September 2024

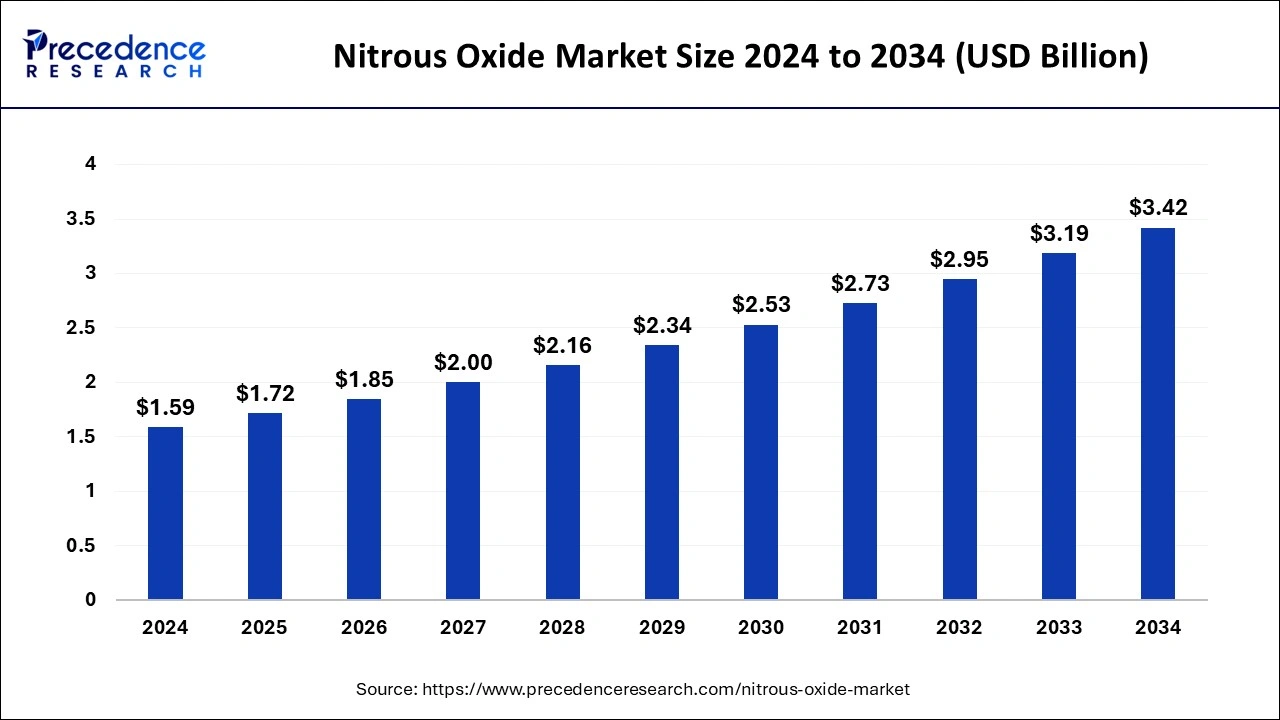

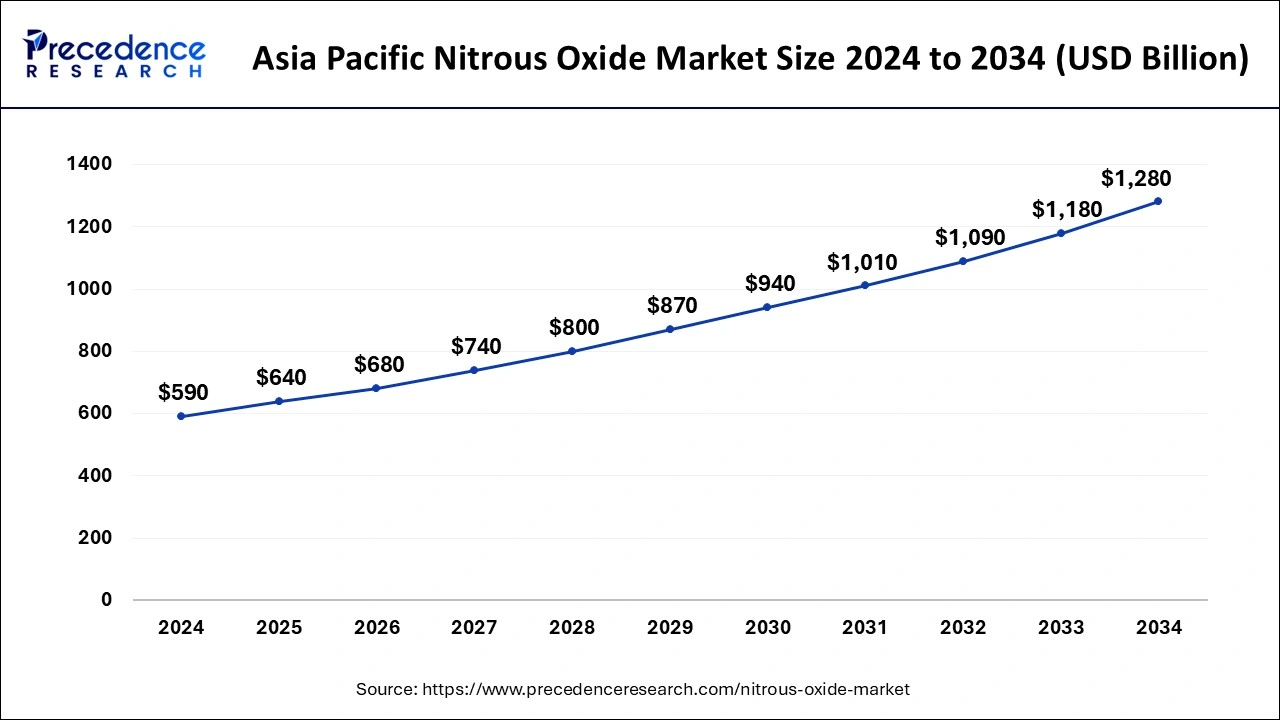

The global nitrous oxide market size is calculated at USD 1.72 billion in 2025 and is forecasted to reach around USD 3.42 billion by 2034, accelerating at a CAGR of 7.96% from 2025 to 2034. The Asia Pacific nitrous oxide market size accounted for USD 640 million in 2025 and is expanding at a CAGR of 8.05% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nitrous oxide market size was estimated at USD 1.59 billion in 2024 and is predicted to increase from USD 1.72 billion in 2025 to approximately USD 3.42 billion by 2034, expanding at a CAGR of 7.96% from 2025 to 2034.

The Asia Pacific nitrous oxide market size was valued at USD 590 million in 2024 and is predicted to be worth around USD 1,280 million by 2034, rising at a CAGR of 8.05% from 2025 to 2034.

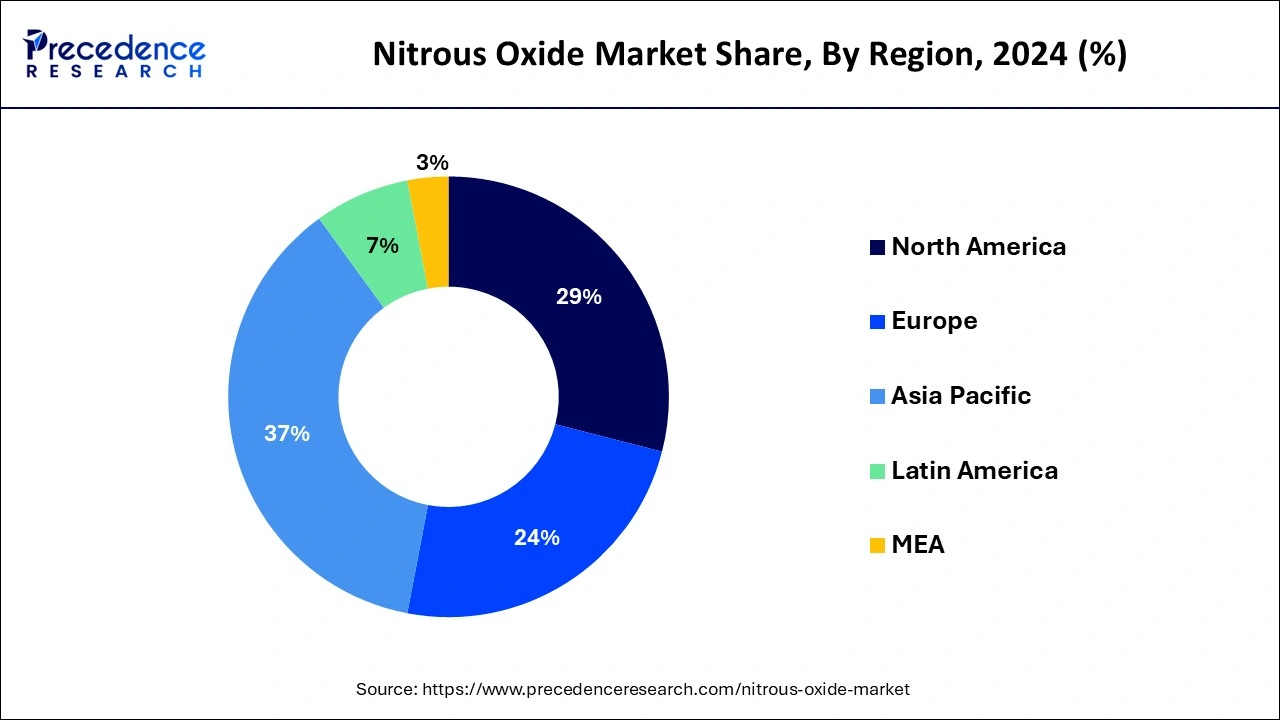

Asia-Pacific dominated the nitrous oxide market with the largest market share of 37% in 2024 driven by its extensive use in the medical sector. As healthcare infrastructure continues to develop, there is a growing need for anesthetics in medical procedures and surgeries. The automotive sector, particularly in countries with a strong motorsports culture, contributes to the demand for nitrous oxide. The use of nitrous oxide for performance enhancement in racing and recreational vehicles has gained popularity in certain markets within the Asia-Pacific region.

Additionally, economic growth in countries like China, India, Japan, and others has led to increased disposable income, influencing consumer behavior. This, in turn, may impact the demand for recreational activities, including those involving nitrous oxide. Howeover, growing environmental awareness may also impact the nitrous oxide market in the Asia-Pacific region, with increasing emphasis on sustainable practices and eco-friendly alternatives.

North America is poised for rapid growth in the nitrous oxide market due to diverse applications across various industries. Nitrous oxide is widely used in the medical field as an anesthetic during surgeries and dental procedures. The well-established healthcare infrastructure in North America contributes to the consistent demand for nitrous oxide in medical applications. Compliance with safety and environmental regulations is crucial in the nitrous oxide market. The regulatory landscape varies across North American countries, and market participants need to adhere to standards to ensure the safe production, distribution, and use of nitrous oxide.

Europe is growing at a notable rate in the nitrous oxide market. Nitrous oxide is employed as a propellant in the food and beverage industry, especially in the production of whipped cream. The region's culinary traditions and the demand for high-quality food items contribute to the use of nitrous oxide. Nitrous oxide may find applications in various industrial processes, including manufacturing, electronics production, and research. Its unique properties make it suitable for specific applications within these sectors. Furthermore, ongoing research and innovation in nitrous oxide production processes and applications contribute to market growth and create opportunities for manufacturers and suppliers.

The nitrous oxide market consists of the production, distribution, and consumption of nitrous oxide, a colorless and odorless gas with the chemical formula N2O. Nitrous oxide is commonly known as laughing gas and is used for various purposes, including medical applications such as anesthesia, as a propellant in whipped cream dispensers, and in the automotive industry for enhancing engine performance. The production of nitrous oxide involves industrial processes, and companies or facilities may be engaged in manufacturing and refining it. These processes may include the synthesis of nitrous oxide as a byproduct of chemical manufacturing. The market consists various trends such as technological advancements in production methods, changes in demand due to evolving applications, and shifts in consumer preferences. Environmental concerns and regulations regarding the impact of nitrous oxide emissions on the atmosphere may also influence the market.

Nitrous Oxide Market Data and Statistics

| Report Coverage | Details |

| Market Size by 2034 | USD 3.42 Billion |

| Market Size in 2024 | USD 1.59 Billion |

| Market Size in 2025 | USD 1.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.96% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Ongoing advancements in medical technologies

Ongoing advancements in medical technologies are significantly driving the demand for the nitrous oxide market. As medical practices continue to evolve, the versatile applications of nitrous oxide as an anesthetic agent in various medical procedures are becoming increasingly vital. The demand for minimally invasive surgeries and dental procedures, coupled with the emphasis on patient comfort, has led to a growing reliance on nitrous oxide for its sedative and analgesic properties. Advanced medical technologies, including improved delivery systems and precise monitoring equipment, enhance the safety and efficacy of nitrous oxide administration. The gas's quick onset and offset of action make it particularly valuable for procedures where rapid adjustments are crucial.

Furthermore, ongoing research and development initiatives focus on refining nitrous oxide formulations, optimizing dosage control, and exploring novel medical applications. The expansion of healthcare infrastructure, especially in emerging markets, further amplifies the demand for nitrous oxide. As medical facilities upgrade their capabilities, the need for reliable and efficient anesthetic options, such as nitrous oxide, continues to rise. This trend aligns with the broader objective of improving patient outcomes and overall healthcare experiences. Overall, the symbiotic relationship between ongoing medical advancements and the demand for nitrous oxide underscores its pivotal role in contemporary healthcare practices.

Environmental concerns

Environmental concerns pose a significant restraint on the demand for the nitrous oxide market. Nitrous oxide, though widely used for its anesthetic and performance-enhancing properties, is also recognized as a potent greenhouse gas with a significant impact on climate change. The emission of nitrous oxide into the atmosphere contributes to global warming and depletion of the ozone layer, making it a focus of environmental scrutiny. Increasing awareness of the environmental implications of nitrous oxide use has led to calls for more sustainable alternatives in various industries. Stricter regulations and emission reduction targets set by governments and international bodies further intensify the pressure on industries to mitigate their carbon footprint, potentially impacting the acceptance of nitrous oxide in certain applications.

Efforts to address these environmental concerns include research into alternative propellants in the food industry and exploring eco-friendly anesthetic options in healthcare. Companies are also investing in technologies to capture and reduce nitrous oxide emissions during production processes. However, until these alternatives become widespread and cost-effective, the environmental impact of nitrous oxide may continue to restrain its demand, particularly in regions where environmental regulations are stringent and sustainability considerations play a central role in decision-making.

Innovations in nitrous oxide production

Innovations in nitrous oxide production are fostering promising opportunities within the market. Ongoing research and development initiatives are focused on enhancing production processes to make them more efficient, cost-effective, and environmentally sustainable. These innovations not only contribute to the overall quality of nitrous oxide but also open doors to new applications and market expansion. Technological advancements in production methods are aimed at optimizing resource utilization and minimizing environmental impact. Improved catalysts, novel reaction pathways, and advanced purification techniques are some of the key areas of innovation. These developments lead to increased production efficiency, ensuring a stable and reliable supply of nitrous oxide to meet growing demands across various industries.

Furthermore, innovations in production technologies often go hand-in-hand with sustainability efforts. Companies are exploring cleaner and greener manufacturing processes, aligning with the global push towards eco-friendly practices. Such initiatives not only address environmental concerns but also position nitrous oxide as a more socially responsible choice within the marketplace. As the industry continues to invest in cutting-edge production techniques, the opportunities for market growth are substantial.

The medical segment held the largest share of the nitrous oxide market in 2024. In the medical field, nitrous oxide serves as a valuable anesthetic during surgical and dental procedures. Known for its analgesic properties, it provides sedation to patients while allowing for quick recovery post-administration. The medical segment is a major consumer of high-purity nitrous oxide for its crucial role in pain management.

The automotive segment is expected to generate a notable revenue share in the market. Nitrous oxide is widely utilized in the automotive industry for its role as an oxidizer, enhancing engine performance. Commonly employed in racing and high-performance vehicles, nitrous oxide injection systems contribute to increased horsepower and torque, making it a popular choice among automotive enthusiasts.

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2025

July 2024