January 2025

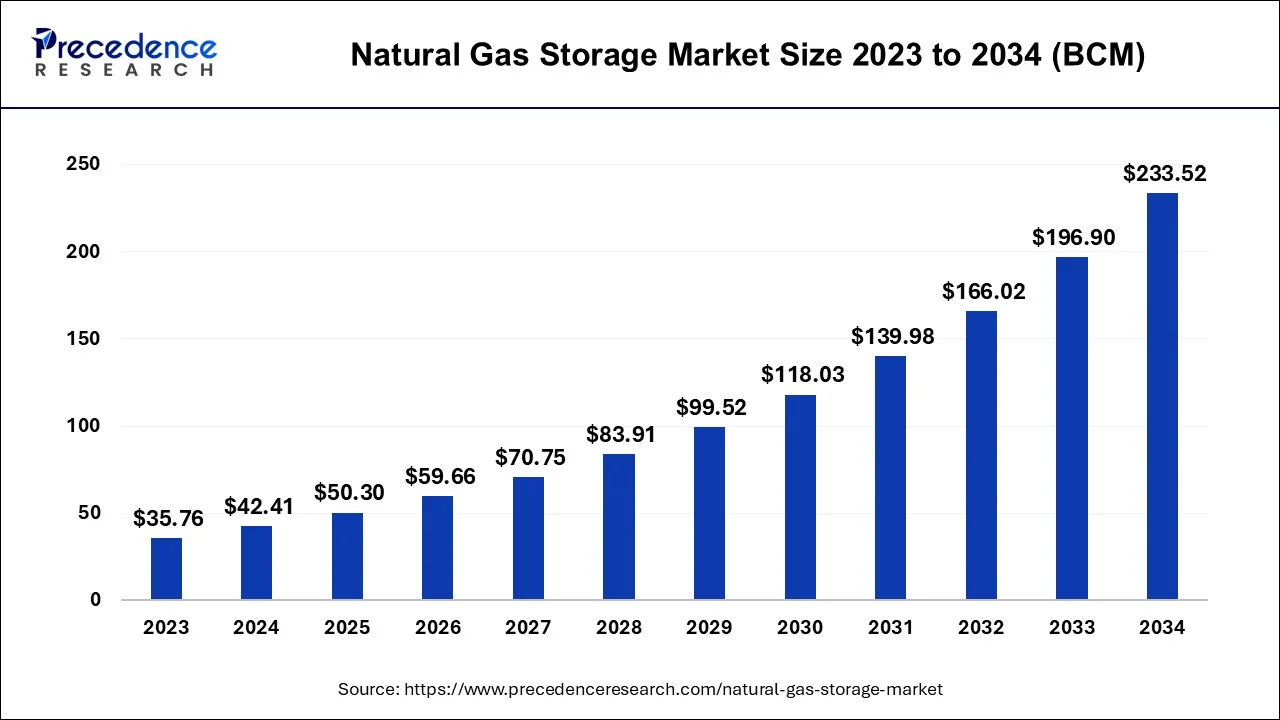

The global natural gas storage market size accounted for 42.41 bcm in 2024, grew to 50.30 bcm in 2025 and is predicted to surpass around 233.52 bcm by 2034, representing a healthy CAGR of 3.50% between 2024 and 2034. The North America natural gas storage market size is calculated at 19.08 bcm in 2024 and is expected to grow at a fastest CAGR of 18.72% during the forecast year.

The global natural gas storage market size is estimated at 42.41 bcm in 2024 and is anticipated to reach around 233.52 bcm by 2034, expanding at a CAGR of 3.50% from 2024 to 2034.

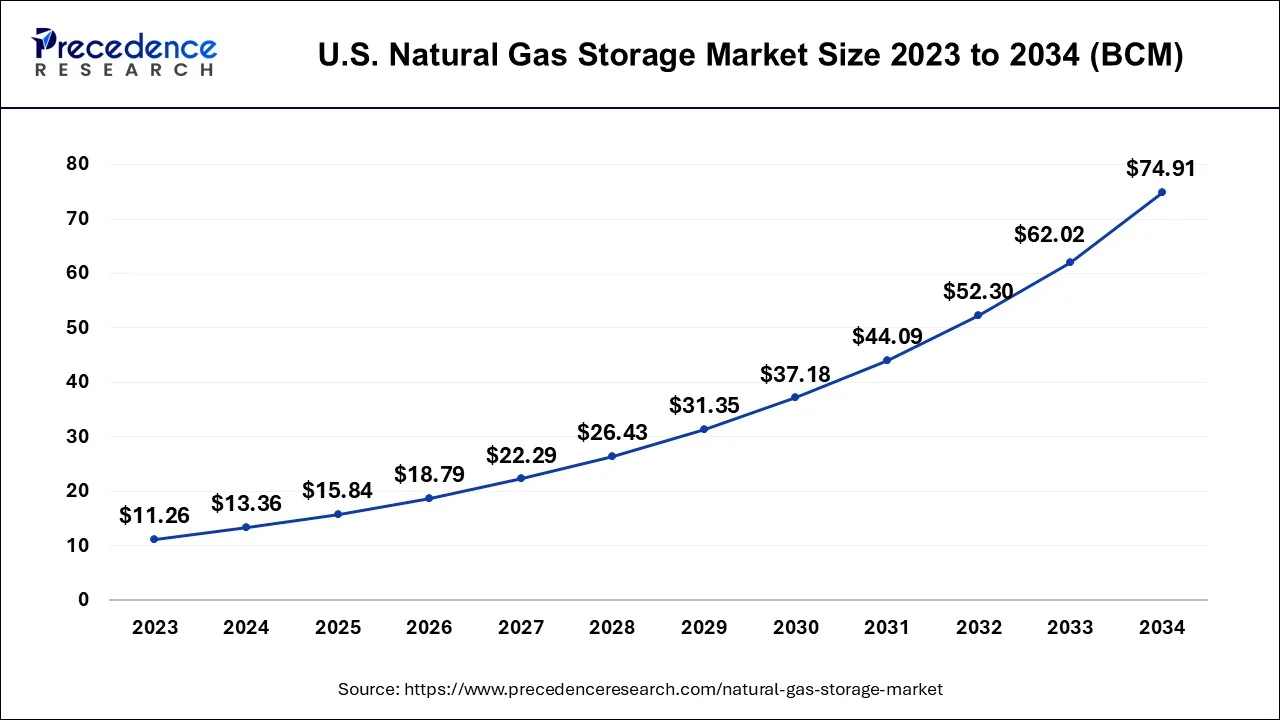

The U.S. natural gas storage market size is evaluated at 13.36 bcm in 2024 and is predicted to be worth around 74.91 bcm by 2034, rising at a CAGR of 18.80% from 2024 to 2034.

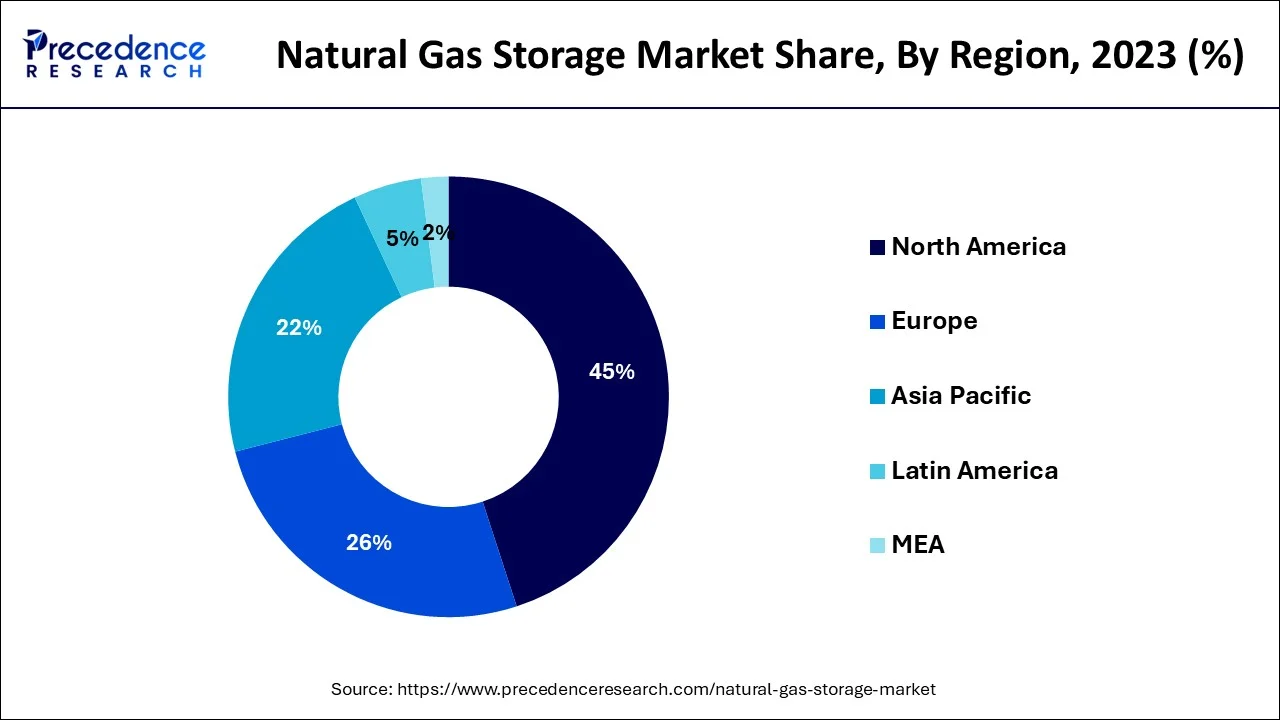

In 2023, the North America region dominated the natural gas storage market due to its large reserves, well-developed infrastructure, and numerous storage options, such as salt caverns and depleted fields. The strategic geographical location of the region, technical improvements, and a market-friendly environment with government assistance all contribute to its growth. North America is a significant region in addressing dynamic energy requirements due to its liberalized energy market, reliance on a diverse energy mix, and flexibility to seasonal demand variations. Additionally, the U.S. is the major producer of natural gas which means that there is a large supply of natural gas available for storage. There are over 4,000 natural gas storage facilities in the United States, which can store a total of approximately 4 trillion cubic feet of natural gas. The demand for natural gas in the U.S. is also increasing due to the increased use of natural gas for power generation and the rising trend of natural gas-powered vehicles.

The U.S. market of natural gas storage is expected to develop as a result of the rising necessity of storing gas from fractured reservoirs. Over the next several years, increased seasonal consumption from a variety of end-use industries and manufacturing companies in the area is expected to combine with rising natural gas output to drive market expansion. Furthermore, it is projected that favorable government rules favoring fuels with low carbon content relative to certain other fossil fuels will continue to be a positive factor for growth in natural gas consumption.

The demand will also be increased by technical developments as well as growing public knowledge of natural gas's environmental benefits. During the forecast timeframe, factors such as rising natural gas consumption in the industrial, chemical, and transportation sectors, mostly from Asia-Pacific countries, are anticipated to propel the market of gas storage. Additionally, as the world works toward a low-carbon economy, the benefits of using fossil fuel as a clean-burning, versatile, and economical fuel are anticipated to lead to an increase in natural gas prices in the future. However, it is anticipated that the demand's seasonality and volatility, along with the mismatch between demand and supply will impede the market's expansion for natural gas storage. It is anticipated that the high natural gas production will spur oil and gas production and boost the requirement for storage facilities.

Subterranean storage areas and above storage areas are the two categories that compose the market. Aquifers drained lakes, and salt caves are the three main categories into which subterranean storage facilities are separated. The region's expanding chemical, commercial, and transportation industries will probably increase the need for natural pumped storage. Future oil and gas demand is also projected to increase due to the benefits of someone using gas as a spotless, versatile, and efficient fuel for a range of uses, as well as the global shift toward a reduced society.

Gas storage is typically utilized to fulfill consumer needs; during times of economic downturn, gas is stored, also during times of maximum supply, gas is extracted from storage. The subterranean or above forms of storage of natural gas are the two categories that make up the market. Gaseous types of fossil fuels are primarily kept in subterranean storage facilities. Aquifer depletion, the depleted reservoir in oil and gas sectors, and salt cavern formations are the three main types of subterranean storage facilities.

The various storage options each have unique physical properties, including porosity, permeability, maintenance costs, and other relevant site abilities. The growth in oil & gas development that followed the rise in natural gas consumption resulted in more above- and below-ground storage sites. Thus, it is anticipated that the storage of the natural gas industry will experience steady expansion in the years to come.

Due to its many advantages placed above a white above-ground stockpiling and the rising number of sites due to their low operational and infrastructure costs, the subsurface memory (UGS) segment is anticipated to have the largest percentage of the market, led by the United States, with the greatest percentage of UGS capacity.

The US Department of Energy's investigation into chilling salt deposits to store more gas and reduce operating costs is opening up opportunities for the industry under study.

With a rising reliance on natural gasoline and to ensure natural gas supply regardless of demand and supply Europe is predicted to have the fastest-growing industry.

| Report Coverage | Details |

| Market Size in 2024 | 42.41 BCM |

| Market Size by 2034 | 233.52 BCM |

| Growth Rate from 2024 to 2034 | CAGR of 3.50% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Favorable government policies will boost the market for natural gas stockpiling

An increased focus on alternative fuels will help to drive demand

The market's expansion is driven by the widespread adoption of wearable sports equipment with RTLS embedded

Storage for natural gas is expensive, and transmission capacity is constrained

Because of its favorable environmental effects, natural gas is being used in industry at an increasing rate

In 2023, the large underground type held the biggest market share (92%). Like the majority of other products, fossil fuel may be kept in storage for a very long time. Natural gas exploration and development typically take time. Additionally, natural gas sometimes isn't used right away after arriving at its location, so it's kept in facilities, probably underground. With seasonal changes, subterranean coal and gas storage has become a crucial component of the energy supply, especially for countries in Europe and North America. Production that is constant and consistent contrasts with demand and usage that are erratic and follows a seasonal pattern depending on the patterns. Due to the significant increase in demand for subterranean natural gas on the international market, the percentage of usage has been observed to increase steadily.

In addition, natural gas is kept in gaseous or liquid form in the above storage tanks. The locations in which the above-ground storage facilities are located lack subsurface caves. The above-ground storage tanks are generally inexpensive to install and provide simple access to storage facilities. Natural gas is additionally stored locally in portable tanks which are placed onto railroads or barges for lengthy transit in addition to stationary terrestrial storage tanks. The terrestrial segment, which had the second-largest share of the market in 2023, is expected to grow at a respectable CAGR over the course of the projected year.

The shallow groundwater type's drained reservoirs segment held the biggest market share in 2023. One of the earliest and most common types of gas storage is in fractured reservoirs. Formations known as depleted reservoirs have already had all of their exploitable fossil fuels extracted from them. Approximately 50% of the fossil fuels inside the deposit need to be preserved as a cushion gas to sustain pressure in fractured reservoirs. Due to the infrastructure already in place for gas storage, these reservoirs have mostly been utilized for this purpose. They offer a long combustion cycle of 50 to 200 days and a moderate gas delivery.

The CAGR that is anticipated to be the greatest during the forecast timeframe belongs to the salt cavern. Current salt resources give rise to salt caverns. Due to their steel-like structural strength, which makes the caverns resistant to reservoir deterioration over the course of the storage unit, they are appropriate for storing gas. Aquifers are underground formations of porous, permeable rock that serve as spontaneous water reservoirs. Due to the necessity for geological classification before storage, these structures are the least appealing and the costliest type of natural energy storage site. Aquifers are typically found in pressure distribution near water pressure upon exploration.

By Type

By Underground Storage Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

January 2025

March 2025