August 2024

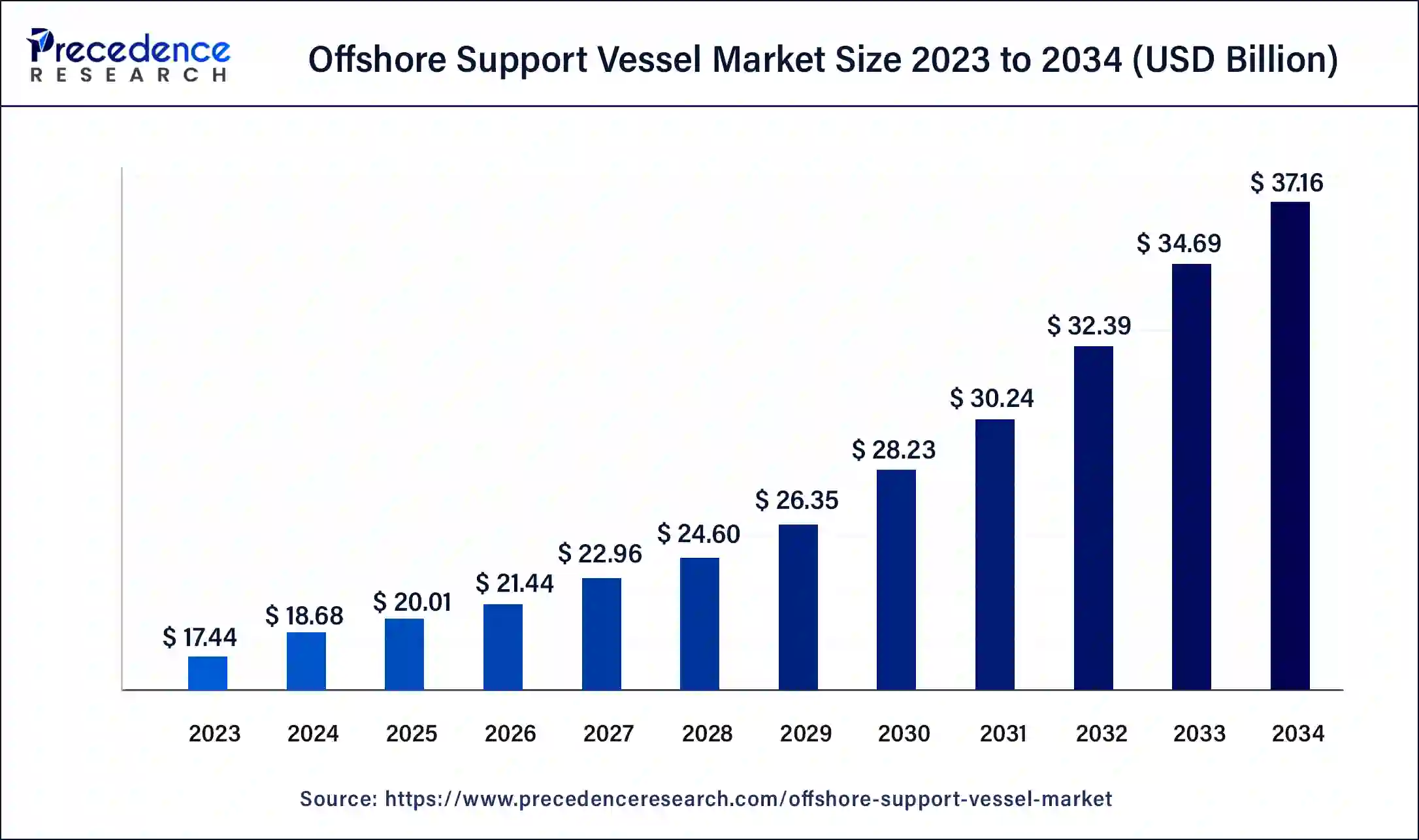

The global offshore support vessel market size was USD 17.44 billion in 2023, calculated at USD 18.68 billion in 2024 and is expected to be worth around USD 37.16 billion by 2034. The market is slated to expand at 7.12% CAGR from 2024 to 2034.

The global offshore support vessel market size is expected to be worth USD 18.68 billion in 2024 and is anticipated to reach around USD 37.16 billion by 2034, growing at a solid CAGR of 7.12% over the forecast period 2024 to 2034. The increasing demand for the offshore support vessels in the oil and gas generation field and other offshore construction activities are driving the growth of the market.

The offshore support vessels are generally known as the offshore supply vessels. The offshore vessels are specially designed for operating in oceans, seas, and other sea bodies to cater to a number of industrial applications such as anchor handlings, platform support, maintenance, construction, and others. It provides services to the rigs for the maintenance and the repairing offshore wind turbines. The offshore support vessels provide greater flexibility in operations and versatility that can used in any type of project. The rising maritime activities are driving the growth of the offshore support vessel market.

In September 2023, The ABS, a leading provider in maritime classification and advisory services, came into collaboration with Crowley to explore the use of augmented reality technologies in vessels and other marine environments. The partnership was developed based on Crowley’s new service network agreement using augmented reality on select vessels.

How Can AI Impact the Offshore Support Vessel Market?

The implementation of AI in the maritime industry is expanding and revolutionizing marine industrial operations. The maritime industry is already known as the critical global trade and commerce industry. The rising adaptation of the maritime industry in the transportation industry is driving the growth of the sector. The implementation of AI helps the officers on vessels to make informed decisions, which will result in optimized performance and energy efficiency. The adoption of AI helps in reducing the consumption of fuel and reducing greenhouse gas emissions in offshore applications and fleet management.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.16 Billion |

| Market Size in 2023 | USD 17.44 Billion |

| Market Size in 2024 | USD 18.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Fuel, Type, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increasing maritime sector for the transportation and logistics

The rising acceptance of the maritime sector as the transportation, logistics, and supply chain management activities across the world is driving the demand for the offshore support vessel market. The offshore support vessels are large in size and used in transporting supplies and people.

The rise in global trade and the logistics activities in supplying goods and materials internationally caused the increase in demand for offshore support vessels for efficient transportation activities. There are several types of offshore support vessels used in transporting supplies, goods, equipment, offshore workers, and below-deck cargo, such as dry bulk, freshwater, liquid mud, and excess fuel in support of exploration, production, and exploitation of offshore energy mineral sources.

Challenges associated with the OSVs

Although there are a number of benefits associated with the OSVs, there are some limitations, including remote operations, equipment maintenance, and weather, which are restraining the growth of the offshore support vessel market.

Offshore support vessel advancements

The ongoing investment in research and development in offshore support vessels is driving future opportunities for expansion in the offshore support vessel market. The evaluation of the offshore support vessel in the multi-role platform is done by adopting principles like high workability in harsh environments, integrated and compact design that helps optimize functionality, and reduced fuel consumption. Increased operability with lower operations and ownership costs. Increased comfort in accommodation and efficient workflows.

The cladding material segment is expected to show significant growth in the offshore support vessel market during the forecast period. The vessels are the standard material that is used in various industrial operations. The standard vessels are majorly designed to contain fluid at the 15psi. The increased adoption of the cladding material for the manufacturing or the production of vessels due to its enhanced mechanical properties is driving the demand for the cladding material segment. Cladding is the process in which a layer of material is deposed to the workpiece to enhance structural integrity. The clad is corrosion resistant, protects the vessels from the reaction of stored liquid, and improves their strength.

The liquefied natural gas (LNG) segment is expected to show notable growth in the offshore support vessel market during the forecast period. The increasing adoption of LNG-based offshore vessels is due to its benefits, increased efficiency, and affordability. The rising awareness about environmental pollution drives the adoption of less polluted fuel in power engines that emits fewer carbon particles into the environment and drives the demand for liquefied natural gas (LNG) driven offshore support vessels.

The multipurpose support vessel segment is expected to grow at the fastest rate in the offshore support vessel market during the predicted period. The multipurpose support vessel provides a wide range of applications in the service of the offshore oil field industry. The multipurpose support vessels have beneficial properties such as firefighting, dynamics positioning, cranes, helipads, and moonpools. These types of vessels are highly equipped with a number of sensors and weapons.

The multipurpose support vessel is used in a wide range of industrial applications such as offshore oil and gas, cargo transportation, construction and maintenance, and others. The multipurpose support vessel plays an important role in enhancing cost efficiency, adaptability, and efficiency in worldwide shipping operations. The rising logistics activities, offshore oil field activities, and other maritime activities are boosting the demand for multipurpose support vessels.

The deepwater segment is expected to grow significantly in the offshore support vessel market during the anticipated period. The increasing demand for offshore support vessels in deepwater activities such as construction activities and oil and gas exploration and construction activities is due to their highly advanced devices and the size of the vessels that can carry heavy load material.

The offshore wind segment is expected to show notable growth in the offshore support vessel market during the forecast period. The offshore wind is the energy that is produced from the force of wind from the sea and transformed into electricity. While offshore support vessels can used in a wide range of applications in the construction and maintenance of offshore wind power plants, they are used in constructing wind power plants in the sea, transporting the components, cables, wires, foundation, and other electronics or the raw material that used on the construction of the wind power plants. It is used in maintenance, platform support, firefighting, diving operations, and other applications. The rising economic development globally, the rising demand for electricity generation from renewable energy sources, and the adoption of the green production of energy are driving the adoption of wind power energy generation.

North America is expecting a significant growth during the forecast period. The growth of the market is attributed to the rising demand for energy generation, and maritime activities are driving the demand for offshore support vessels. The rising availability of the major vessel manufacturing units and the availability of the leading market players in vessel or ship manufacturing are driving the growth of the offshore support vessel market.

The region is known for being the early adopter of the technologies in every sector, and economically developed countries like the U.S. and Canada are heavily investing in the transportation and supply chain industry that drives the demand for cargo ships, which also contributes to the growth of the offshore support vessel market in the region.

Asia Pacific is expecting accountable growth during the predicted period. The growth of the market is attributed to the rising demand for offshore support vessels in various industrial applications such as transportation, logistics, import and export facilities, cargo shipments, and oil and gas field supply and construction. Additionally, the rising investment in global trade activities by the regional governments is driving the growth of the offshore support vessel market across the region.

Segments Covered in the Report

By Material

By Fuel

By Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

August 2024

October 2024