January 2025

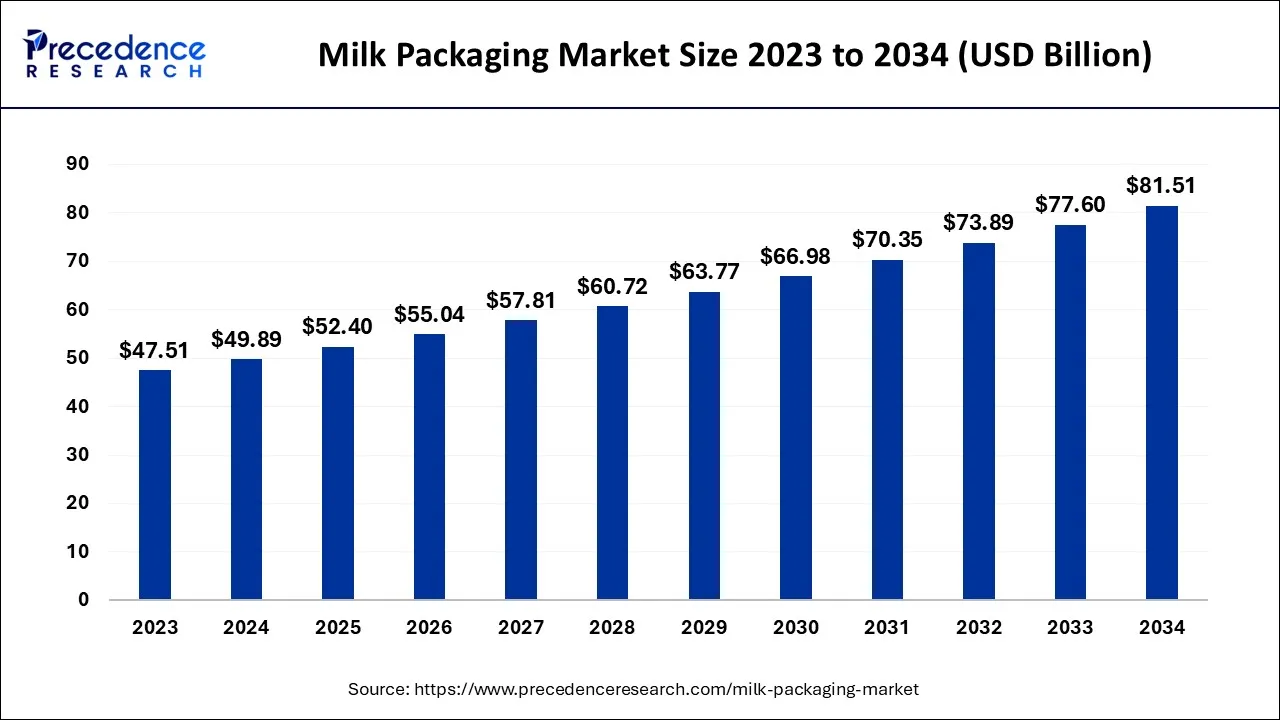

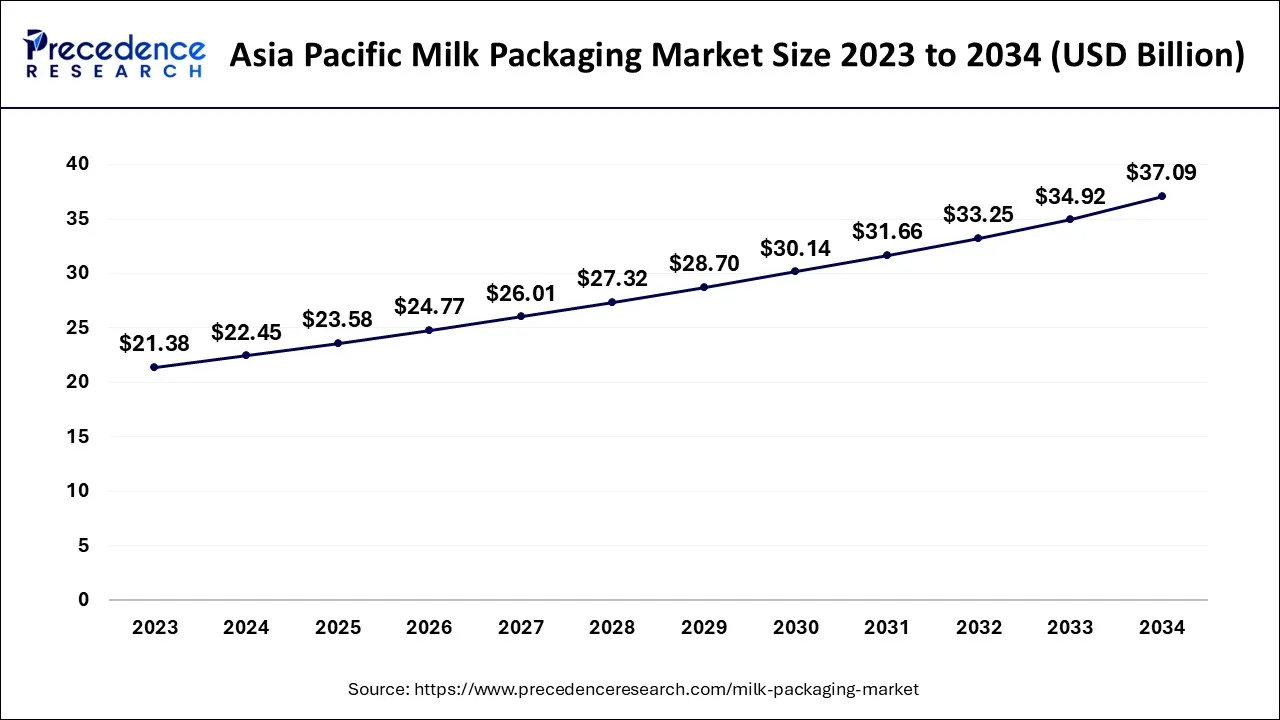

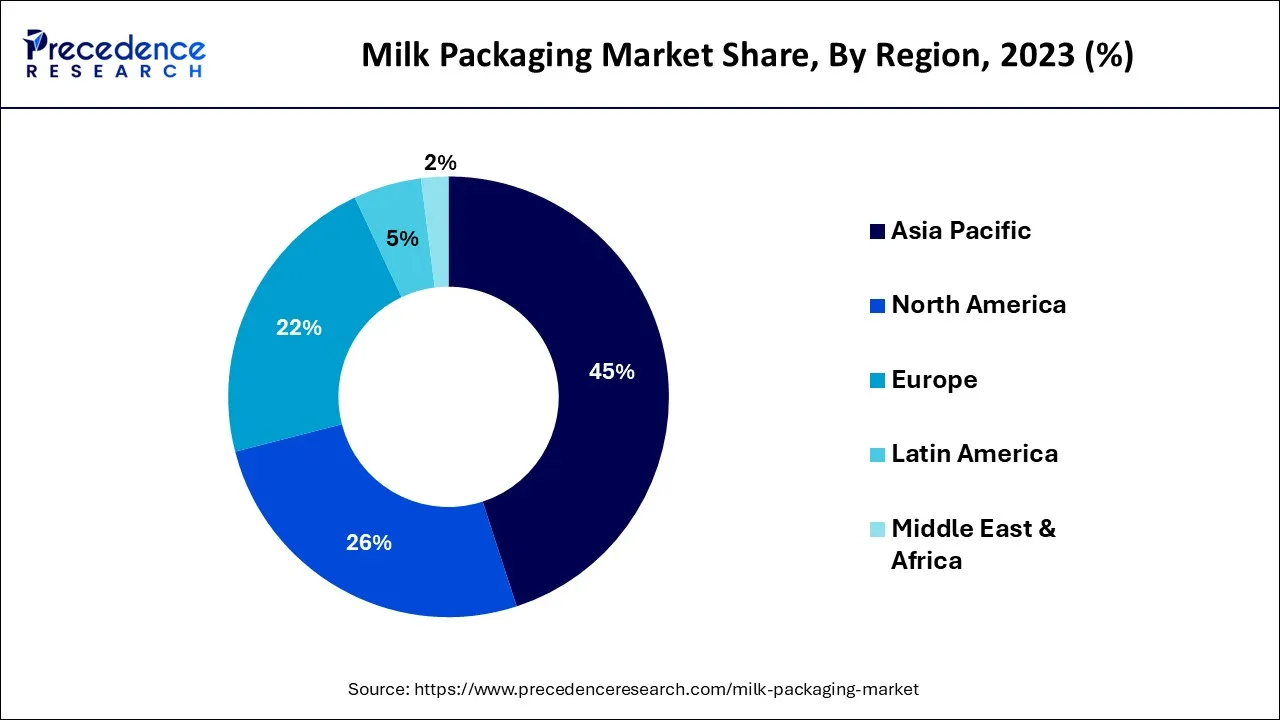

The global milk packaging market size accounted for USD 49.89 billion in 2024, grew to USD 52.40 billion in 2025, and is expected to be worth around USD 81.51 billion by 2034, registering a healthy CAGR of 5.03% between 2024 and 2034. The Asia Pacific milk packaging market size is predicted to increase from USD 22.45 billion in 2024 and is estimated to grow at the fastest CAGR of 5.15% during the forecast year.

The global milk packaging market size is expected to be valued at USD 49.89 billion in 2024 and is anticipated to reach around USD 81.51 billion by 2034, expanding at a CAGR of 5.03% over the forecast period 2024 to 2034.

The Asia Pacific milk packaging market size is exhibited at USD 22.45 billion in 2024 and is projected to beMilk Packaging Market worth around USD 37.09 billion by 2034, growing at a CAGR of 5.15% from 2024 to 2034.

The Milk Packaging Market is expected to be dominated by Asia Pacific during the forecast period. The largest producers and consumers of milk in the Asia Pacific region are the region's developing nations, particularly India and China. Additionally, the presence of a dense population and the escalating industrial innovations are promoting the development of the Milk Packaging Market throughout the forecast period. Products containing lactose are typically accepted by consumers in the Asia Pacific region, opening up new lactose-free options. The growing concerns about children's nutrition will also balance the consumption of dairy products and accelerate the expansion of the milk packaging market in the coming years.

Many farmers in the Asia Pacific region rely heavily on the dairy industry for their income. The Milk Packaging sector is expected to experience the highest growth during the forecast period. In nations like India, where there is an enormous discrepancy between demand and supply, more than 15% of the world's milk is produced. In addition, the Indian government has decided to follow up with the ban on the imports of milk and milk products under these unfavourable conditions. Additionally, this has helped regional farmers greatly in increasing their yield.

The government also encourages foreign businesses to boost domestic production. Furthermore, it is widely used in many other countries in the Asia Pacific, including China. As a result, the focus on raising milk production is anticipated to fuel the expansion of the Milk Packaging Market in the Asia Pacific region.

Milk packaging is the process of using various types of containers to transport, identify, safeguard, and facilitate milk merchandising. It helps the packaged milk's shelf life extend from a few hours to weeks and months. It protects against germs and other outside elements like light and moisture.

In addition, milk packaging serves as an essential conduit between the producer and the consumer to ensure the safe delivery of the milk through various production, transportation, storage, distribution, and marketing stages. It also allows manufacturers to distinguish their products from those of their competitors.

The market's anticipated expansion will be driven by small households' widely used preference for single-serve milk packages. In addition, a rise in the population's health consciousness has increased the demand for milk as a source of protein and calcium. It has also been established that milk is the main source of vitamin D and minerals, which will drive the growth of the milk packaging market in the coming years.

Additionally, one of the major factors propelling the expansion of the milk packaging industry globally is the accessibility of flavored milk products. Over the coming years, the industry for milk packaging will see profitable growth due to the expanding use of milk in the preparation of various milk products. According to the forecast, an increase in the consumption of dairy products and bakery goods, along with shifting societal norms, will amplify the business boom.

Furthermore, emerging economies are anticipated to fuel demand for and growth in new flavors and products that focus on health. Moreover, the demand for flavored milk is expected to rise globally due to consumers' impulsive eating patterns brought on by their hectic work schedules, which is anticipated to fuel the growth of the global milk packaging market in the years to come. Furthermore, it is anticipated that the manufacturers' increased R&D efforts and technological advancements will create opportunities for revenue growth both during the forecast period and in the years to come.

| Report Coverage | Details |

| Market Size in 2024 | USD 49.89 Billion |

| Market Size by 2034 | USD 81.51 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Materia and By Packaging Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising preferences for sustainability in packaging

Consumers are becoming more environmentally conscious and actively seeking sustainable packaging options, including milk. They are looking for packaging materials that are recyclable, biodegradable, compostable, and made from renewable resources. Milk brands that offer sustainable packaging options can attract environmentally conscious consumers and build brand loyalty, which will lead to increased sales and market share.

Many milk brands and manufacturers have set their own sustainability goals as part of their corporate social responsibility initiatives. Considering the rising initiatives for sustainable packaging, the preference for sustainability in packaging is intended to drive the growth of the milk packaging market.

Waste management concerns

The lack of adequate recycling infrastructure, particularly for complex or multi-layered milk packaging materials, can restrain the growth of the milk packaging market. Many milk packaging materials, such as laminates or composites, may not be easily recyclable or have limited recycling options, which can result in them being disposed of as waste, leading to environmental concerns.

The absence of efficient and accessible recycling options can hinder the sustainability credentials of milk packaging and limit its growth potential, especially in regions or markets where recycling infrastructure is underdeveloped or insufficient.

There are creative packaging methods in addition to paper-based packaging and packaging in plastic containers. UHT (Ultra High Temperature) milk can now be packed in completely sterile aseptic pouches with the necessary barrier properties to give them a shelf life of up to 90 days because of innovations in milk polybags.

These long-lasting milk pouches are made with nylon-based LDPE poly films that are thicker. This kind of packaging method significantly reduces the price of packaging and shipping UHT milk. A self-standing sterile pouch with an air-filled handle for holding and pouring, known as the Ecolean concept, is one of many innovations in milk packaging. As a result, the Milk Packaging Market is expanding due to the numerous innovations in milk packaging.

Plastic accounted for the largest market share. This expansion is attributable to the increasing popularity of plastic in milk packaging. Milk packaging typically uses plastic containers or packages, and the exploding innovations in plastic milk packaging are further fueling the development of this industry.

Additionally, the others market is predicted to expand at the fastest CAGR of 5.74% from 2024 to 2034 due to the increasing adoption of innovative milk packaging techniques like aseptically packaged milk using Tetra Paks for milk packaging with benefits like ultra heat-treated, not needing to be refrigerated, and 100% recyclable with guaranteed good quality milk making them the preferred option by every health care professional over the conventional milk containers.

The Pouches and Bags Segment accounted for the largest market share in 2023. This increase can be attributed to the increasing popularity of pouches and bags for milk packaging. Milk can be packaged in bags and pouches instead of plastic bottles and containers. The advantages of pouches include secondary packaging, which makes the entire process automated, systematic, and quick. It also helps maintain food safety and quality standards while maintaining a count of pouches and crates combined with bagged milk, which is more affordable to produce and purchase and is therefore preferred in nations like Canada. These factors are further boosting the expansion of the Pouches and Bags segment.

Additionally, the Cartons segment is predicted to expand at the fastest CAGR of 5.40% from 2024 to 2034 due to the prominent use of cartons in milk packaging due to their benefits such as superior presentation, customer and seller friendliness, low cost, environmental friendliness, lightweight, and simple availability in comparison to other milk packaging methods like those including plastic containers.

Segments Covered in the Report

By Material

By Packaging Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025