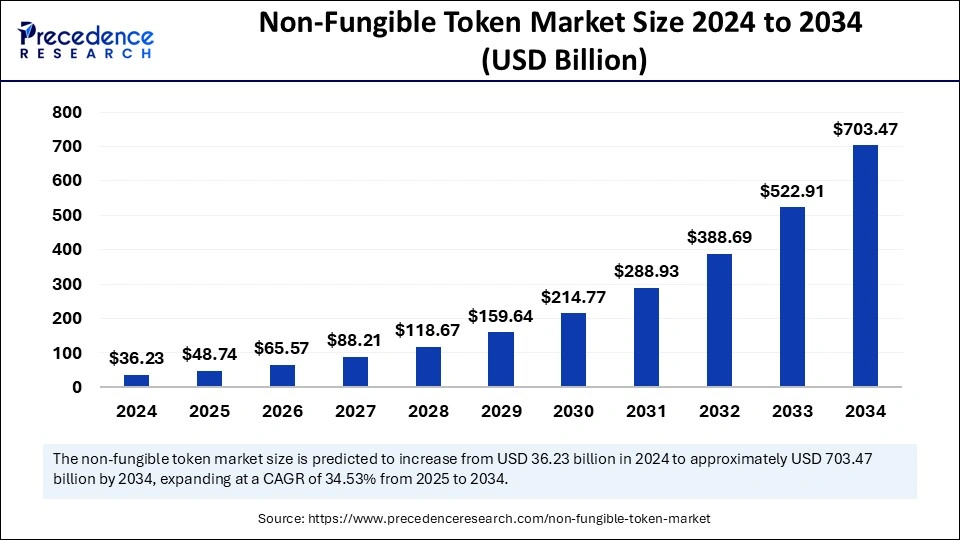

The global non-fungible token market size is calculated at USD 48.74 billion in 2025 and is forecasted to reach around USD 703.47 billion by 2034, accelerating at a CAGR of 34.53% from 2025 to 2034. The North America market size surpassed USD 11.59 billion in 2024 and is expanding at a CAGR of 34.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global non-fungible token market size accounted for USD 36.23 billion in 2024 and is predicted to increase from USD 48.74 billion in 2025 to approximately USD 703.47 billion by 2034, expanding at a CAGR of 34.53% from 2025 to 2034. The market is growing due to the increasing adoption of non-fungible token in digital art, gaming, and collectibles.

Artificial intelligence (AI) is significantly enhancing NFT experiences. Intelligent algorithms are being used to produce original music, artwork, and digital collectibles, allowing artists to push the limits of their creativity. Even non-traditional artists can now create unique pieces due to AI, creating new opportunities for creativity and personalization. Beyond creation, machine learning (ML) and AI help with targeted marketing and promotion of NFTs, allowing people to buy and sell NFTs more effectively. Moreover, AI analyzes data about past NFT sales and current market trends. This probably enhances the NFT experience. Platforms such as Art Blocks and Alethea AI are leading this movement by providing responsive and generative NFTs that are capable of learning and adapting over time.

Incorporating intelligent systems is also changing the way that NFTs are marketed, consumed, and curated. By recommending pertinent digital resources based on user preferences and behavior, AI enhances user experiences. This personalization aids collectors in finding specialized content. AI is also helping to optimize metadata, which improves the way NFTs are tagged, categorized, and indexed for easier platform discoverability. These developments are simplifying the NFT ecosystem and increasing its usability and scalability.

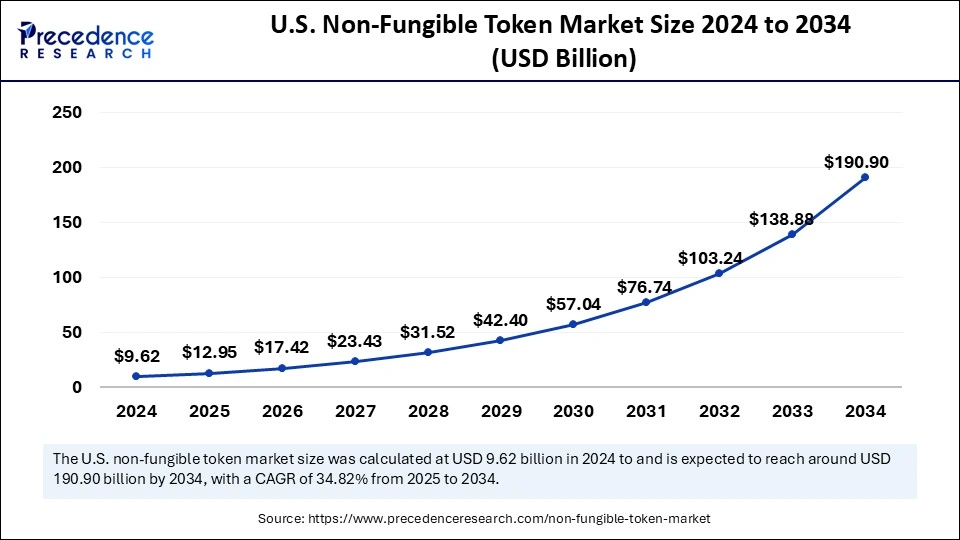

The U.S. non-fungible token market size was exhibited at USD 9.62 billion in 2024 and is projected to be worth around USD 190.90 billion by 2034, growing at a CAGR of 34.82% from 2025 to 2034.

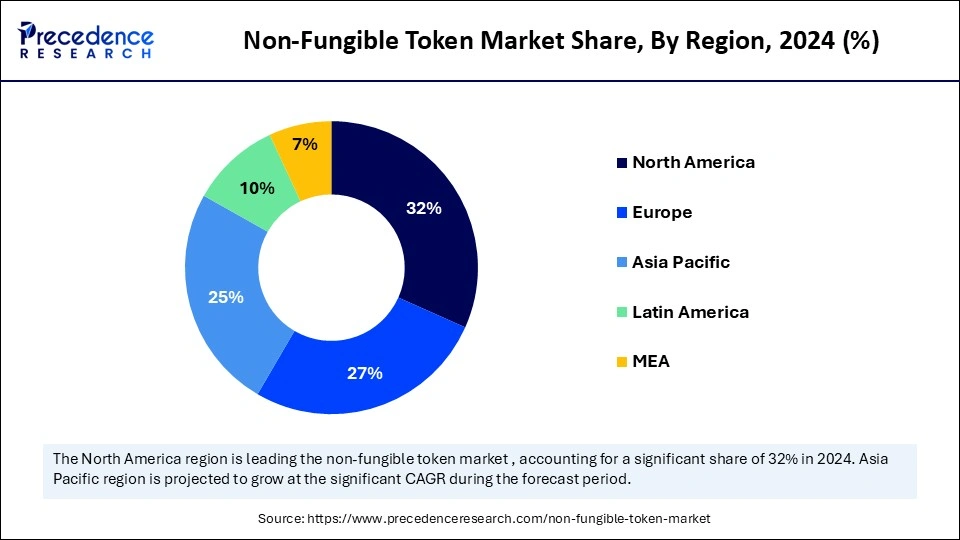

North America dominated the non-fungible token market with the largest share in 2024. This is mainly due to its developed digital economy, widespread knowledge of blockchain technology, and robust investor activities. NFTs have become more widely accepted due to the existence of well-known NFT platforms, venture capital backing, and media coverage. Customers in the region follow trends quickly, and companies are actively experimenting with NFT integrations. North America continues to lead the way in NFT innovation due to its digital ecosystem. Additionally, the region boasts a strong legal framework that supports digital assets, which gives investors more assurance.

Asia Pacific is expected to grow at the fastest rate during the forecast period. This is mainly due to the rising participation of customers in utility-based projects, art, and NFT gaming. This increase is driven by tech-savvy populace and robust mobile-first economies. Companies in the region are also using NFTs for digital identity and customer loyalty. Through creative Web3 startups and partnerships, NFTs are becoming more widely available and pertinent. Many users are being drawn to community-driven platforms and play-to-learn games. Additionally, localized platforms and educational campaigns are making it easier to onboard new users.

Europe is observed to grow at a considerable growth rate in the upcoming period. There is a high demand for NFTs to bring innovations and creativity. NFTs in art, fashion, and digital collectibles are of great interest to European users. Luxury brands and cultural institutions are investigating NFTs to improve digital storytelling and brand interaction. Europe is continuing to establish a leading position in the global market by emphasizing quality ethics and long-term value. Regulatory organizations are actively forming NFT usage frameworks to foster openness and confidence. In addition, Europe has a long and rich history of art and culture, supporting the growth of the European non-fungible token market.

The non-fungible token market is experiencing rapid growth due to the increasing interest in digital ownership in the fields of virtual real estate, gaming, music, art, and collectibles. Through the use of blockchain technology, NFTs provide a transparent and safe means of confirming authenticity and ownership, removing duplication and guaranteeing security. NFT has revolutionized the production, distribution, and consumption of digital content. The NFT ecosystem keeps developing as user awareness rises and new use cases appear.

Recently, Nike has taken a significant step in the NFT space by acquiring RTFKT Studios, a digital fashion and NFT brand. Through these acquisitions, Nike has launched virtual sneakers and collectible wearables. One of their successful drops, Crypto Kicks, allowed users to customize digital sneakers linked to unique NFT tokens. This move not only positions Nike as a pioneer in digital fashion but also showcases how established brands are leveraging NFTs to engage with younger, tech-savvy audiences in immersive virtual environments.

| Report Coverage | Details |

| Market Size by 2034 | USD 703.47 Billion |

| Market Size in 2025 | USD 48.74 Billion |

| Market Size in 2024 | USD 36.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 34.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Digital Ownership

As the world is quickly shifting to digital-first experiences, people are now seeking ways to exchange and display digital goods by themselves. NFTs have made it possible by granting substantiated ownership of virtual goods, music, art, and videos. The demand for digital collectibles and assets is rising as more people spend time on online platforms like social media, gaming, and virtual reality. This trend is especially noticeable among younger generations, who value individuality, digital identity, and community more. Users can express their uniqueness and establish their digital persona through exclusive ownership of NFTs.

Play-to-Earn and GameFi Ecosystems

With the popularity of blockchain-based gaming, a new economic model has emerged, allowing players to make real money with NFTs. Users can breed, trade, or use their NFTs as digital pets in games like Axie Infinity to earn rewards. Users in developing nations are particularly drawn to this play-to-earn model because it offers a reliable source of income. A significant change from conventional gaming models, where items are locked within a single ecosystem, to NFTs that offer true ownership of in-game assets is further boosting the growth of the non-fungible token market. Participation and investment are further encouraged by the incorporation of DeFi components into gaming.

Market Volatility and Speculations

NFT prices can fluctuate significantly due to the limited supply, high demand, hype, speculation, and influencer activities. This type of speculation leads to inflated valuations of assets that are not justified by their actual utility and demand. Investors suffer financial losses as many NFTs become unsellable once the hype subsides. Trust in NFTs as long-term assets is weakened by this unpredictability. Because of this uncertainty, institutional investors who are looking for steady returns frequently avoid portfolios that contain a lot of NFTs, limiting the growth of the non-fungible token market.

Scams, Fraud, and Security Risks

Since NFTs are anonymous and decentralized, scams like rug pulls and listings for fake artwork have become common. Numerous users have lost money because of malware or phishing links. The irreversible nature of blockchain makes it nearly impossible to recover NFTs once they have been stolen. In addition to hurting individuals, scams also harm the ecosystem's reputation as a whole. Although platforms are spending money on security tools, mass users still lack awareness and vigilance.

Expansion into Gaming and Metaverse

NFTs enable players to own, trade, and profit from their game assets. They have a lot of potential in the gaming sector. These resources can be anything from virtual land to skins and weapons, providing a feeling of security and investment in virtual marketplaces. Axie Infinity and the Sandbox are two blockchain-based games that have already demonstrated how NFTs can produce enormous user engagement and income. NFTs will be essential to identify asset ownership and cross-platform interoperability as the metaverse expands. Users can now effortlessly move their digital assets between platforms due to NFT. Additionally, it promotes decentralized governance and community-driven development. Virtual economies may soon make it more difficult to distinguish between digital and real financial systems. This is a very promising frontier, as major tech companies are already investing in it.

Brand Engagement and Loyalty Programs

As digital collectibles, coupons, or membership passes, NFTs can be incorporated into customer loyalty programs. Major brands like Nike, Coca-Cola, and Starbucks have started NFT campaigns to connect with younger tech-savvy consumers. Through exclusive experience and limited edition drops, such campaigns not only improve customer interaction but also open new revenue streams. Additionally, NFTs provide transparency and traceability in campaigns, which increases customer trust. With the help of digital badges and gated content, loyal customers feel more appreciated and involved. In addition, these tokens can unlock tangible advantages like discounts or event access. Brands can gain a deeper understanding of consumer behavior by utilizing data from NFT engagement. In general, own-way marketing is being replaced by interactive community-driven branding thanks to NFTs.

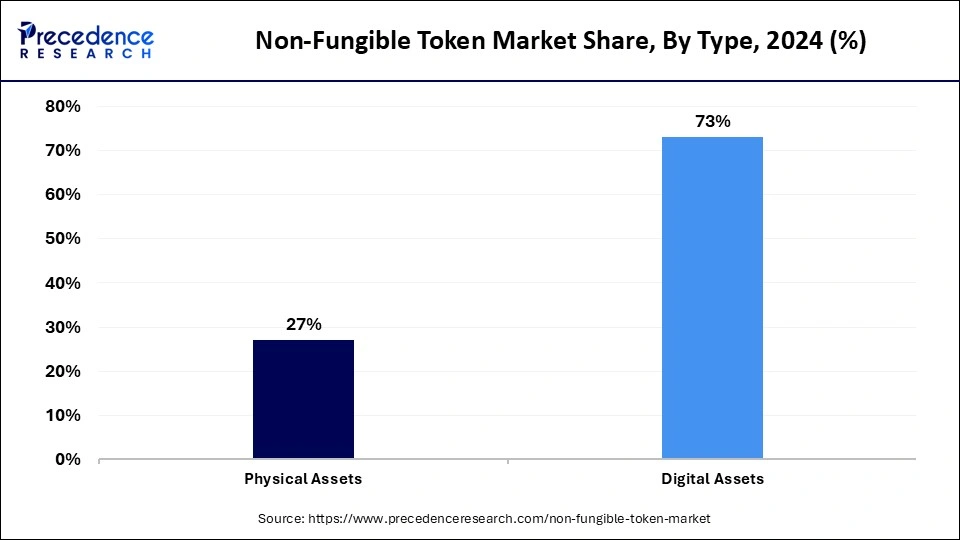

The digital assets segment led the non-fungible token market with the largest share in 2024. This is mainly due to the rise in the popularity of digital assets such as digital art, collectibles, gaming products, and virtual real estate. Because these assets are so simple to create, store, and transfer, both creators and collectors can now easily access them. Additionally, digital assets enable immediate ownership verification via blockchain, fostering transparency and trust. The rising emphasis on digital formats by major platforms and marketplaces like Rarible and OpenSea is expected to maintain the segment’s position in the NFT ecosystem.

The physical assets segment is expected to expand at the highest CAGR during the assessment years. NFTs create a bridge between the real and virtual worlds and present a new opportunity for both collectors and investors. The segment growth can be attributed to the rising consumer demand for high-value products, authenticity, ownership proof, and traceability. To give customers unique benefits or experiences, brands and artists are experimenting with fusing physical goods with NFTs. The future of the market is anticipated to be significantly shaped by physical NFTs. The rising demand for physical assets such as vehicles and paintings further supports segmental growth.

The collectibles segment held the largest share of the non-fungible token market in 2024. The most widely used NFTs have been in the collectibles segments, which include everything from digital trading cards to virtual game items and celebrity memorabilia. These products appeal to a wide range of consumers due to their emotional value, individuality, and community involvement. Mass adoption, particularly among younger demographics, has been fueled by initiatives like NBA Top Shot and other NFTs with pop culture themes. The market remains vibrant and active because collectibles are also simple to trade and frequently offer benefits like early access or limited edition drops. Their allure is rooted in exclusivity, nostalgia, and the excitement of digital ownership. NBA Top Shot sells officially licensed basketball highlight clips as tradable NFT collectibles.

The art segment is expected to grow at the fastest rate in the coming years. With the help of NFTs, digital artists can now sell their work directly to consumers worldwide, guaranteeing authenticity and resale royalties. This democratization has spurred a creative explosion that has drawn well-known artists as well as up-and-coming talent. The emergence of art-focused marketplaces such as Foundation, SuperRare, and Known Origin. The art-maker keeps expanding quickly as more creators experiment with the medium and more buyers recognize its lasting worth.

The personal end-use segment dominated the non-fungible token market with the largest share in 2024. Individuals today buy the majority of NFTs for investment, collection, or personal ownership. A personal NFT holder can display their ownership online, participate in communities centered around particular projects, or just hold assets in the hopes of appreciation. Personal use is now the most common due to the simplicity of purchases made through user-friendly platforms and wallets. The combination of individual ownership, creativity, and identity in the digital sphere makes this market so successful. Individuals can now buy Bored Ape Yacht Club NFTs to use as profile pictures and gain access to exclusive communities.

The commercial segment is expected to grow at the fastest rate in the upcoming period. The growth of the segment can be driven by marketing loyalty programs, ticketing IP protection, and product authenticity businesses that are heavily using NFTs. Brands are using NFTs to provide distinctive experiences and foster deeper customer engagement. Additionally, businesses are investigating NFTs for licensing solutions, digital products, and supply chain tracking. An increasing number of industries utilizing NFTs further support segmental growth. Recently, Starbucks launched NFT-based loyalty reward program through its Odyssey Web3 to enhance customer engagement.

By Type

By Application

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client