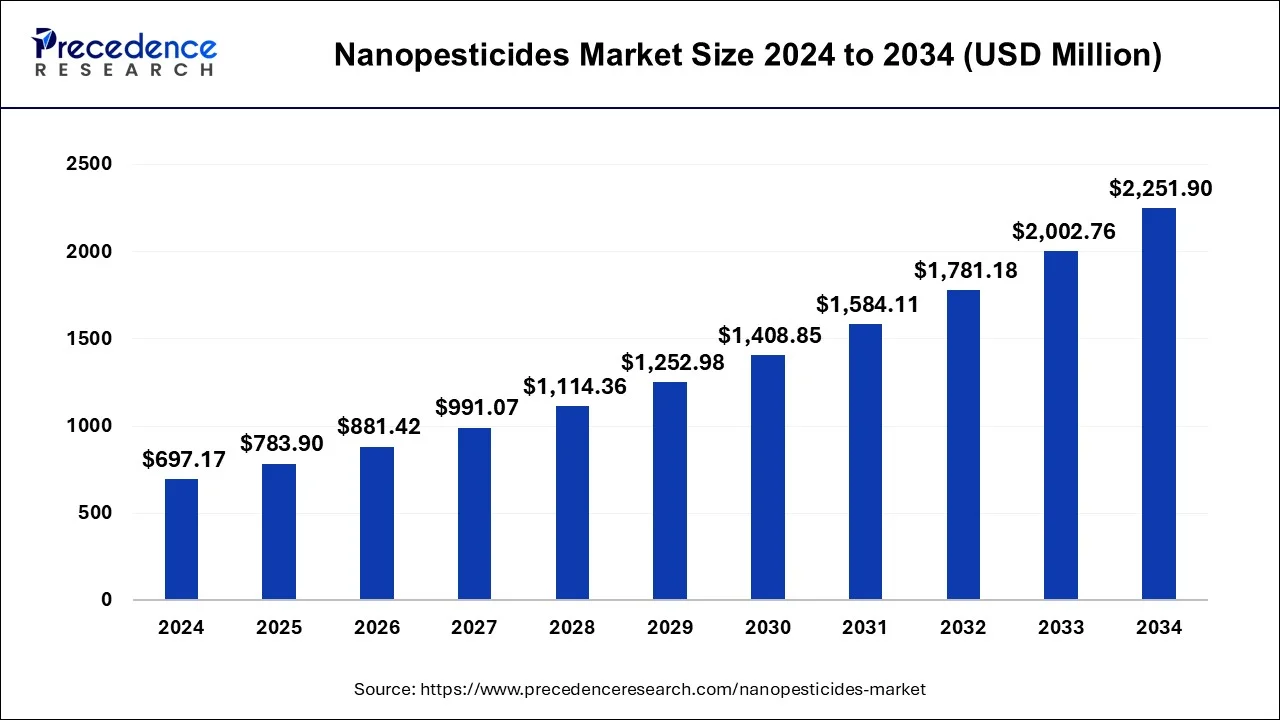

The global nanopesticides market size is calculated at USD 783.9 million in 2025 and is forecasted to reach around USD 2,251.9 million by 2034, accelerating at a CAGR of 12.44% from 2025 to 2034. The Asia Pacific market size surpassed USD 244.01 million in 2024 and is expanding at a CAGR of 12.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nanopesticides market size was worth around USD 697.17 million in 2024 and is anticipated to reach around USD 2,251.9 million by 2034, growing at a CAGR of 12.44% from 2025 to 2034. The growing demand for crop enhancing agents around the world boosts the growth of the nanopesticides market.

AI has played a major role in the chemical industry. In chemical sector, AI technology is adopted for improving the testing methodologies and reducing cost of manual labors. Nanopesticides industry is an integral branch of the chemical industry also integrates AI in their production facilities to enhance production process along with lowering errors in finished products. Also, the integration of AI in nanopesticide sector helps in detecting the effects of chemicals coupled with detecting the pest content that are crucial for the crop development. Moreover, AI helps in brand marketing and analyzing consumer preferences regarding any product. Thus, the advancements in AI is playing a significant role in shaping the nanopesticides market.

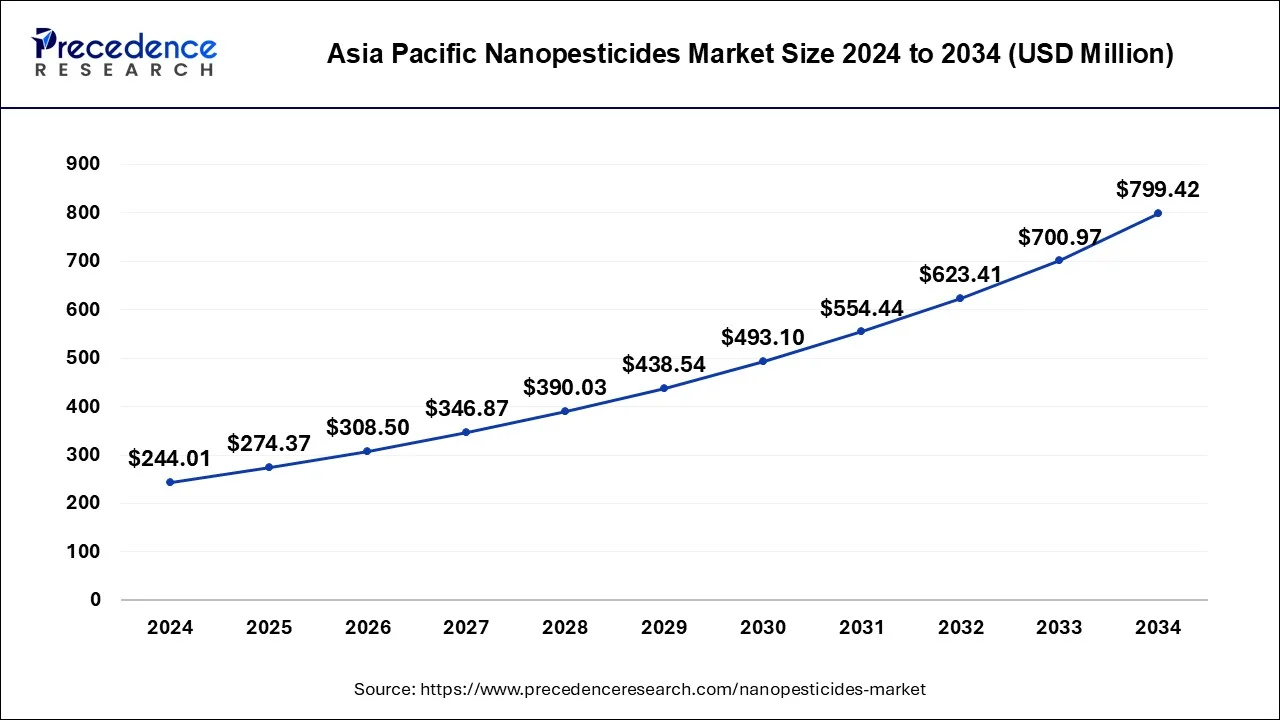

The Asia Pacific nanopesticides market size was exhibited at USD 244.01 million in 2024 and is projected to be worth around USD 799.42 million by 2034, growing at a CAGR of 12.60% from 2025 to 2034.

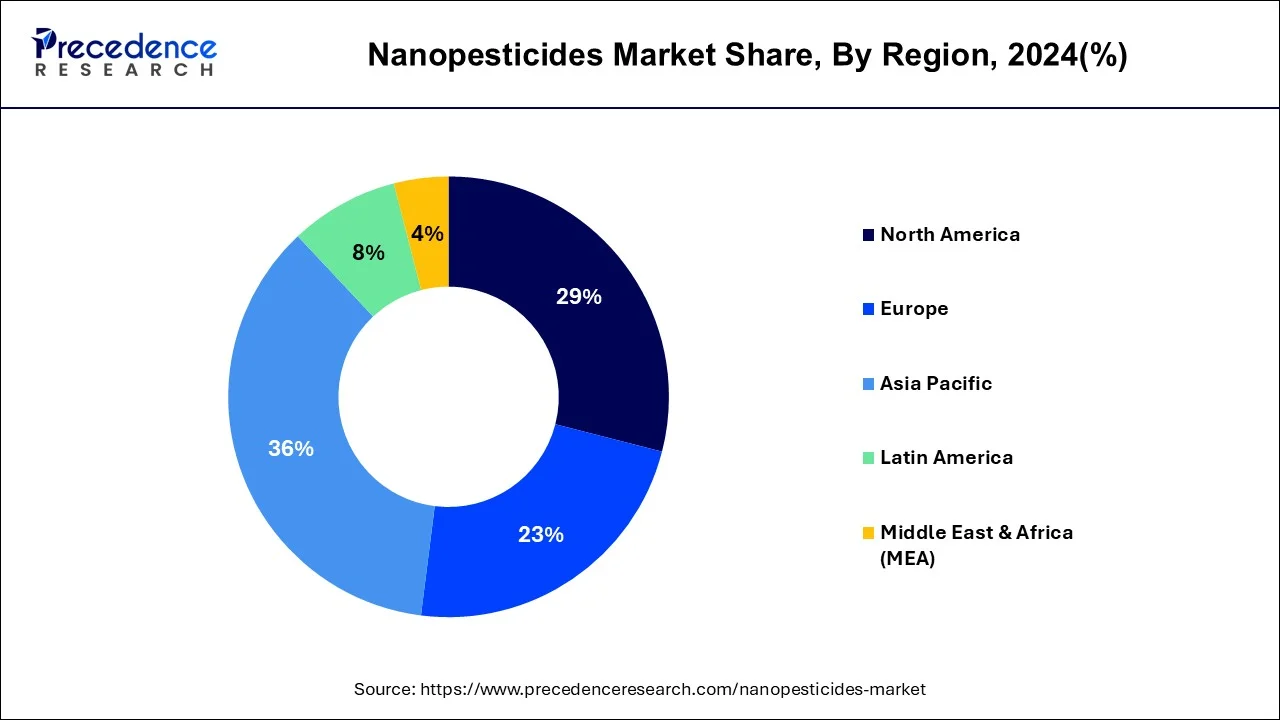

Asia Pacific dominated the nanopesticides market. The rising population in several countries such as India and China has increased the demand for food crops that in turn increases the demand for nanopesticides, thereby boosting the market growth. Also, the government of several countries are investing heavily for improving the agricultural sector that in turn boosts the industrial expansion in this region. Moreover, the increasing prevalence of crop diseases along with technological advancements in pesticides manufacturing sector has driven the growth of the nanopesticides market.

North America is projected to grow with the highest CAGR during the forecast period. The rising demand for industrial crops in U.S. and Canada has driven the market growth. Also, numerous government initiatives aimed at reducing emission along with rapid investment in crop management solutions has boosted the market expansion. Moreover, the presence of several market players of nanopesticides such as Marrone Bio Innovations, Valent BioSciences, Corteva and some others is expected to propel the growth of the nanopesticides market.

Nanopesticides are pesticides whose composition incorporates nanotechnology to improve their properties. Nanopesticides, which have use characteristics comparable to pesticides, comprise nanoparticles that preferably surpass the 100nm size limit specified for regulatory purposes by various governmental agencies. Polymer-based formulations have garnered the most attention in the continual evaluation of research gaps and future goals in nanopesticides, followed by formulations including inorganic nanoparticles as well as nanoemulsions.

To achieve maximum benefit, nano-pesticides are used because they provide sustained release kinetics with high stability, efficient solubility, and enhanced permeability. They also help to promote pest control effectiveness for a longer period of time and prevent degradation of the encapsulated molecules that are in challenging environmental conditions.

The usage of nanopesticides implies a large reduction in the environmental effect of plant protection product active ingredients, as well as an improvement in crop quality and quantity. Although much of the research in nanopesticides is still in its early stages, the product's future is linked to the balance of its advantages in terms of improving effectiveness and minimizing the use and effect of plant protection products, combined with its disadvantages related to nanoparticle contamination by people and the environment.

Nanopesticides are used in a variety of crop protection applications, including seed treatment, preservation of fresh produce and vegetables, crops, feeds and fodder, and so on.

The COVID-19 epidemic harmed the food and agriculture industries. COVID-19 has impacted food and agricultural productivity, including nutrition, as well as farmer livelihoods, as a result of social alienation. However, because to the health advantages associated with fruits and vegetables, population intake rose throughout the pandemic. Nanopesticides are used in the packing of fruits and vegetables to preserve the freshness of these perishable foods. These also boost the chemical content of vegetables and fruits such as beta carotene, naringenin, as well as chlorogenic acid, while also providing a nutritious source of fibre, which aids in weight management by reducing constipation, lowering cholesterol, regulating blood sugar levels, and lowering blood sugar levels. Nanopesticides are also commonly employed in food packaging, which contains nanoparticles with antimicrobial properties that improve the shelf life and freshness of packaged food. As a result, the increased consumption of fruits and vegetables, as well as an increase in demand for food packaging, are expected to boost the nanopesticide market over the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 783.9 Million |

| Market Size by 2034 | USD 2,251.9 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.44% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Utility, Type, End-user, Target Organism, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The industrial crop segment held the dominant share of the market. The rising demand for oilseeds and fiber crops has boosted the market growth. Also, the research and development activities related to nanopesticides for enhancing industrial crops propels the industrial expansion. Moreover, the growing focus on rubber crops by government of several countries along with increased demand for soyabean in developing nations drives the market in a positive direction.

The nanoinsectides segment led the industry. The rising emphasis on improving productivity of crops has driven the market growth. Also, the rapid adoption of nanotechnology for killing insects that are harmful for crop development boosts the market expansion. Moreover, nanoinsecticides can help in improving the effectiveness of insecticides by enhancing their solubility, durability, stability and permeability, thereby driving the nanopesticides industry.

The non-agricultural segment held the largest share of the market. The rising trend of lawn gardening among the people boosts the market growth. Also, the growing use of nanopesticides for ornamental.

horticulture and forestry drives the market expansion. Moreover, the increasing demand for eco-friendly pesticides for residential use is driving the growth of nanopesticides market.

Segments Covered in the Report

By Utility

By Type

By End-user

By Target Organism

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client