January 2025

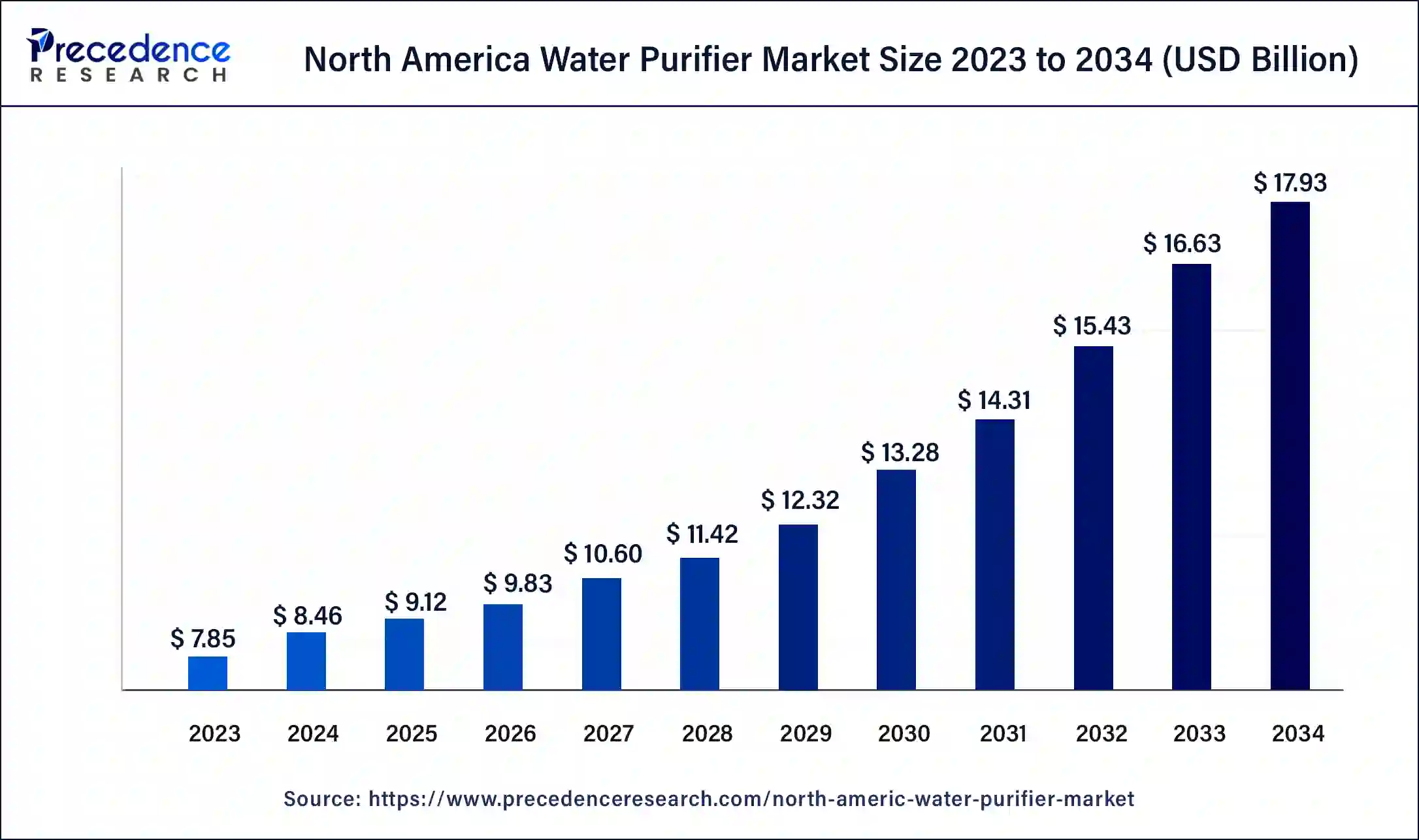

The North America water purifier market size was USD 7.85 billion in 2023, calculated at USD 8.46 billion in 2024 and is projected to surpass around USD 17.93 billion by 2034, expanding at a CAGR of 7.8% from 2024 to 2034.

The North America water purifier market size accounted for USD 8.46 billion in 2024 and is expected to be worth around USD 17.93 billion by 2034, at a CAGR of 7.8% from 2024 to 2034. The North America water purifier market is driven by growing worries regarding the purity of tap water.

In North America, water purifiers aim to guarantee that everyone has access to safe, clean drinking water. The need for home water filtration systems has been fueled by worries about water quality, including toxins like lead, chlorine, bacteria, and other pollutants, even though municipal water sources are usually dependable. For home and commercial usage, these systems seek to eliminate contaminants and enhance the water's general taste, odor, and quality.

A growing trend in water purifiers is the integration of smart features and networking. Customers are drawn to gadgets that offer real-time water quality data, filter replacement notifications, and customization capabilities, which can be remotely monitored and managed through mobile apps. Advertised water purifiers with health benefits like alkaline water or mineral improvement are becoming increasingly common as the emphasis on health and wellbeing grows. These devices promise to enhance nutritional value and purify water.

An increasing number of people use eco-friendly water purifiers that use sustainable materials and reduce water waste. Eco-aware customers are drawn to systems with reusable filters, energy-efficient operation, and minimal plastic packaging.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.8% |

| North America Market Size in 2023 | USD 7.85 Billion |

| North America Market Size in 2024 | USD 8.46 Billion |

| North America Market Size by 2034 | USD 17.93 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type and By End-user |

| Geography Covered | North America, U.S., Canada, and Mexico |

Concerns about water quality

Customers are becoming more aware of tainted water's possible health dangers. If ingested frequently, contaminants such as germs, viruses, pesticide residues, heavy metals (such as lead and mercury), and medication residues can present major health risks. To guarantee the security and caliber of their drinking water, people are searching for efficient water purifying options. The outdated infrastructure of many North American towns' water distribution systems raises questions about the purity of the water. Microbiological infections and heavy metals can seep into the water supply through older pipes. As a result, businesses and individuals are making proactive investments in water purifiers to prevent future problems with water quality brought on by aging infrastructure.

Increasing interest in the health benefits of clean water

Public alarm has been heightened by several studies and publications that show pollutants in municipal water sources. These studies frequently point out that extra filtering or purification steps must be taken to guarantee that water is safe to drink. Laws and standards also fuel the need for water purifiers the government sets about water purity. Even though municipal water treatment plants must adhere to strict regulations, people and companies are investing in extra water filtration systems due to worries about deteriorating infrastructure and possible gaps in water quality enforcement.

Stringent regulations by the Environmental Protection Agency (EPA) and other bodies

Manufacturers of water purification products need regulatory agency certifications and permissions before releasing them on the market. This entails providing thorough paperwork, carrying out testing in accordance with guidelines, and proving the product's safety and effectiveness. Difficulties or delays in gaining these approvals may hamper both product releases and market entry.

Growing adoption of smart home technology

Data on water quality, usage, and system performance are gathered and analyzed by smart water purifiers. This data-driven strategy offers producers and customers insightful information. Customers can better comprehend how much water they use and how it is being cleaned. Manufacturers can utilize this information to develop filtering technologies, create better products, and provide users with tailored recommendations. There are several ways in which smart water purifiers support environmental sustainability. These devices optimize the replacement and consumption of filters by using real-time usage data to cut down on waste and increase resource efficiency.

The RO water purifier segment dominated the North America water purifier market in 2023. Customers are becoming increasingly conscious of the health benefits of drinking clean, safe water. RO systems are renowned for their capacity to eliminate contaminants and potentially dangerous microbes, ensuring that the water is safe to drink. RO water purifiers are typically installed as point-of-use (POU) units attached straight to the water supply line or tap. With this configuration, filtered water is available whenever needed without storing huge amounts or relying on outside water sources. One of the factors fueling the need for RO purifiers is convenience.

The activated carbon filters segment is the fastest growing North America water purifier market during the forecast period. Different contaminants can be effectively removed from water using activated carbon filters. The material used in these filters is activated carbon, which has a lot of surface area and can absorb substances including pesticides, herbicides, chlorine, and volatile organic compounds (VOCs). Because they can target a variety of pollutants, activated carbon filters are a popular choice for both homes and businesses.

Customer knowledge of water quality and the health consequences of consuming contaminated water has significantly increased. The need for water purifiers that can consistently remove dangerous materials is rising. Consumers are looking for sustainable alternatives as their concerns about the effects of plastic waste from bottled water usage on the environment grow. Activated carbon filters ensure clean and safe drinking water while lessening the need for single-use plastic bottles, making them a greener option.

The residential segment dominated the North America water purifier market in 2023. Homes are seeking dependable ways to ensure their water is safe to drink due to growing worries about waterborne illnesses, pollution, and deteriorating infrastructure in some places. The need for domestic water purifiers has increased due to this increased awareness. Manufacturers are developing innovative filtration systems that are more economical, user-friendly, and efficient. These developments include sophisticated filtration methods, including ion exchange, activated carbon filtration, UV disinfection, and reverse osmosis (RO). These methods meet specific needs for removing contaminants and enhancing the quality of the water.

The commercial segment shows a significant growth in the North America water purifier market during the forecast period. In North America, safety requirements for business facilities and water quality are strictly regulated. Businesses and organizations are required to supply their staff, clients, patients, and guests with clean and safe drinking water. As a result, water purifiers' use to guarantee adherence to legal requirements has skyrocketed.

The increased focus on health and well-being has impacted organizational policies and consumer preferences. By making clean, pure drinking water available to all stakeholders, many businesses prioritize their health and well-being. This trend is especially noticeable in sectors such as corporate offices, hospitality, and healthcare.

U.S. has its largest market share in 2023 in the North America water purifier market. Consumers and companies are investing in dependable water purification solutions due to growing awareness of waterborne diseases, pollutants like lead and arsenic in water supplies, and environmental issues such as plastic pollution from bottled water. This increased worry drives market growth and sales. U.S. water quality and safety laws are so strict that water filtration systems must be installed in commercial, industrial, and residential settings. Adherence to regulatory requirements generates a steady demand for water purifiers, which favors revenue shares.

Almost 2 billion people, or 25% of the global population, do not have access to clean drinking water. To change that, researchers at the University of Texas at Austin have developed a brand-new, reasonably priced, portable water filtering system. The new setup uses a syringe to gather the contaminated water, which is injected into a hydrogel filter to remove almost all tiny particles.

Researchers claim that compared to current commercial choices, this technology offers significant cost, convenience, effectiveness, and sustainability advantages, making it simple for consumers to create drinkable water from adjacent streams and rivers.

Canada shows a significant growth in the North America water purifier market during the forecast period. Canadian consumers are becoming more conscious of the value of safe and clean drinking water. Water quality and health risks have increased due to pollutants in water sources, outdated infrastructure, and industrial pollution. Customers are, therefore, actively looking for dependable water purifiers to ensure they always have access to safe and clean drinking water, both at home and in public areas. As a result of this increased awareness, the need for water purifiers in Canada's residential, commercial, and industrial sectors has increased.

The Canadian government has established stricter laws and guidelines for the safety and purity of water. These rules, upheld by organizations like Environment and Climate Change Canada and Health Canada, require water treatment and purification procedures to adhere to predetermined guidelines.

Segments Covered in the Report

By Product Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

September 2024

October 2024