January 2025

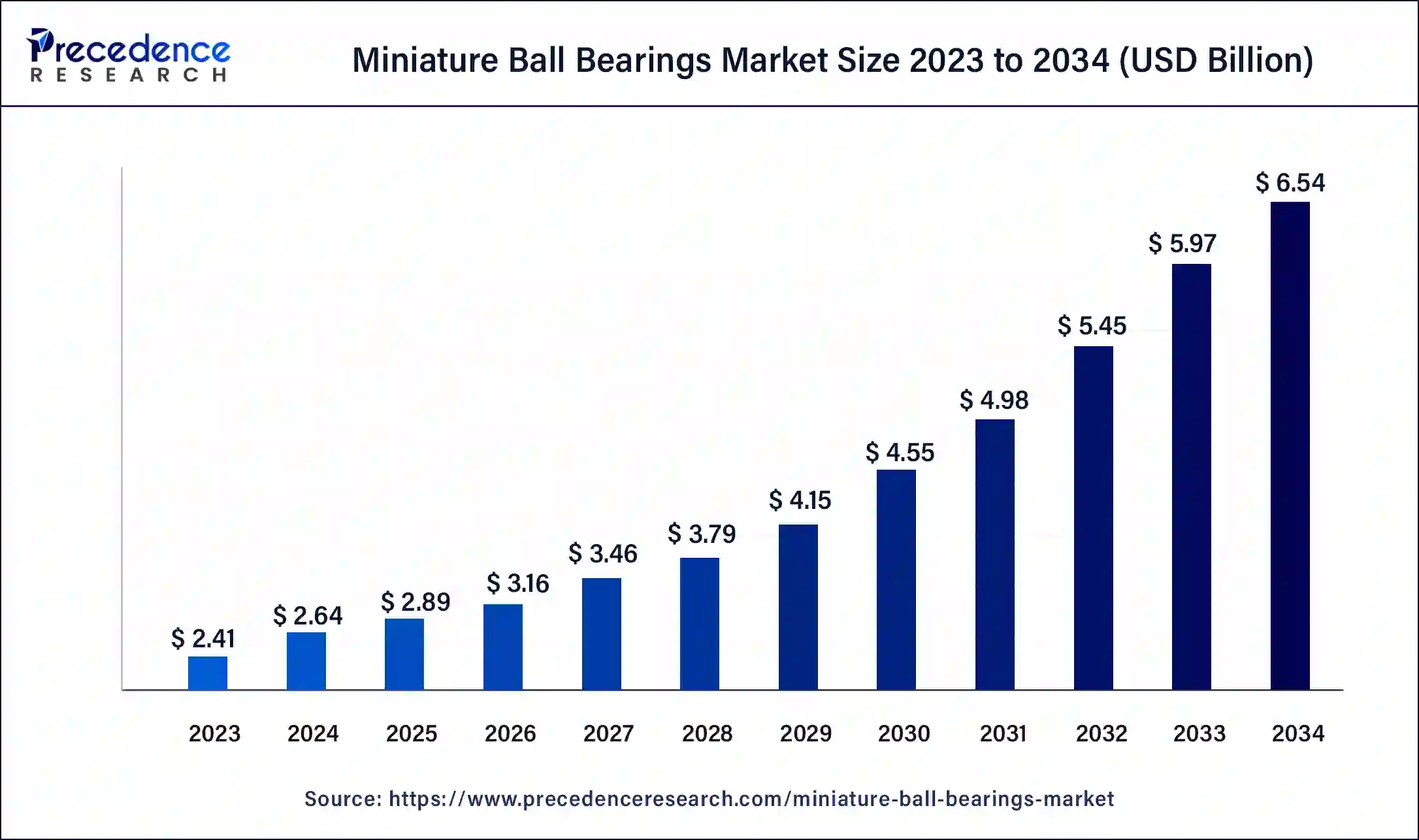

The global miniature ball bearings market size was USD 2.41 billion in 2023, calculated at USD 2.64 billion in 2024 and is projected to surpass around USD 6.54 billion by 2034, expanding at a CAGR of 9.5% from 2024 to 2034.

The global miniature ball bearings market size accounted for USD 2.64 billion in 2024 and is expected to be worth around USD 6.54 billion by 2034, at a CAGR of 9.5% from 2024 to 2034.

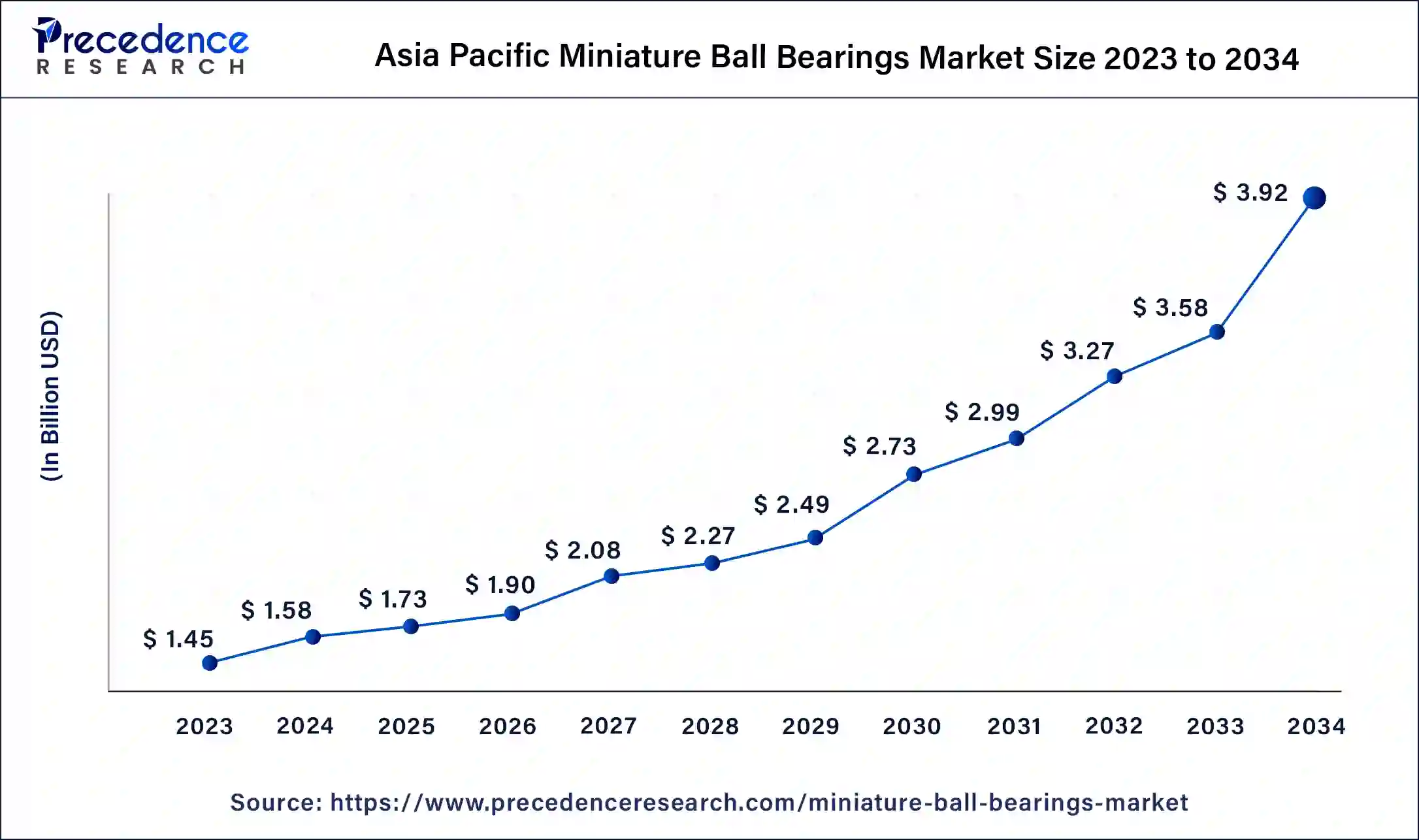

The Asia Pacific miniature ball bearings market size was estimated at USD 1.45 billion in 2023 and is predicted to be worth around USD 3.92 billion by 2034, at a CAGR of 9.7% from 2024 to 2034.

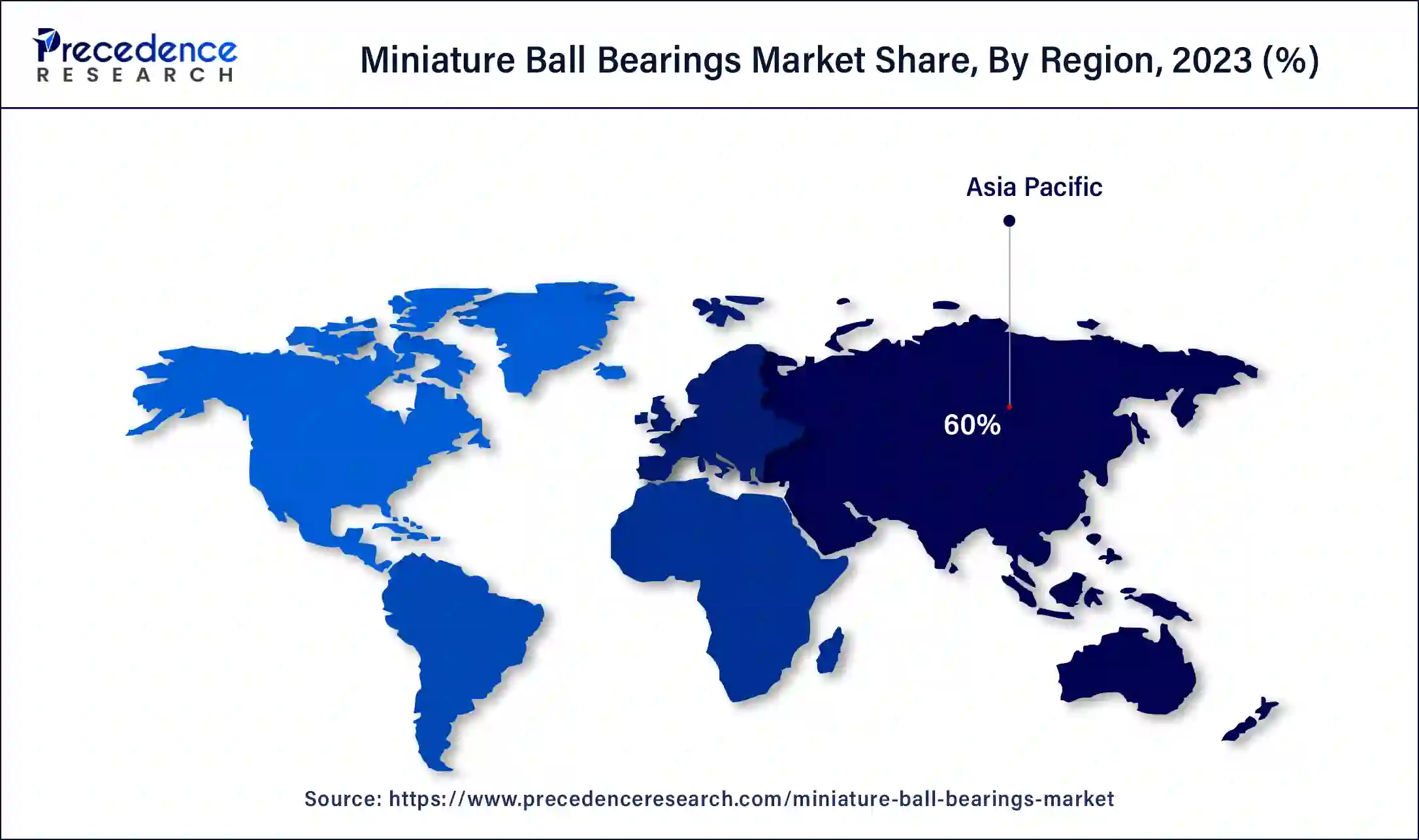

Asia Pacific dominated the miniature ball bearing market and accounted for the largest revenue share of 60% in 2023. The rapid industrialization in the developing countries of Asia Pacific is boosting the demand for miniature ball bearing across the region. The Asia Pacific is the most lucrative market for the automotive manufacturing, electrical appliance, health care appliances, and industrial equipment and machineries. Hence, the demand for the miniature ball bearing is high in Asia Pacific countries such as China, Japan, India, and South Korea. Moreover, China and India are the manufacturing hub of the world. Therefore, the Asia Pacific is anticipated to sustain its dominance in the forthcoming years in the miniature ball bearing market.

The other hand, North America is projected to witness the fastest growth rate throughout the forecast period. North America is the most promising market for the innovative and technologically advanced products. The increasing investments on the aerospace and robotics technology are expected to boost the demand for the miniature ball bearing in the region. US is the most prominent market in North America.

The growing demand for the miniature ball bearing or the instrument bearing in various end use applications such as automotive, robotics, industrial, and electrical appliances is driving the growth of the miniature ball bearing market. Technological advancements in various fields such as medical equipment, computers, robots, and audio and visual equipment has posed a challenge to the producers to manufacture and serve the increasing demand for miniature ball bearings with improved performance, reliability, and efficiency. Moreover, rapid industrialization and urbanization coupled with growing demand for automated equipment in different fields such as industries, household, and commercial is positively contributing to the growth of the miniature ball bearing market.

Easy availability of thousands of different types and designs of miniature ball bearing such as high speed radial, radial retainer, angular contact, thrust, and pivot is effectively serving the needs of the end use industries. Furthermore, the latest technological advancements in manufacturing miniature ball bearings such as ultra-precision technology is fueling the growth of the miniature ball bearing market. Equipment and machines have become downsized and compact in the past few years and owing to this the demand for the miniature ball bearing has increased rapidly. With the advancements in the technologies, machines and equipment are expected to become more compact and downsized that will rapidly boost the demand for the miniature ball bearing.

| Report Highlights | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.5% |

| Market Size in 2023 | USD 2.41 Billion |

| Market Size in 2024 | USD 2.64 Billion |

| Market Size by 2034 | USD 6.54 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

By product, in 2023, the dust cover miniature dominated the market with around 45% share in terms of revenue of the total market. The dust cover miniature ball bearings efficiently handle misalignments and loads while providing lubrication along with the protection from dirt. It provides cost efficiency and space saving that makes dust cover miniature ball bearing the dominating segment. The open miniature ball bearing is expected to grow at a promising rate owing to the growing uses of miniature ball bearing in manufacturing different equipment and machines in the fields of computer, robotics, and electrical appliances.

By Application, in 2023, the automotive dominated the market with around 39% share in terms of revenue of the total market. The automotive segment is followed by the industrial, aerospace, and household appliances segment.

Miniature ball bearings are extensively used in the automotive sector for manufacturing engine fans, wipers, motors, and other automotive components. The growing demand for automotive among the consumers is propelling the demand for the miniature ball bearings in the automotive manufacturing. This is a key factor fueling the demand for the miniature ball bearing.

The growing popularity of compact sized equipment in commercial space and households is driving the miniature ball bearing market demand. The machines and equipment used in aerospace, households, and industries are becoming downsized, thereby rapidly increasing the demand for the miniature ball bearings as miniature ball bearings perfectly fits and functions in the small-sized machines and equipment.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved and efficient miniature ball bearings. Moreover, they are also focusing on maintaining competitive pricing.

In April 2021, NSK Ltd. has developed ultra-high speed ball bearing for its use in the motors of electric vehicles. This third generation ball bearing is capable of operating at around 1.8 million dmN. It is claimed that this ball bearing is the fastest grease lubricated bearing for the automotive and it provides longer range and improve fuel efficiency. This will drive the growth of the miniature ball bearing market due to the rapid growth of the electric vehicle industry.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2024