May 2023

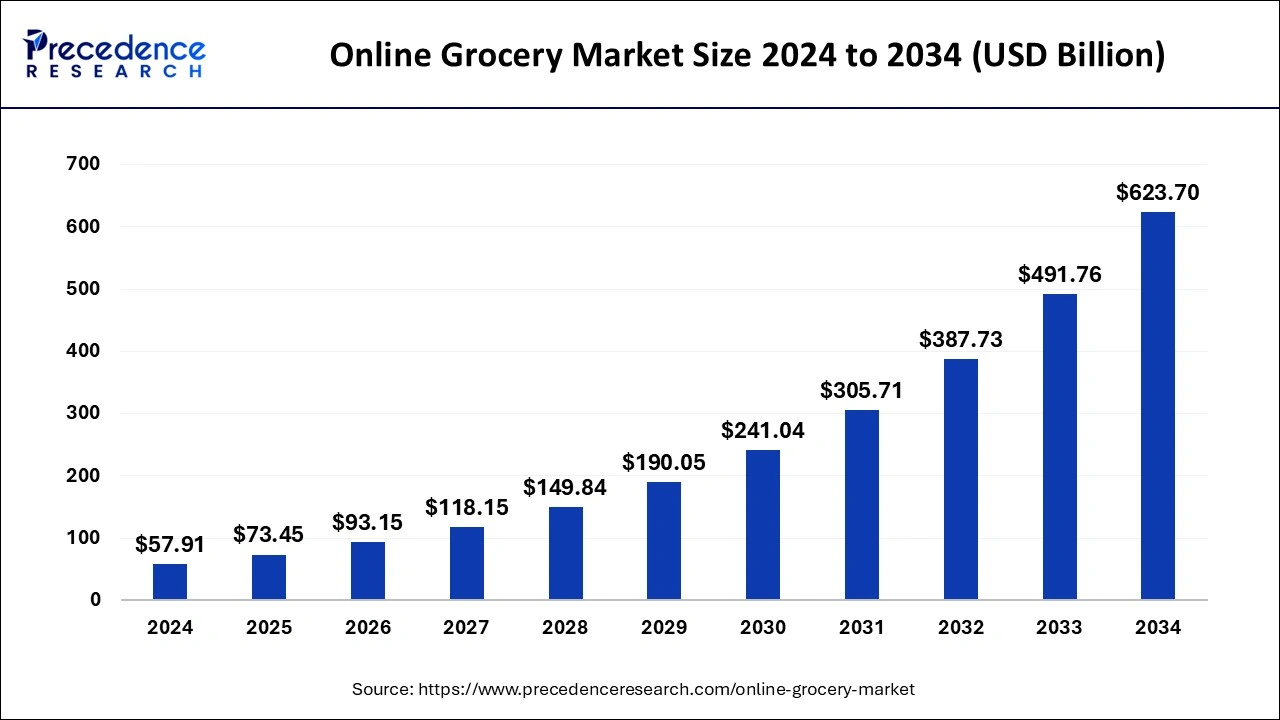

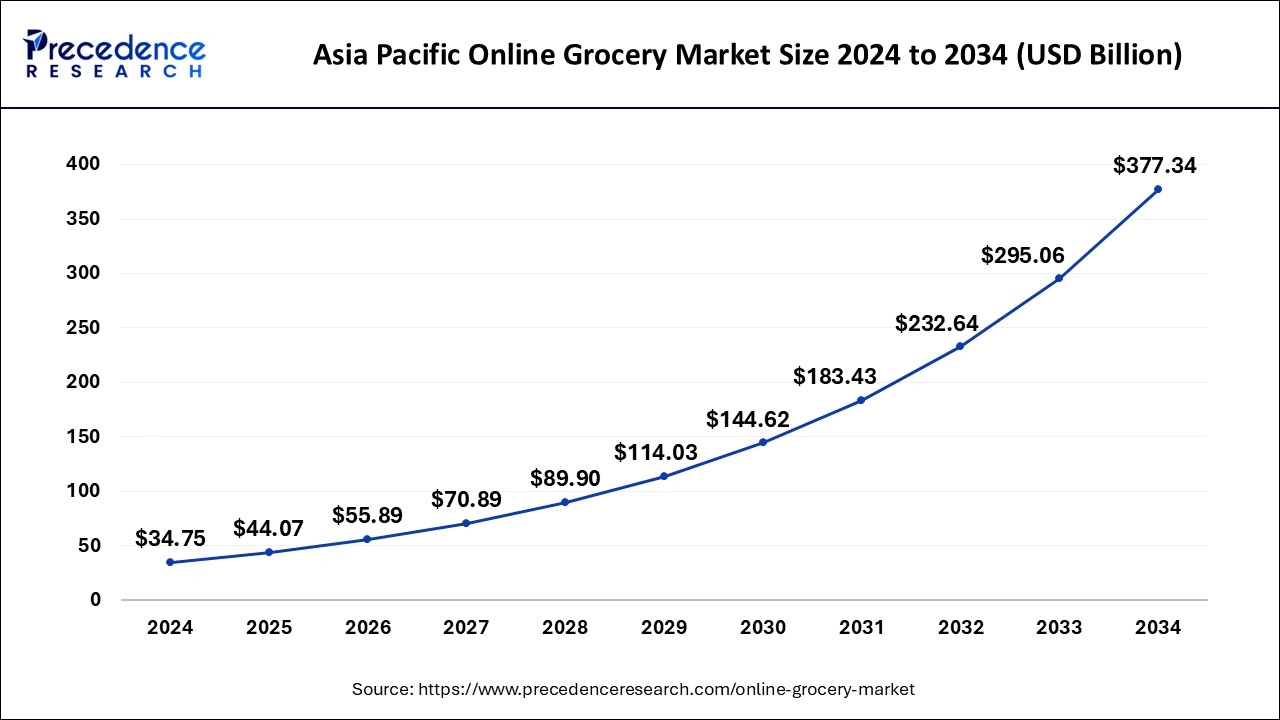

The global online grocery market size is calculated at USD 73.45 billion in 2025 and is forecasted to reach around USD 623.70 billion by 2034, accelerating at a CAGR of 26.83% from 2025 to 2034. The Asia Pacific online grocery market size surpassed USD 44.07 billion in 2025 and is expanding at a CAGR of 26.93% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global online grocery market size was estimated at USD 57.91 billion in 2024 and is anticipated to reach around USD 623.70 billion by 2034, expanding at a CAGR of 26.83% from 2025 to 2034.

The Asia Pacific online grocery market size was evaluated at USD 34.75 billion in 2024 and is predicted to be worth around USD 377.34 billion by 2034, rising at a CAGR of 26.93% from 2025 to 2034.

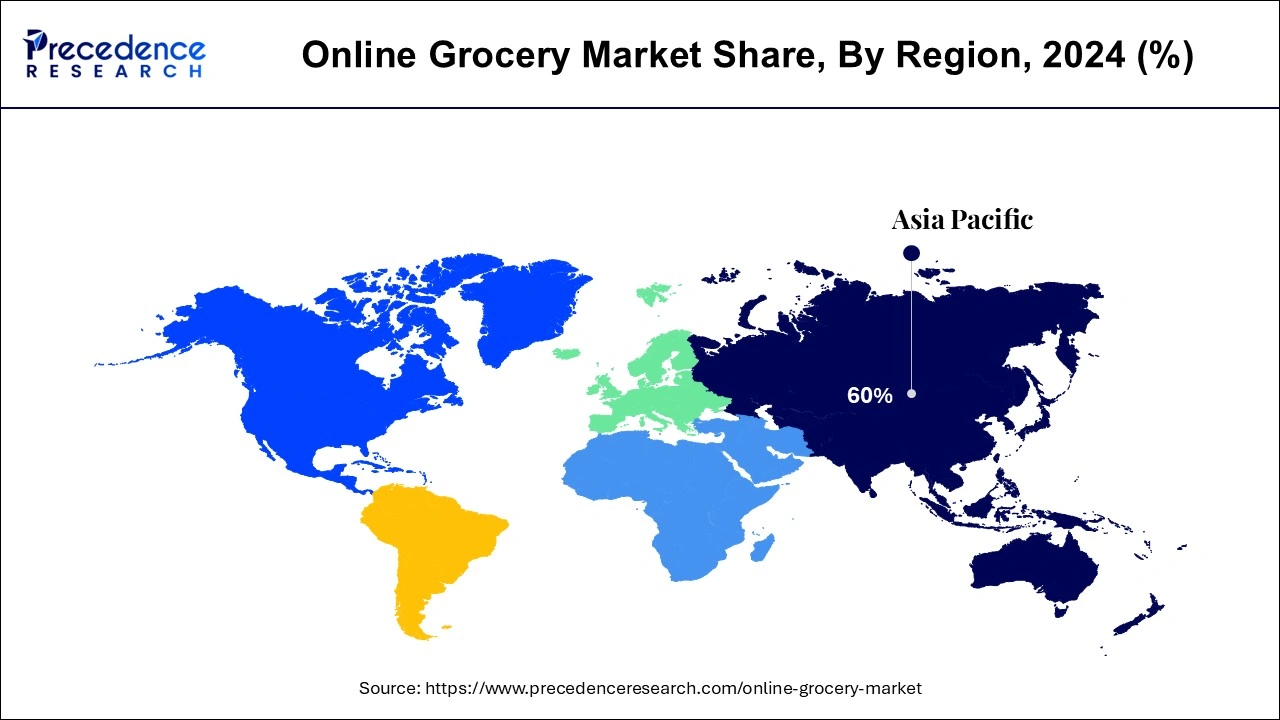

Asia Pacific dominated the global online grocery market with the largest market share of 60% in 2024. North America is forecasted to rise during the forecast period. Apart from these nations, India and China are considered to be very high potential markets for the platform. Due to digitization in India and China, which are Asia Pacific markets are expected to have a growth. The coronavirus lockdown had helped in a significant rise in online grocery sales in these regions.

The various government initiatives that are aimed at digitally empowering these nations, this market is expected to grow during the forecast. US is witnessing a steady growth in this platform. Several key players, Walmart Amazon.com Inc, Instacart etc. are all from North America.

The online grocery market is growing rapidly as the preferences of the consumers are changing due to the pandemic and the growth of E-commerce industry. The global pandemic has brought this platform to the center stage. Previously, due to high ecommerce fees or not so user-friendly website designs stunted the growth of this market. Apart from the pandemic, there are other factors that have led the customers to adopt this platform. Previously, when all the grocery was brought from the shops, now there is a shift from the shops to the online grocery stores. Items of personal care, Snacks, packaged foods, dairy, fresh meat, frozen food all of them have seen a significant rise. Major online stores are providing services like that help in placing the order and collecting it on the same day. This helps in the rapid growth of the services market. The click and collect concept is adopted in order to have contactless shopping experience.

Shopping online helps in saving the time required in traveling up and down to the store, collecting the things and prevents wastage of fuel or gas. Customers have an advantage of a fully stocked store even if you try to place an order at midnight. Online grocery shopping will help in reduction of the carbon dioxide emissions compared to the individual household trips for such shopping. The tendency of impulse buying within is turned down during online shopping. The feature of price comparison provided by these platforms makes the life of the housewives easy and helps save their money. Searching the products online is also easy as compared to the shops. Many groceries store sites help you with your shopping list that you last ordered, so this also helps in reordering the items. It is also less stressful as compared to dealing with the busy grocery store, when everyone else is there during the peak hours.

There is a change in the preference for grocery shopping through online channels due to changes in technology due to urbanization and shift in consumer shopping habits. The growing disposable income and attractive discounts that are offered by the online grocery stores is driving the market. Low service fees and easy availability of time slots is also helping the market grow. The options offered by online grocery stores are more than the conventional stores. A hectic lifestyle has also led to an increase in the market share.

The availability of smartphones or smart devices at home, along with Internet connectivity, have also led to a growth in the online sales. Increased liking for hassle free shopping and a growing inclination towards the ecommerce platforms is also expected to help the market grow. The online grocery stores also provide some attractive offers like cash back, discounted offers and express delivery options.

| Report Coverage | Details |

| Market Size by 2034 | USD 623.70 Billion |

| Market Size in 2025 | USD 73.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 26.83% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Delivery, Purchasers, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

All the staples and the staples and the cooking essentials segment accounted for the highest market share of 34% in the year 2024. Staples include the demand for grains, oil, which are necessities in any household. Especially across Asia Pacific apart from the staples the dairy market is expected to grow at par with the staple segment. Due to doorstep delivery available for the milk and milk products this market is growing. That is expected to be a 24% growth in the fresh produce segment. Due to availability of meat and seafood online this market is also expected to rise in the forecast period. The breakfast and dairy segment is expected to grow at a notable CAGR over the forecast period. Online grocery stores cover a wide range of products, like the cereals, vegetables, fruits, bakery,breakfast products, Poultry and meat.

Based on the delivery type the segment can be further classified into click and collect or home delivery. The home delivery option is expected to have a larger market share during the forecast period. The click and collect process allows the customer to place an order through the online website for the products and while selecting the option for pick up. The benefit of click and collect order is that the delivery is within on the same day or the next day. So it helps in saving time and the shipping costs.

The segment can be further classified as one time customer or subscribed customers. The subscription services are rapidly growing and it's playing a niche role in driving the market. It helps in allowing the customers to have free delivery cash back offers and priority of having the earlier slots for delivery. It helps in building trust among the customers and also encouraging customers to opt for subscriptions that are annual. In the recent years, there has been a rise of online shopping subscriptions. In order to retain the customers or subscription services are provided which provide rewards or savings.

Jordan Berke a former ecommerce executive with Walmart China said that, he's telling the grocers to stretch the fulfillment capacity of their stores by utilizing all the extra space and automation before going into a dark facility. Grocers are investing money in labor and order management system. In order to provide efficient pickup orders they are allotting dedicated spaces in the stores.

In order to automate the manual tasks and processes and to reduce the errors made in pricing the products accurately, a grocery automation software is installed to withstand the competition, many retailers are trying to enter this segment of online selection and delivery of grocery. This is the new trend which will help the retailers to grow and develop post pandemic. In order to keep the customers with a particular organization these platforms are providing incentives in the form of loyalty programs. This loyalty program helps in order to compete with the large enterprises and also the small convenience stores. In the market as many platforms are providing the E commerce option. In order to survive the competition, they have to offer a user experience that customers find convenient to use. Personalization also plays a very important role based on customers preferences retailers should make their software that would provide recommendations. The retailers are combining their platforms with apps and recipe sites that not just help in shopping, but also help in building recipes around the individual items that are bought in order to provide dedicated customer service.

By Product

By Delivery

By Purchasers

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2023

October 2024

September 2024

March 2025