July 2024

The global operational risk management solution market size is calculated at USD 1.80 billion in 2024, grew to USD 1.96 billion in 2025 and is predicted to hit around USD 4.41 billion by 2034, expanding at a CAGR of 9.4% between 2024 and 2034. The North America operational risk management solution market size accounted for USD 760 million in 2024 and is anticipated to grow at a fastest CAGR of 9.5% during the forecast year.

The global operational risk management solution market size is calculated at USD 1.80 billion in 2024 and is projected to surpass around USD 4.41 billion by 2034, expanding at a CAGR of 9.4% from 2024 to 2034.

The U.S. operational risk management solution market size size is exhibited at USD 531.26 million in 2024 and is projected to be worth around USD 1,326.85 million by 2034, growing at a CAGR of 9.6% from 2024 to 2034.

North America has held the largest revenue share at 42% in 2023. North America holds a significant share in the operational risk management solution market due to several factors. First, the region's well-developed financial sector and stringent regulatory environment drive the adoption of risk management solutions. Second, the prevalence of cyber threats and data breaches necessitates advanced operational risk mitigation tools. Third, a strong focus on compliance, coupled with a high level of digital transformation, fuels demand.

Additionally, the presence of prominent solution providers and a robust IT infrastructure enhance market growth. These factors collectively contribute to North America's dominant position in the operational risk management solution market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands a significant share in the operational risk management solution market due to several factors. Rapid economic growth, digital transformation, and increased business complexity in the region have heightened operational risk concerns.

Furthermore, regulatory changes and the need for compliance drive the adoption of risk management solutions. The region's diverse industries, including finance, healthcare, and manufacturing, all require robust risk mitigation strategies. As a result, Asia Pacific is a key growth driver, with businesses in the region recognizing the value of operational risk management solutions to ensure business continuity and financial stability.

Operational risk management solutions encompass a comprehensive array of strategies and tools employed by businesses to systematically identify, evaluate, mitigate, and supervise risks inherent in their day-to-day activities. These sophisticated solutions involve the methodical scrutiny of potential perils, including but not limited to human errors, technological glitches, compliance challenges, and unforeseen external circumstances that have the potential to disrupt operational processes and result in financial setbacks. They typically encompass frameworks for risk assessment, systems for monitoring and tracking incidents, as well as the establishment of policies and procedures aimed at ensuring the effective management of these risks.

By deploying these solutions, organizations can preemptively fortify their operations, bolster their capacity to withstand disruptions and ensure adherence to regulatory standards, ultimately diminishing the likelihood of operational disruptions and financial repercussions. These solutions hold particular significance for industries like banking, healthcare, and manufacturing, where operational stability and continuity are of utmost importance.

In essence, operational risk management solutions provide a multifaceted arsenal of methods and resources for organizations to methodically discern, assess, mitigate, and oversee the various threats intertwined with their daily operations. These encompass a comprehensive analysis of conceivable hazards, encompassing human lapses, technological hiccups, compliance complexities, and unexpected external contingencies, which have the potential to perturb operational workflows and engender financial setbacks.

These solutions typically incorporate frameworks for evaluating risks, mechanisms for monitoring and documenting incidents, alongside the development of policies and procedures designed to ensure the adept handling of these risks. The implementation of these solutions allows organizations to proactively secure their operations, enhance their ability to endure disruptions and guarantee adherence to regulatory norms, thereby lessening the odds of operational interruptions and financial repercussions. Industries like banking, healthcare, and manufacturing, where operational dependability and continuity are of paramount importance, derive exceptional value from these measures.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.41 Billion |

| Market Size in 2024 | USD 1.80 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.4% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Deployment, Enterprise Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital transformation

The operational risk management solution market is experiencing robust growth driven by the ongoing digital transformation of businesses. This transformation introduces a fresh set of operational risks stemming from technology, data, and interconnectedness. As companies embrace innovative technologies, cloud integration, and data-driven decision-making, the demand for sophisticated risk management solutions has surged. Digital transformation initiatives expose organizations to cyber threats, data breaches, and technological breakdowns.

To effectively mitigate these risks, enterprises seek comprehensive operational risk management solutions capable of identifying, evaluating, and addressing digital risks. These solutions often encompass real-time monitoring, advanced analytics, and AI-driven tools for proactive threat detection and response.

Moreover, the intricate interconnections within digital ecosystems and global supply chains emphasize the need for enhanced visibility and control over operations. Staying in compliance with evolving digital regulations further underscores the indispensability of these solutions. In essence, digital transformation magnifies operational risks, compelling the adoption of advanced operational risk management solutions that can adapt to this evolving landscape, positioning them as indispensable components of contemporary business strategies.

Implementation costs

Implementation costs represent a significant restraint on the growth of the operational risk management solution market. While these solutions offer substantial benefits, the initial financial outlay for acquiring, customizing, and integrating them can be substantial. This cost includes purchasing software, hardware, and investing in employee training. For smaller and mid-sized enterprises with limited budgets, this financial burden can be a significant deterrent to adoption.

Moreover, ongoing expenses, such as software maintenance and updates, can further strain resources. Organizations must also allocate resources for hiring or training staff to effectively operate the solutions. The cumulative cost can lead businesses to delay or forgo implementing operational risk management solutions altogether, leaving them vulnerable to operational disruptions and financial losses.

Addressing this restraint requires vendors to offer cost-effective solutions and businesses to carefully evaluate the long-term benefits of risk mitigation against the upfront expenses, potentially leveraging return on investment (ROI) calculations to justify the investment.

AI and analytics

AI and advanced analytics are catalyzing opportunities in the operational risk management solution market by revolutionizing risk assessment, prediction, and mitigation. These technologies enable organizations to proactively identify potential risks, assess their impact, and take informed, real-time actions to mitigate them. AI-driven models can process vast amounts of data and identify patterns that human analysts might miss, providing a more comprehensive risk analysis.

Additionally, predictive analytics can forecast potential risks and their financial implications, allowing companies to allocate resources efficiently and reduce financial exposure. Real-time monitoring, powered by AI, offers the ability to detect emerging threats promptly, thereby preventing operational disruptions. These capabilities are invaluable in a rapidly changing business environment where digital transformation, cyber security threats, and evolving regulatory requirements demand a more agile and data-driven approach to operational risk management, presenting significant growth opportunities for AI and analytics-driven solutions.

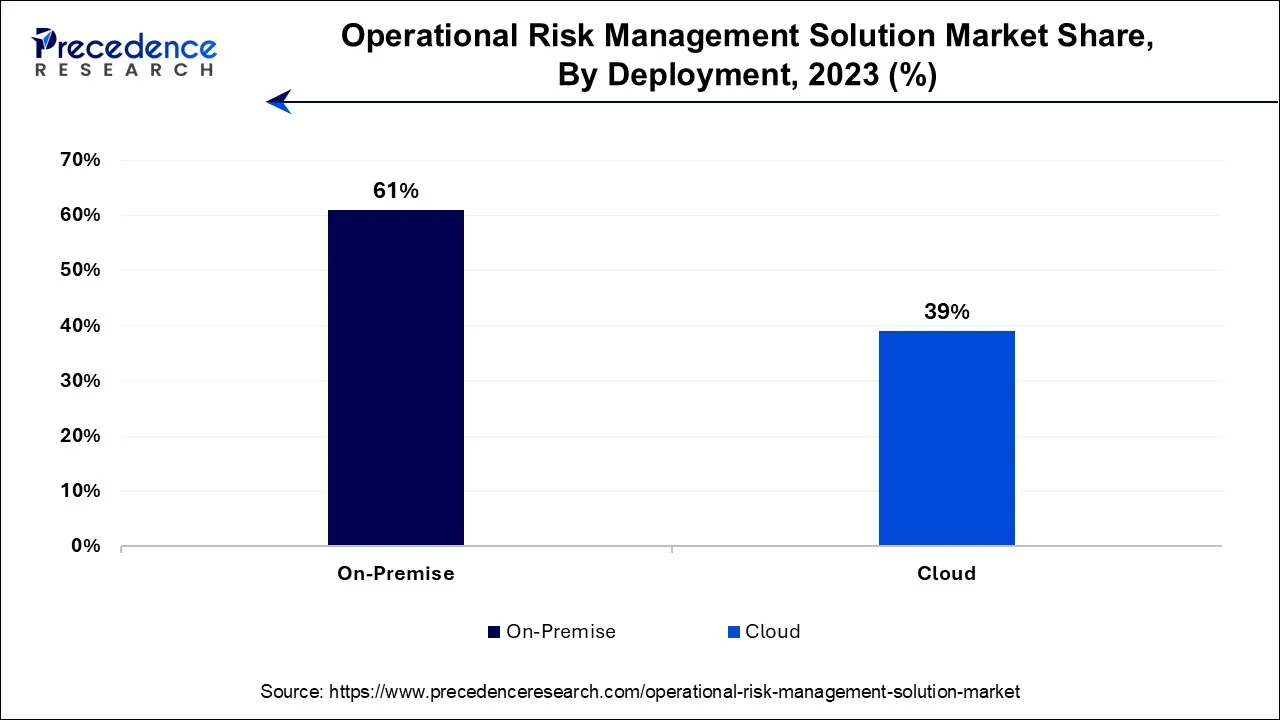

The on-premise segment has held 61% revenue share in 2023. The on-premise segment dominates the operational risk management solution market due to factors like data security, regulatory compliance, and customization. Many organizations, especially in highly regulated industries, prefer on-premises solutions to maintain control over their data and adhere to strict compliance requirements.

They also value the ability to customize solutions to suit specific operational needs. While cloud-based solutions are gaining traction for their flexibility and scalability, the on-premise segment continues to hold a major share, reflecting the ongoing significance of data control and tailored risk management strategies in the business landscape.

The cloud segment is anticipated to expand at a significant CAGR of 10.2% during the projected period. The cloud deployment segment commands significant growth in the operational risk management solution market due to its scalability, accessibility, and cost-effectiveness. Cloud-based solutions offer organizations the flexibility to adapt to changing risk landscapes and evolving compliance requirements. They eliminate the need for extensive on-premises infrastructure, reducing upfront costs. Cloud solutions enable remote access, real-time updates, and seamless integration with other systems, promoting efficient risk management.

The ease of deployment and scalability make cloud-based solutions attractive to organizations seeking to modernize their operational risk management practices, making this segment a major contributor to the market.

The large enterprise segment had the highest market share of 60% in 2023. Large enterprises dominate the operational risk management solution market due to their greater financial resources, complex operational structures, and stringent regulatory requirements. These organizations face multifaceted operational risks and need comprehensive solutions to ensure business continuity.

Large enterprises can invest in advanced, customized solutions, have dedicated risk management teams, and allocate substantial budgets for compliance. Additionally, the scale of their operations necessitates more extensive risk management measures. Smaller enterprises may opt for simpler solutions or delay adoption, leading to the large enterprise segment holding a major share in the market.

The small and medium enterprises segment is anticipated to expand fastest over the projected period. SMEs (Small and Medium-sized Enterprises) hold significant growth in the operational risk management solution market due to their growing recognition of the need for risk mitigation. These businesses are increasingly vulnerable to operational disruptions, making risk management essential.

The availability of cost-effective and scalable cloud-based solutions tailored for SMEs has made adoption more accessible. Additionally, regulatory pressures and the desire to protect their reputation and financial stability drive SMEs to invest in these solutions. As a result, the SME segment plays a pivotal role in the market's growth, accounting for major growth.

Segments Covered in the Report

By Deployment

By Enterprise Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

October 2024

April 2025

August 2024