April 2025

Non-Oncology Precision Medicine Market (By Product: Diagnostics, Therapeutics; By Application: Oncology, CNS, Immunology, Respiratory, Infectious Diseases, Neurology, Others; By End-use: Hospitals, Diagnostic Centers, Research & Academic Institutes, Others; By Ecosystem: Applied Sciences, Precision Diagnostics, Precision Therapeutics, Digital Health and Information Technology) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024 – 2034

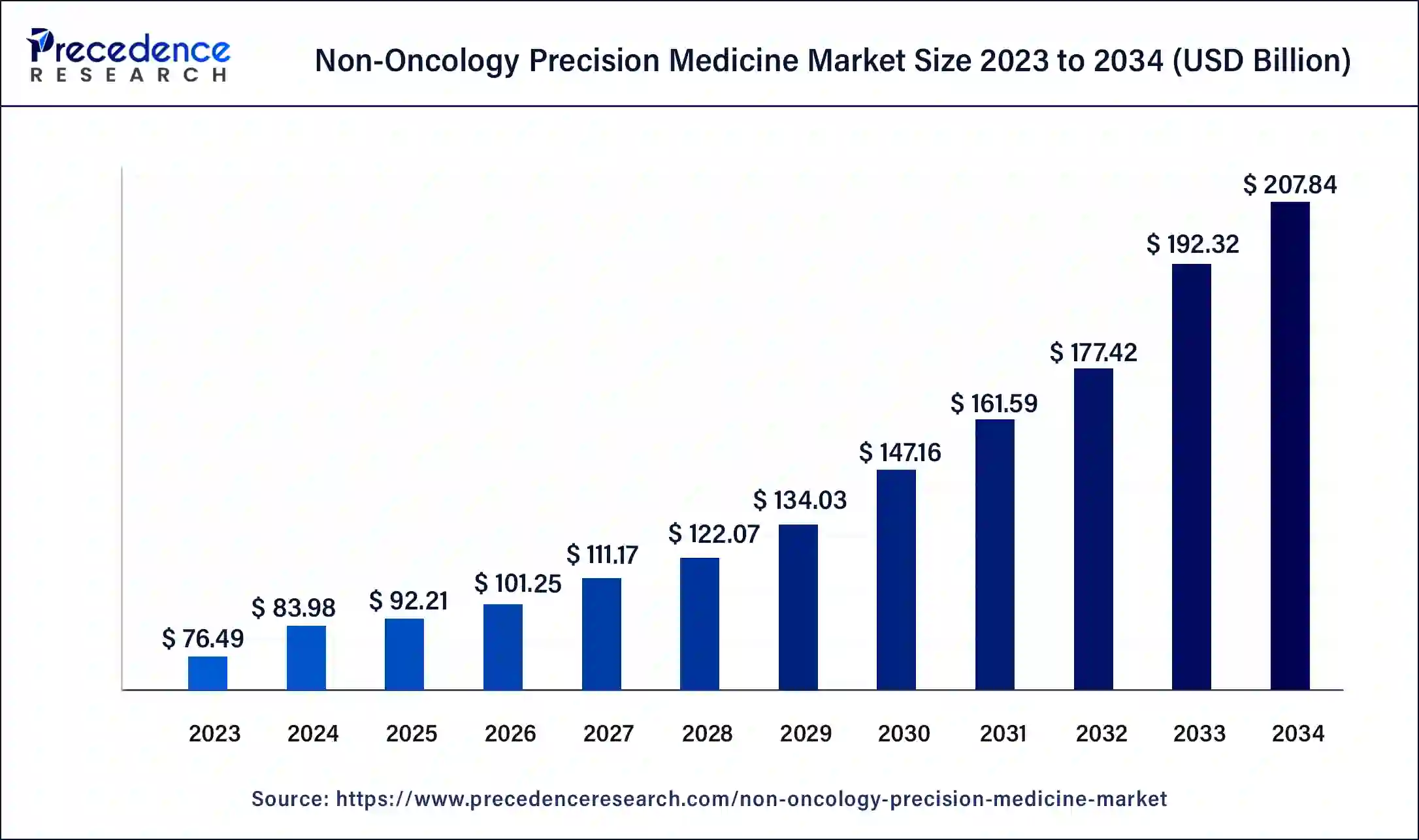

The global non-oncology precision medicine market size was USD 76.49 billion in 2023, calculated at USD 83.98 billion in 2024 and is expected to reach around USD 207.84 billion by 2034, expanding at a CAGR of 9.5% from 2024 to 2034.

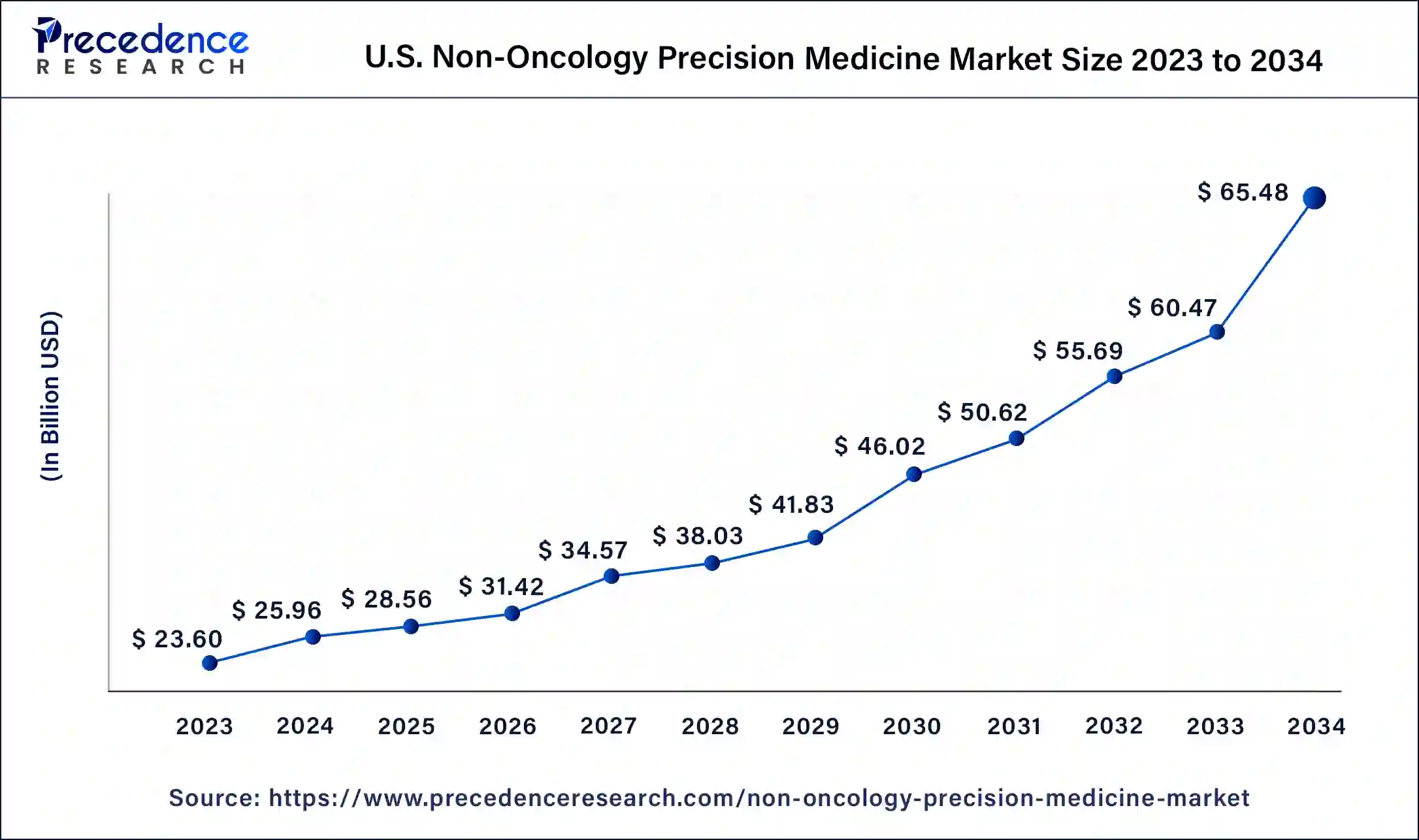

The U.S. non-oncology precision medicine market size surpassed USD 21.46 billion in 2023 and is predicted to be worth around USD 65.48 billion by 2034, expanding at a CAGR of 9.69% from 2024 to 2034.

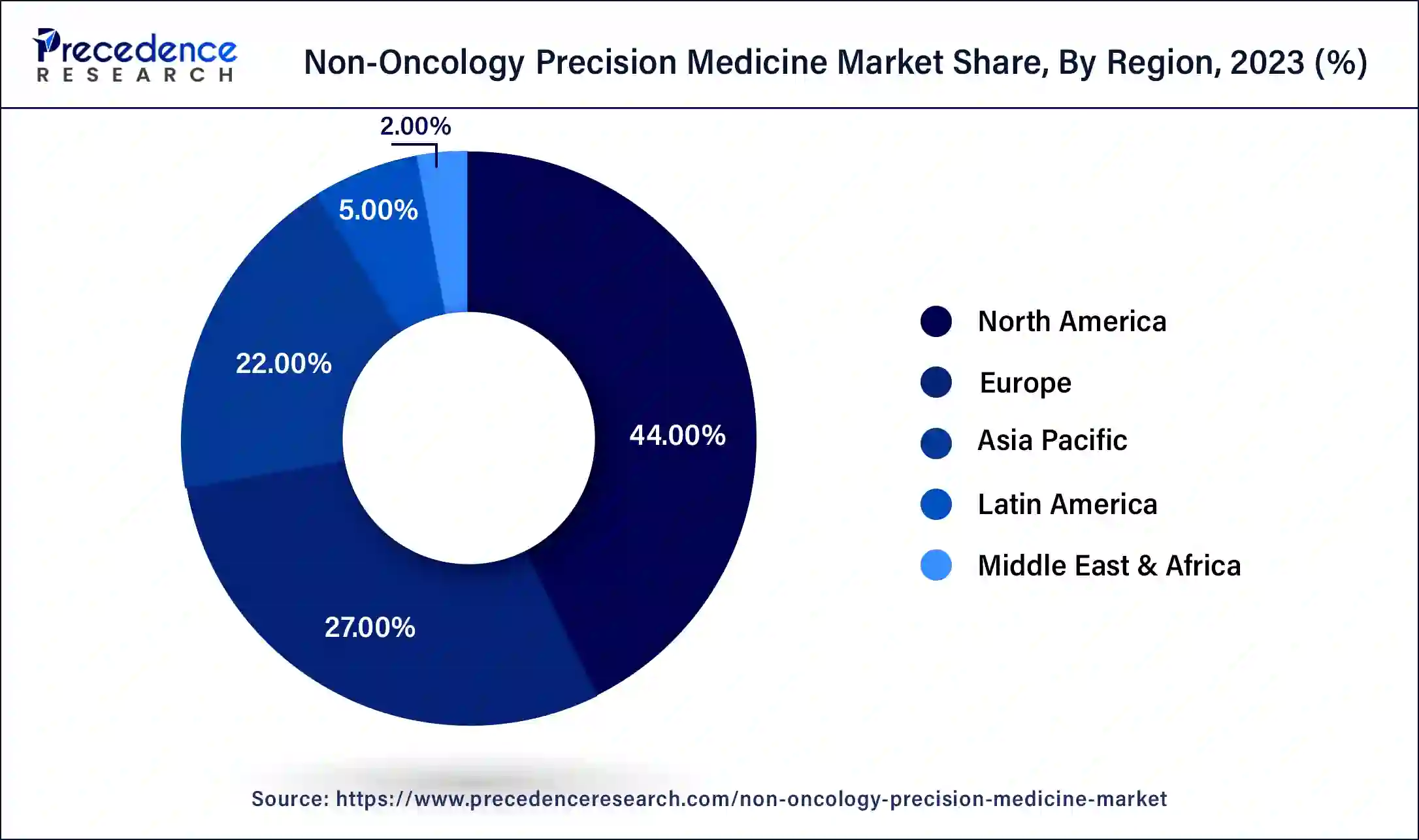

Developing reception of non-oncology precision medicine approaches in the North American district will upgrade the market esteem. North American non-oncology precision medicine market represented 44% of income share in 2022 attributable to the rising commonness of malignant growth and hereditary problems, developing utilization of non-oncology precision medicine approaches, and the presence of noticeable organizations like Pfizer, Qiagen, Quest Diagnostics, and Roche. The locale is supposed to proceed with its strength during the conjecture time frame. This development can be ascribed to the high reception pace of medical care IT frameworks in clinical work processes and cutting-edge sequencing advancements, which help create customized and pharmacogenomic information effectively and proficiently.

In the Asia Pacific, the market is supposed to develop quickly over the estimated period. This is essentially attributable to the minimal expense related to leading clinical preliminaries of recently evolved non-oncology precision medicines and diagnostics around here, which draws in unfamiliar interests here.

Likewise, great government drives to embrace customized medical services arrangements are further adding to showcase development in the district. For example, in Singapore, the National Precision Medicine program and the Three Beyonds program were sent off for advancing the take-up of innovations and computerized foundation for supporting customized medical services. The use of customized arrangements has the degree of creating explicit treatment answers for various patients because of the particular immuno-aggregate of the patient. Henceforth, approaches hold a promising answer for distinguishing hereditary, organic, and natural factors that could influence the antibody reaction and propose the elective measurement expected by a specific populace bunch.

Headways in disease biologics will drive the development of non-oncology precision medicine. Improvement of fresher therapeutics approaches including quality treatment for disease treatment and expanding number of patients going through prescient analysis will push the market development. Then again, significant expense and expected danger to individual wellbeing information are a portion of the variables that might defeat the market development.

There have been critical improvements in the market somewhat recently. The quantity of organizations, government, and private examination establishments associated with the business has been consistently developing. Constant and untiring endeavors of researchers in surveying the human genome and distinguishing genomic biomarkers have been productive. Additionally, government drives play likewise had a significant impact being the development of the market.

Right now, the market is overwhelmed by non-oncology drugs. In any case, expanded R&D exercises for different illnesses are projected to build the number of medications for cardiovascular, irresistible, and neurological sicknesses among others. The quantity of non-oncology accuracy medication drugs is anticipated to develop dramatically, and the consistent extension of the non-oncology accuracy medication portfolio will drive the business development.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,370.84 Billion |

| Market Size in 2023 | USD 871.04 Billion |

| Market Size in 2024 | USD 954.05 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.53% |

| Largest Market | North America |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, End-use, Ecosystem, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A Glance at Chronic Diseases

The most common chronic disorders include high cholesterol, depression, hypertension, chronic obstructive pulmonary disease, diabetes, epilepsy, chronic kidney disorder, ischemic/coronary heart disease, heart failure, arthritis, and Alzheimer’s disease and dementia. These common disorders affect millions of individuals globally. As per the reports of World Health Organization (WHO), approximately 50 million or more are suffering from dementia, and the same number of individuals are fighting epilepsy. From these cases of dementia, about 60 % to 70% are the case of Alzheimer’s. Prominent players like Novartis AG and Pfizer are advancing therapies for the procedures of numerous nervous system diseases. The increasing concentration on a few therapies and the advancement of precision medicines for the populace impacted with chronic diseases is anticipated to bolster the extension of this sector.

Evolution of Precision Medicines

The global precision medicine industry has shown a notorious advancements in the last decade. All the organizations, academic and research institutes, and governments included in this sector have shown a steady growth. Various scientists constantly working on the development of these medicines got fruitful results in the studies of human genome and establishing genomic biomarkers. Several governments have also showed their presence in these developments in the form of launching various initiatives. For example, Barack Obama, the president of the U.S. announced the launch of an initiative named “Precision Medicine Initiative” in the year 2015. The purpose of this initiative was to create national research compliance of over 1 million Americans who contribute their inherited information as a means of their support to establish novel ways of enhancing the identification of the disorder and its treatment. These efforts resulted in the more number of drugs getting approval for the precision medicines.

The precision medicines accessible based on the numbers in the market was only 5 in the year 2005. This single digit grew to 81 in the year 2012. In 2016, the number of precision medicines available in the market were 132. As per the data collected for 2020, around 286 drugs are readily available in the market and there are many such drugs are in datebook. Cancer drugs are influencing the market at present. However, research and development (R&D) activities for the disorders like infectious, cardiovascular, neurovascular, and others are burgeoning, which in turn is expected to propel the number of drugs present in the market. The portfolio of these medicines is constantly expanding which is going to augment the growth of this industry.

The rising number of non-oncology precision medicine treatments will support the market movement

The therapeutics section in the non-oncology precision medicine market is scheduled to observe a 11% development rate through 2032. There has been consistent development in non-oncology precision therapeutics for the designated therapy of conditions like a malignant growth, and hereditary infections. Besides, organizations are additionally engaged with the advancement of designated treatments for different signs including cardiovascular sicknesses, irresistible infections, and gastroenterology among others. The advancement of novel medications and expanding utilization of medications in non-oncology precision medicine treatment plans will fuel the development of the therapeutics portion.

The rising pervasiveness of CNS issues overall will push the market interest. The CNS fragment caught over 15% of the portion of the overall industry in 2022. CNS problems such as Alzheimer's sickness, different sclerosis, epilepsy, and others influence a huge number of individuals across the world. As per the report of WHO, almost 50 million individuals overall have epilepsy. Above 50 million individuals experience the ill effects of dementia. Alzheimer's contributes to around 60-70% of these cases as it is the most considered normal type of dementia. Many organizations, for example, Pfizer and Novartis AG are associated with the advancement of designated treatments for the treatment of different sensory system problems. The developing spotlight on designated treatments and improvement of customized clinical treatment plans for individuals impacted with CNS problems will encourage the business extension.

Expanding mindfulness in regards to the significance of prescient diagnostics testing will drive the market income. The diagnostics centers portion is ready to extend at 14% CAGR through 2032 driven by the rising number of demonstratives focuses across the world. Headway in symptomatic methods and cutting-edge framework offering most ideal types of assistance to patient populace are a portion of the elements influencing the business movement. Furthermore, there has been development in mindfulness among the populace in regards to the significance of diagnostics. developingan interest in prescient indicative testing for disease, hereditary problems, and pneumonic issues among others will set out development open doors on the lookout.

Opportunities amid the Pandemic

The novel corona virus has had a significant impact on all the industries related to economy, growth, and physical and mental wellbeing of every populace. The purpose of every sector was to provide the best services with reference to safety and quality during this challenging period. The impact of the novel corona virus was the highest in the healthcare industry. However, this virus did not impact much on precision medicines. The outspread of the novel corona virus uplifted the demand for the technological developments, flexibility, and evolution of the non-oncology precision medicines. Rise in respiratory disorders at a quick rate is the propelling reason for the growth of the non-oncology precision medicines, as the same disorders need authentic drug procedure. A limelight has been brought by the novel corona virus in the markets of the non-oncology medicines. The novel corona virus did not have a straight effect on this market, but in return has offered lucrative opportunities for the advancement of these non-oncology precision medicines for numerous disorders like cardiovascular, among others.

Competitive Landscape

The global non-oncology precision medicine market appears to be extremely competitive in account of the various prominent players present in the market. Prominent players in this market are constantly focusing on increasing their product portfolio by expanding their applications or by filing the new ones for the molecules. A few other strategic moves like academic collaboration, acquisitions and mergers to get in popularized molecule or arranging methods is also expected to witness a significant impact on the current trends of the market. Key market players also focusing on the advancement of the available products to expand their footprints and progress their positions in the market across the globe. In addition, several products are getting approved, and in the race to increase the number of precision drugs, constant advancing activities and other strategic moves by the market key players is playing a vital role in the expansion of this industry in the years to come.The key market players are continually participated in different formative procedures like association, joint efforts, new item dispatches, and acquisitions to reinforce their market position and gain a piece of the pie.

Segments Covered in the Report

By Product Type

By Application

By End-use

By Ecosystem

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

November 2024

April 2025