March 2025

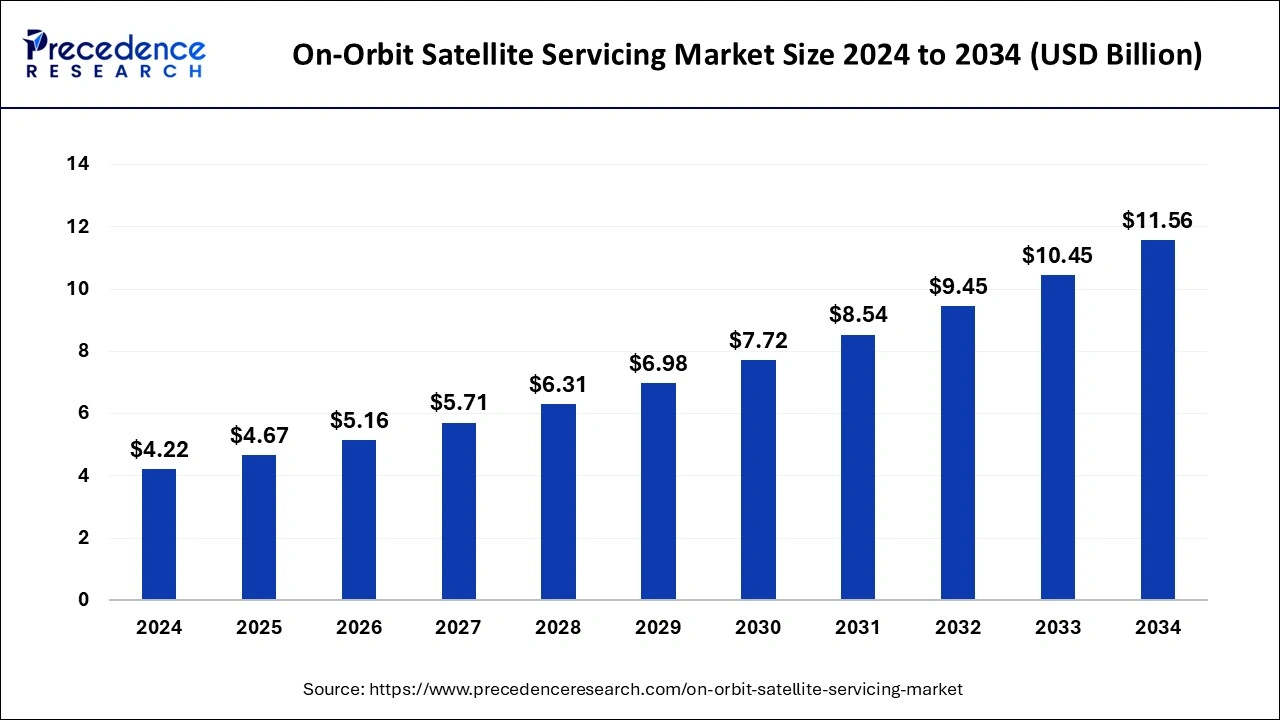

The global on-orbit satellite servicing market size is calculated at USD 4.67 billion in 2025 and is forecasted to reach around USD 11.56 billion by 2034, accelerating at a CAGR of 10.56% from 2025 to 2034. The North America market size surpassed USD 1.56 billion in 2024 and is expanding at a CAGR of 10.77% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global on-orbit satellite servicing market size accounted for USD 4.22 billion in 2024 and is expected to exceed around USD 11.56 billion by 2034, growing at a CAGR of 10.60% from 2025 to 2034. The rising demand to maintain and repair satellites in space, which is essential to extending the life of satellites and improving their performance, contributes to the growth of the on-orbit satellite servicing market.

Integration of artificial intelligence in the on-orbit satellite servicing market has the potential to transform in terms of streamlining operations, managing complex network systems, and improving data processing. Artificial intelligence facilitates decision-making, solving problems, and performing tasks automatically. In addition, the incorporation of machine learning helps the system to learn and improve with the help of analyzed data patterns to make predictions or optimize satellite performance in real-time bases.

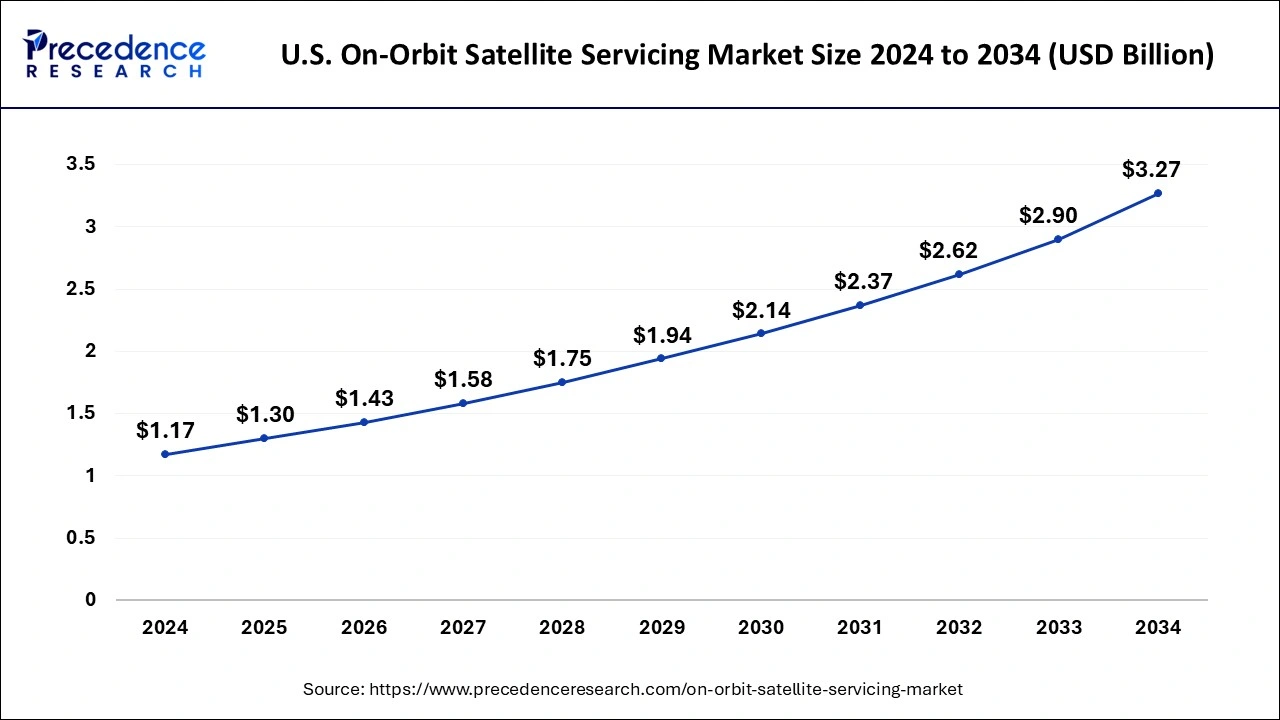

The U.S. on-orbit satellite servicing market size was evaluated at USD 1.17 billion in 2024 and is projected to be worth around USD 3.27 billion by 2034, growing at a CAGR of 10.82% from 2025 to 2034.

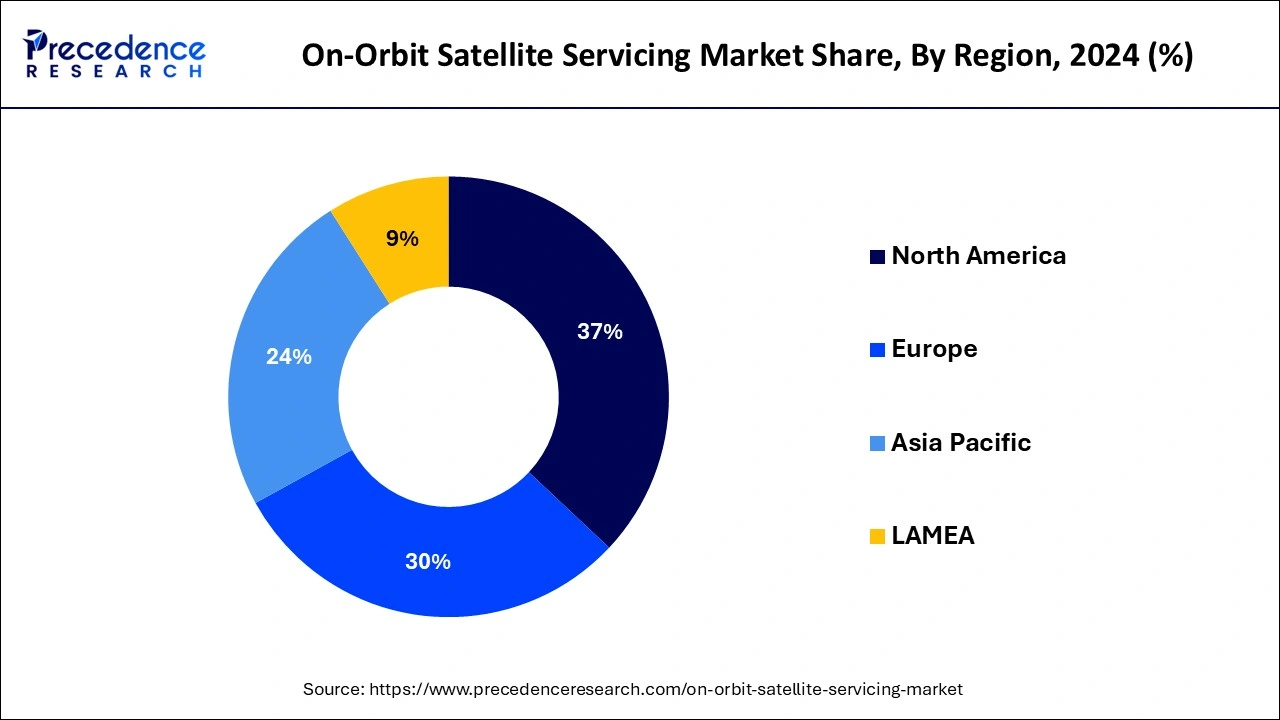

North America held the largest share of the on-orbit satellite servicing market in 2024. The dominance of this region is observed due to the consistent advancement, strategic investment, and developed infrastructure. The Space Force is making a robust investment of USD 200 million each year to develop an initial operational satellite refueling and sustainment capacity. They also believe that a great investment benefits the development of the commercial industry.

The investment in on-orbit refueling capabilities is maintaining America’s strategic advantage in space. In North America, particularly in the United States, NASA plays a crucial role in advancing programs such as NASA Satellite Servicing Capabilities Office (SSCO), which develops cutting-edge technologies such as robotic systems, tools, and many more.

Asia Pacific is projected to expand at the fastest rate in the on-orbit satellite servicing market during the forecast period. The growth of this region is primarily observed due to the increasing satellite deployment into orbit to meet the demand for earth observation, communication, and navigation services. The region is highly dominating in countries such as China, India, and Japan. China is developing a comprehensive approach to space operation issues such as stainability, efficiency, and reducing debris. Several companies established in China are planning refueling and active debris removal demonstration missions.

On-orbit satellite servicing comprises servicing, refueling, repairing, and upgrading satellites present in orbit. The on-orbit satellite servicing market is a rapidly growing transformative and disruptive capacity that offers operators unprecedented flexibility and resilience for space assets. The capabilities are achieved through new infrastructure for earth observation, communication, space exploration, space travel, and habitat, which are integral parts of creating a better world. The broad application of on-orbit satellite servicing benefits on a scientific, economic, strategic, and societal level. This on-orbit satellite servicing technology reduced the chances of failure with the help of cheaper and faster development of satellites and repair missions.

| Report Coverage | Details |

| Market Size by 2024 | USD 4.22 Billion |

| Market Size in 2025 | USD 4.67 Billion |

| Market Size in 2034 | USD 11.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Orbit Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Debris removal

The challenge of space debris elimination is the primary driver of the on-orbit satellite servicing market. This practice is greatly achieved through the government and space agencies/organizations, particularly in countries such as Europe, the United Kingdom, and Japan, where these regions invest in projects designed to develop demonstrators for debris removal. This is an essential initiative, as debris poses a substantial threat to satellite services. International collaboration helps in propelling debris removal by reducing the cost of OOS.

Policy Challenges

An on-orbit satellite servicing market company only succeeds when there is a set of regulations and liability issues addressed. Along with that, the servicing company must have a remote sensing license as they use cameras for inspecting the client’s satellite without any intention of clicking pictures of the Earth. Acquiring this license is a lengthy process as it needs to be reviewed by national security. This challenge can be resolved by obtaining a federal government outline of high-level policy priorities for servicing. Furthermore, there are other OOS industrial regulations.

Collaborative initiative

The collaboration between companies and governments is expected to expand the on-orbit satellite servicing market as this will multiply the stakeholders in the space industry who are working towards improving satellite performance, reducing cost, and ensuring safety. The satellite servicing companies recognize the areas of development for future necessities, which will help in economic growth in space and various opportunities for refurbishment.

The robotics servicing segment contributed the highest on-orbit satellite servicing market share in 2024. The dominance of the segment is observed due to the extensive utilization of robotics arms to repair, refuel, or exchange parts of the satellite. Along with that, it offers inspection, assembly, and maintenance of large space infrastructure and the removal of orbital debris. Many researchers and representative engineering applications and technology verification have shown individual interest in space robots for OOS. Modern space robots are equipped with features such as high intelligence and performance which help in dealing with OOS's increasing complexity.

The refueling segment will show significant growth in the on-orbit satellite servicing market during the forecast period. The expansion of this segment is noticed due to the rising demand for refueling capacity for future space exploration. This technology is gradually bringing significant savings by reducing the cost associated with replacing satellites with new ones. Along with that, this technology also encourages sustainable ways of designing missions and reducing the number of deorbited satellites.

The LEO (Low Earth Orbit) segment captured the biggest on-orbit satellite servicing market share in 2024. As Low Earth Orbit (LEO) is close to the Earth at 1200 to 2000 kilometers, it is the easiest orbit to reach for satellites. LEO is extensively used for communication, spaying, military reconnaissance, and other imaging applications. The preference of LEO is high compared to any other orbit due to its reduced latency which holds the ability to provide service with a lower latency rate.

The GEO (Geostationary orbit) segment is expected to grow at the fastest CAGR in the on-orbit satellite servicing market during the forecast period. The demand for GEO is as it is the ideal orbit if a satellite needs to stay fixed above at a specific location. This is commonly used as a telecommunication satellite for weather data, broadcast TV, and many more. As of July 2023, according to UCS satellite database lists, there are 6,718 known satellites, and 580 are at GEO.

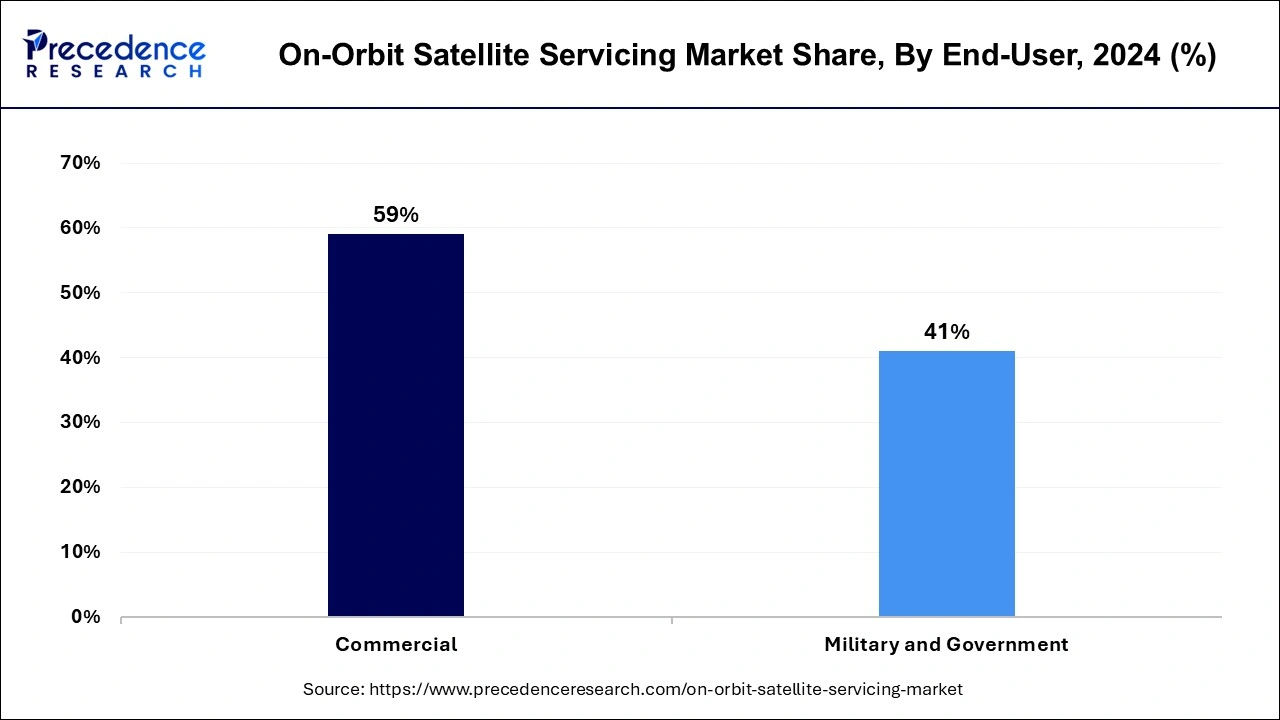

The commercial segment dominated the on-orbit satellite servicing market in 2024. The dominance of this segment is credited to the presence of on-orbit satellite servicing companies, which are integrated with advanced technology such as robotic arms, sensors, and software to command, interact, and manipulate the satellite. Additionally, commercial companies use automation, robotics, and navigation technology to maneuver satellites to position them for servicing.

The military and government segment is projected to expand rapidly in the on-orbit satellite servicing market over the coming years. The growth of this segment is owed to the utilization of OOS for satellite intelligence gathering, navigation, and communication by the military and government. Along with that, they are also being used for disaster management, agriculture, and forestry. Some established OOS from the military and government are OSAM-1 and the On-orbit Satellite Servicing Study by NASA project.

By Service

By Orbit Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

November 2024

February 2025

April 2025