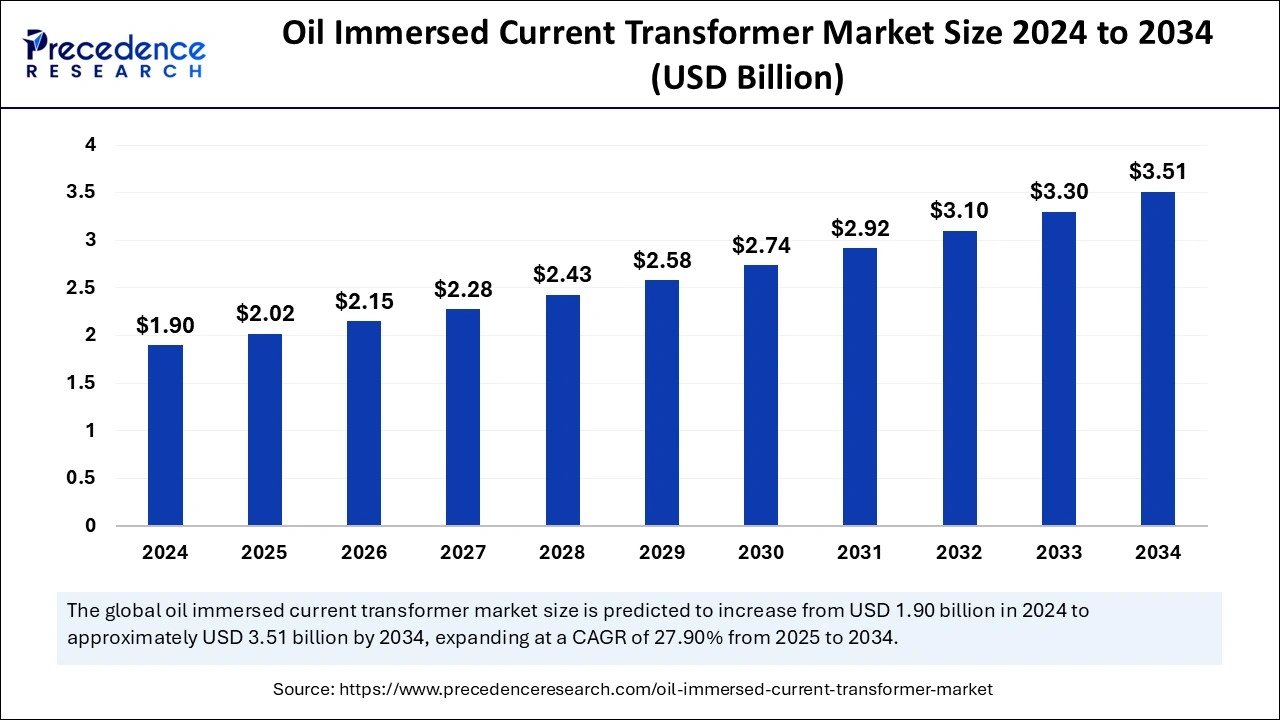

The global oil immersed current transformer market size is calculated at USD 2.02 billion in 2025 and is forecasted to reach around USD 3.51 billion by 2034, accelerating at a CAGR of 6.32% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oil immersed current transformer market size was estimated at USD 1.90 billion in 2024 and is predicted to increase from USD 2.02 billion in 2025 to approximately USD 3.51 billion by 2034, expanding at a CAGR of 6.32% from 2025 to 2034. The high demand for high-performance and cost-effective electrical components is the major driver of the global oil immersed current transformer market. The need for oil immersed current transformers in power generation, transmission, and distribution sectors is contributing to expanding the market.

Artificial intelligence (AI) has been the edge platform in every exciting technology. The integration of AI into utility is an exciting factor floating in the industry. Automation is the key factor driving the focus on leveraging modern technologies in electricity infrastructure. The self-adaptive capabilities of AI algorithms in exciting technology or systems significantly impact electricity infrastructure. AI algorithms have proved essential for activities, including predictive maintenance, optimizing transformer utilization, and preventing failures in the oil immersed current transformer market.

The integration of AI in electricity manufacturing is well known for helping to optimize design, predict maintenance needs, and improve overall grid reliability. Additionally, the leverage of graph convolutional network (GCN) and common vector approach (CVA) in oil immersed transformers has provided good results. The ongoing surge in the integration of cutting-edge AI algorithms to improve the diagnostic performance of oil immersed transformers is likely to lead to novel and significant market trends in the upcoming period.

As the demand for electricity increases in modern homes or offices, the need for and adoption of cutting-edge technologies is surging. The oil immersed current transformer market has witnessed spectacular growth in its adoption to handle sensitive electricity measurements. Oil immersed current transformers are electric transformers filled with insulating mineral oil that help to measure high currents in power grids and cooling oil. Prior demands for renewable energy sources are driving the need for cutting-edge technologies like oil immersed current transformers.

Several factors, like the need for real-time data collection, power management, load balancing, the conversion of high transmission voltage to suitable for distribution, accurate current measurements, and steady power supply to the heavy electrical systems, are responsible for shifting end-users focus on oil immersed current transformers. Additionally, the government and regulatory pressure is shifting manufacturers toward a sustainability emphasis. Manufacturers commitment to reducing environmental impacts and carbon emissions is impacting the overall production process, including material sourcing, manufacturing processes, operation, and end-of-life management, leading to the development of more efficient and cost-effective oil immersed current transformers.

The major challenge for the oil immersed current transformer market is to maintain high-voltage environments. However, the leverage of cutting-edge technologies is transforming its conditions and is well-suited to such challenges. Technology advancements are allowing the integration of advanced technologies with exciting systems of oil immersed current transformers, including sensors and communication capabilities, to transform them into smart transformers. The access to real-time monitoring of transformer health, temperature, and load in oil immersed current transformers provides more accuracy, efficiency, waste management properties, and safety of the oil immersed current transformers.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.51 Billion |

| Market Size in 2025 | USD 2.02 Billion |

| Market Size in 2024 | USD 1.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Voltage Rating, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The demand for renewable energy solutions

Growing urbanization, construction, and infrastructure development are driving the need for renewable energy sources to provide clean energy and energy-efficient applications. The increased utilization of electric households is responsible for the rise in electricity consumption, making it essential for the availability of alternative solutions. The growing utilization of oil and its impact on sustainability and the environment, including challenges of leakage and disposal, are driving a shift toward the adoption of high-voltage oil immersed current transformers with sustainable applications. Furthermore, government initiatives and funding to promote the adoption of renewable energy transformers are driving innovations and developments in the oil immersed current transformer market.

High initial cost

The need for high-voltage oil immersed current transformers is the major factor impacting the initial costs. High initial costs regarding materials, manufacturing complexity, testing, certifications, and installations are restraining the adoption of high-voltage oil immersed current transformers. High initial cost hampers the adoption of the oil immersed current transformer market by small and medium-sized utilities, leading to hindering market computations. Furthermore, costs related to installation and maintenance are also influencing the adoption rate.

Increased investments in grid modernization

The shift of utility toward smart grid technology integration, including advanced sensors and IoT devices, is driving demand for modernized grid infrastructures. End-users surged the demand for renewable energy integrations and energy-efficient solutions. Investments in solar and wind power are emerging, and the adoption of grind modernization is being adopted to maintain efficient and reliable energy transformations. Additionally, the ability of grid modernizations to reduce energy waste and improve efficiency helps to enhance its investments and support.

The growing investments in government and manufacturing companies in grid expansion and modernization projects to comply with demands for high-quality current transformers have increased, leading to significant opportunities for the development of oil immersed current transformer market. The growing investments in grid modernization to provide efficient energy transformation and distributions are boosting the utilization of high-voltage oil immersed current transformers.

The wound type segment has held the largest oil immersed current transformer market share in 2024. The segment growth is attributed to the great demand for wound-immersed current transformers due to their high accuracy, reliability, and versatility. The growing demand for high voltage powers requires highly accurate and reliable electric current measuring. The demand for safe, efficient, and cost-effective applications in electric systems is the major reason behind the high adoption of wound-type current transformers.

The toroidal segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to its high accuracy advantages and unique design. Toroidal-type current transformers provide safe monitoring of actual electric current flow in devices. Their compact designs allow them to be opened, installed, and closed without disconnecting the circuits. Low maintenance and less installation complexity make them popular.

The > 33 kV to ≤ 66 kV segment dominated the global oil immersed current transformer market in 2024 because of the increased demand for electricity due to rapidly growing industrialization and urbanization. Factors like technological advancements in transformer design and materials and the expanding renewable energy sector are fueling the segment expansion. The > 33 kV to ≤ 66 kV current transformers are the highest system voltage with rated frequency standards. The need for transmission and distribution infrastructures and grid modernizations is driving the adoption of > 33 kV to ≤ 66 kV oil immersed current transformers. The > 33 kV to ≤ 66 kV current transformers provide higher electrical withstand capability than the external insulation.

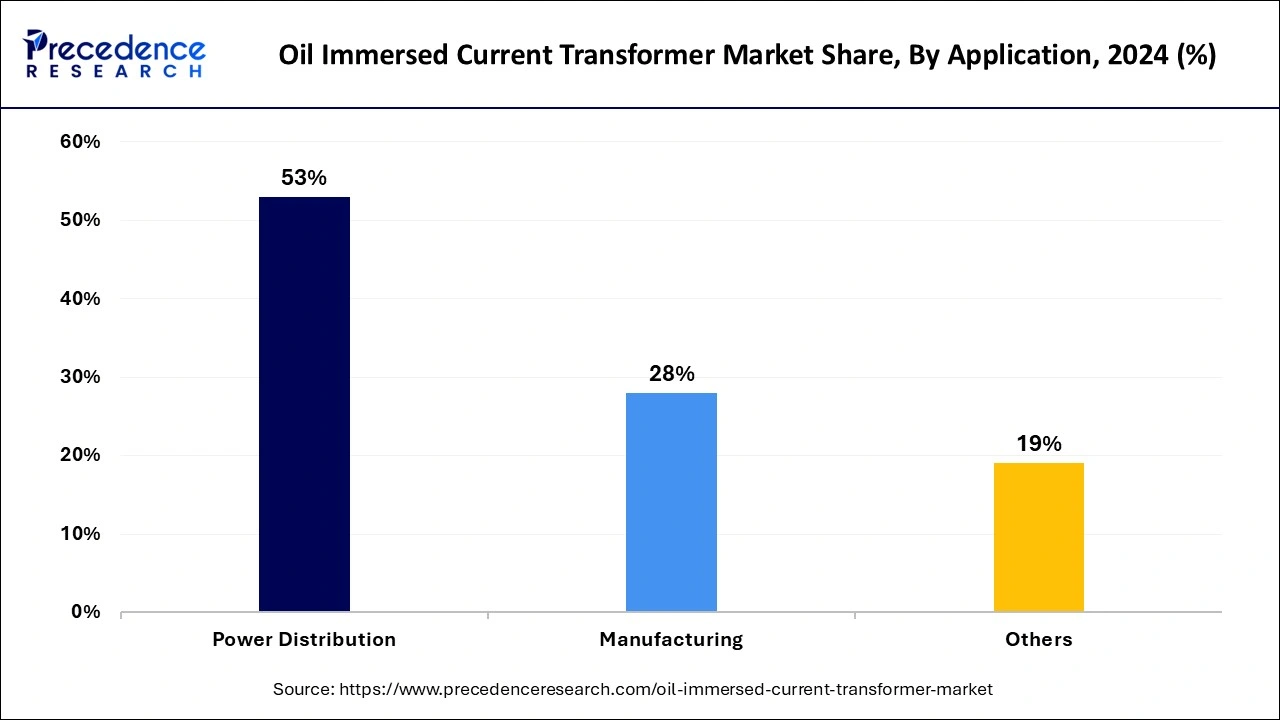

The power distribution segment generated the biggest oil immersed current transformer market share in 2024 due to increased demand for power distribution infrastructure in rapidly expanding urbanization and industrialization. The expansion of renewable energy sources and integration of smart grid technology increased the need for current transformers for power distribution to meet the rising electricity demand. Power distributors improve grid reliability and safety, which makes them ideal for electricity infrastructure.

On the other hand, the manufacturing segment is expected to expand at the fastest CAGR over the projected period. The segment is driving market growth due to the need for oil immersed current transformers for high-capacity and reliable electrical instruments to support varied manufacturing processes. The manufacturing process requires a highly reliable and efficient power supply, making it essential for the adoption of oil immersed current transformers. Furthermore, the ability of oil immersed current transformers to reduce downtime, provide accurate measurement, and improve operational efficiency makes them popular in manufacturing applications.

Asia Pacific is the largest shareholder of the oil immersed current transform market due to various factors, such as the large demand for electricity in rapidly growing urbanizations and industries. Government investments in grid modernization and integration of renewable energy sources with oil immersed current transformers are playing a crucial role in the Asian market. This initiative is further encouraging development and access to innovative and advanced oil immersed current transformers in the region.

Countries like China and India are contributing a significant share of the regional market due to their rapidly growing urbanization and industrialization. China is leading the regional market because of the country's well-established technology infrastructure and standards and government policies for electricity infrastructure. India is the second largest country, leading the Asian oil immersed current transformer market due to the country's urbanization and increased demand for electricity in expanded industries.

North America is estimated to expand the fastest CAGR in the oil immersed current transformer market between 2025 and 2034 due to the region's well-established energy sector. The surge in the development and adoption of sustainable technologies in the energy sector to reduce environmental impact and carbon footprints is a prior factor leveraging key companies' determination to advance electricity technologies, including oil immersed current transformers. Moreover, the presence of key manufacturers is driving regions' technological advances in electricity infrastructure. Availability and access to cutting-edge technologies are enabling their integration with oil immersed current transformers to improve their efficiency and performance, making them a priority choice by end-users of North America.

The United States leads the regional market due to environmental regulatory pressures for sustainable practices and increased demand for grid modernization and the adoption of smart grid technologies. Developments of AI-driven data centers, unprecedented electrification, and the adoption of reusable technology in manufacturing are influencing the adoption of oil immersed current transformers in the country. Countries' commitment to complying with advanced power infrastructure and regulatory standards to reduce carbon emissions is projected for extreme market potential in the forecast period.

By Product

By Voltage Rating

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client