December 2024

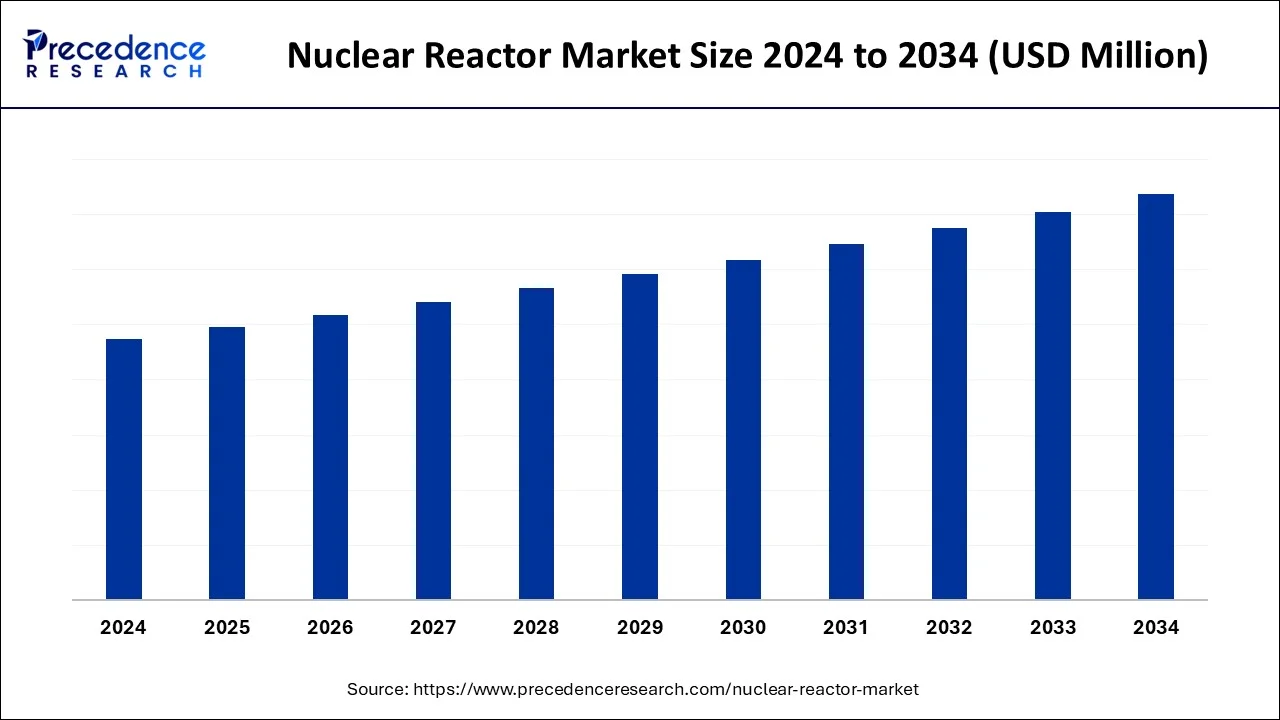

The global nuclear reactor market is surging, with an overall revenue growth expectation of hundreds of millions of dollars from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global nuclear reactor market will increase in the future years as more than countries turn to nuclear power for the generation of electricity. The nuclear reactor market growth is attributable to the development of nuclear power infrastructure.

The global nuclear reactor market will grow in the future years as more countries turn to nuclear power for the generation of electricity. According to the report published by the World Nuclear Association, nuclear power accounts for about 9% of the world's electricity from around 440 power reactors. Nuclear power taps on the generation of heat through atomic fission reactions, a process in which the nucleus of an atom is split to produce a tremendous amount of heat. This heat is used to make steam through heat exchangers where heat is used to turn the turbines and thus generate electricity.

Different types of reactors used in nuclear power stations are boiling water reactors (BWR), fast breeder reactors (FBR), pressurized heavy water reactors (PHWR), pressurized water reactors (PWR), and others. The global trend toward cutting CO2 emissions and improving energy security is expected to favor additional improvements in nuclear technology and, thus, market growth. Thus, the increasing reactor design investments and safety enhancements are expected to be key drivers in this growth.

The application of artificial intelligence (AI) brings immense progressive changes to the nuclear reactor market due to the optimization of their performance and reliable safety standards. Utilizing AI for predictive analysis, the reactor operators are positioned to predict when a reactor has become faulty or when it requires maintenance, hence cutting on time and costs spent on maintenance. Machine learning identifies the behavior of the reactor, detecting and predicting performance changes in real-time. The use of AI integration in nuclear reactors enhances the progress of next-generation nuclear reactors for improved energy production.

| Report Coverage | Details |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Equipment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for clean energy

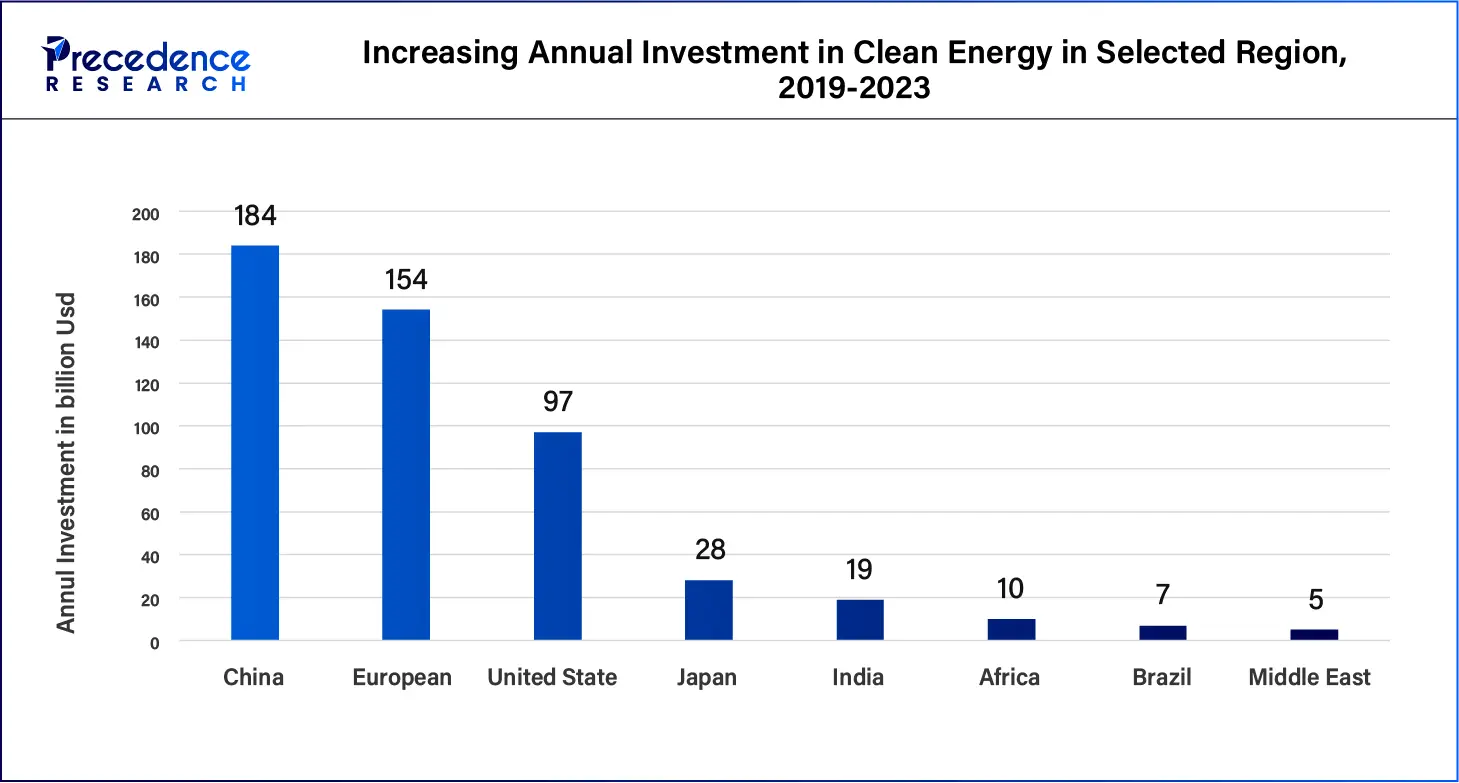

Increasing demand for clean energy is expected to drive growth in the nuclear reactor market. In a global shift towards decreasing carbon emissions, nuclear energy assures the population of a clean source of energy as opposed to fossil fuels. The production of power by nuclear reactors does not emit greenhouse gasses, hence making it lucrative for governments and energy providers that have green targets to achieve. The increasing concern about adopting renewable power has created a greater focus on investing in nuclear technology, which has boosted the market. Such a transition towards clean energy sources is expected to cement the place of nuclear energy within the global energy system.

Additionally, there is increasing consumption of nuclear energy as a clean energy solution, especially in such regions as the Asia-Pacific, where countries, including China and India, have now embarked on constructing new reactors to be utilized in meeting their energy needs without having to rely on coal, thus boosting the market.

Poor nuclear waste management

Impede nuclear waste management is projected to hamper the nuclear reactor market in the coming years. The handling, storage, and disposal of high-level nuclear wastes is very expensive and complicated. This continual problem is projected to slow down the market’s evolution as more stakeholders attempt to identify suitable and effective ways to address the waste problem in a manner that is acceptable and sustainable. Moreover, the lack of standard regulations in dealing with nuclear waste poses a problem in international relations in disposing of waste, which hinders the market’s development for expansion and improvements.

Rising investments in nuclear infrastructure

Rising investments in nuclear infrastructure are likely to create immense opportunities for the nuclear reactor market. The governments and private sector bodies across the globe are investing heavily in upgrading the existing nuclear power plants and developing new nuclear units, especially in regions characterized by high energy consumption. These investments are applied to improvements in reactor safety, upgrades of the life cycle of operating reactors, and development of advanced reactor technologies. The world is slowly turning to energy security and speaking of energy independence, which means that there is much emphasis on nuclear infrastructure, especially in the developing world.

The IAEA estimates that as of this year, more than fifty nuclear power plants are under construction, with major projects in China, India, and Russia. Additionally, the United States and the United Kingdom have signaled that they will be investing billions in the development of small modular reactors in the long-term energy plan.

The pressurized water reactor (PWR) segment held a dominant presence in the nuclear reactor market in 2023 due to their safer operations. PWR is designed to operate in such a way that water is both used to cool and moderate the reactor core, keeping the pressure of the water high to avoid reaching the boiling point. This technology is now preferred by many countries, including the United States, France, and Russia. Additionally, the existence of a well-developed supply chain for PWR components and fuel is expected to boost their utilization and segment.

The advanced reactor segment is expected to grow at the fastest rate in the nuclear reactor market during the forecast period of 2024 to 2034, as they offer better security, performance, and eco-friendly models. This subsegment consists of new-generation technologies comprising small modular reactors (SMRs) and Generation IV reactors, which are not restricted by conventional reactor designs. These reactors are anticipated to have several benefits, including cheaper construction costs, shorter time taken to deploy the reactors, and the capacity to interconnect with renewable energy systems. Furthermore, the increasing global demand for better forms of energy is expected to fuel developments in advanced reactors, thus fuelling the segment.

The auxiliary equipment segment accounted for a considerable share of the nuclear reactor market in 2023, owing to the growing importance of reactor safety, enhanced operational characteristics, and increased legislation prerequisites. It also incorporates non-driving systems, which may consist of a cooling system, backup power to a main reactor, and control systems, which are very crucial in making sure that the plant is safe to function. Growing safety requirements and stringent regulatory norms likely spur demand for Auxiliary Equipment, as they support the function of the reactor units that are essential to power generation. Additionally, the increase of capacity for nuclear powers and upgrades of currently operating units for compliance with new safety standards are expected to fuel the segment.

The island equipment segment is anticipated to grow with the highest CAGR in the nuclear reactor market during the studied years due to the overwhelming importance of this asset in the function and safety of nuclear power stations. Island Equipment includes the main parts of a nuclear power plant that is involved in the conversion of nuclear energy into power, such as turbines, generators, and condensers. These components are essential in the power generation system and are central to the operations of the plant. The high demand for Island Equipment is explained by the high operating and new reactors and the new reactor installations. Furthermore, the adopted vertical integration strategies promoted the replacement of these components as technology improved, and there was a need to produce energy with higher efficiency and reliability. All these factors further propel the market in the coming years.

Asia Pacific held the largest share of the nuclear reactor market in 2024 due to its investment in nuclear power and progressive growth in energy demands. The majority of countries in this region, especially China and India, have bearish intent on expanding their nuclear energy programs. China has been actively expanding its nuclear capacity and plans to have more than 150 new reactors by 2035, according to the World Nuclear Association.

India is also in the process of initiating a new nuclear program to meet its energy requirements and cut down on emissions. The region’s dominance is highly attributed to the government's stance on the use of nuclear energy as a solution to energy insecurity and climate change issues. Furthermore, strong and prominent financial resources to dedicate to the setup of a mature nuclear supply chain are observed in this region.

europe is projected to host the fastest-growing nuclear reactor market in the coming years, owing to the rising investment and better plans and policies for the diversification of energy resources. Nations in this region are among the nations that have embarked on serious long-term nuclear power developmental programs. Furthermore, the promising regions in the development of their nuclear reactors share investments and development plans.

By Type

By Equipment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

August 2024

April 2025