What is the Monocrystalline Solar Cell Market Size?

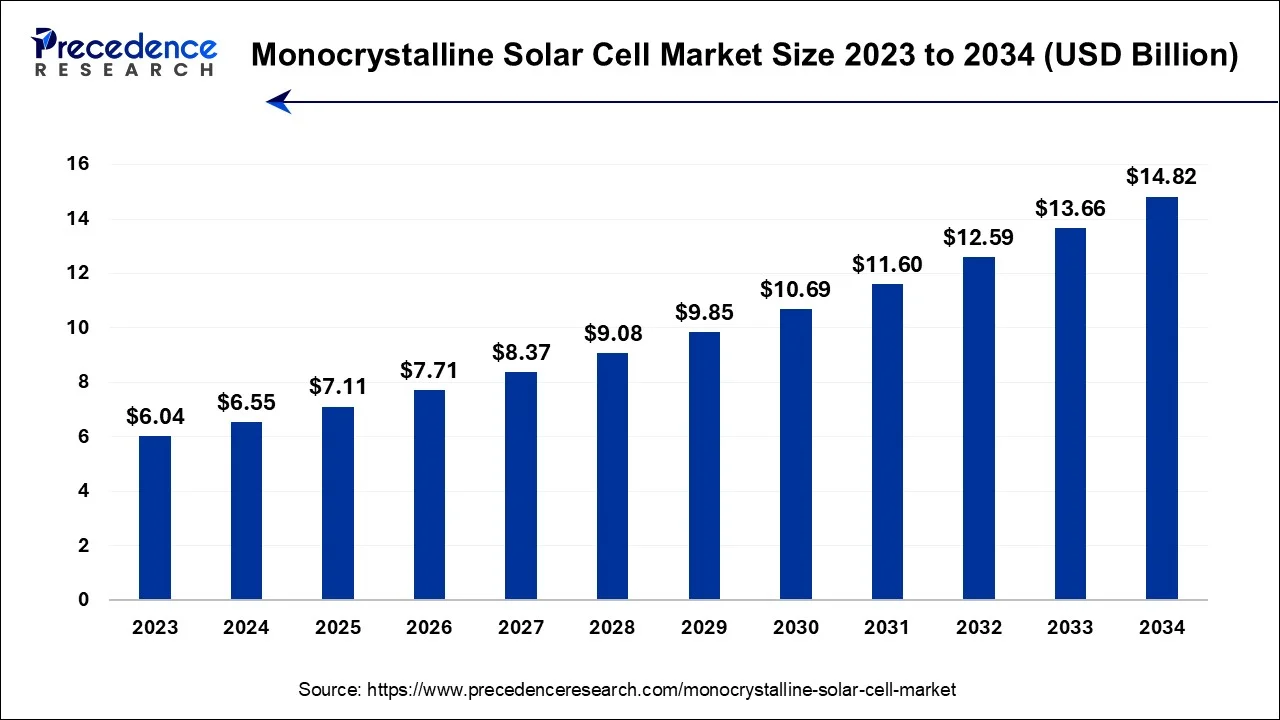

The global monocrystalline solar cell market size is calulated at USD 7.11 billion in 2025 and is anticipated to reach around USD 15.92 billion by 2035, growing at a CAGR of 8.39% from 2026 to 2035.

Market Highlights

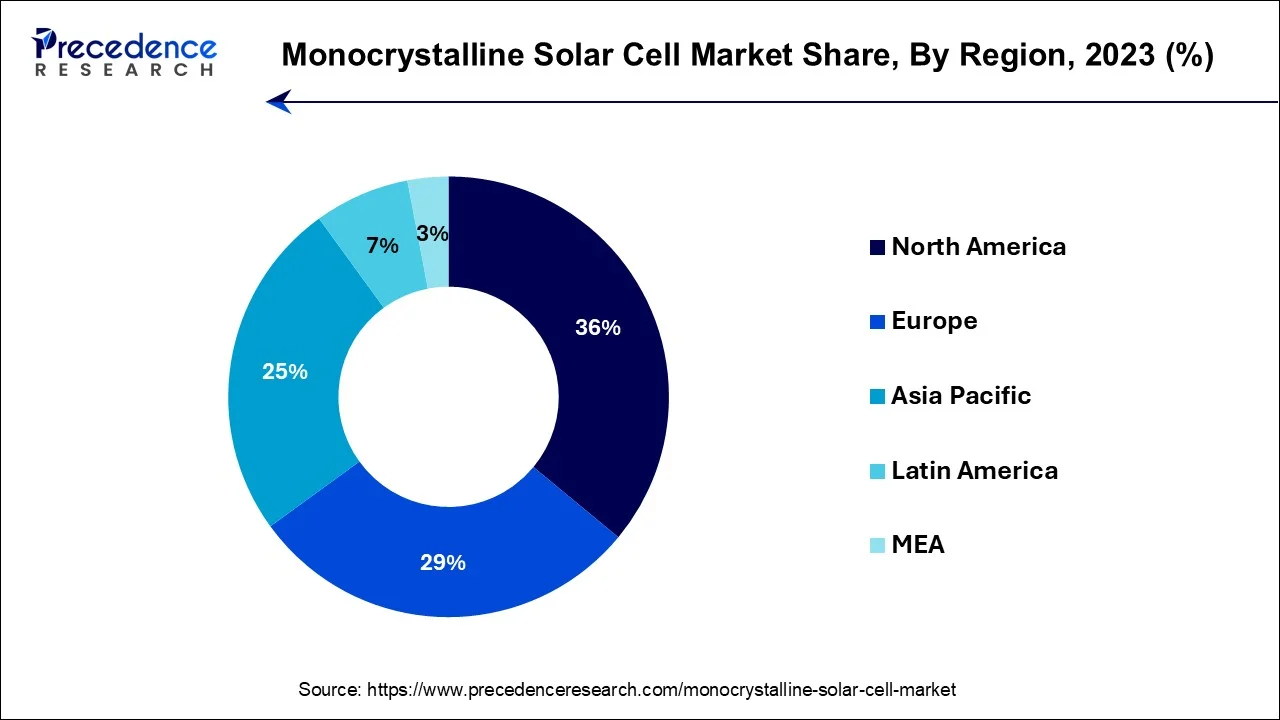

- North America contributed more than 36% of revenue share in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR during the forecast period.

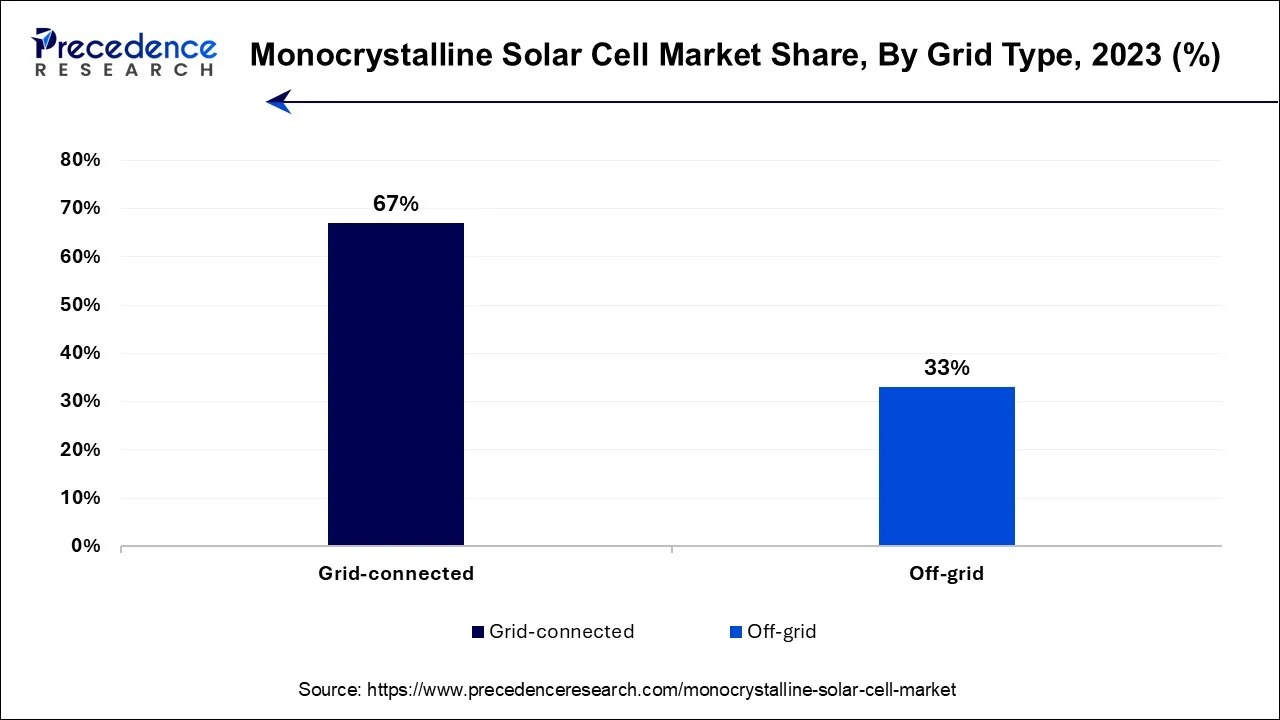

- By Grid Type, the grid-connected segment has held the highest revenue share of 67% in 2025.

- By Grid Type, the off-grid segment is anticipated to grow at a fastest CAGR of 7.8% during the projected period.

- By Application, the industrial segment has held the biggest market share of 39% in 2025.

- By Application, the AI system segment is estimated to grow at the fastest CAGR over the projected period.

- By Installation, the ground-mount solar PV segment contributed more than 67% in 2025.

- By Installation, the rooftop solar PV segment is anticipated to grow at the fastest CAGR over the projected period.

- By Technology, the crystalline silicon cells segment held the major revenue share of 45% in 2025.

- By Technology, the thin film cells segment is expected to grow at a notable CAGR of 8.6% over the predicted period.

Market Overview

A monocrystalline solar cell is a type of photovoltaic cell used to convert sunlight into electricity. It is made from a single crystal structure, typically silicon, ensuring high purity and efficiency. These cells are known for their uniform dark appearance and high energy conversion efficiency, making them a popular choice for solar panels in residential and commercial applications. Monocrystalline solar cells offer a compact and efficient solution for harnessing solar energy.

Monocrystalline Solar Cell Market Growth Factors

The monocrystalline solar cell market is currently experiencing substantial growth driven by the global transition towards renewable energy sources. These solar cells, renowned for their high efficiency and purity, serve as vital components in solar panels utilized across various applications. One of the primary growth drivers for the monocrystalline solar cell market is the worldwide shift towards renewable energy.

Solar power, facilitated by these cells, plays a crucial role in mitigating carbon emissions and achieving clean energy objectives. Moreover, the inherent efficiency advantages of monocrystalline solar cells make them a compelling choice for residential, commercial, and industrial installations, further boosting their demand.

Continuous research and development efforts have led to notable technological advancements in monocrystalline solar cells, including improved manufacturing processes and increased cell efficiency. These developments contribute to the market's growth trajectory, as they enhance the overall performance and appeal of solar panels employing these cells. Industry trends indicate a rising adoption of bifacial solar panels, capable of capturing sunlight from both sides, thereby increasing overall energy generation.

Additionally, the integration of energy storage solutions with monocrystalline solar cells is becoming a prevalent trend, ensuring a stable and reliable power supply even during periods without direct sunlight.

Despite the positive outlook, the monocrystalline solar cell market faces challenges, including cost competitiveness compared to lower-cost alternatives like polycrystalline cells. Ensuring a stable supply of high-purity silicon, a critical raw material for monocrystalline solar cells, also poses a challenge that can impact production. In terms of business opportunities, the growing demand for residential solar installations offers significant potential for monocrystalline solar cell manufacturers to cater to homeowners seeking sustainable energy solutions. Furthermore, utility-scale projects, both grid-tied and off-grid, present substantial business prospects, particularly in regions blessed with abundant sunlight.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 7.71 Billion |

| Market Size in 2025 | USD 7.11 Billion |

| Market Size by 2035 | USD 15.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.39% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Grid Type, Application, Technology, Installation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Renewable energy transition and superior efficiency

The monocrystalline solar cell market is propelled by the global shift towards renewable energy sources. These solar cells are instrumental in harnessing solar energy to generate clean electricity, playing a pivotal role in reducing carbon emissions and addressing climate change.

As nations worldwide commit to clean energy solutions, solar power has emerged as a key answer to the challenge. Monocrystalline solar cells lead this transition, offering high energy conversion efficiency and contributing to the growth of solar energy capacity. Governments and utility companies actively promote solar power adoption through incentives and policies, further driving demand for these cells.

Additionally, the exceptional efficiency of monocrystalline solar cells sets them apart in the market. These cells have a superior ability to convert a greater percentage of sunlight into electricity compared to other solar cell types. This efficiency advantage is essential for various applications, including residential, commercial, and industrial installations, ensuring maximum energy generation and optimal return on investment.

As consumers and businesses increasingly seek cost-effective and high-performance solar solutions, the unmatched efficiency of monocrystalline solar cells drives their surging demand, establishing them as a preferred choice in the renewable energy landscape.

Restraints

Material availability and energy intensity

The production of monocrystalline solar cells heavily relies on high-purity silicon, a critical raw material. The limited availability of this specialized silicon can pose challenges in scaling up production to meet growing demand. Silicon refinement processes are energy-intensive and time-consuming, making them costly and potentially environmentally impactful. This constraint can lead to supply shortages and increased costs, hindering the market's growth potential.

The energy intensity of producing monocrystalline solar cells poses environmental concerns and impacts production costs. The energy-intensive nature of silicon purification and cell manufacturing can increase the carbon footprint of the solar cell production process. This challenges the market's sustainability goals and can deter environmentally conscious consumers and governments from fully embracing monocrystalline solar technology.

Moreover, the high energy intensity can affect the overall cost competitiveness of monocrystalline solar cells, making them less attractive in regions with higher energy prices. To address these restraints, the industry must invest in research and development to reduce the energy intensity of manufacturing processes and explore alternative materials. Ensuring a stable supply chain for silicon through recycling and responsible sourcing is also crucial to mitigate material availability challenges and promote the sustainability of the monocrystalline solar cell market.

Opportunities

Residential solar installations and utility-scale projects

As homeowners increasingly embrace solar power to reduce electricity bills and their carbon footprint, the monocrystalline solar cell market experiences a substantial boost. Monocrystalline solar panels are favored in residential settings due to their high efficiency and space-saving design. Homeowners are drawn to these cells because they can generate more electricity in limited roof space, making them a cost-effective choice.

The desire for energy independence and environmental consciousness drives the installation of residential solar systems, which, in turn, fuels the demand for monocrystalline solar cells.

The monocrystalline solar cell market witnesses a substantial surge in demand driven by utility-scale solar projects, both grid-tied and off-grid, around the world. Governments and utilities are increasingly investing in large-scale solar farms to address escalating energy requirements and mitigate greenhouse gas emissions. Monocrystalline solar cells emerge as the favored choice for these ambitious projects due to their unparalleled efficiency and reliability.

Regional Insights

Grid Type Insights

According to the grid type, the grid-connected has held 67% revenue share in 2023. Grid-connected monocrystalline solar cell systems are solar power installations that are connected to the local electricity grid. These systems generate electricity from sunlight using monocrystalline solar cells and feed any excess power back into the grid. This surplus energy can be sold back to the utility company, resulting in potential savings for the system owner. A trend in grid-connected systems is the integration of smart technology for real-time monitoring and efficient energy management.

The off-grid segment is anticipated to expand at a significantly CAGR of 7.8% during the projected period. Off-grid monocrystalline solar cell systems, on the other hand, operate independently and are not connected to the utility grid. These systems are often used in remote areas or for backup power during emergencies. An emerging trend in off-grid applications is the use of monocrystalline solar cells in microgrids, providing reliable electricity to communities without access to the grid, and in portable solar solutions for outdoor activities.

Application Insights

The industrial application is anticipated to hold the largest market share of 39% in 2023. Industrial applications in the monocrystalline solar cell market encompass large-scale solar installations designed to meet the energy needs of industries and commercial enterprises. These projects often involve solar farms or arrays with significant power generation capacity. A notable trend in industrial applications is the integration of solar power with manufacturing processes, reducing energy costs and carbon footprints.

The AI system sector is projected to grow at the fastest rate over the projected period. Residential applications involve the use of monocrystalline solar cells in smaller-scale installations on residential rooftops or properties. The trend in residential applications centers on increased adoption by homeowners seeking energy independence and lower electricity bills. Advances in energy storage solutions, such as home batteries, are also complementing residential solar systems, enabling greater energy self-sufficiency.

Installation Insights

The Ground-mount solar PV segment had the highest market share of 67% in 2023. Ground-mount solar PV installations involve placing solar panels on the ground, typically in open areas or solar farms. These systems excel at generating substantial electricity, making them particularly suited for utility-scale projects. Within the monocrystalline solar cell market, there's a noticeable trend favoring the adoption of monocrystalline solar panels in ground-mount installations. This preference arises from the remarkable efficiency of monocrystalline cells, ensuring optimal energy production even when space is limited, thereby enhancing the viability and attractiveness of large-scale solar ventures.

The rooftop solar PV segment is anticipated to expand at the fastest rate over the projected period. Rooftop solar PV, on the other hand, involves the installation of solar panels on building rooftops. These systems are popular among residential and commercial property owners. In the monocrystalline solar cell market, the trend is leaning towards rooftop installations incorporating monocrystalline solar cells. Their superior efficiency makes them suitable for smaller rooftop spaces, allowing property owners to maximize energy generation while minimizing their carbon footprint.

Technology Insights

The crystalline silicon cells segment held the largest revenue share of 45% in 2023. Crystalline Silicon Cells in the monocrystalline solar cell market are characterized by their use of high-purity, single-crystal silicon wafers. They offer excellent energy conversion efficiency and durability, making them a preferred choice for various installations.

A notable trend in this segment is the continued optimization of manufacturing processes to reduce costs while maintaining efficiency, making crystalline silicon cells more accessible to a broader range of consumers.

The thin film cells segment is anticipated to grow at a significantly faster rate, registering a CAGR of 8.6% over the predicted period. Thin film cells, on the other hand, use semiconductor materials deposited in thin layers on a substrate. While they are generally less efficient than crystalline silicon cells, thin film cells are more flexible and lightweight, enabling innovative applications like building-integrated photovoltaics.

A trend in thin film technology involves enhancing efficiency through advanced materials and deposition techniques, expanding their use in specific niches such as solar farms with ample space and lower efficiency requirements.

Regional Insights

U.S. Monocrystalline Solar Cell Market Size?

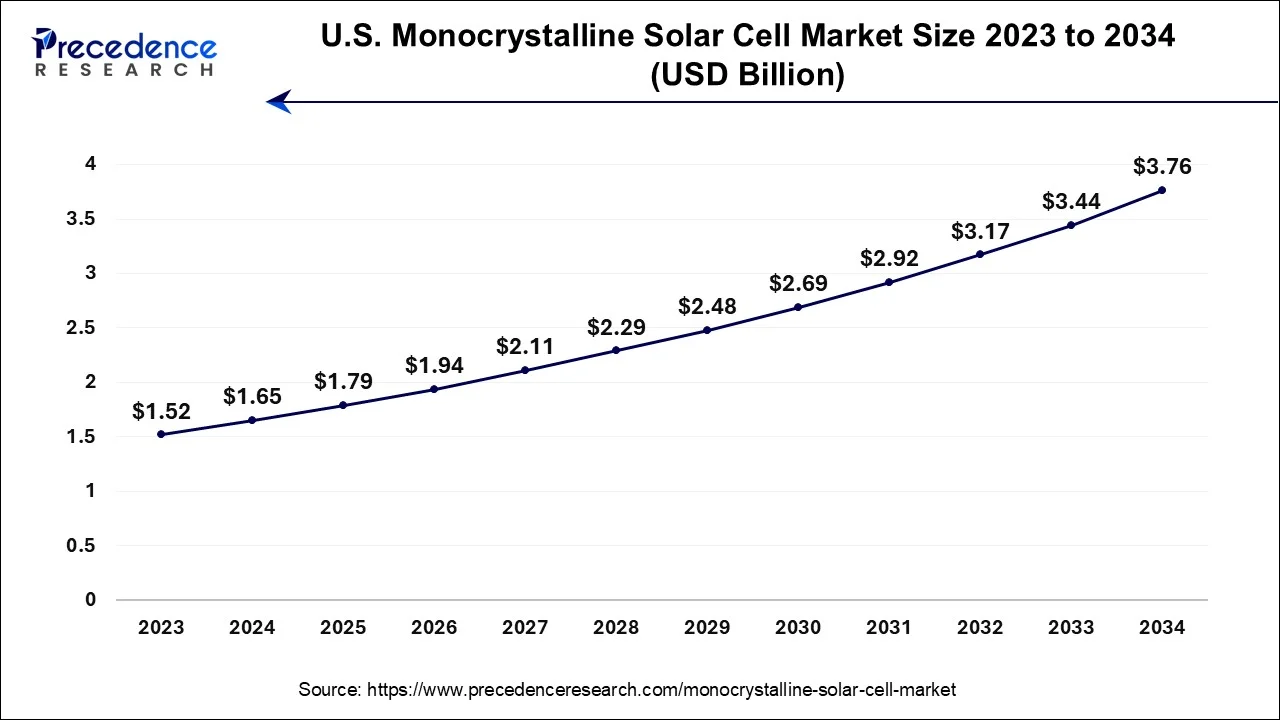

The U.S. Monocrystalline Solar Cell market size is exhibited at USD 1.79 billion in 2025 and is expected to grow to USD 4.05 billion by 2035 at a CAGR of 8.51% from 2026 to 2035.

How is the Dominating Growth of North America in the Monocrystalline Solar Cell Market in 2025?

North America has held the largest revenue share 36% in 2023. In North America, the monocrystalline solar cell market is characterized by astrong emphasis on renewable energyadoption and sustainability. The region has witnessed a growing trend towards residential solar installations, driven by government incentives and increasing environmental awareness. Utility-scale solar projects also thrive, especially in sun-rich states. Net-metering policies and advancements in energy storage solutions have further fueled the adoption of monocrystalline solar cells. As a result, North America has seen a steady increase in solar capacity, contributing to a flourishing market.

U.S. Monocrystalline Solar Cell Market Analysis

The U.S. market is moving forward through trade policies and tariffs, and the expansion of manufacturing capacity. The huge demand for American-made solar power modules is driven by federal policies and incentives. In January 2025, Hemlock Semiconductor received $325 million of U.S. government funding.

Why is the Asia Pacific the Fastest-Growing Region in the Monocrystalline Solar Cell Market?

Asia-Pacific is estimated to observe the fastest expansion.In this region, there is a huge solar energy potential and experiences surging energy demands. Countries such as China and India have been proactive in promoting solar energy adoption, underpinned by ambitious renewable energy targets and supportive subsidies. Large-scale solar projects, whether connected to the grid or off-grid, are on the rise, as utility companies invest substantially in clean energy initiatives.

The market in Asia-Pacific benefits from ongoing technological advancements and cost reductions in solar technology, cementing the region's position as a key driver of monocrystalline solar cell adoption and solar energy expansion.

India Monocrystalline Solar Cell Market Analysis

India is progressing due to robust government policy support, a surging demand for large-scale solar parks, and technological innovation. In August 2025, India approved six manufacturers of solar cells with 13 GW of annual production capacity.

How did Europe Grow Notably in the Monocrystalline Solar Cell Market?

In Europe, the monocrystalline solar cell market is marked by a commitment to sustainable energy and reduced carbon emissions. Governments and businesses across the continent are actively investing in solar energy projects. European countries offer robust incentives, including feed-in tariffs and favorable regulations, encouraging the adoption of monocrystalline solar cells. Additionally, Europe is witnessing a growing trend of integrating solar power with energy storage solutions for enhanced reliability and grid stability, further driving market growth.

How is the Significant Growth of the Monocrystalline Solar Cell Market within South America?

South America is expected to experience significant growth during the forecast period due to the superior efficiency of solar cells, cost reduction, and utility-scale projects.

- In December 2025, the Colombian government announced the launch of a new solar energy project that will initially generate 650 megawatts of energy and is projected to benefit more than 500,000 families on the Caribbean coast.

How is the Momentous Drive of the Middle East and Africa in the Monocrystalline Solar Cell Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by a rapid shift towards high-efficiency technology and the rising power demand. In July 2025, Saudi Arabia announced the launch of multi-billion-dollar greenfield solar projects.

Value Chain Analysis

- Raw Material Sourcing

This stage involves the sourcing of high-purity silicon, which is the primary raw material for monocrystalline solar cells.

Key Players: Wacker Chemie, Hemlock Semiconductor, REC Silicon, GCL-Poly Energy - Ingot & Wafer Manufacturing

High-purity silicon is melted and crystallized into monocrystalline ingots, which are then sliced into thin wafers.

Key Players: LONGi Green Energy, JinkoSolar, Tongwei Co., Canadian Solar - Solar Cell Fabrication

Wafers are processed into monocrystalline solar cells through doping, etching, anti-reflective coating, and metallization.

Key Players: Trina Solar, JA Solar, SunPower, First Solar (for high-efficiency cells)

Monocrystalline Solar Cell Market Companies

- First Solar, Inc.

- SunPower Corporation

- Canadian Solar Inc.

- JA Solar Holdings Co., Ltd.

- Trina Solar Limited

- JinkoSolar Holding Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Hanwha Q CELLS Co., Ltd.

- REC Group

- LG Electronics Inc.

- SolarWorld AG

- Yingli Solar

- Shunfeng International Clean Energy Limited (SFCE)

- Risen Energy Co., Ltd.

- GCL System Integration Technology Co., Ltd.

Recent Developments

- In March 2025, Suniva, a US-based manufacturer of monocrystalline silicon solar cells, and Heliene partnered with Corning to create one of the first fully “Made in America” solar module supply chains, supplying U.S.-made polysilicon, wafers, and cells to expand domestic solar production. (Source:https://www.saurenergy.com)

- In August 2025, JA Solar Holdings Co., Ltd. launched a leading PV module named ‘DesertBlue', which is engineered specifically for desert and semi-arid regions. (Source: https://www.jasolar.com/ )

- In August 2025, Trina Solar Limited planned to debut high-efficiency modules and an energy storage lineup at RE+ 2025.

(Source: https://www.trinasolar.com/ ) - In 2022, SunPower and First Solar collaborated on a thin-film PV and crystalline silicon tandem solar module for rooftop installations, marking a renewed partnership between the solar industry leaders.

- In 2022, SunPower and First Solar collaborated to create innovative residential solar modules. SunPower specializes in the development, design, production, and sales of efficient and dependable solar cells, modules, and systems, making this partnership a significant development in the solar industry.

- In 2020, Schneider Electric Solar Spain, a subsidiary of Schneider Electric, partnered with Qbera Capital LLP to offer solar off-grid solutions to businesses in sub-Saharan Africa. This collaboration aims to address energy challenges and promote sustainable power solutions in the region.

- In 2018, Trina Solar partnered with Huawei, Sungrow, and Nclave to offer a comprehensive solution called TrinaPro for utility-scale ground-mounted PV systems. This collaboration leverages Trina Solar's agreements with Huawei Technologies, Sungrow, and its strategic partnership with Nclave Renewable.

Segments Covered in the Report

By Grid Type

- Grid Connected

- Off-Grid

By Application

- Residential

- Commercial

- Industrial

- Power Utilities

By Technology

- Crystalline Silicon Cells

- Thin Film Cells

- Ultra-Thin Film Cells

By Installation

- Ground-Mount

- Rooftop Solar PV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting