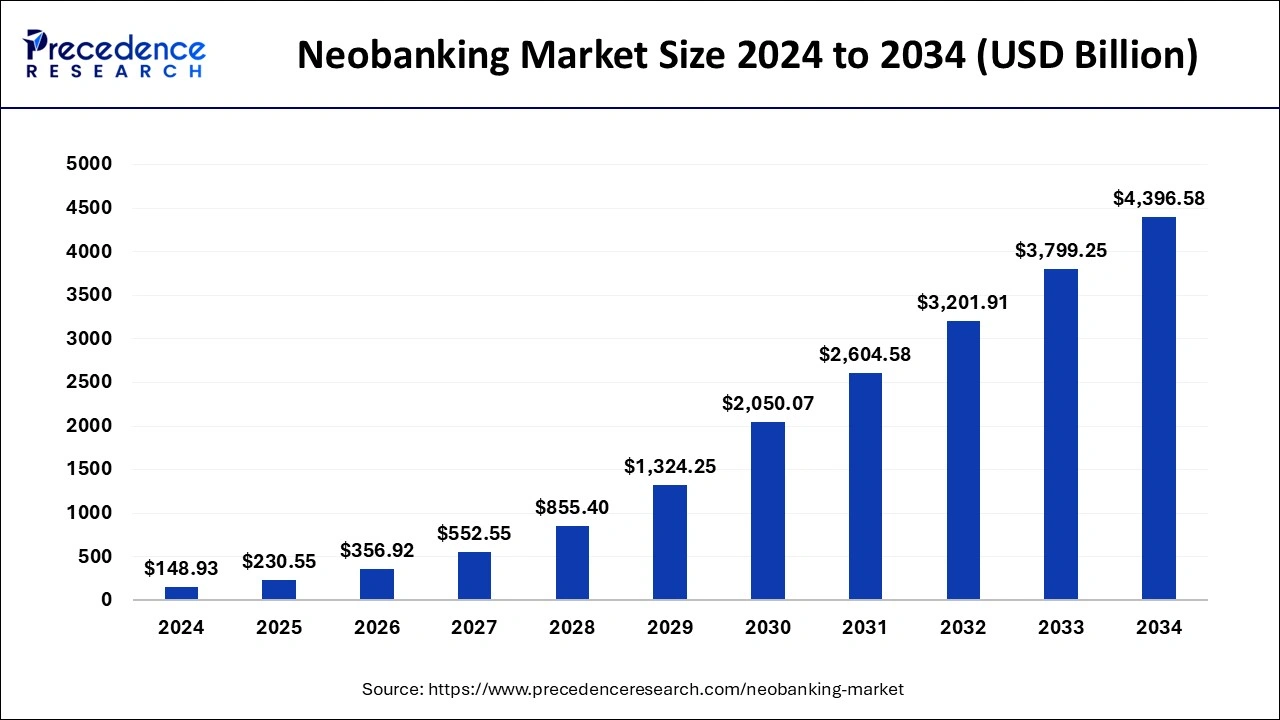

The global neobanking market size is evaluated at USD 230.55 billion in 2025 and is forecasted to hit around USD 4,396.58 billion by 2034, growing at a CAGR of 40.29% from 2025 to 2034. The Europe market size was accounted at USD 50.64 billion in 2024 and is expanding at a CAGR of 40.28% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global neobanking market size accounted for USD 148.93 billion in 2024 and is predicted to increase from USD 230.55 billion in 2025 to approximately USD 4,396.58 billion by 2034, expanding at a CAGR of 40.29% from 2025 to 2034. The neobanking market provides a smooth online and mobile banking experience, enabling users to simply handle their money from any location at any time via web or mobile apps.

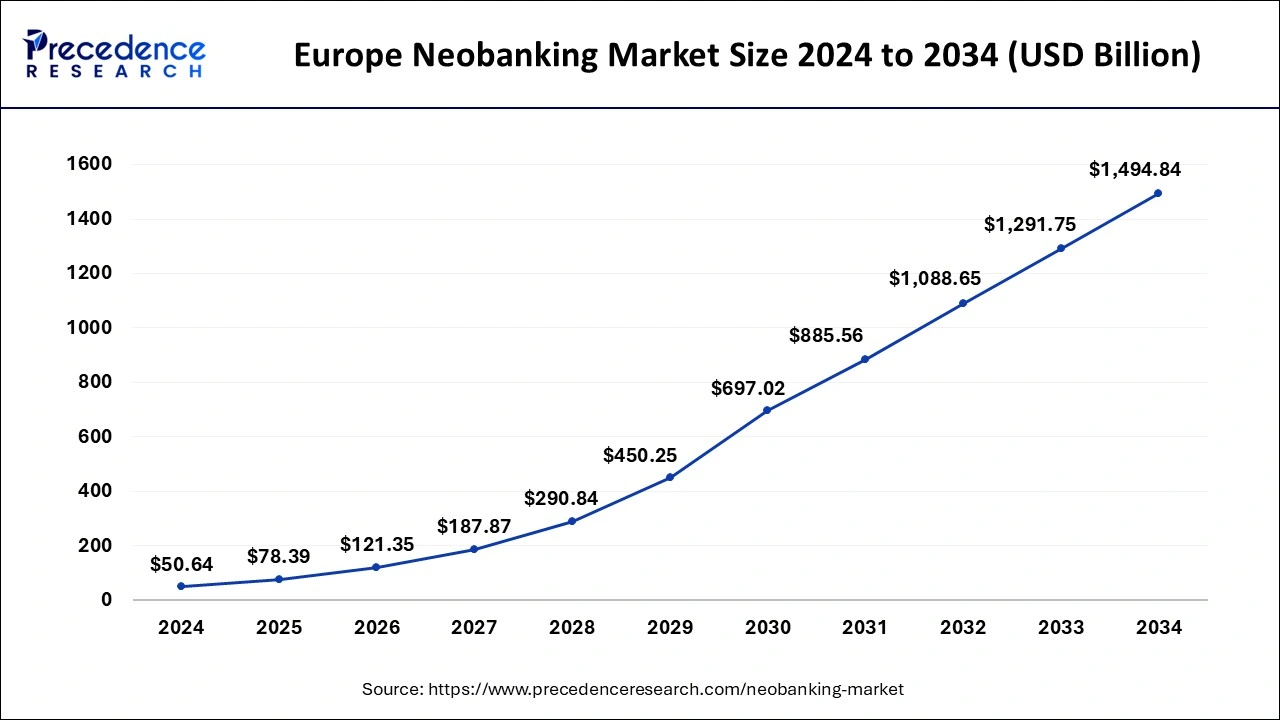

The Europe neobanking market size was exhibited at USD 50.64 billion in 2024 and is projected to be worth around USD 1,494.84 billion by 2034, growing at a CAGR of 40.28% from 2025 to 2034.

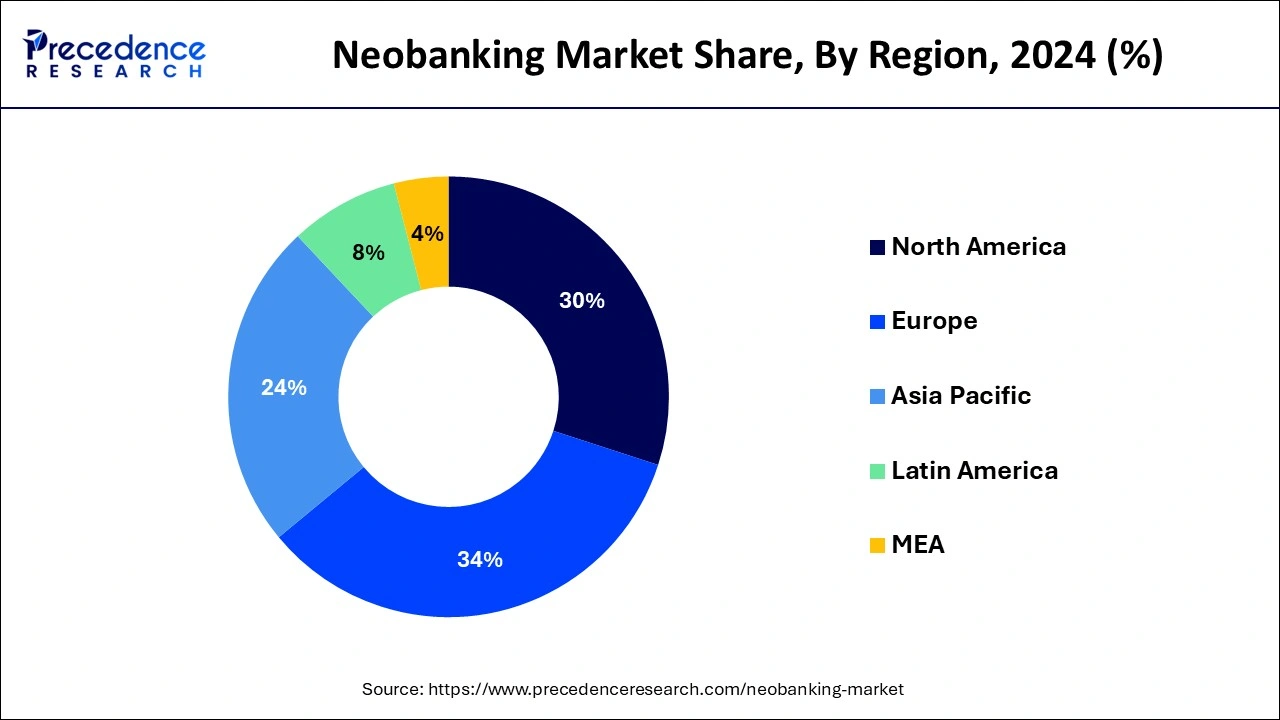

Europe dominated the neobanking market in 2024. The convenience of online and mobile banking services has led to a growing adoption of digital banking solutions among European consumers. New entrants into the banking industry were made easier by regulatory reforms like the EU's Payment Services Directive 2 (PSD2), which encouraged open banking and gave third-party providers permission to access client account information. Customers were drawn to neobanks because of their ease of use, openness, and customized financial services—especially those in younger age groups. Several neobanks catered to the needs of contemporary consumers by providing services, including real-time expenditure alerts, simple foreign transfers, and budgeting tools. To increase their product offerings and attract a wider clientele, neobanks in Europe were collaborating strategically with fintech firms and traditional financial institutions.

Asia Pacific is expected to experience significant expansion in the neobanking market in the upcoming years. The region's neobanking market was expanding rapidly and undergoing major change. Neobanks—digitally-only banks without physical branches—were becoming more and more popular because of their unique features, ease of use, and frequently cheaper costs when compared to traditional banks. Digital technology, such as online banking and cell phones, is being rapidly adopted in the Asia-Pacific area. This technologically literate populace is more receptive to online banking options. The need for banking services that better suit the tastes and lifestyles of the many young, digitally native clients is rising, as evidenced by the rise in neobanks' mobile-first banking offerings. Neobanks could be more successful in reaching these groups because of their lowered entrance barriers and streamlined account opening procedures.

The need for more accessible and convenient banking services, as well as shifting customer preferences and technology improvements, have all contributed to the notable rise of the new banking sector in recent years. Neo banks are financial institutions that prioritize digitalization above physical branches, conducting all of their business online or through mobile apps. Generally speaking, they provide a variety of banking services like checking and savings accounts, loan products, and payment processing.

Globally, the neobanking market has been growing quickly. Several forecasts predicted that by the middle of the 2020s, the size of the worldwide neobanking market would have grown to billions of dollars, with double-digit growth rates anticipated. Factors including growing internet usage, growing smartphone adoption, and growing discontent with traditional banks' offerings are driving this expansion.

Neobanks generally cater to small enterprises, tech-savvy individuals, and millennials who are looking for simplified, user-friendly banking services. These clients are frequently drawn to Neobanks because of their cutting-edge features, affordable prices, and focus on digital convenience. Neobanking has become a global phenomenon, with major participants rising in different parts of the world. While the U.S. and Europe have been the neobanking market, other regions, such as Asia Pacific and Latin America, are also seeing an increase in the number of companies focused on digital banking. Partnerships between neobanks and traditional banks may increase in frequency as they develop and broaden their product offerings, which might further disrupt and reshape the financial services sector as a whole.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 40.29% |

| Market Size in 2025 | USD 230.55 Billion |

| Market Size in 2024 | USD 148.93 Billion |

| Market Size by 2034 | USD 4,396.58 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Account Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Agility and flexibility

The neobanking market is always changing due to shifts in customer preferences, legislation, and technology. Neobanks must make swift adjustments to their offerings in order to remain competitive and relevant. Neobanks provide smooth online banking experiences by largely relying on technology. They can effectively incorporate new features and technology, like blockchain-based services, biometric verification, and AI-driven personalization since they are agile. Neobanks must scale their operations effectively as they expand. By being agile, companies can enroll new clients, grow their infrastructure, and introduce new services without running into serious obstacles. Neobanks must have flexible risk management plans in order to handle uncertainty successfully. When it comes to recognizing and managing new risks, such as financial weaknesses or cybersecurity threats, they need to act quickly.

Cybersecurity risks

Neobanks manage enormous volumes of private client data, such as financial and personal details. This data may be taken and maybe sold on the dark web in the event that their systems are compromised, which could result in financial fraud and identity theft. Neobanks frequently depend on outside suppliers for a range of services, including customer service, payment processing, and cloud hosting. These vendors may provide ports of entry for hackers looking to get access to neobank's systems if they have inadequate security measures in place. Social engineering techniques can be utilized by attackers to coerce staff members or clients into disclosing confidential information or carrying out unapproved tasks. This could involve strategies like insider threats or pretexting.

AI and automation

The neobanking market uses chatbots and virtual assistants driven by AI to offer 24/7 customer service. These automated systems can maintain accounts, get transaction histories, and answer standard questions about balances, freeing up human agents to work on more complicated problems. Artificial intelligence (AI) algorithms are used to evaluate credit risk, identify fraud, and stop money laundering. Neobanks are better than traditional banks in spotting suspicious activity and reducing risks because they have real-time access to enormous volumes of transaction data. Backend procedures like loan approvals, KYC (Know Your Customer) verification, and account opening are made more efficient by automation. Neobanks can lower operating costs, speed up service delivery, and increase scalability by automating these processes.

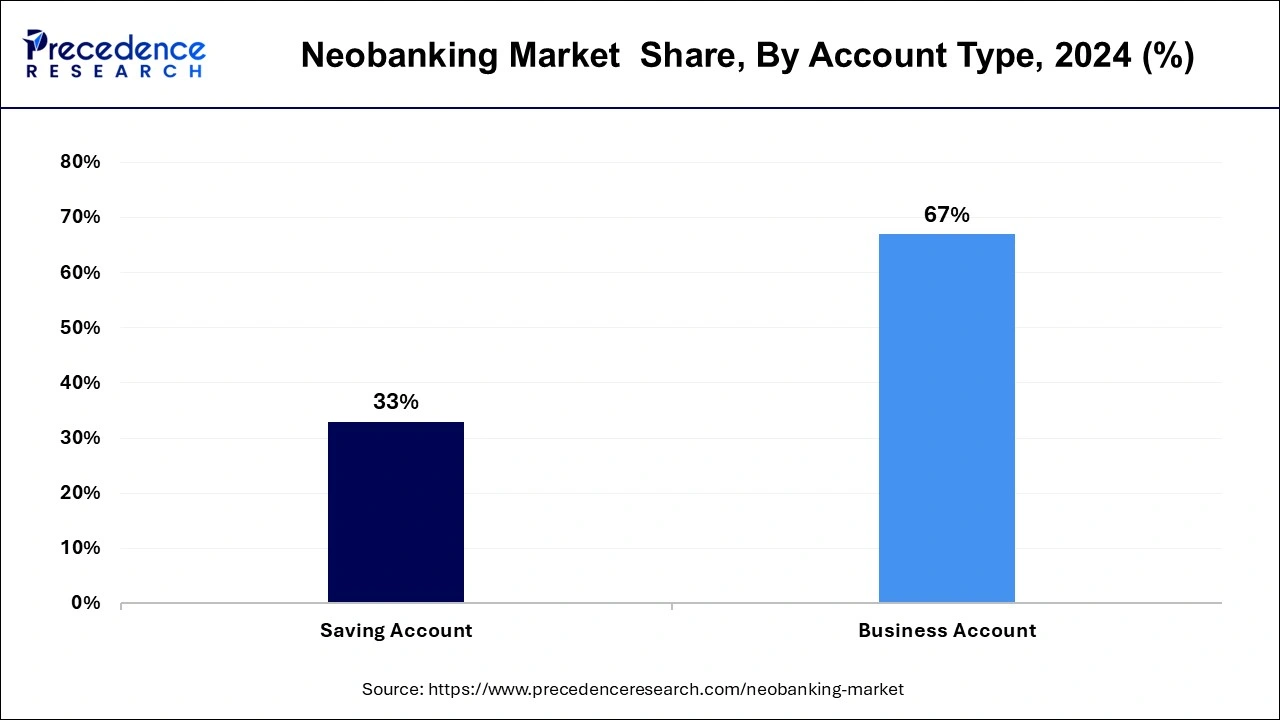

The business account segment held the largest share of the neobanking market in 2024 and is expected to maintain its position during the forecast period. Neobanks frequently provide a number of features designed to meet the needs of businesses, like digital invoicing, tracking expenses, connectivity with accounting software, and team member rights that may be customized. Make sure the charge schedules offered by various neobanks fit your company's financial plan by comparing them.

While some neobanks charge monthly fees based on usage, others give free basic accounts with the option to upgrade for extra capabilities at a cost. Verify whether the neobank easily connects with the other platforms and technologies your company utilizes, like accounting software, payment gateways, and e-commerce sites. You and your team may save time and have a better banking experience with a smooth and user-friendly interface. Make sure the Neobank mobile app or platform fulfills your usability requirements by giving it a test.

The saving accounts segment is expected to witness significant growth in the neobanking market over the projected period. Neobanks usually run completely online, enabling users to register and maintain their accounts via websites or mobile applications. Digitally aware consumers who like to manage their finances on the go will find this ease appealing. In comparison to regular banks, certain neo-banks provide savings account interest rates that are greater. Their ability to pass on savings to consumers in the form of better interest rates is made feasible by their lower operational expenses, which result from the lack of physical branches. Several neo-banks include saving and budgeting features in their applications. Better financial management is encouraged by these tools, which assist users in tracking their expenditures, creating savings objectives, and automating savings transfers.

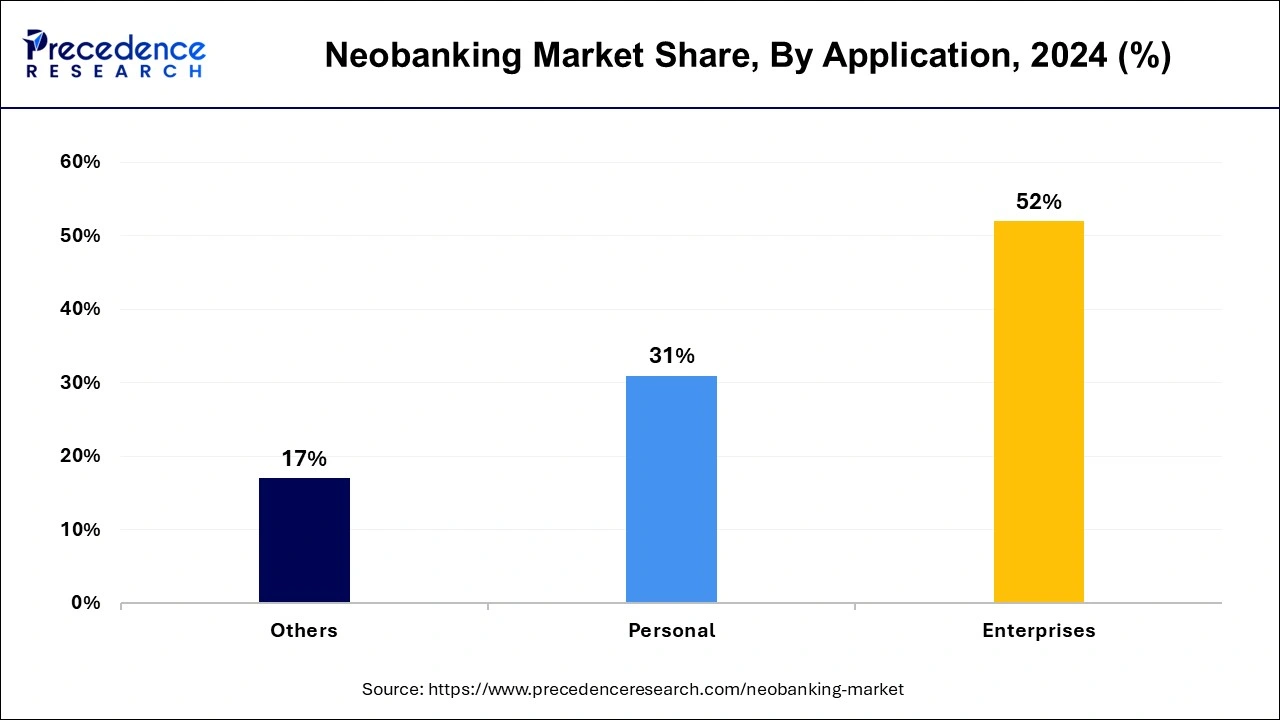

The enterprise segment dominated the neobanking market in 2024. The market for neo-banking has been growing quickly, and many businesses have entered it to take advantage of the rising demand for digital banking services. Revolut is a prominent neobanking platform that provides various financial services such as currency exchange, stock trading via its mobile app, and banking. The UK-based neobank Starling Bank is well-known for its innovative features, including in-app budgeting tools and real-time expenditure notifications, as well as its user-friendly mobile app. Tencent supports the Chinese neobank WeBank. It primarily uses digital channels to provide a variety of banking services, such as loans, wealth management, and microfinance.

The personal segment is expected to witness the fastest growth in the neobanking market. In the new banking sector, the term "personal segment" refers to the offering of banking services that are customized for individual customers. Neobanks—also referred to as challenger banks or digital banks—offer a variety of financial services exclusively online or through mobile apps, doing away with the necessity for physical branches. Peer-to-peer and bill-paying functions are among them, as is the option to send money abroad—often at a lower cost and with quicker processing times than with traditional banks. Some neobanks provide their clients with credit cards, overdraft protection, and personal loans despite being less prevalent than traditional banks. Neobanks normally give prompt assistance to resolve any problems or concerns using digital channels, including live chat, email, or phone support.

By Account Type

By Application

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client