January 2025

The global non-woven fabrics market size is calculated at USD 37.26 billion in 2025 and is forecasted to reach around USD 68.24 billion by 2034, accelerating at a CAGR of 6.92% from 2025 to 2034. The Asia Pacific non-woven fabrics market size surpassed USD 14.32 billion in 2024 and is expanding at a CAGR of 6.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global non-woven fabrics market was valued at USD 34.92 billion in 2024 and is expected to reach USD 68.24 billion by 2034 with a CAGR of 6.92% from 2025 to 2034.

The Asia Pacific non-woven fabrics market size was estimated at USD 14.32 billion in 2024 and is anticipated to reach around USD 27.98 billion by 2033, poised to grow at a CAGR of 6.95% from 2025 to 2034.

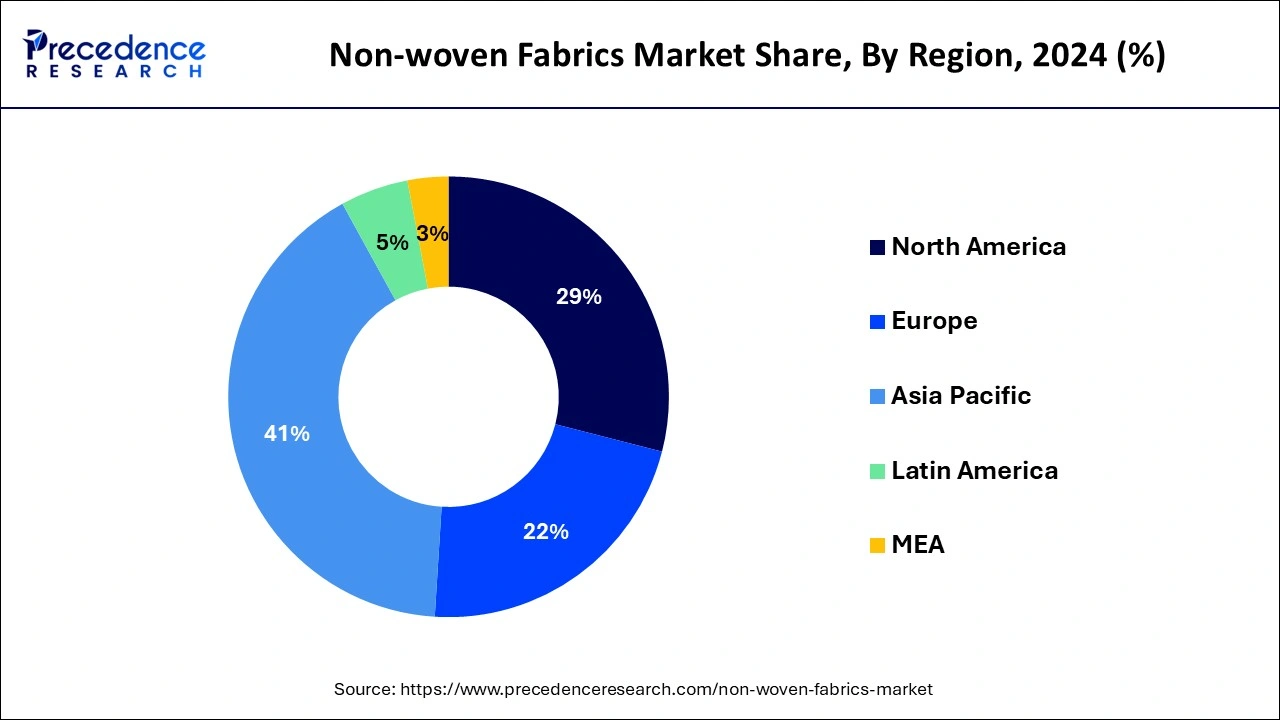

The Asia Pacific led the global nonwoven fabrics market with more than 41% volume share in the year 2024. The prominent growth of the region is mainly due to increasing birth rate along with ageing population in the region that requires extra attention towards their hygiene. In addition to this, by providing good education to youth along with stringent laws regarding birth detection in hospitals, the government in the region has targeted to stop the female infanticide that expected to improve the female to male ratio. This approach is further anticipated to propel the demand for female hygiene products in the region.

Moreover, increased spending towards construction activity in order to develop internal infrastructure in emerging economies such as China and India further projected to boost the demand for non-woven fabric in the region.

North America projected to register notable growth for the global nonwoven fabrics market on account of rising reconstruction activities for upgrading the infrastructure along with significant growth of the transportation sector. Besides this, maturity in the disposable nonwoven application in the region anticipated to hinder the market growth over upcoming years.

Rising awareness related to personal hygiene products that include sanitary napkins, baby diapers, and adult incontinence products along with the increasing population with age group above 60 years across the globe expected to be the key factor that drives the market growth for nonwoven fabrics over the analysis period. Moreover, flame resistance coupled with superior strechability offered by the product estimated to positively influence the market growth.

Nonwoven fabrics are prominently used in the road construction projects as geotextiles this enhances the durability of roads. Their increasing demand in the construction sector is mainly because of their low maintenance cost. Further, increasing construction activities across the predominantly across the developing countries expected to propel the demand for non-woven fabrics over the upcoming years.

Apart from the construction sector, positive growth outlook on automotive and transportation industry estimated to further influence the market growth for non-woven fabrics over the forecast timeframe. Non-woven fabrics are significantly used in the manufacturing of several interior as well as exterior parts of the automobile because of their moldability, durability, and light weight properties. In addition, the automotive industry predicted to grow notably with the increasing demand for electric and battery-powered passenger cars that again triggers the growth for non-woven fabric products in the industry.

| Report Highlights | Details |

| Market Size in 2025 | USD 37.26 Billion |

| Market Size by 2034 | USD 68.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.92% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Polypropylene emerged as the leading product segment across the global market and accounted for a volume share of more than 60% in 2024. Polypropylene products are extensively used by the industry participants because of their availability in different grades and properties that can be modified by using auxiliary chemicals and treatment processes.

Polyester expected to be the second largest product segment across the market and anticipated to register a steady growth rate during the upcoming years owing to their increasing penetration in applications such as agriculture, automotive, and medical & surgical equipment.

Carded Polyester fabric also estimated to register notable growth in the coming years because it offers higher stability along with superior internal bond strength due to uniformity in the fiber alignment. The aforementioned properties offered by the product projected to propel its demand particularly in the production of feminine hygiene pads, adult incontinence, infant diapers, and toddler training pants.

Durable application accounted for the major volume share in the global non-woven fabrics market with more than 50% of the market share in 2024 and expected to maintain the same trend during the upcoming years. Rising spending in the construction activities majorly in the developing countries such as China, India, and Brazil that has significantly triggered the demand for non-woven fabrics as geotextiles estimated to drive the demand for non-woven fabrics in durable application segment.

Apart from durable, disposable segment anticipated to witness substantial growth over the forthcoming years. The growth of the segment is mainly because of constant replacement of reusable medical non-woven fabrics with disposable fabrics in order to prevent contamination among patients. Further, rising population with age group more than 60 years along with high birth rate across various nations such as Japan, the U.S., Germany, Monaco, UK, China, and India expected to further thrive the market growth for disposable non-woven fabrics.

By Product

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

September 2024

March 2025