December 2024

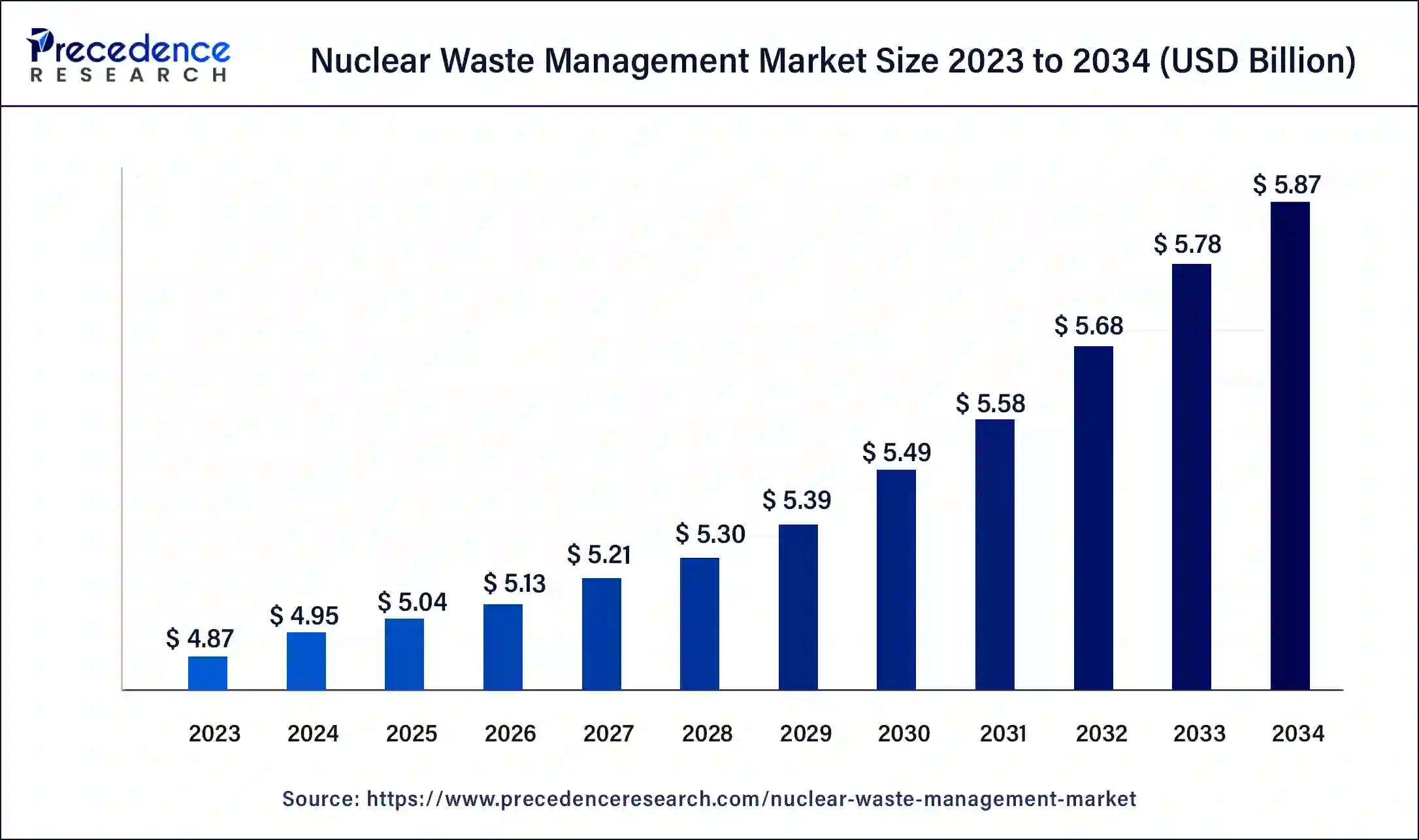

The global nuclear waste management market size surpassed USD 4.87 billion in 2023 and is estimated to increase from USD 4.95 billion in 2024 to approximately USD 5.87 billion by 2034. It is projected to grow at a CAGR of 1.72% from 2024 to 2034.

The global nuclear waste management market size is projected to be worth around USD 5.87 billion by 2034 from USD 4.87 billion in 2024, at a CAGR of 1.72% from 2024 to 2034. The nuclear waste management market growth is attributed to the increase in nuclear energy production.

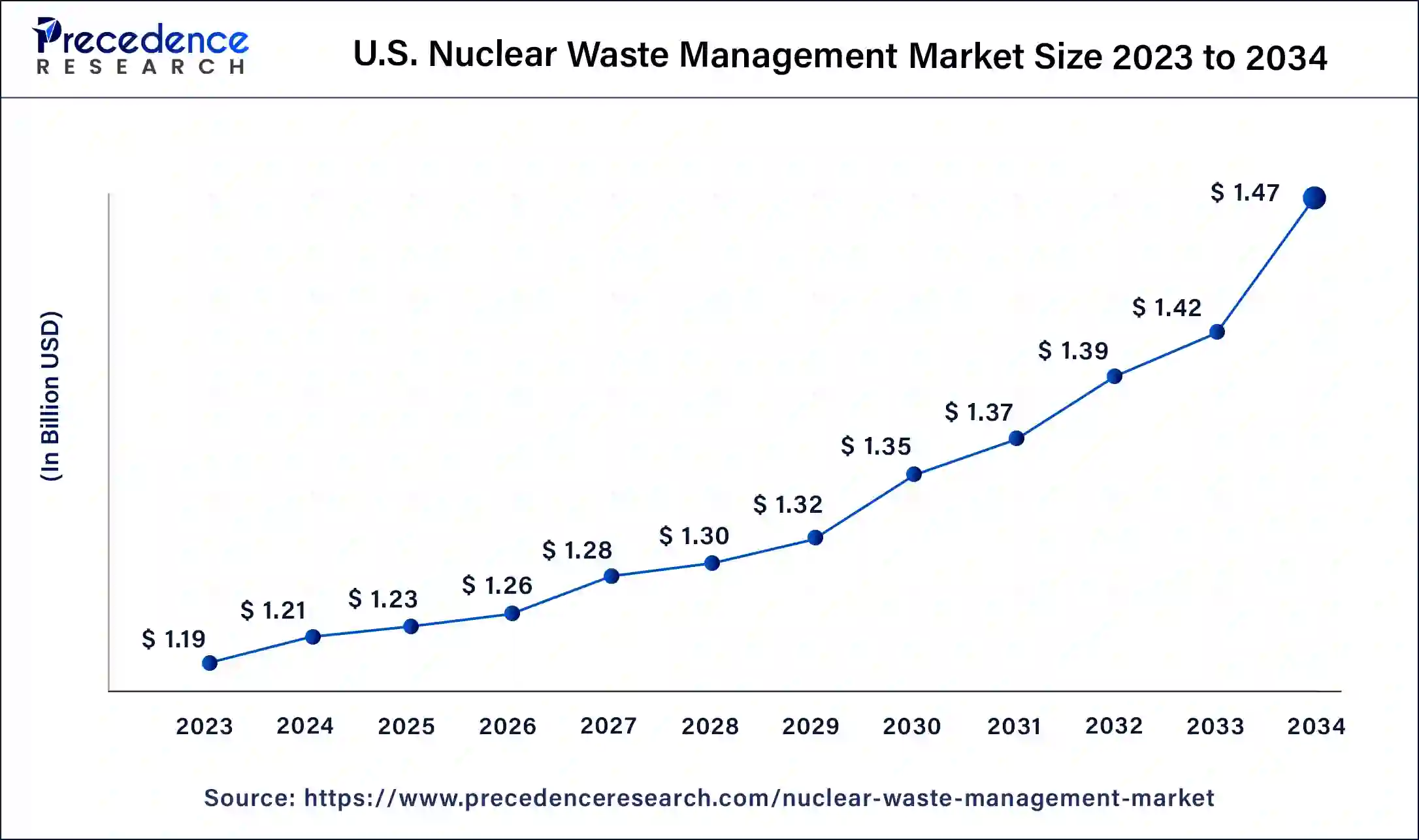

U.S. Nuclear Waste Management Market Size and Growth 2024 to 2034

The U.S. nuclear waste management market size was exhibited at USD 1.19 billion in 2023 and is projected to be worth around USD 1.47 billion by 2034, poised to grow at a CAGR of 1.93% from 2024 to 2034.

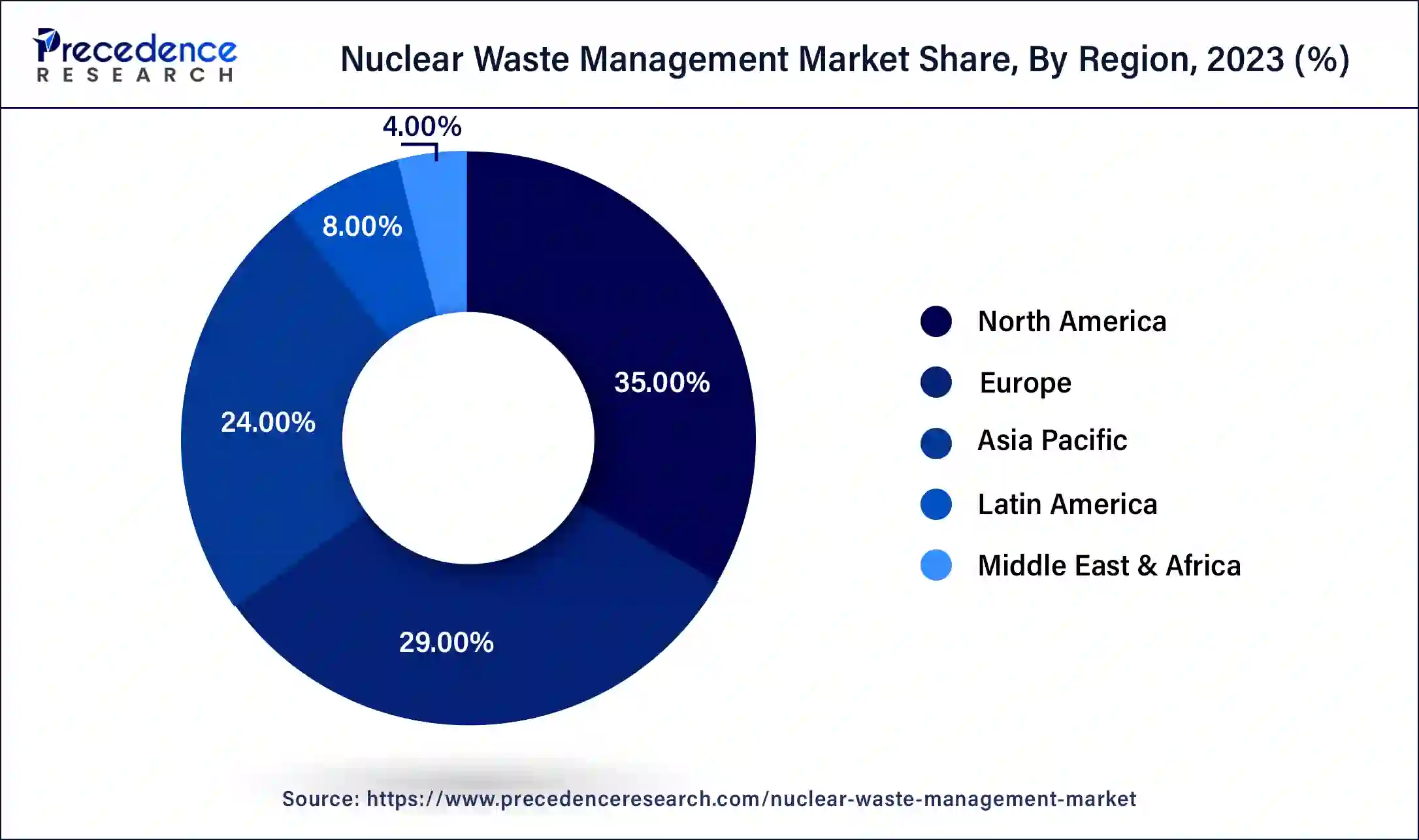

North America dominated the nuclear waste management market in 2023 due to the developed nuclear energy system and the adoption of rigid regulatory policies. The United States boasts of having a large number of active nuclear reactors, creating large amounts of radioactive waste. The relatively mature infrastructure for waste storage and disposal has most probably continued to drive the region’s market.

Moreover, the growing deployment of decommissioning for obsolete nuclear power stations in the respective region might have contributed to the need for proper waste management solutions. The increasing trend of utilizing environmentally friendly technologies and methods of waste disposal might have also strengthened the region in the market, along with the presence of the nuclear waste management market players in North America.

Asia Pacific is expected to grow at the fastest CAGR in the nuclear waste management market during the forecast period, owing to the fast expansion of nuclear energy in nations such as China or India. These countries have, in the very recent past, embraced nuclear power as a way of meeting their energy market needs while at the same time minimizing emissions. This has led to the expansion of the facilities generating nuclear energy, thus increasing the generation of radioactive waste for which effective management systems are largely required.

The growing interest in developing nuclear power, the capability of the region’s states, and the governmental efforts to address the waste generating and disposal issues are expected to inhibit the development of these management technologies. Additionally, cooperation with other countries and recent innovations in nuclear waste treatment and storage predict Asia Pacific is a leader in nuclear waste management, further boosting the nuclear waste management market in this region.

Nuclear energy is being produced and developed further, adding to the energy diversity and minimizing the emission of GHG. Safe control and disposal of nuclear wastes refer to containment storage and processing, which reduce the probability of radiation hazards to personnel, the populace, and the ecosystem. In this way, it preserves the environment and does not allow the penetration of soil, water, and air, which prevents contamination.

Methods for volume reduction of waste facilitate compact storage and also minimize the demand for more storage facilities, including compaction and vitrification. Moreover, other atomic facility wastes that are reprocessed to recover useful content, including spent fuel, help minimize the amount of waste generated. These factors will increase the growth of the nuclear waste management market in the coming years.

Impact of Artificial Intelligence on the Nuclear Waste Management Market

The implementation of sophisticated artificial intelligence algorithms makes it possible to monitor nuclear waste storage facilities and estimate possible failures in order to avoid them and reduce the level of unfavorable impact on the environment. In the nuclear waste management market, artificial intelligence makes it easier to arrive at appropriate decisions concerning the treatment and disposal of waste since it employs algorithms that examine data volumes to define precise approaches.

Additionally, artificial intelligence enhances the use of robotics and serves as an essential means of transporting radioactive substances to reduce human contact with radiation. These AI innovations enhance the management of waste, leading to increased efficiency and compliance with regulatory requirements and public safety standards.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.87 Billion |

| Market Size in 2023 | USD 4.87 Billion |

| Market Size in 2024 | USD 4.95 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 1.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Waste Type, Reactor Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing global energy demand

Increasing global energy demand is expected to drive the nuclear waste management market as countries continue to rely on nuclear power to meet their energy needs. Nuclear is viewed as a base load energy that is clean, and necessary for GHG emissions reduction. The increased generation of nuclear energy comes with challenges of radioactive wastes, thus the need for effervescent waste management systems. Addressing the handling, treatment, and disposal of this waste, various governments and energy providers are investing in high-end technologies.

The trend of nuclear also opens a potential for cooperation in the frame of joint projects and knowledge exchange in countries that have not developed their nuclear sector yet, with increasing frequency of international partnerships. Furthermore, emergent countries are utilizing large amounts of radioactive fuels for nuclear energy creating demand for sustainable waste disposal, thus propelling the nuclear waste management market.

High costs of nuclear waste management

The high cost of nuclear waste management is expected to hinder the market. The process is rather complicated and costly, involving techniques for the safe handling, transportation, and disposal of radioactive substances. Sophisticated techniques, rules, and requirements that focus on safety and the challenge of repository push up expenses and financial load of governments and nuclear stations. Such high costs prevent investment in nuclear energy projects and the development of handling nuclear waste. Furthermore, the low profitability of nuclear waste management, especially where the economy of the concerned country is at a lower level, poses another hindrance to the nuclear waste management market growth in the coming years.

Growing investment in advanced technologies

A rise in spending on innovative technologies, such as vitrification and deep geological repositories, is expected to create immense opportunities for the players competing in the nuclear waste management market. These technologies are intended to work under close environmental containment to safely store high-level radioactive waste for longer periods. Many IT firms are in the process of designing solutions for making these processes more effective, and the companies that find themselves in the focus of such technologies can record high interest from the governments and private investors searching for effective solutions for managing waste in a proper manner.

The trend of durability in safety and the reduction of environmental impact is pushing researchers further in the search for new substances for storage and improved containment. Furthermore, modern technologies, such as robotics and automation, are also being applied to these technologies, making it easier to handle radioactive wastes more safely and accurately. Such involvements with research institutes are witnessing the advancement of these innovations, with the needed compliances and cost considerations addressed by key industry players. All these factors contribute to boosting the nuclear waste management market in the coming years.

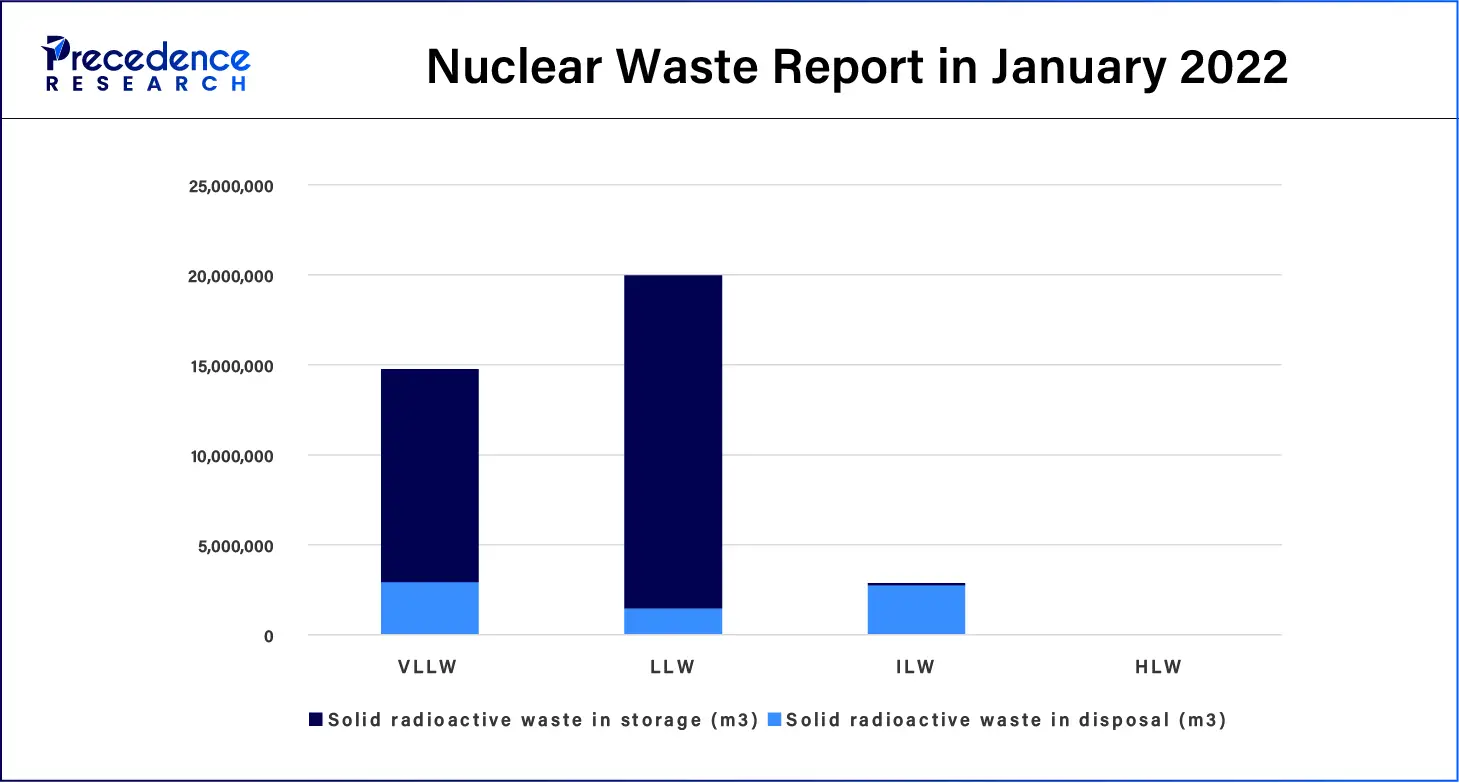

The low level waste segment dominated the nuclear waste management market in 2023 due to the large amount of waste produced by nuclear power plants, facilities involved in the use of radioisotopes in the medical field, and several industrial applications. In comparison with high-level and intermediate-level waste, LLW is comparatively easier to deal with and does not call for equally high levels of containment.

Due to the high generation of LLW from various sources, bulk facilities for handling and disposal have been established for volume reduction techniques. There has been a continuous increase in the number of nuclear power plants and medical centers, especially in the developed nations, which are creating constant production of LLW, hence making it the largest segment in the nuclear waste management industry. Moreover, the growing number of contaminated protective wear, tools, filters, and any other articles that may have been used in the nuclear process are expected to boost the market.

The high level waste segment is projected to grow rapidly in the nuclear waste management market in the future years. HLW is made up of highly radioactive by-products resulting from the reprocessing of used nuclear fuel and from the use of nuclear reactors. The inherent complexities in dealing with and storing HLW by the development of higher containment systems and safe geological facilities are anticipated to fuel a major residence in this sub-segment. The number of facilities with decommissioned nuclear reactors, especially in such regions as Europe and North America, is expected to fuel the demand for nuclear waste management solutions.

The pressurized water reactor segment held the largest share of the nuclear waste management market in 2023. PWRs remain the most popular reactors across the world, as they contribute to more than half of the global nuclear power production. This is due to their durability, reliability, safety measures, high temperatures, pressure performance, and efficiency. There is currently a near-disposal issue of nuclear waste requiring new management and efficient disposal methods. Furthermore, with high levels of spent fuel generated by these reactors, there is a need for special waste containment facilities. Global development of nuclear power infrastructure, especially in the developed world, boosts the demand for PWR reactor nuclear waste management solutions.

The boiling water reactors segment is projected to expand significantly in the nuclear waste management market in the coming years due to their lower complexities of design and operating costs, which make them ideal for new nuclear power generation. The use and expansion of BWRs, especially in areas that are aimed at developing the security of the supply of energy and at the minimum emission of carbon, leads to the creation of a voluminous quantum of radioactive waste, which needs very careful handling. The existing BWRs, which include old models of reactors, are also expected to feature in waste management since, as they undergo decommissioning, they create other waste products.

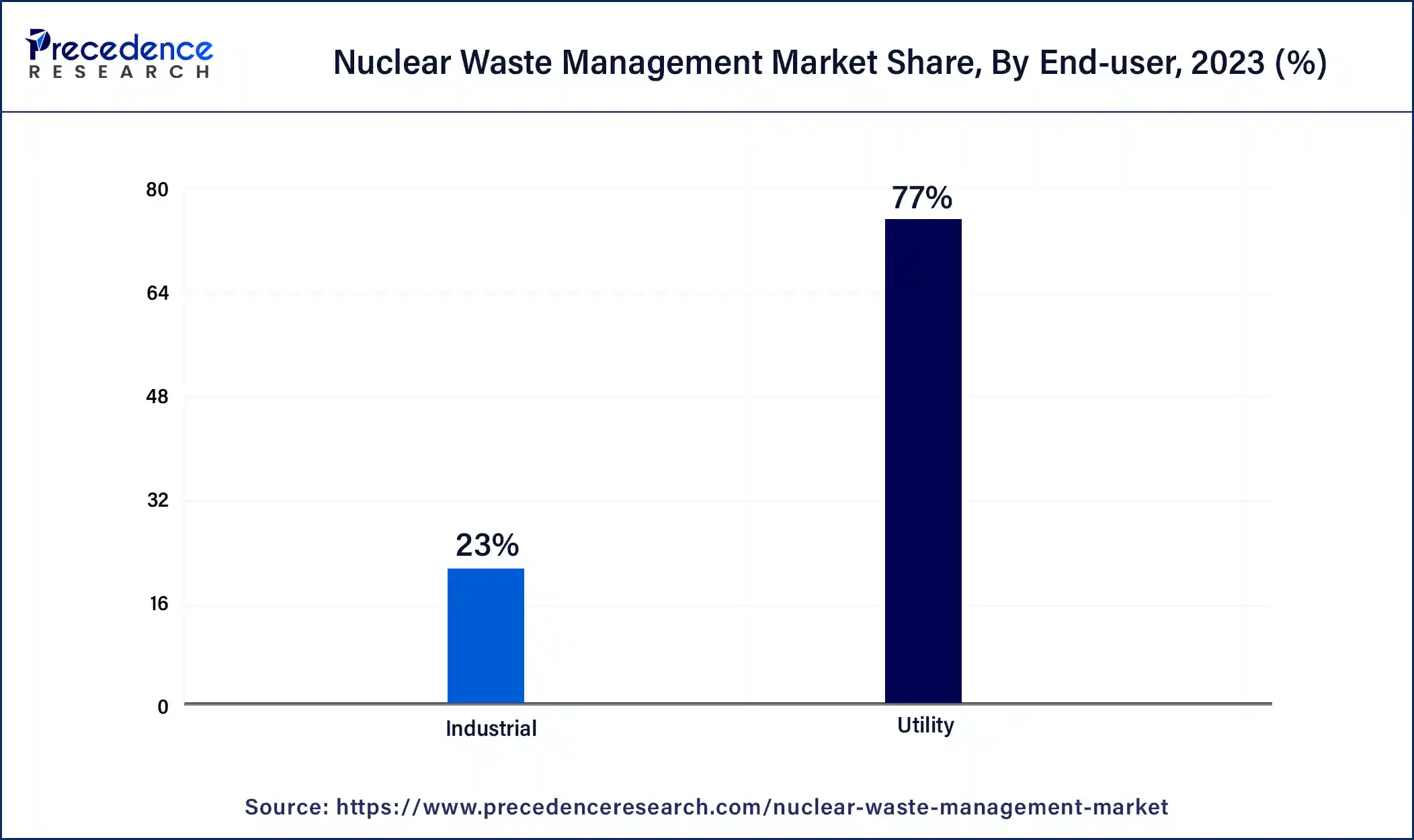

The utility segment dominated the nuclear waste management market in 2023 due to the high proliferation of nuclear power plants for generating electricity. Utilities are the largest generators of nuclear waste, with high-level waste arising from spent nuclear fuel because utilities supply energy on a constant basis. The world’s continuing need for electricity and the rising leaning toward nuclear energy as a clean and sure source of power.

A large number of countries are using nuclear energy in the consumption mix in order to supply environmental objectives, therefore bringing relevant investments in the management of waste utilities. Furthermore, the utility has been the largest segment of the market, most likely due to the stringent laws regarding the management and treatment of waste in its operation; hence, utilities are forced to adhere to more sophisticated waste management standards to avoid the risk of being policy or lawfully sued on issues relating to waste handling and disposal.

The industrial segment is projected to grow rapidly in the nuclear waste management market in the coming years, owing to the increased demand for nuclear technology in various industries. Specific sectors, including healthcare, research sectors, and manufacturing sectors, use nuclear technology for different purposes, such as diagnostic, food irradiation, testing of material, etc., which produces different types of wastes that are radioactive in nature. This has instigated the need for the management of industrial wastes, including nuclear waste. As the services expand, there will be more service opportunities for waste management services.

Segments Covered in the Report

By Waste Type

By Reactor Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

November 2024

April 2025