October 2024

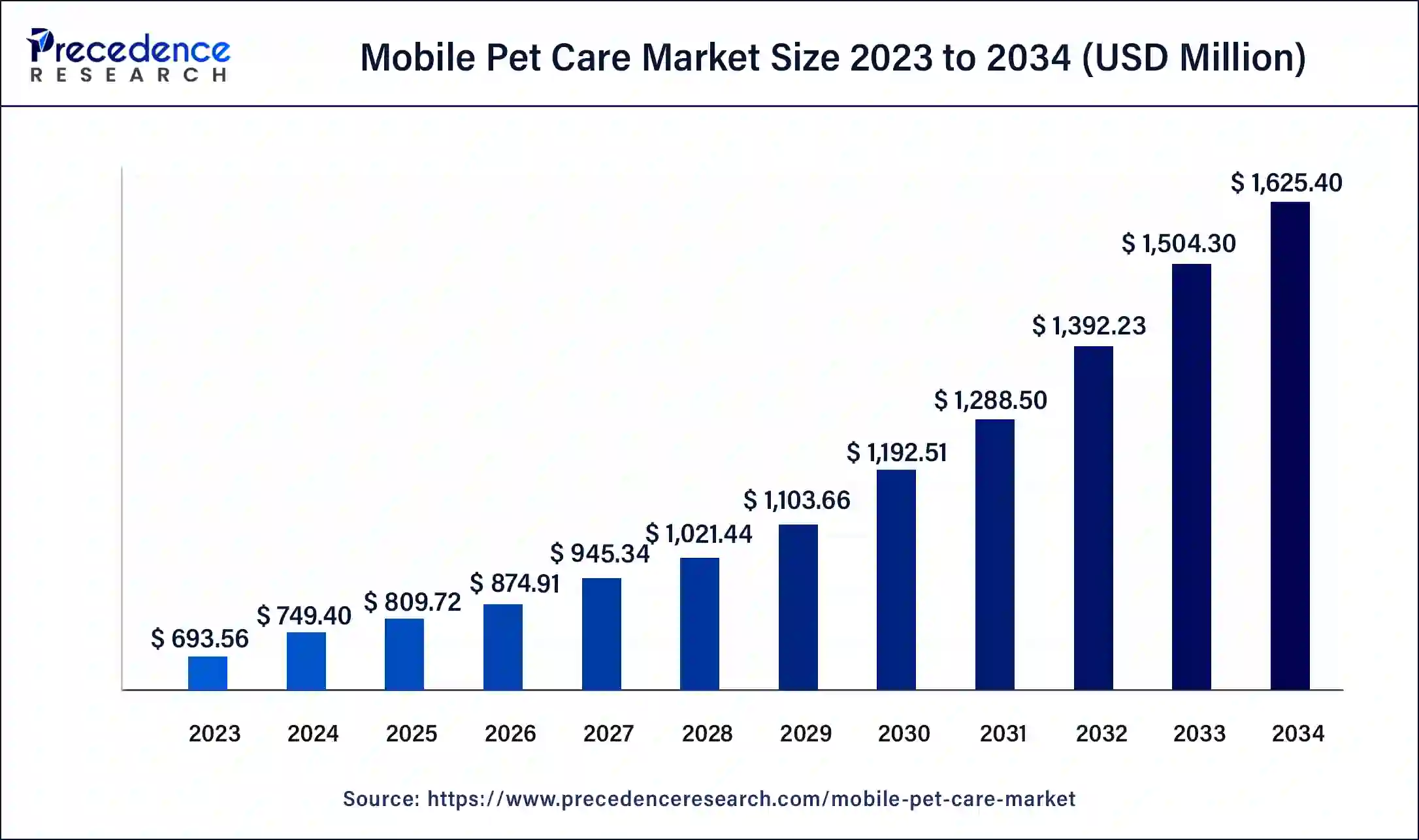

The global mobile pet care market size was USD 693.56 million in 2023, calculated at USD 749.40 million in 2024 and is expected to be worth around USD 1625.40 million by 2034. The market is slated to expand at 8.05% CAGR from 2024 to 2034.

The global mobile pet care market size is projected to be worth around USD 1,625.4 million by 2034 from USD 749.40 million in 2024, at a CAGR of 8.05% from 2024 to 2034. A rise in pet adoption and humanization and increased consumer spending on pet care and grooming are driving growth in the mobile pet care market.

Mobile pet care refers to pet support services that bring care to the owner’s home. This includes grooming, veterinary, and other services such as training and massages. The service provider makes in-person visits to the pet owner’s home with the required equipment, resulting in a lower degree of stress for the pets while caring for and treating them. Generally, an appointment is made with a mobile clinic similar to that made at a traditional veterinary hospital or grooming salon. An estimate for services can be requested before the appointment, and a notice period is required to allow for preparation and rescheduling.

A rising number of pet owners and a shift in consumer attitudes around the well-being and care of pets are driving growth in the mobile pet care market. Pet ownership saw a surge during the pandemic. The high cost of mobile pet care services is a challenge to growth in the market. Advances in internet connectivity, technological advances, and the popularity of apps make accessing services in the mobile pet care market easier, presenting avenues for growth.

How Artificial Intelligence is Transforming the Mobile Pet Care Market

Artificial intelligence has led to innovations and optimization in the mobile pet care market. Machine learning capabilities are being employed to address various pet care needs with location-based services availed on-demand through mobile apps. These apps connect dog walkers, pet sitters, pet groomers, and veterinary service providers to end-users. India-based platforms such as Petsfolio offer digital consultations with vets. IoT also allows for real-time pet care through tracking and medical monitoring. Trackers and sophisticated camera systems for the home allow owners to monitor behavior and ensure safety.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,625.40 Million |

| Market Size in 2023 | USD 693.56 Million |

| Market Size in 2024 | USD 749.40 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.05% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Services, Animal, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing pet ownership and humanization

Growth in the mobile pet care market is driven by increased spending on pet-related healthcare including diagnostics, pharmaceuticals, and veterinary care, which has extended pet lifespans, further driving the need for elder pet care services. Mobile pet care services offer advantages such as the convenience of no travel or waiting rooms, stress reduction due to a more familiar environment for the pet, and personalized attention on a one-to-one basis.

Consumers' attitudes towards pets have also shifted in the mobile pet care market, with several owners humanizing their pets and thus being willing to pay more for pet food, pharmaceuticals, grooming services, and more. There is a growing trend to humanize pets, with owners increasingly seeing them as family members. Owners are willing to spend more on ‘premium’ products and services that are healthy, nutritious, and improve living conditions. The pet healthcare industry is seeing several virtual pet veterinary consulting services spring up, with veterinarians and pet groomers willing to conduct home visits for a higher fee.

Premium cost of availing services and rising urbanization

While mobile pet care market services offer several advantages, the cost of employing them remains high. Agencies providing these services tend to charge an additional fee for house calls and on-site visitation, depending on the area and distance from their stationary clinic setup. There may also be extra charges for pets with matted hair and potentially aggressive breeds.

The mobile pet care market grooming services are available in several major cities globally, but the high cost of these premium services limits demand, especially among the lower-income population. Costs are becoming more personalized and expensive with the increased shift to urbanization forcing individuals into smaller living spaces and longer working hours; both young and aging populations are looking for small, low-maintenance pets for companionship.

Pet humanization trends are expected to continue

The trend of pet humanization is expected to continue in the mobile pet care market, with the bond between humans and their pets driving growth in the market as owners increasingly prioritize their pets’ well-being. This continued trend of humanization is expected to create demand for highly personalized grooming and veterinary services and even higher spending on pet comfort, which comes with mobile pet care services.

The grooming segment held a dominant presence in the mobile pet care market in 2023. The grooming segment is comprised of services such as bathing, brushing, nail trimming, and others. Depending on the type of pet, length of coat, and type of coat, owners need to bathe their companions at least once every four to eight weeks for dogs, with a haircut every 10-12 weeks. During the pandemic, many pet owners have adjusted to largely online-based shopping, including for pet grooming products. Maintaining a required supply of pet grooming products at home allows for a more personalized experience when opting for mobile pet care services.

The veterinary segment is expected to grow significantly in the mobile pet care market over the study period. The use of mobile veterinary services has seen significant growth in the past few years. Services provided include wellness assessments, dentistry, and in-home euthanasia and hospice, among others.

By animal type, in 2023, the dog segment led the global mobile pet care market. Compared to cats and other pets, dogs need regular grooming, especially if they are long-haired breeds. Dogs require more active owner intervention for fur care for breeds with thick and curly coat types. Since most dogs need more frequent bathing and haircuts, the demand for dog-specific grooming is high in the mobile pet care market. A pet’s lifestyle also influences their grooming needs. For example, an outdoor, active dog might get dirtier and need more frequent baths than an indoor cat. Regular grooming has several advantages, including the prevention of skin infections, fur issues, and parasites such as fleas and ticks.

The cat segment is projected to expand rapidly in the mobile pet care market in the coming years. While cats typically groom themselves and others may not require bathing at all, long-haired breeds and hairless breeds such as sphynx cats generally require more attention. Despite this, the growing number of cat adoptions across the globe, especially during the pandemic, is driving demand in this segment of the mobile pet care market. Cats also generally tend to be more skittish; it is not uncommon for cats to be scared of people and environments they don’t know. Mobile pet care service providers allow cautious pets to be groomed or treated in a more familiar environment, reducing overall stress for the animal.

North America dominated the global mobile pet care market in 2023. The region has a large number of pet owners. There is also scope for growth in the region, as several Americans think there isn’t enough emphasis on the well-being of pets, with pet owners twice as likely as non-pet owners to say there is not enough emphasis on pets’ well-being. The region’s widespread infrastructure and large distances between service hubs significantly contribute to the demand for mobile pet care services. Consumer spending patterns in the region show growing favor for the pet care market, focusing on premium products.

Asia Pacific is expected to grow at the fastest rate in the mobile pet care market during the forecast period of 2024 to 2034. Pet adoption rates in countries such as China and India continue to rise substantially. The demand for pets has stemmed from continuous improvements in the living standards of pet owners, which has led them to pay more attention to the personalized needs of their pets. There is also an increasing average spend per pet, which is contributing to significant growth within the Chinese pet industry.

Chinese residents show a preference for cats over dogs, with the cat population seeing accelerated growth since 2019. Pet ownership rates were also estimated to be 35-40% in T1 and T2 cities.

Pet ownership in India also continues to rise, with the number of pet owners in India has increased from 20 million in 2015 to 30 million in 2023. The growing urban middle class is increasingly adopting pets, especially since the advent of nuclear families. A rise in disposable income has become another notable driver. More financial resources mean people are willing to invest in the well-being and comfort of their pets, leading to a surge in demand for premium pet products and services such as mobile pet care.

Segments Covered in the Report

By Services

By Animal

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

March 2025

April 2025

January 2025