October 2024

Natural Fiber Composites Market (By Type: Wood Fiber Composites, Hemp Fiber Composites, Flax Fiber Composites, Jute Fiber Composites, Other Natural Fibers; By Matrix: Inorganic Compound, Natural Polymer, Synthetic Polymer; By End-use; Automotive, Building and Construction, Consumer Goods, Packaging, Aerospace, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

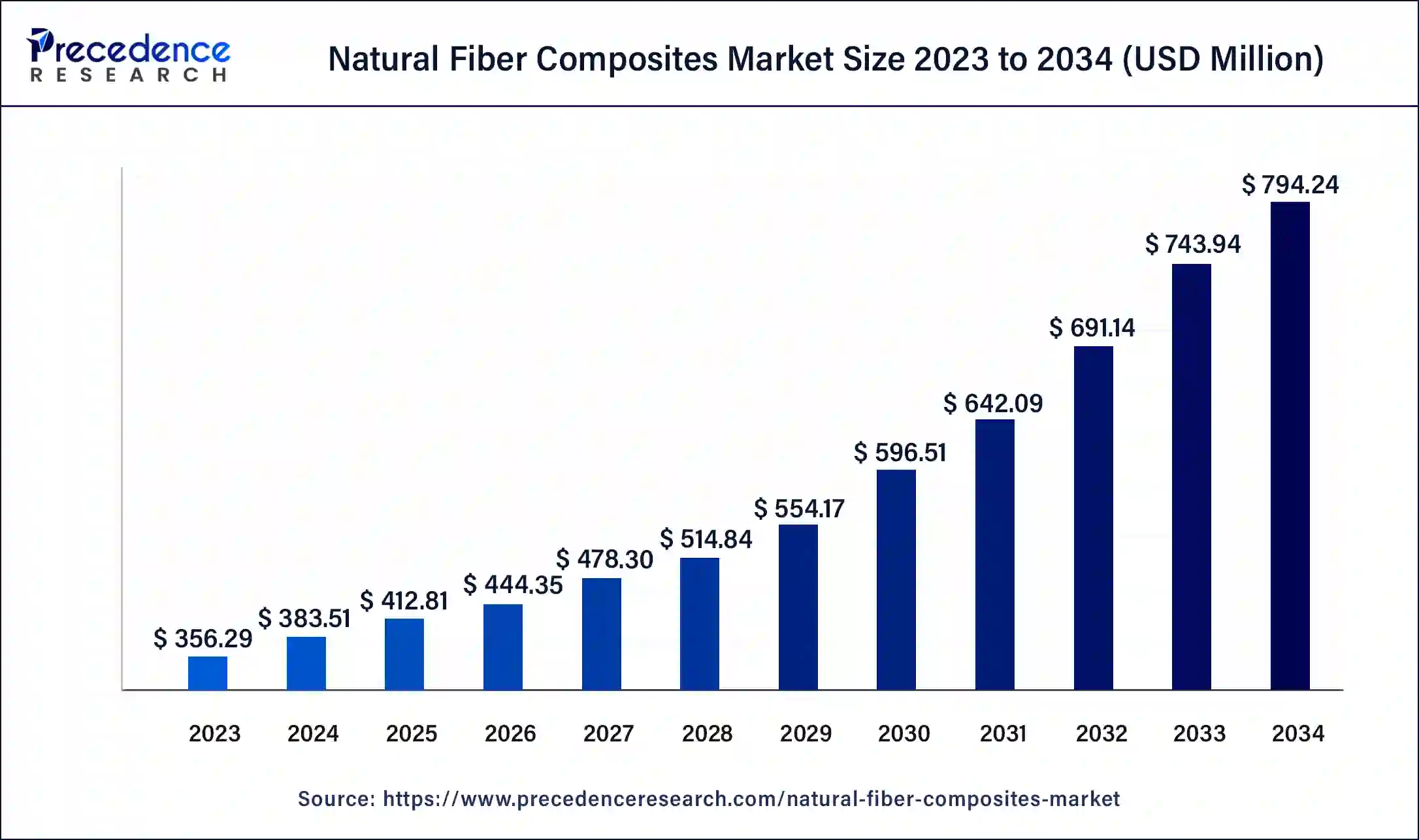

The global natural fiber composites market size is estimated at USD 383.51 million in 2024 and is anticipated to reach around USD 794.24 million by 2034, growing at a CAGR of 7.6% from 2024 to 2034. The natural fiber composites market is driven by the increasing need for sustainable and eco-friendly materials.

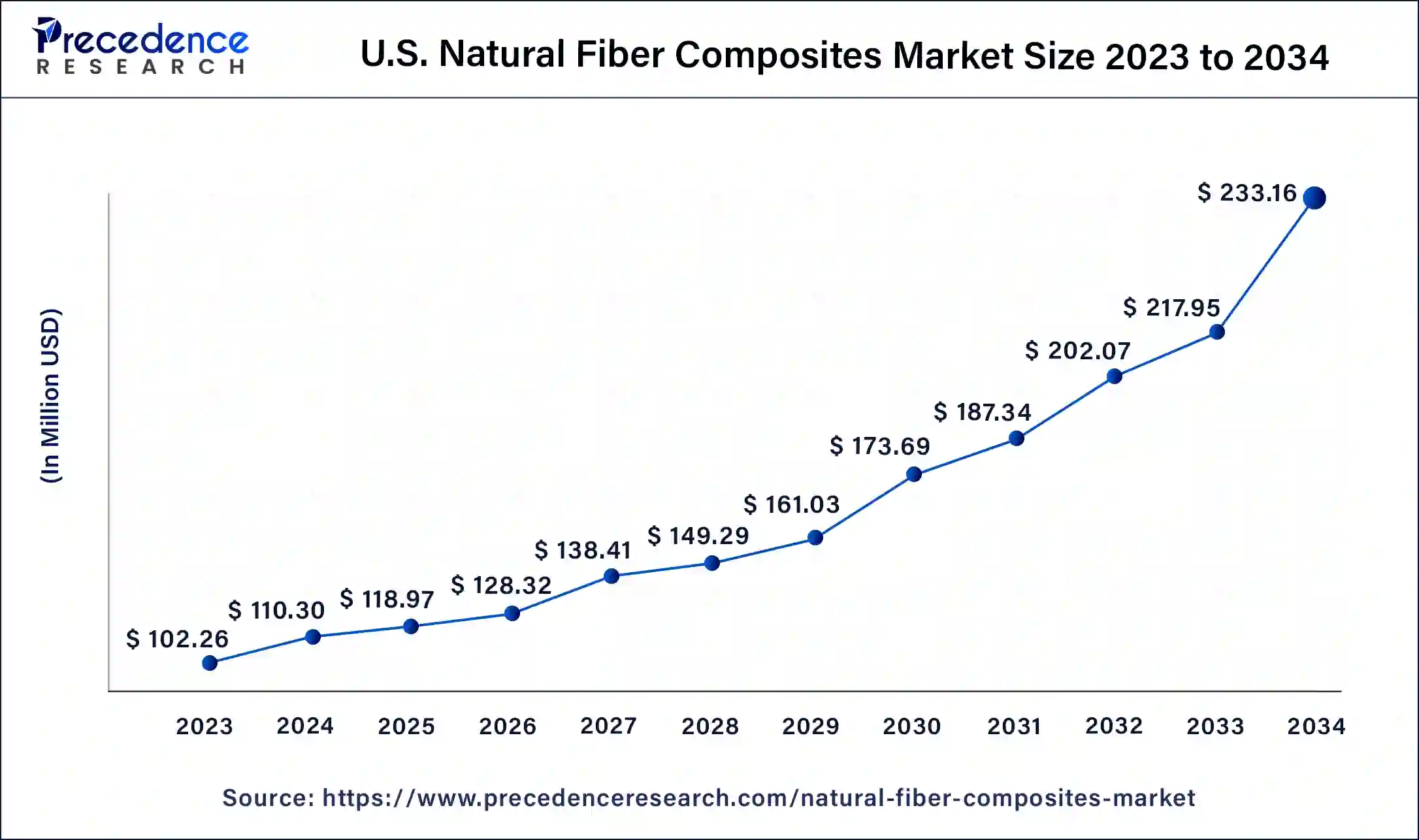

The U.S. natural fiber composites market size was valued at USD 102.26 million in 2023 and is predicted to be worth around USD 233.16 million by 2034, at a CAGR of 7.77% from 2024 to 2034.

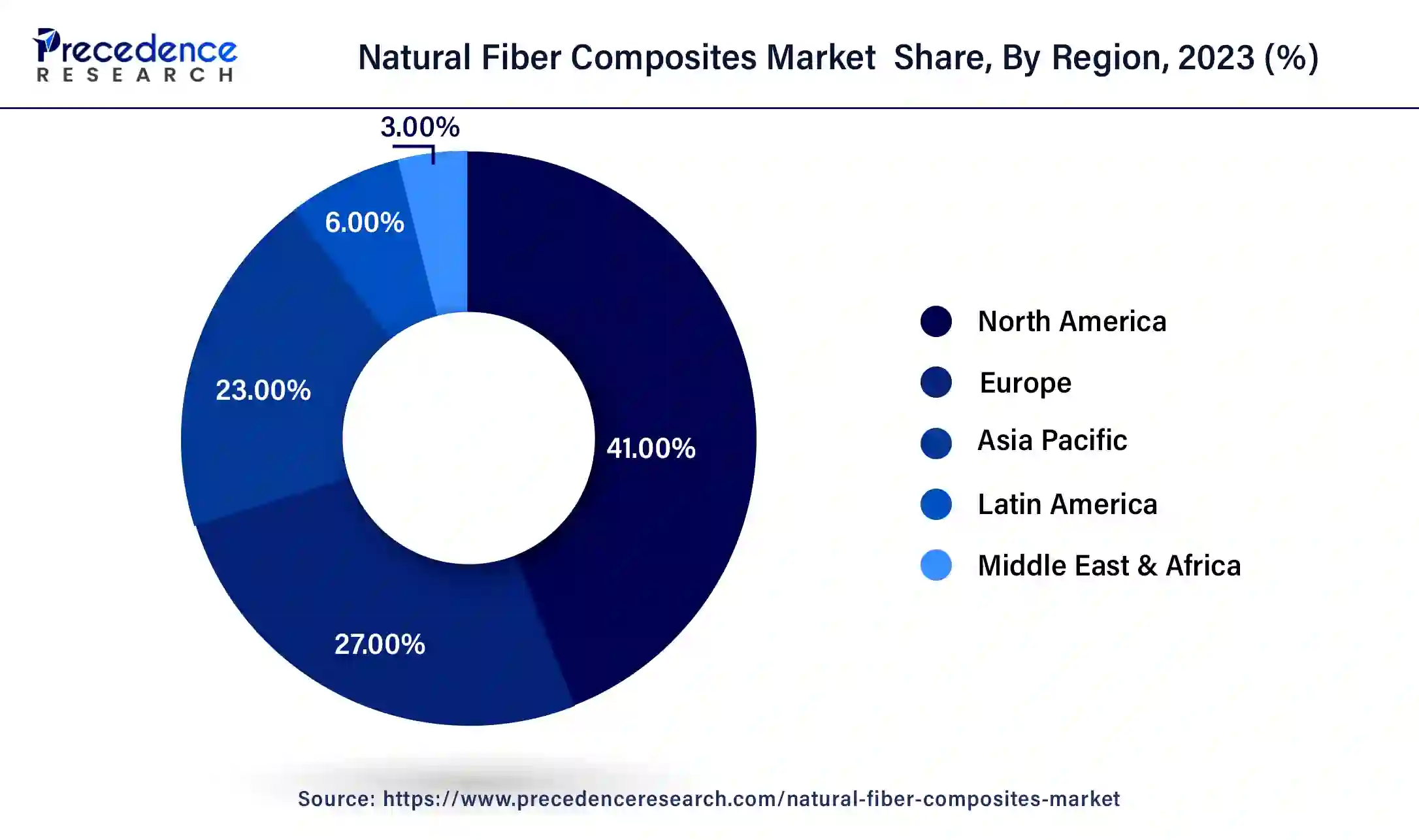

North America had a significant share of the natural fiber composites market in 2023. Natural fiber composites are used mainly by the building and automobile industries. These industries are thriving in North America and are always looking for environmentally friendly substitutes for conventional materials like metal and man-made polymers. Natural fiber composites are becoming more and more appealing to producers in the sector since they provide robust, long-lasting, and eco-friendly solutions.

Asia-Pacific is observed to be the fastest-growing natural fiber composites market during the forecast period. Natural fiber composites are widely used by the region's rapidly growing construction, automotive, and packaging industries. Many people choose natural fiber composites over their conventional synthetic counterparts due to the increased focus on eco-friendly and sustainable materials. These industries are driving the need for natural fiber composites, promoting regional market expansion. Asia-Pacific nations are making significant R&D investments to improve the qualities and uses of composites made of natural fibers.

Improvements in manufacturing techniques, like composite formulation and fiber treatment, enhance these materials' functionality and robustness. Furthermore, natural fiber composites are becoming more widespread in various industries due to continuous innovation in product design and engineering.

Natural Fiber Composites Market Overview

The natural fiber composites market is the industry that revolves around the production, innovation and distribution of composite materials and solutions that are generally observed to be a part of fiber obtained from natural sources. The industry is being supported by the rising emphasis on sustainable solutions across the globe. Bio-based polymer composites, also known as natural fiber-reinforced composites, have drawn increased attention because of their renewability, biodegradability, affordability, and lightweight.

Natural Fiber Composites Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.6% |

| Global Market Size in 2023 | USD 356.29 Million |

| Global Market Size in 2024 | USD 383.51 Million |

| Global Market Size by 2034 | USD 794.24 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Matrix, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advances in processing technologies

Due to advanced processing techniques, natural fiber composites are manufactured more cost-effectively and efficiently. Production process optimization, waste reduction, and throughput have been achieved through automation, robotics, and computer-aided design and manufacturing (CAD/CAM) technology. Because of the decreased production costs overall, natural fiber composites are now more economically feasible for large-scale manufacturing in various industries. The production of natural fiber composites has been able to scale rapidly due to advancements in processing technology, which have allowed producers to fulfill rising demand without sacrificing effectiveness or quality.

Scalable procedures facilitate an easy transition towards broad adoption in the consumer products, construction, automotive, and aerospace industries by enabling seamless integration into current supply chains and infrastructure.

Tendency to absorb moisture

In natural fiber composites, dimensional instability may result from moisture absorption. The composite material's overall dimensions are altered due to the fibers' swelling due to moisture absorption. The composite parts may warp, buckle, or otherwise deform due to this dimensional instability, rendering them inappropriate for precision applications demanding close tolerances. This problem may make natural fiber composites less appealing to businesses that require consistent dimensional stability, such as aerospace and the automotive industry.

It may also affect the appearance and surface quality of natural fiber composites. The unequal swelling of fibers in response to moisture exposure can result in surface imperfections and defects on the composite surface. This may lessen the completed items' aesthetic appeal, especially when appearance is crucial.

Rising consumer awareness of sustainability influences purchasing decisions

The global shift toward green and using more natural and sustainable resources includes environmental concerns and the petroleum consumption rate. As synthetic fibers became more prevalent around the end of the 20th century, the significance of natural fibers, used for hundreds of years to meet necessities like clothing and shelter, was significantly diminished. Natural fiber's many benefits are its increased softness, durability, and comfort. This indicates that because of their longer usable life, natural fibers are eco-friendly and excellent for sensitive skin in all seasons. They are also biodegradable, processed using fewer and less hazardous chemicals, and require less water to create. Because of these factors combined, clothing made of natural fibers lowers the dangers to human and environmental health.

The wood fiber composites segment dominated the natural fiber composites market in 2023. Wood fiber composites have many advantages, including dimensional stability, a high strength-to-weight ratio, and resistance to biological and moisture deterioration. For various purposes, these qualities make them a desirable substitute for conventional materials like concrete, metal, and plastics. For example, wood fiber composites offer the natural feel and appearance of wood in outdoor decking, but they require less upkeep and are more weather-resistant than natural wood.

The jute fiber composites segment is the fastest growing in the natural fiber composites market during the forecast period. The jute plant, which produces a high yield and proliferates, is the natural source of jute, a natural fiber. Sustainable and renewable materials are becoming increasingly popular as industry and consumers grow more ecologically conscious. Jute is a desirable option for many applications since it satisfies this requirement. In comparison to synthetic and natural fibers like hemp and flax, it is comparatively cheap. Because of its low cost, it is a financially feasible choice for producers who want to create high-quality composites at a reasonable price.

Jute fiber composites are becoming increasingly in demand in many industries, including consumer goods, automotive, construction, and textiles. Jute composites are utilized in the car industry to make door panels, trunk liners, and interior components since they are eco-friendly and lightweight. Jute composites are also being investigated for panels, insulation, and roofing materials in the building industry.

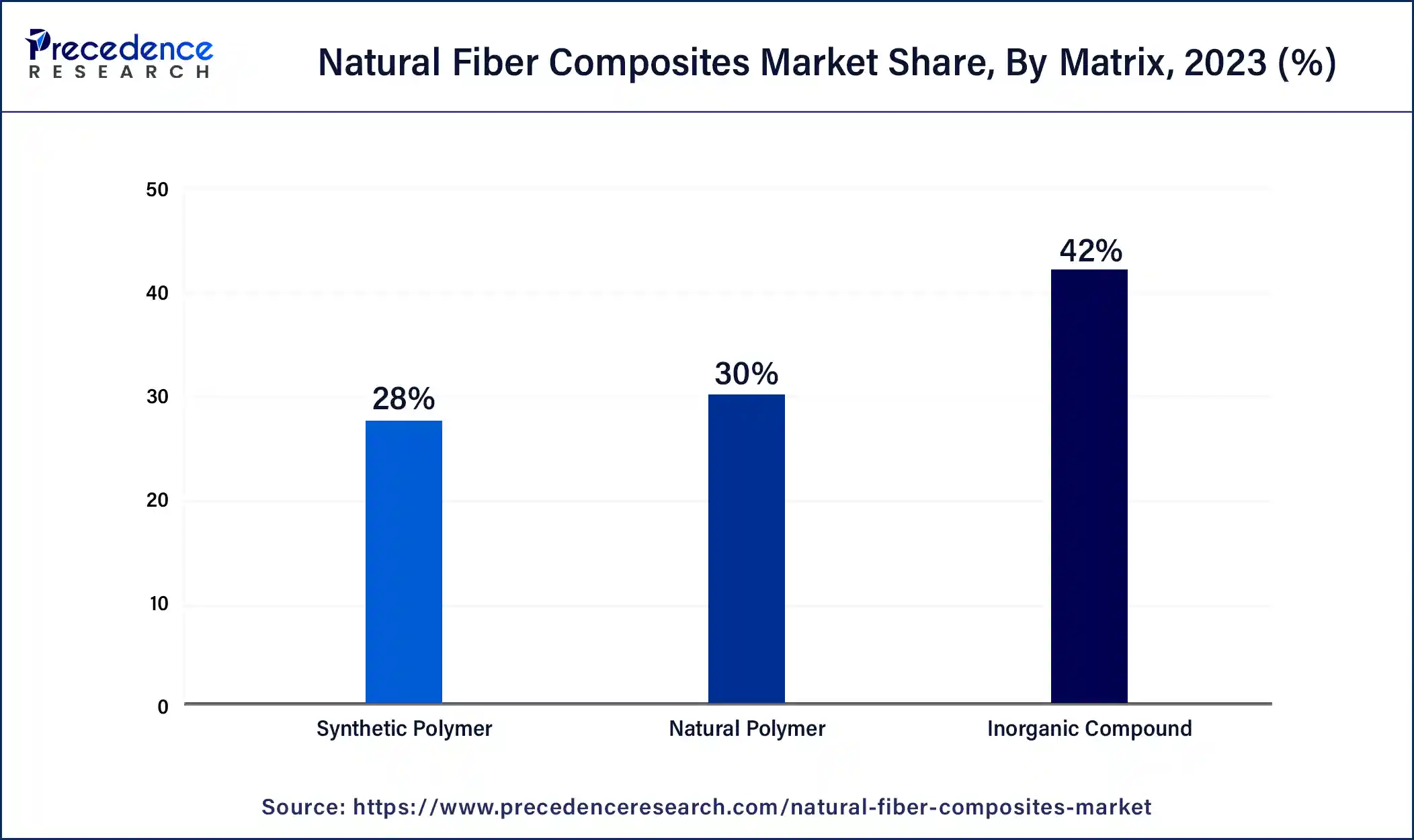

The inorganic compound segment dominated the natural fiber composites market in 2023. When compared to organic fibers, inorganic compounds frequently show better resistance to extreme heat and severe chemicals. This qualifies them for use in settings where exposure to harsh environments is frequent, like in chemical processing and industrial machines. Strict regulatory requirements in some areas, like aerospace and defense, make using materials with well-established and dependable qualities necessary. Since inorganic compounds frequently contain well-established performance data, they are chosen for applications where adherence to safety regulations is crucial.

The natural polymer segment is the fastest growing in the natural fiber composites market during the forecast period. Natural polymer-based composites are becoming increasingly in demand in various sectors, including consumer goods, construction, automotive, and packaging. Natural polymer composites are used in automotive applications to replace conventional materials such as carbon fiber and fiberglass in interior components, which lowers vehicle weight and increases fuel efficiency. These composites are utilized to create long-lasting, environmentally beneficial building materials.

The automotive segment dominated the natural fiber composites market in 2023. Natural fiber composites are appropriate for various automotive applications because they provide an excellent blend of strength, stiffness, and impact resistance. They can be utilized in structural elements like load flooring, spare wheel covers, body panels, and interior elements like door panels, dashboard trims, and seat backs. Furthermore, natural fibers' adaptability and usefulness in vehicle design are increased by simply molding into intricate shapes utilizing traditional manufacturing processes like compression or injection molding.

Segments Covered in the Report

By Type

By Matrix

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

April 2025

September 2024

September 2024