June 2024

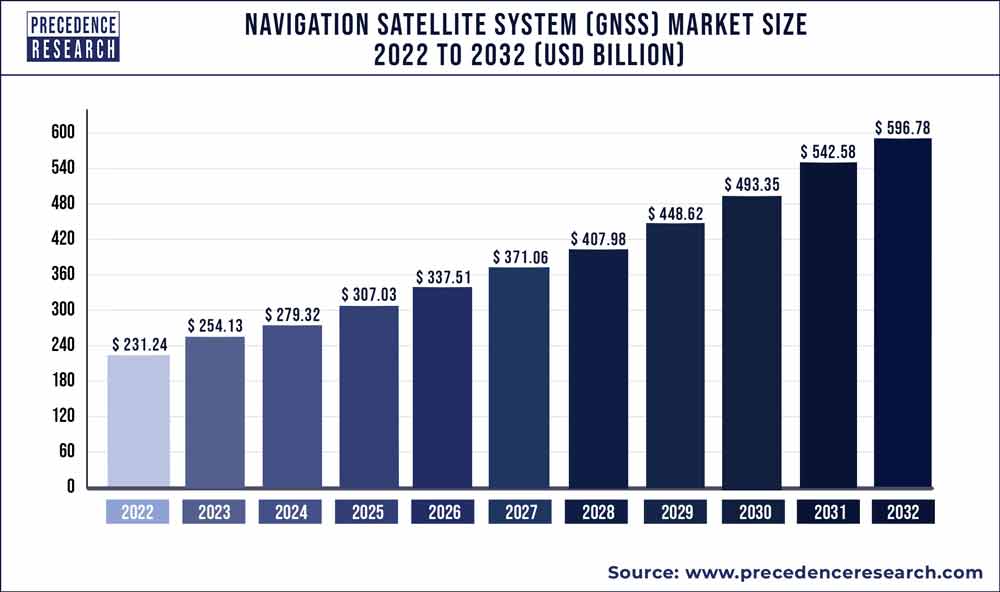

The global navigation satellite system (GNSS) market size reached USD 231.24 billion in 2022 and it is expected to be worth around USD 596.78 billion by 2032, poised to grow at a CAGR of 9.95% during the forecast period 2023 to 2032.

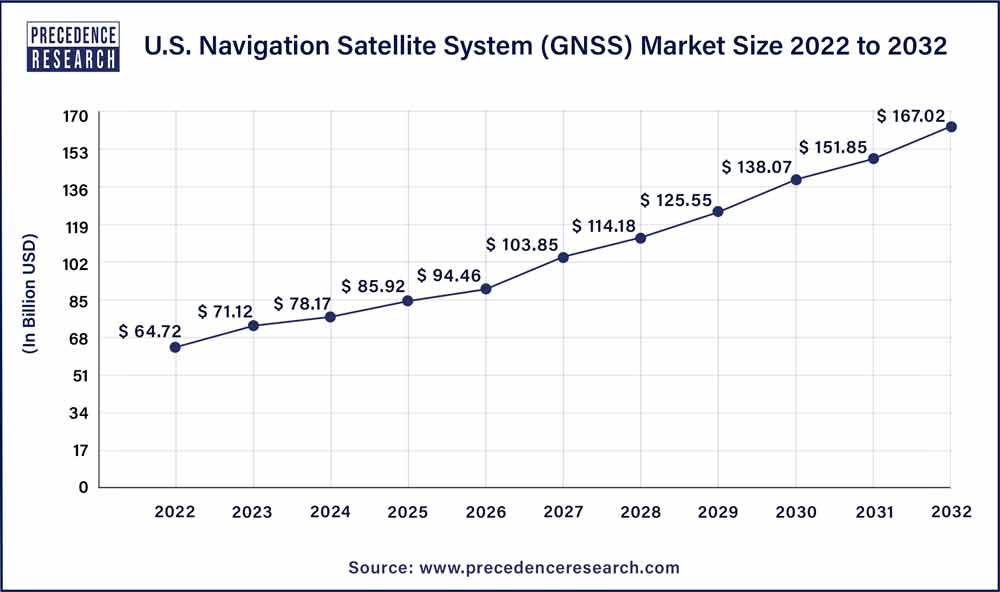

The U.S. navigation satellite system (GNSS) market size accounted for USD 64.72 billion in 2022 and is estimated to reach around USD 167.02 billion by 2032, growing at a CAGR of 9.95% from 2023 to 2032.

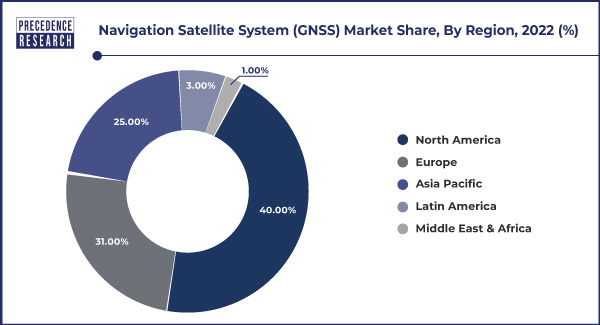

North America has held largest revenue share in 2022. The presence of several prominent GNSS technology providers, such as Garmin, Trimble, NovAtel, and Hemisphere GNSS has contributed to the growth and innovation in the GNSS market across the region. It is widely adopted across various sectors in North America such as transportation for vehicle navigation, logistics, and fleet management. In agriculture, precision farming practices rely on GNSS for accurate positioning and guidance. Additionally, GNSS is vital for aviation, maritime, surveying, and public safety applications in the North America region.

Asia-Pacific estimated to observe the fastest expansion in the navigation satellite system (GNSS) market in 2022. The region witnessed a significant increase in the adoption of GNSS technology across various sector including transportation, agriculture, construction, telecommunications, and others. Furthermore, several countries in the Asia-Pacific region have developed or are in the process of developing their regional GNSS systems. For instance, India has its Indian rgional navigation satellite system (IRNSS), also known as NavIC, while Japan has the Quasi-Zenith Satellite System (QZSS). These regional systems may enhance positioning accuracy and reliability within their respective areas of coverage.

Europe had a well-established and active navigation satellite system (GNSS) market, with a strong emphasis on the development and utilization of GNSS technology. One of the standout features of the European GNSS market is the Galileo system, which is owned and operated by the European Union. Galileo is designed to provide independent positioning, navigation, and timing services to users worldwide. It aims to offer increased accuracy and resilience compared to other global GNSS systems. Galileo is used in various sectors, including transportation, agriculture, telecommunications, and emergency services.

Navigation satellite system (GNSS) depends on constellations of satellites orbiting Earth, such as the global positioning system (GPS), to transfer signals that are received and processed by GNSS receivers globally. These receivers, are integrated into an array of devices and applications, which enable users to precisely determine their geographical velocity, location, and time information.

The GNSS market encompasses various facets, including the deployment and maintenance of satellite constellations, the development of GNSS receivers, ground-based infrastructure, and monitoring stations. Its applications span across numerous sectors, such as transportation, with GPS navigation in vehicles and the advancement of autonomous driving, aviation, where GNSS aids in aircraft navigation and air traffic control, maritime navigation for ships and vessels, precision agriculture with tools for farming and crop monitoring, land surveying and mapping, search and rescue operations, and critical timing and synchronization for telecommunications and financial transactions.

The growth of the navigation satellite system (GNSS) market can be attributed to various factors such as increasing demand for location-based services (LBS) across various industries, including transportation, logistics, and retail. GNSS technology enables real-time tracking, precise navigation, and personalized services, enhancing user experiences and business operations. GNSS technology also plays a critical role in safety and emergency services. Governments and organizations rely on GNSS for accurate location data in search and rescue operations, maritime safety, and emergency response, contributing to its continued growth.

The rise of autonomous vehicles is another pivotal growth driver such as self-driving cars, drones, and other autonomous systems rely heavily on GNSS for accurate positioning and navigation. As the autonomous vehicle industry matures and gains traction, the demand for high-precision GNSS solutions is expected to surge. Moreover, the agricultural sector is witnessing an expansion in precision farming practices. Farmers utilize GNSS-based guidance systems for tasks such as precision planting and yield monitoring, which not only boost crop production efficiency but also reduce resource consumption.

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 9.95% |

| Market Size in 2023 | USD 254.13 Billion |

| Market Size by 2032 | USD 596.78 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Solution, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In today's interconnected world, LBS have become ubiquitous, seamlessly integrating into our daily lives and a wide array of industries. Consumer's growing reliance on location-aware applications is one of the primary drivers for the navigation satellite system (GNSS) market. Smartphone users depend on GPS-enabled apps for turn-by-turn navigation, finding nearby businesses, and tracking fitness activities. Additionally, ride-sharing and food delivery services heavily rely on GNSS technology for real-time location updates, making them indispensable in urban environments.

Moreover, businesses across multiple sectors leverage LBS to provide personalized experiences and targeted marketing to customers. Retailers use location data to send promotional offers to nearby shoppers, enhancing customer engagement and driving foot traffic to physical stores. Logistics and delivery companies optimize routes and provide customers with real-time package tracking, improving efficiency and customer satisfaction.

In transportation and fleet management, GNSS-based solutions enhance safety and efficiency. Public transportation systems use real-time tracking to provide accurate arrival times to commuters, while logistics companies benefit from route optimization to reduce fuel consumption and delivery times. Thus, the increasing demand for LBS in everyday life, commerce, and various industries underscores the vital role of GNSS technology. For instance, in June 2023, Point One Navigation partnered with Septentrio to expand their precision location solutions throughout Western Europe. It is suitable for various demanding applications, such as precision agriculture, industrial autonomy, logistics and delivery, robots and autonomous vehicles.

Moreover, its accuracy, reliability, and global coverage make GNSS the backbone of location-based services, driving continued growth and innovation in the GNSS market as it continues to serve a diverse range of applications and industries.

GNSS has become an indispensable tool for precise positioning, navigation, and timing services, several security-related challenges have emerged that raise apprehensions among users and organizations. Vulnerability of GNSS signals to interference and jamming is one of the major concern for the market. Deliberate jamming or unintentional interference can disrupt GNSS signals, leading to inaccurate positioning information. This vulnerability has significant implications for critical sectors such as aviation, maritime, and defense, where precise navigation is essential for safety and security.

Moreover, the threat of spoofing, where malicious actors generate counterfeit GNSS signals to deceive receivers, has gained attention. This can have severe consequences, from leading vehicles or vessels astray to compromising the security of critical infrastructure. The reliance on GNSS for critical infrastructure and services also makes it a potential target for cyberattacks.

Protecting GNSS infrastructure from cyber threats is a growing concern, as any disruption could have far-reaching consequences, affecting not only navigation but also financial transactions, telecommunications, and emergency services. As these security challenges persist and evolve, there is an increased need for robust security measures and backup navigation systems. Organizations and governments are actively exploring alternative positioning technologies and improving signal authentication methods to address these concerns.

GNSS technology, comprising satellite constellations like GPS, GLONASS, Galileo, and BeiDou, plays a pivotal role in enabling the precise positioning, navigation, and timing necessary for the safe and efficient operation of these autonomous platforms. It also provides the foundational location data that autonomous vehicles rely on for real-time decision-making. Accurate GNSS data enables these vehicles to determine their exact positions on the road, calculate routes, and navigate complex environments, including highways and urban streets. Moreover, GNSS augmentation systems like real-time kinematic (RTK) and satellite-based augmentation systems (SBAS) offer centimeter-level accuracy, which is critical for ensuring the safety of passengers and pedestrians.

Drones, whether used for delivery services, aerial surveys, or surveillance, are increasingly dependent on GNSS technology. Precise positioning is essential for drone flight control, collision avoidance, and the execution of specific tasks. GNSS also aids in geofencing and defining no-fly zones, enhancing safety and security. As the autonomous vehicle and drone markets continue to grow and diversify, GNSS technology providers have an opportunity to innovate and develop more advanced solutions that cater to the unique requirements of these emerging industries.

Impact of COVID-19:

The COVID-19 pandemic presented challenges to the GNSS market, particularly in terms of supply chain disruptions and economic uncertainty. However, it also highlighted the technology's importance in maintaining essential services and enabling remote work and telemedicine. As industries adapt to the new normal and prioritize resilience, GNSS technology is likely to continue playing a crucial role in various applications, offering opportunities for growth and innovation.

The increased adoption of telemedicine and remote work during the pandemic emphasized the need for accurate timing and synchronization, which GNSS technology provides. This led to potential opportunities in the telecommunications sector. Furthermore, agriculture continued to rely on GNSS technology for precision farming, helping to optimize crop management and maintain food production during the pandemic. GNSS technology also played a vital role in disaster response and management, including tracking the movement of relief supplies and ensuring accurate coordination during emergencies.

Based on the solution, service solution is anticipated to hold the largest market share in 2022. Service providers offer real-time positioning and navigation services that utilize GNSS technology. These services are commonly used for vehicle navigation, asset tracking, and location-based applications. GNSS correction services enhance the accuracy and reliability of GNSS signals. These services correct errors introduced by factors like atmospheric conditions and signal delays, ensuring more precise positioning for applications that require high accuracy.

On the other hand, the system is projected to grow at the fastest rate over the projected period. This includes GNSS receivers, which are devices or components integrated into various applications like smartphones, vehicles, aircraft, and surveying equipment. GNSS receivers capture satellite signals and calculate precise positioning and timing data.

According to the type, the global constellations has held highest revenue share in 2022. These global constellations allow users worldwide to access accurate location and timing information. They serve a wide range of industries and applications, including transportation, agriculture, telecommunications, and emergency services. The availability of multiple global constellations offers redundancy and resilience in GNSS services, ensuring that users have access to reliable navigation and positioning data in various regions and under different conditions. For instance, United States' GPS is the most well-known and widely used global GNSS system. It consists of a constellation of satellites orbiting the Earth and provides highly accurate positioning and navigation data to users across the globe.

The regional constellation type is anticipated to expand at a significantly CAGR during the projected period. These constellations provide coverage and navigation services within specific geographical regions or areas, focusing on enhancing positioning accuracy and reliability in those particular regions. For instance, NavIC is India's regional GNSS system, designed to cover the Indian subcontinent and surrounding areas. It consists of a constellation of satellites that provide highly accurate positioning and timing information for users in India and neighboring regions. NavIC is used in various applications, including transportation, agriculture, and disaster management.

Based on the application, road is anticipated to hold the largest market share in 2022 and is projected to grow at the fastest rate over the projected period. The Road application within the Navigation Satellite System (GNSS) market encompasses the use of GNSS technology for various purposes related to road transportation and navigation. GNSS plays a pivotal role in improving road safety, optimizing traffic management, and enhancing the overall efficiency of road networks. It is also used in road transportation for vehicle navigation, route optimization, and fleet management. It provides real-time traffic information, assists in autonomous vehicle navigation, and enhances overall road safety.

Segments Covered in the Report:

(Note*: We offer reports based on sub-segments as well. Kindly, let us know if you are interested)

By Solution

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024