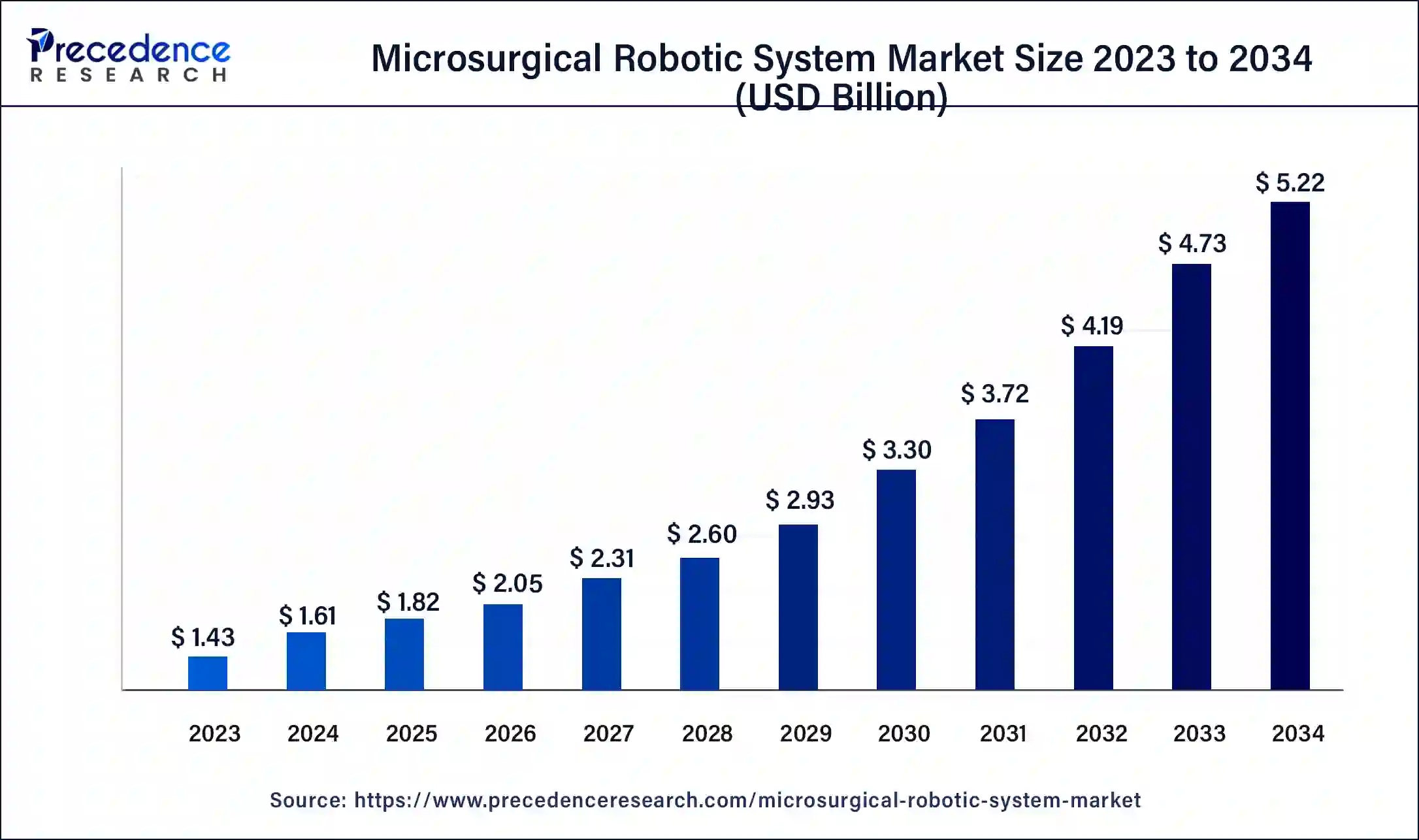

The global microsurgical robotic system market size was USD 1.43 billion in 2023, estimated at USD 1.61 billion in 2024 and is anticipated to reach around USD 5.22 billion by 2034, expanding at a CAGR of 12.49% from 2024 to 2034.

The global microsurgical robotic system market size accounted for USD 1.61 billion in 2024 and is predicted to reach around USD 5.22 billion by 2034, growing at a CAGR of 12.49% from 2024 to 2034.

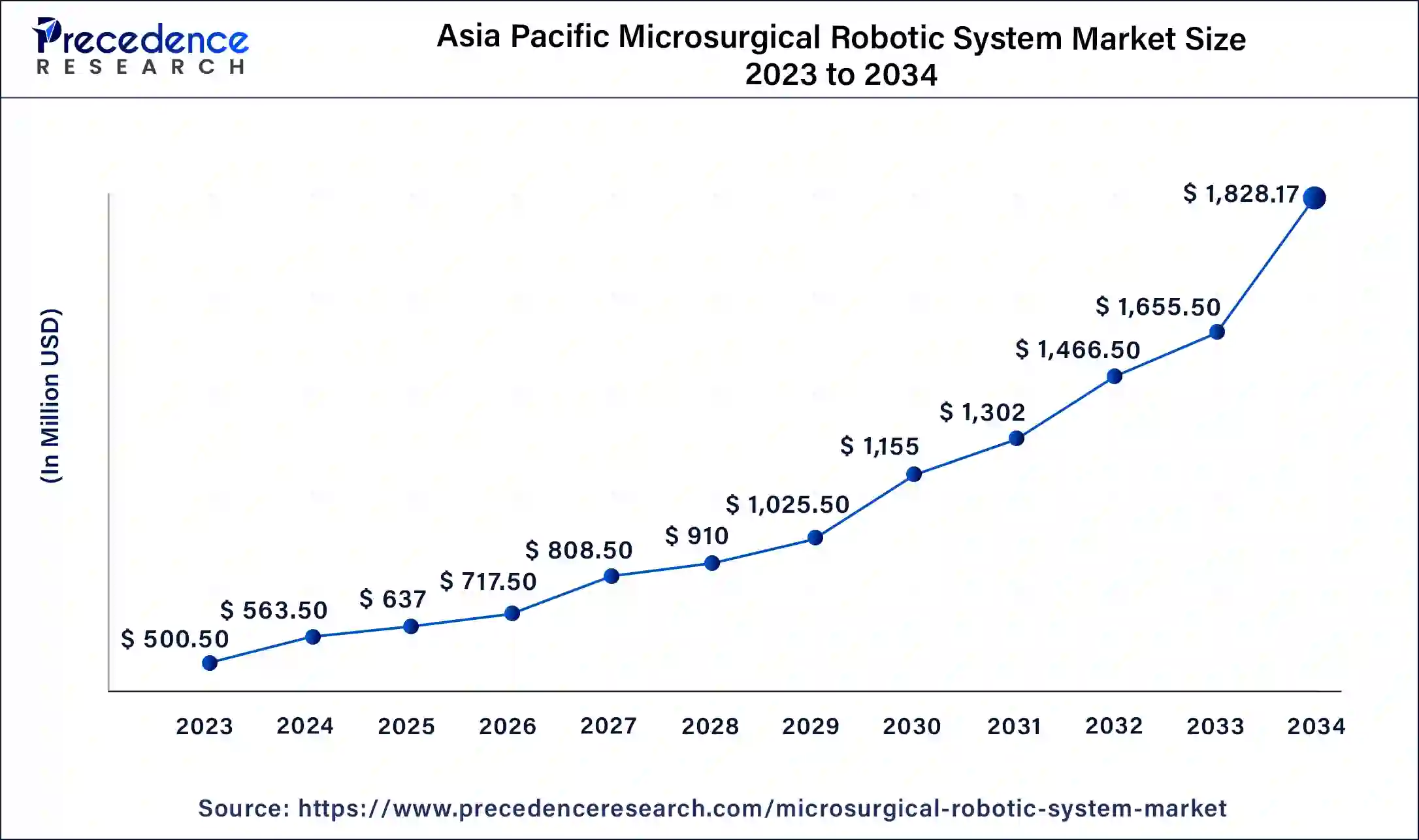

The Asia-Pacific microsurgical robotic system market size was valued at USD 500.50 million in 2023 and is expected to be worth around USD 1,828.17 million by 2034, at a CAGR of 12.60% from 2024 to 2034.

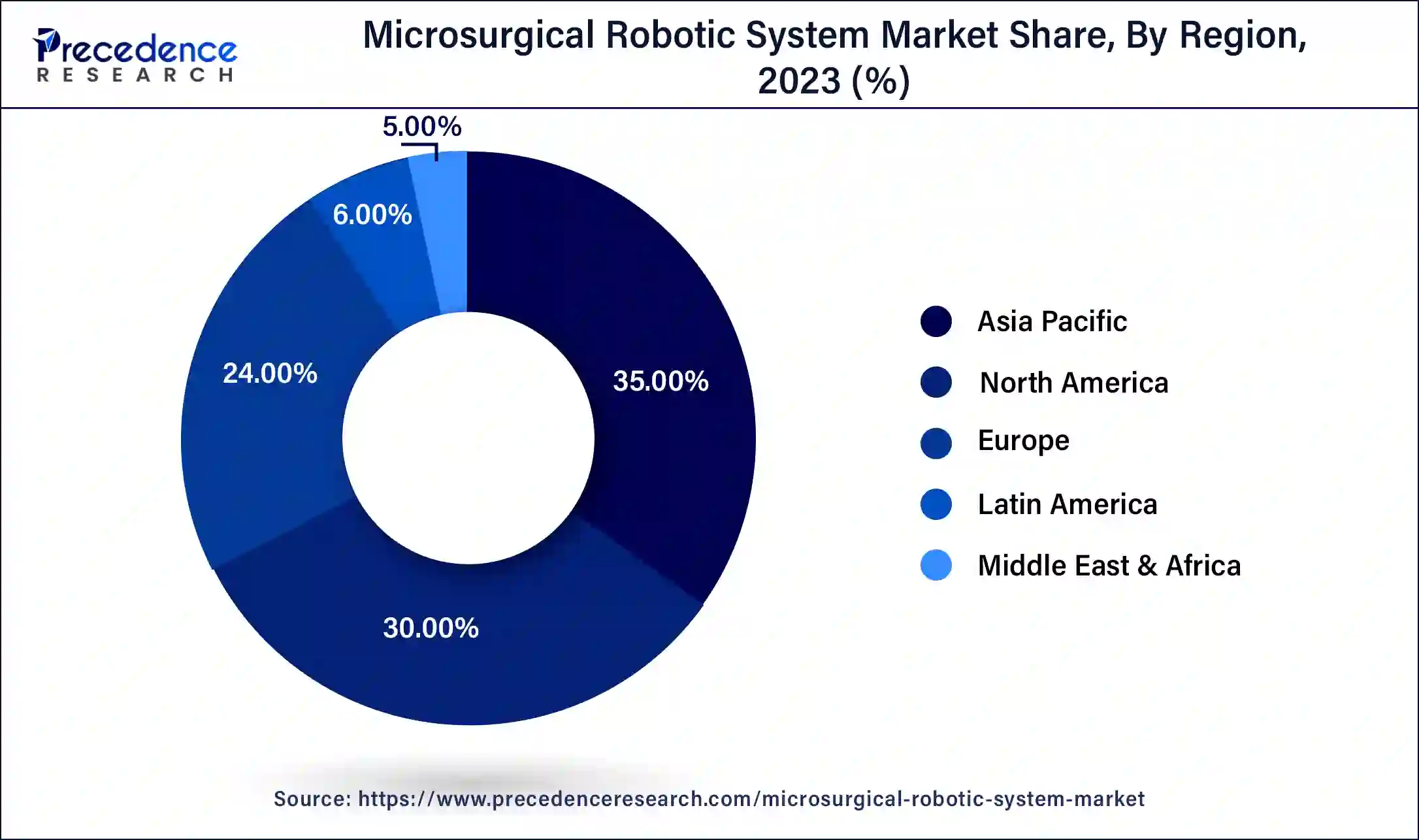

North America has held the largest revenue share 35% in 2023. North America dominates the microsurgical robotic system market due to factors such as advanced healthcare infrastructure, high healthcare expenditure, and early adoption of innovative medical technologies. The region's robust research ecosystem and collaborations between technology developers and healthcare institutions contribute to continuous advancements.

Additionally, favorable reimbursement policies and a well-established regulatory framework facilitate market growth. The region's inclination toward minimally invasive surgeries and a strong presence of key market players further solidifies North America's major share in the microsurgical robotic system market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the microsurgical robotic system market due to a combination of factors. The region's large population base, rising healthcare infrastructure, and increasing prevalence of chronic diseases drive the demand for advanced surgical technologies. Additionally, supportive government initiatives, escalating healthcare investments, and growing awareness among healthcare professionals contribute to the region's significant market share. The evolving economic landscape and the surge in minimally invasive procedures further fuel the adoption of microsurgical robotic systems, making Asia-Pacific a key player in shaping the global market.

A microsurgical robotic system is an advanced medical technology that combines the precision of robotics with the intricacy of microsurgery. This system utilizes robotic arms, often equipped with miniaturized instruments and cameras, to perform delicate surgical procedures with high precision. The surgeon controls the robotic system through a console, translating their hand movements into precise actions by the robotic arms. This allows for greater dexterity and accuracy, particularly in procedures that involve intricate movements or operate on small structures within the body.

The advantages of a microsurgical robotic system include reduced invasiveness, minimized tissue damage, and enhanced visualization, making it particularly beneficial for procedures such as neurosurgery, ophthalmic surgery, and vascular surgery. The system's ability to scale down the surgeon's movements and filter out hand tremors contributes to improved patient outcomes and faster recovery times. While these systems are continually evolving, their integration into medical practice represents a significant leap in the field of surgery, offering new possibilities for complex and precise interventions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 12.49% |

| Market Size in 2023 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.61 Billion |

| Market Size by 2032 | USD 5.22 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Minimally invasive surgeries and improved patient outcomes

Minimally Invasive Surgeries (MIS) and the consequential improvement in patient outcomes are key drivers surging the demand for microsurgical robotic system. The adoption of these systems enables surgeons to perform intricate procedures through small incisions, reducing trauma to surrounding tissues. This results in minimized scarring, faster recovery times, and shorter hospital stays, meeting the growing patient preference for less invasive interventions.

Improved patient outcomes associated with microsurgical robotic system, such as reduced postoperative complications and enhanced precision, instill confidence among both healthcare providers and patients. These systems offer a level of accuracy and control that is challenging to achieve through traditional surgical methods, leading to better overall results. As the healthcare industry increasingly prioritizes patient-centered care and efficient recovery processes, the demand for microsurgical robotic systems continues to surge, driven by the tangible benefits of minimizing invasiveness and optimizing patient outcomes.

Microsurgical robotic system

Maintenance expenses serve as a significant restraint on the growth of the microsurgical robotic system market. While the initial investment in acquiring these advanced systems is substantial, ongoing maintenance costs add a layer of financial burden for healthcare institutions.

Regular updates, software upgrades, and technical support contribute to the overall cost of ownership, making it challenging for some facilities to sustain the long-term use of microsurgical robotic systems. The need for specialized technicians and engineers to perform maintenance tasks further escalates expenses.

These maintenance-related financial pressures can deter healthcare providers, especially those with limited budgets, from adopting or expanding the use of microsurgical robotic systems. To overcome this restraint, there is a growing need for innovative business models, such as service agreements and cost-effective maintenance plans that address the financial concerns associated with the continual upkeep of these sophisticated medical technologies.

Wider application spectrum

The expansion of the application spectrum is a pivotal factor creating significant opportunities in the microsurgical robotic system market. Beyond its current applications in neurosurgery and ophthalmology, the versatility of microsurgical robotic systems opens doors to a broader range of medical specialties. Emerging opportunities lie in fields like microvascular surgery, plastic surgery, and other intricate procedures where the precision and dexterity of robotic assistance are beneficial.

As technology evolves to accommodate diverse surgical needs, healthcare providers can explore new avenues for adopting microsurgical robotic systems, thereby driving market growth. This wider application spectrum not only enhances the market's overall attractiveness but also positions these systems as versatile tools across various medical disciplines, contributing to their acceptance and utilization in an expanding array of surgical interventions.

In 2023, the obstetrics and gynecology surgery segment had the highest market share of 32% on the basis of the application. In the realm of microsurgical robotic system, the obstetrics and gynecology surgery segment specifically focus on utilizing robotic assistance in surgeries pertaining to women's reproductive health. Current trends reveal a growing inclination towards incorporating microsurgical robotic systems in various gynecological procedures, including but not limited to hysterectomies and myomectomies.

This inclination is primarily attributed to the technology's heightened precision and capacity to minimize invasiveness. The adaptability of these systems to execute intricate maneuvers in delicate anatomical areas is also fostering their integration into obstetric procedures, showcasing a promising pathway for advancing minimally invasive surgical approaches within the domain of women's healthcare.

The ophthalmology surgery segment is anticipated to expand at a significant CAGR of 14.2% during the projected period. Ophthalmology surgery within the microsurgical robotic system market involves the use of robotic technology for precise and intricate eye surgeries. This segment encompasses procedures such as retinal surgery, cataract surgery, and corneal surgery. The trend in ophthalmology surgery with microsurgical robotic systems is marked by advancements in image-guided procedures, enhanced visualization, and improved control during delicate eye surgeries. Surgeons benefit from the technology's ability to execute minute maneuvers, contributing to better outcomes and reduced postoperative complications in ophthalmic interventions.

According to the end-use, the hospitals and clinics segment has held a 41% revenue share in 2023. The hospitals and clinics segment in the microsurgical robotic system market refers to the utilization of these advanced systems in medical facilities for various surgical procedures. Trends indicate a growing adoption of microsurgical robotic systems in hospitals and clinics, driven by the demand for precision in surgeries, reduced recovery times, and minimal invasiveness.

As these systems become more integrated into the surgical workflow of healthcare institutions, there is a trend toward enhancing surgeon training programs and optimizing the operational efficiency of microsurgical robotic technology within hospital and clinic settings.

The research institutes segment is anticipated to expand fastest over the projected period. The research institutes segment in the microsurgical robotic system market refers to academic and research institutions utilizing these systems for experimental surgeries, training programs, and innovative medical studies.

A notable trend in this segment is the increasing collaboration between technology developers and research institutes, fostering advancements in microsurgical robotic technology. Research institutions serve as crucial hubs for testing and refining these systems, contributing to their continuous improvement and playing a pivotal role in shaping the future landscape of microsurgical robotic applications.

Segments Covered in the Report

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

February 2025

August 2024