List of Contents

Mutual Fund Assets Market Size and Forecast 2025 to 2034

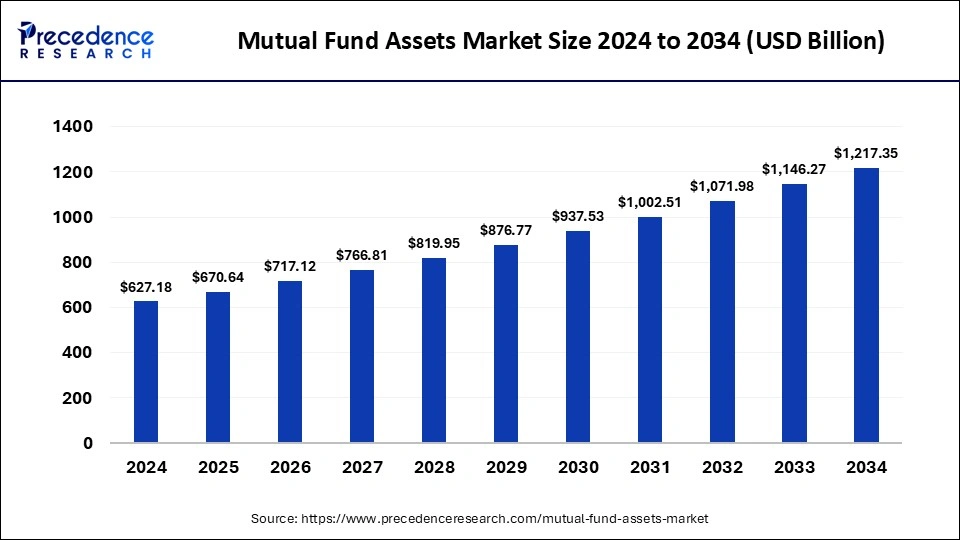

The global mutual fund assets market size was estimated at USD 627.18 billion in 2024 and is predicted to increase from USD 670.64 billion in 2025 to approximately USD 1,217.35 billion by 2034, expanding at a CAGR of 6.86% from 2025 to 2034. Mutual funds buy a diverse portfolio of stocks, bonds, and other securities by pooling the capital of several investors. The risk involved in making investments in individual securities is decreased by this diversification.

Mutual Fund Assets Market Key Takeaways

- The global mutual fund assets market was valued at USD 627.18 billion in 2024.

- It is projected to reach USD 1,217.35 billion by 2034.

- The market is expected to grow at a CAGR of 6.86% from 2025 to 2034.

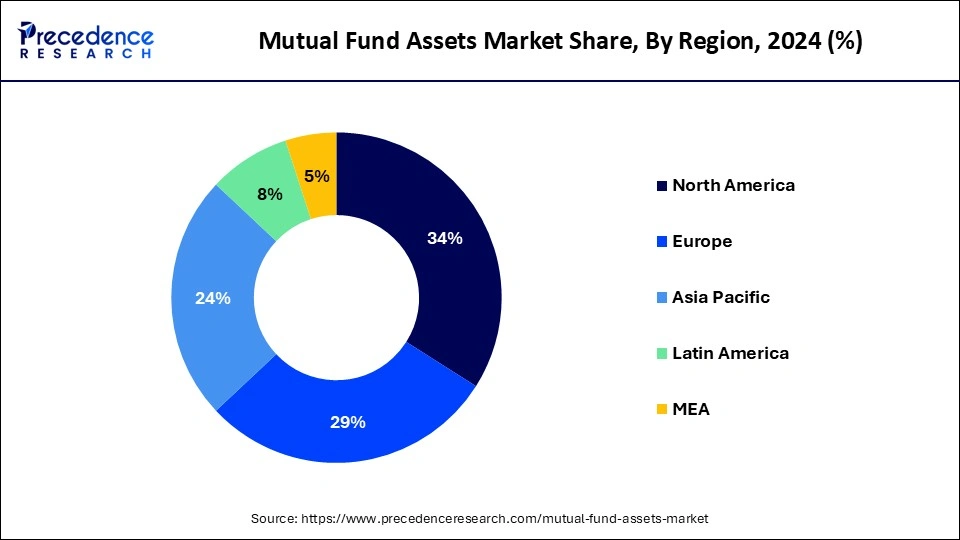

- North America dominated the global market with revenue share of 34% in 2024.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By investment strategy, the equity strategy segment held the largest share of the market in 2024.

- By investment strategy, the sustainable strategy segment is expected to grow rapidly in the market during the forecast period.

- By type, the open-ended segment has contributed more than 84% of revenue share in 2024.

- By type, the close-ended segment is expected to rapidly expand in the global market during the forecast period.

- By distribution channel, the direct sales segment has generated more than 37% of revenue share in 2024.

- By distribution channel, the financial advisors segment is expected to grow rapidly in the market during the forecast period.

- By investment style, the active segment has recorded the largest revenue share of 73% in 2024.

- By investment style, the passive segment is expected to gain a significant share of the market during the forecast period.

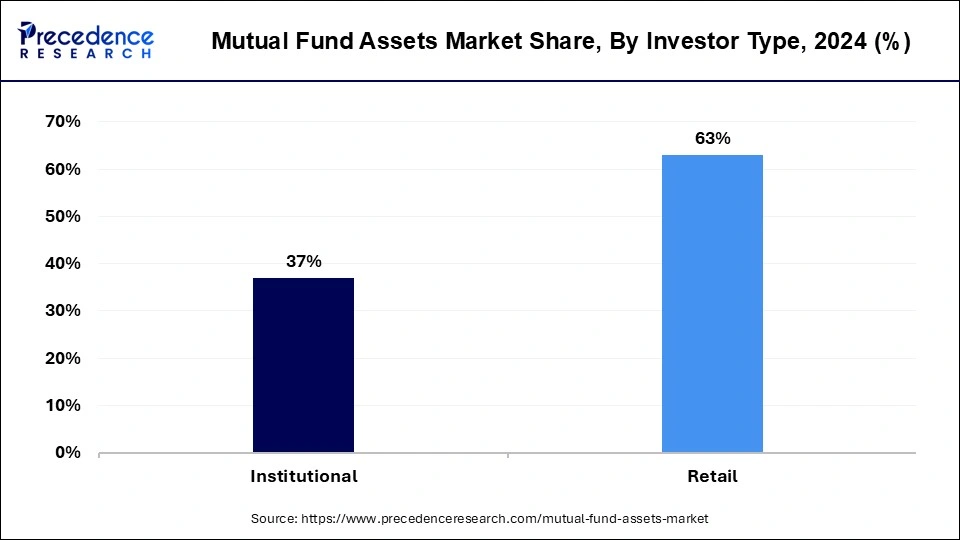

- By investor type, the retail segment has held a major revenue share of 63% in 2024.

- By investor type, the institutional segment is expected to grow rapidly in the market during the forecast period.

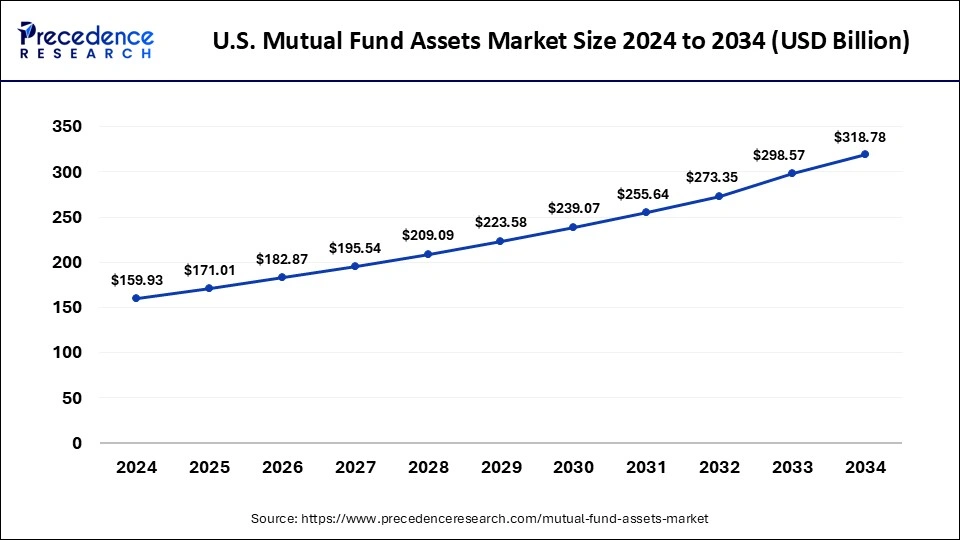

U.S. Mutual Fund Assets Market Size and Growth 2025 to 2034

The U.S. mutual fund assets market size was estimated at USD 159.93 billion in 2024 and is predicted to be worth around USD 318.78 billion by 2034 with a CAGR of 7.14% from 2025 to 2034.

North America holds the largest share of the global mutual fund assets market. North America, and the United States in particular, have one of the biggest and most advanced mutual fund industries in the world. Due to the robust stock market performance and investor appetite for long-term gain, these are the largest categories in AUM. Because of their safety and liquidity, investors utilize them as a temporary place to put funds. The importance of Environmental, Social, and Governance (ESG) standards has grown. A lot of people are searching for mutual funds that complement their ideals and offer strong returns.

- Over $27 trillion in assets under management (AUM) were held by U.S. mutual funds as of 2023, making up a sizeable chunk of the global mutual fund market.

Asia Pacific is expected to host the fastest-growing mutual fund assets market during the forecast period. The Asia Pacific mutual fund assets market is expanding at a swift pace, propelled by factors like rising affluence, urbanization, and the expansion of the middle class.

The swift economic expansion of nations such as China, India, and Southeast Asia has resulted in heightened disposable income and investment potential. Mutual fund trust has increased as a result of reforms and laws intended to protect investors and liberalize the financial system. The distribution and investment process for mutual funds is changing as a result of the use of digital platforms and fintech advances, which are becoming more accessible and effective. Investment flows between the region's various economies are becoming easier because of regulatory harmonization and cross-border fund recognition.

Market Overview

A mutual fund can be referred to as a pooled collection of assets that invests in bonds, stocks, and other securities. With trillions of dollars in assets under management (AUM), the worldwide mutual fund assets market is substantial. The global AUM of mutual funds is estimated to be more than $60 trillion as of late.

Over the last ten years, the mutual fund assets market has been consistently expanding due to expanding investor involvement, rising wealth, and increased knowledge of mutual funds as a suitable investment vehicle. This tendency is influenced by variables including economic expansion, rising disposable incomes, and expanding financial literacy.

The mutual fund assets market is appropriate for long-term investors and strives for financial appreciation. Invest in fixed-income instruments like corporate and government bonds. When compared to equities funds, these funds are typically thought to be lower risk and offer consistent income. These funds have low risk and great liquidity.

The S&P 500 provides inexpensive, wide-ranging market exposure. Investors are placing a growing emphasis on environmental, social, and governance (ESG) factors. ESG-focused funds are getting more and more traction. Also, with the growing use of robo-advisors, digital platforms, and fintech solutions to improve accessibility and user experience, technology is revolutionizing the mutual fund sector.

Mutual Fund Assets Market Growth Factors

- Robust economic expansion frequently results in increased business profits and stock market performance, which draws in more mutual fund investments. Bonds and savings accounts lose appeal as interest rates drop, which encourages investors to move to mutual funds in quest of greater returns.

- Growth can be accelerated by policies that encourage investment and offer tax breaks for mutual fund investments. Robust regulatory structures that safeguard investors have the potential to boost trust and involvement in mutual funds.

- Strong stock market performance has the potential to make equity mutual funds more appealing. Diverse investment portfolios are provided by mutual funds, which may be desirable in erratic markets.

- The emergence of robo-advisors and internet trading platforms has increased accessibility and convenience for mutual fund investing. Technological advances such as automated investment services and mobile apps have reduced entrance barriers for ordinary investors.

- Growth can be stimulated by making more of an effort to inform people about the advantages and workings of mutual fund investing. Investments in mutual funds can increase if investors place more trust in financial advisors to make investment decisions.

- Mutual fund assets are rising quickly in this region, especially in nations like Australia, China, Japan, and India, which are driven by improved regulations, growing investor interest, and economic development.

- Different investor segments may be drawn to new mutual fund product offerings, such as target-date funds, ESG (Environmental, Social, and Governance) funds, and sector-specific funds.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 670.64 Billion |

| Market Size by 2034 | USD 1,217.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.86% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Investment Strategy, Type, Distribution Channel, Investment Style, Investor Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Tax efficiency

When discussing mutual funds, the term "tax efficiency" refers to how well a fund handles its investing plan to reduce investors' tax obligations. An investor's total returns may be significantly impacted by comprehending and maximizing tax efficiency. If losses are greater than gains, mutual funds are obligated to disperse capital gains to their shareholders. When assets are held for less than a year, short-term capital gains are subject to ordinary income tax rates. The long-term capital gains rate, which is often lower, is applied to capital gains on assets held for longer than a year. Prior to making an investment, consider the mutual funds' historical capital gains distributions and turnover rates.

Restraint

Over-diversification

When a mutual fund distributes its holdings among an excessive number of distinct assets, markets, or industries, it is said to be overly diversified in the mutual fund assets market. Although diversification is a crucial tactic for lowering risk, excessive diversification can have negative effects on returns and other factors. There comes a time when the advantages of diversity start to fade. Adding extra assets to a portfolio after it is properly diversified can dilute rewards but does not significantly lower risk. It's possible for the portfolio to resemble the market index as a whole so much that it stops beating the benchmark. Fund managers can concentrate on high-conviction ideas inside a well-diversified framework as opposed to thinly distributing investments across an excessive number of assets.

Opportunity

Financial advisory services

Investors are educated about mutual funds by financial consultants, who go over the various kinds, their risk profiles, possible returns, fees, and tax ramifications. In order to suggest appropriate mutual fund selections, they assist investors in understanding their investing goals, risk tolerance, and time horizon. Financial advisors assist investors in determining and controlling the risks involved in purchasing mutual funds. They talk about the dangers that come with different fund kinds and approaches, like interest rate risk, market risk, credit risk, and liquidity risk. Advisors keep a close eye on the mutual fund performance in their clients' portfolios. They monitor important performance metrics, assess fund performance against pertinent benchmarks, and furnish investors with periodic performance updates.

Investment Strategy Insights

The equity strategy segment held the largest share of the mutual fund assets market in 2024. In the market, a class of mutual funds that focus mostly on stock or equity investments is known as the equity strategy segment. The long-term goal of these funds is to achieve capital appreciation by combining the funds of several investors into a diverse portfolio of equities. Mid-cap funds make investments in the equities of medium-sized businesses, which are riskier but often offer greater growth potential than large-cap stocks. Stocks of businesses that consistently distribute dividends to their owners are purchased by dividend funds. These funds provide investors the chance for capital growth in addition to a consistent income source.

The sustainable strategy segment is expected to grow rapidly in the mutual fund assets market during the forecast period. The incorporation of sustainability into mutual fund strategies has gained significance in recent times, as investors aim to achieve not only financial returns but also positive social and environmental impacts from their investments. Funds designated for sustainability may concentrate on certain subjects like water conservation, clean technology, or renewable energy.

These themes give investors exposure to businesses actively tackling social and environmental issues while also aligning with more general sustainability aims. On the other hand, some funds might use negative screening to weed out businesses engaged in contentious sectors like tobacco, the production of weaponry, or the use of fossil fuels. Reporting and transparency are essential components of sustainable investing. Typically, funds in this category offer frequent updates on their effect, carbon footprint, and ESG performance measures, among other sustainability data.

Type Insights

The open-ended dominated the mutual fund assets market in 2024. Investors in open-ended mutual funds are free to purchase and sell units whenever they choose, subject to the daily determination of the fund's net asset value (NAV). Unlike closed-end funds, which have a set number of shares and trade on exchanges like stocks, this characteristic provides liquidity by making it easy for investors to enter or quit the fund. Because there aren't many substantial obstacles to entrance or departure for investors with different levels of financial capability, the open-ended portion promotes accessibility and inclusivity. Moreover, because they are not concerned with liquidity limitations when overseeing the fund's portfolio, fund managers are able to allocate capital more effectively thanks to this structure.

The close-ended segment is expected to rapidly expand in the global mutual fund assets market during the forecast period. A mutual fund type where the number of shares is fixed is referred to as a "closed-ended segment" in the market. This implies that new investors usually have to acquire shares from existing owners on the secondary market rather than directly from the fund. Similar to stocks, closed-ended funds are traded on stock markets, where supply and demand drive price fluctuations. Closed-ended funds have a fixed pool of capital, in contrast to open-ended funds, which continuously issue and redeem shares in response to investor demand.

Distribution Channel Insights

the direct sales segment held the largest share of the mutual fund assets market in 2024. The distribution channel whereby mutual fund units are offered directly to investors by the asset management company (AMC), eschewing any middlemen like brokers or financial advisors, is known as the "direct sales" segment in the market. In this market, investors purchase mutual fund units straight from the fund manager via a variety of platforms, including websites, mobile applications, and physical locations. Brokers and financial advisors are examples of middlemen who are not involved in direct sales. Investors communicate with the asset management firm directly. Direct sales channels frequently offer instruments and educational materials to support investors in making well-informed investment decisions. These could contain investing calculators, research papers, and instructional materials.

The financial advisors segment is expected to grow rapidly in the mutual fund assets market during the forecast period. A significant part of the market is occupied by the financial advisor segment. Financial advisors serve as go-betweens for investors and mutual fund firms, offering insightful counsel and direction on making investments. Mutual fund firms use financial advisors as distribution vehicles. They provide their clients with mutual fund products according to their financial status, investment objectives, and risk tolerance. Financial advisors offer individualized financial guidance based on the requirements of their customers. To suggest appropriate mutual fund investments, they evaluate their clients' time horizon, risk tolerance, and financial objectives. Financial advisers help their clients create and maintain diversified investment portfolios, which can contain mutual funds in addition to stocks, bonds, and exchange-traded funds (ETFs).

Investment Style Insights

The active segment dominated the mutual fund assets market in 2024. Funds managed by portfolio managers that actively buy and sell securities in an effort to outperform a specific benchmark index or meet a particular investment objective are referred to as the "active segment." When making financial decisions, these managers rely on their knowledge, research, and analysis. In comparison, funds in the passive category aim to mimic the performance of a certain index, like the S&P 500, rather than surpass it. This is in contrast to the active segment. Because they require less ongoing management than active funds, passive funds usually have lower management fees.

The passive segment is expected to gain a significant share of the mutual fund assets market during the forecast period. Investment strategies that seek to mimic the performance of a certain market index, as opposed to actively choosing individual assets to beat the market, are referred to as passive in the market. Fund managers create portfolios in this sector that are designed to replicate the weighting and composition of a selected index, like the FTSE 100 or the S&P 500. Because less research and decision-making go into this strategy than with actively managed funds, management fees are usually lower. Exchange-traded funds (ETFs), also referred to as passive mutual funds or index funds, have grown in popularity among investors looking for less expensive, diversified exposure to a range of asset classes.

Investor Type Insights

The retail segment dominated the mutual fund assets market in 2024. Unlike institutional investors like banks, insurance firms, or pension funds, individual investors who place their personal money into mutual funds are represented by the retail section of the market. Retail investors usually show a wide spectrum of risk tolerance, ranging from aggressive (favoring equities funds or sector-specific funds) to cautious (favoring bonds or money market funds). Because of changing investor preferences, regulatory changes, and technology improvements, the retail section of the market is dynamic and ever-changing. For mutual fund providers looking to draw in and keep retail investors, it is essential to comprehend the distinct traits and patterns of this market.

The institutional segment is expected to grow rapidly in the mutual fund assets market during the forecast period. The market for mutual fund assets includes institutional investors, who are huge organizations like governments, corporations, insurance companies, pension funds, endowments, and foundations. These organizations use mutual funds as an asset management tool to help them reach their financial goals.

Typically, institutional investors invest significant sums of money billions or even millions of dollars. They are able to bargain for reduced costs and improved fund management services as a result. These investors frequently hire teams of financial experts to handle their assets. To improve their portfolios, they employ complex techniques, extensive research, and analytics. Many mutual funds' long-term growth plans are in line with the long-term investment horizons of institutional investors, who typically have goals like supporting endowments or pensions.

Mutual Fund Assets Market Companies

- Black Rock

- UTI Mutual Fund

- Morgan Stanley

- PIMCO

- DSP Mutual Fund

- Trustee

- JPMorgan Chase & Co

- Capital Group

- Vanguard

Recent Developments

- In January 2024, A hybrid fund called the Multi-Asset Allocation Fund was introduced by Bandhan Mutual Fund. It would invest in a variety of asset classes, with 50% of the allocation going into Indian stocks. 10% will go toward actively managed high-quality Fixed Income, 15% will go toward fully hedged arbitrage strategies, 15% will go toward international equities across the US and other developed markets as well as emerging markets, and 10% will go toward domestic gold and silver, according to the fund house.

- In February 2024, HSBC Mutual Fund introduced the HSBC Multi Asset Allocation Fund, an open-ended scheme that invests in debt and money market securities, gold/silver ETFs, and equities and equity-related instruments. The scheme's new fund offer, or NFO, will be available for subscription starting on February 8 and ending on February 22.

Segment Covered in the Report

By Investment Strategy

- Equity Strategy

- Fixed Income Strategy

- Multi-Asset/Balanced Strategy

- Sustainable Strategy

- Money Market Strategy

- Others

By Type

- Open-ended

- Close-ended

By Distribution Channel

- Direct Sales

- Financial Advisor

- Broker-Dealer

- Banks

- Others

By Investment Style

- Active

- Passive

By Investor Type

- Retail

- Institutional

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client