August 2024

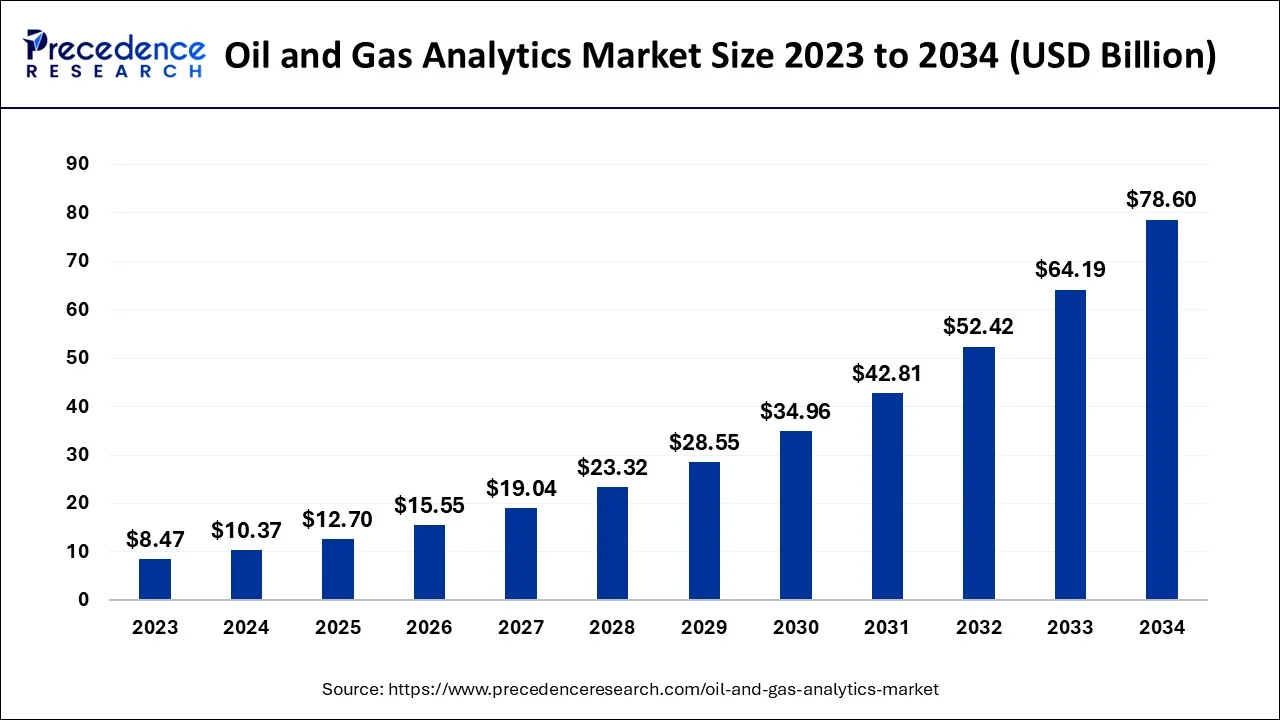

The global oil and gas analytics market size accounted for USD 10.37 billion in 2024, grew to USD 12.7 billion in 2025 and is predicted to surpass around USD 78.60 billion by 2034, representing a healthy CAGR of 22.45% between 2024 and 2034.

The global oil and gas analytics market size is exhibited at USD 10.37 billion in 2024 and is predicted to surpass around USD 78.60 billion by 2034, growing at a CAGR of 22.45% from 2024 to 2034. . Boost in the transportation and travel industry across the globe fuels the growth of the oil and gas analytics market.

Oil and gas analytics is a statistical method to enable predictive analysis. The oil and gas analytics is done to reduce the risk in the market, maximizing the yield and accelerating the performance. The oil and gas industry analytics provides a set of techniques to extract trends and patterns of the current demand from the data to assist the decision-making process or optimization. Descriptive analytics, predictive analytics, diagnostic and perspective are a few pillars of analytics. Many oil and gas companies have employed oil and gas analytics (predictive type) to reduce downtime and maintenance costs to improve asset management.

Oil and gas analytics offers multiple advantages to the oil and gas company, such as improved occupational safety and proper optimization of drilling operations. Companies that have adopted oil and gas analytics are likely to develop rapidly. The analytics process for oil and gas companies is done using a large amount of field data and machine learning algorithms. The collected data helps optimize business performance, forecast the future and understand consumer behaviour. Highly complex and variable data from the oil and gas industry have forced companies to adopt oil and gas analytics in recent years.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.37 Billion |

| Market Size by 2034 | USD 78.60 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 22.45% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Offering, By Deployment Platform, By Application, and By User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increasing demand for energy all across the globe is seen as a significant driving factor for the market. The growth of the oil and gas analytics market is attributed to the growing awareness of security during operations in the oil and gas industry. The demand for oil and gas analytics is boosted as several companies have started investing in digitization. The deployment of artificial intelligence and the Internet of Things (IoT) in the global oil and gas analytics market is considered a significant driver for the market's growth. Many oil and gas companies are focused on increasing efficiency and performance with proper data insight. All these requirements are fulfilled by the oil and gas analytics. This factor fuels the growth of the global oil and gas analytics market.

The overall advancements in the travel and transportation industry result in increased oil consumption. Oil and gas analytics provide data to oil and gas companies that offer visionary solutions to the companies. Thus, increased oil consumption across the globe is seen as another driving factor for the growth of the global oil and gas analytics market. The greater oil demand has forced oil companies to explore new oil reserves to fulfil the demand. Companies require cost optimization during such processes. This acts as the market driver for oil &gas analytics. Furthermore, the significant growth of the global oil and gas analytics market is driven by advancements in process automation and growing demand for the implementation of big data analytics.

The uncertainty or volatility in crude oil prices stands as a restraining factor for the growth of the global oil and gas analytics market. Unpredictable events such as war and natural or human-made disasters hamper the market's growth. For instance, the Russia-Ukraine war in 2022 showed adverse impacts on the oil and gas market. Russia is one of the largest producers of oil and natural gas. The war affected the energy market globally, directly affecting the growth of the global oil and gas analytics market. Moreover, the stringent policies and regulations on the oil and gas industry hamper the growth of the market and act as a restraint for market growth.

Based on the offering, the software segment acquires the largest share of the market. Rapidly growing demand for machine learning and artificial intelligence for compelling market predictions is driving the software segment's growth. Technological advancements in the market, such as the use of robotics and sensor networks in the upcoming years, are prone to grow in the software segment during the forecast period of 2024-2034.

The service segment of the oil and gas analytics market is further divided into professional, integrated and maintained. The service segment offers secure storage and maintenance of generated data. It also ensures the data protection and authentication of the user before accessing the data. Considering the advantages provided by the service, the segment is expected to grow at a good rate during the forecast period.

Based on the deployment platform, the global oil and gas analytics market is segmented into on-premises and cloud. Many companies have adopted the cloud platform to analyze their business performance. The cloud service segment is the dominating global oil and gas analytics market.

Cloud-based services allow better reliability and lower downtime. Also, managing big data has become easier with cloud services. Cloud services also offer remote and connected operations, which is convenient for oil and gas companies. With such super flexible options of operations for oil and gas industries, the cloud segment is expected to witness noticeable growth during the forecast period.

Based on the application, the global oil and gas analytics market is segmented into upstream, midstream and downstream. The upstream segment is expected to boost during the forecast period owing to the increased exploration of crude oil sources. The midstream segment refers to the transportation and storage of crude oil and natural gas.

To avoid the potential risks associated with the logistical or transport process, oil and gas companies deploy analytics. In contrast, the downstream segment shows potential for growth in the upcoming years. This segment holds the distribution and sale process to the consumers. Oil and gas companies use predictive oil and gas analytics for the distribution and sale process.

Based on the user, the global oil and gas analytics market is segmented into small & medium enterprises and large enterprises. Large enterprise is the dominating segment of the market. The capabilities of large enterprises to invest in oil and gas analytics are higher. Along with this, the data that is required to be handled during the analytics is enormous for large enterprises. In the case of small & medium enterprises, the volume of data is small, and such enterprises are not capable of investing huge capital in the market.

North America acquires the largest revenue share of the global oil and gas analytics market. Growing investments in the energy and power sector in North America are considered the major driving factor for the market's growth. The rapid adoption of cloud services in the region has boosted the market's growth. Increased operational activities in the oil and gas industry have surged the region's demand for data management services. This factor is contributing to the development of the market. The oil and gas analytics market in Europe is anticipated to show a significant increase during the forecast period owing to the rapid digitization in the region. Multiple oil companies in Germany and France have already deployed cloud services for data analytics. Thus, the increasing deployment of cloud-based services in the oil and gas industry in Europe is seen as a significant driver for the growth of the market.

Asia Pacific is considered the fastest-growing region and is projected to hold the highest revenue share during the forecast period in the global oil and gas analytics market. The growing demand for data analysis required during the exploration of oil sources in the region is contributing to the growth of the market. The increasing number of software companies that provide analytics platforms for oil and gas companies is another factor propelling the growth of the oil and gas analytics market in Asia Pacific.

Increasing local and foreign investment in the oil and gas market in the Middle East is likely to grow the market revenue share of the region during the forecast period. The higher rate of oil production in the area is supplementing the uptake of new oil industry projects, mainly in the gulf countries. This factor is fueling the growth of the oil and gas analytics market in the Middle East. Middle East and Africa are prone to augment the global market for oil and gas analytics.

Segments Covered in the Report

By Offering

By Deployment Platform

By Application

By User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024

July 2024

November 2024