January 2025

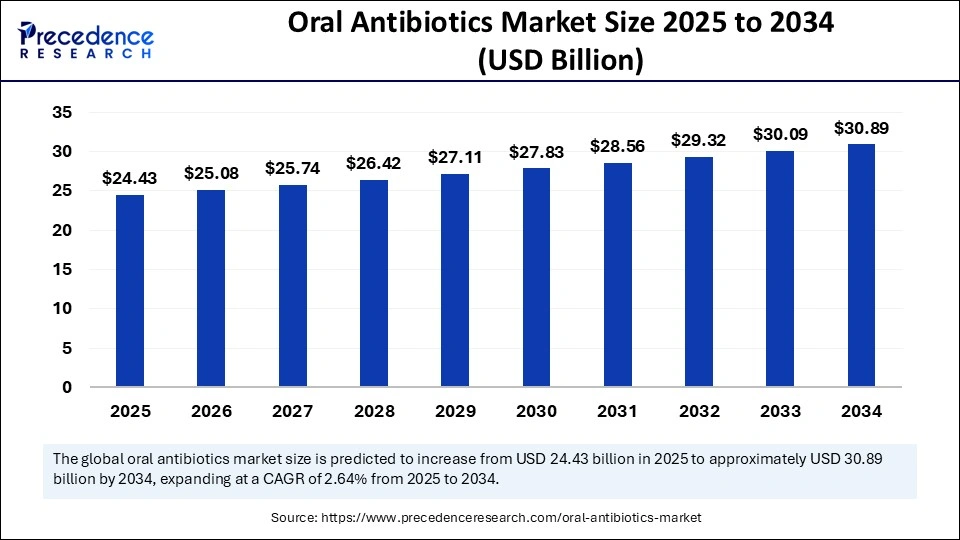

The global oral antibiotics market size is calculated at USD 24.43 billion in 2025 and is forecasted to reach around USD 30.89 billion by 2034, accelerating at a CAGR of 2.64% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oral antibiotics market size accounted for USD 23.8 billion in 2024 and is predicted to increase from USD 24.43 billion in 2025 to approximately USD 30.89 billion by 2034, expanding at a CAGR of 2.64% from 2025 to 2034. The market is driven by rising bacterial infections, antibiotic resistance concerns, pharmaceutical innovations, and expanding healthcare access, fueling demand for advanced, effective, and accessible treatments worldwide.

Artificial intelligence (AI) is transforming the way new antibiotics are developed by expediting the discovery of new antibiotics, optimizing the formulations of antibiotics, and enhancing treatment paradigms. Machine learning models are used to analyze large datasets to identify novel antibiotic compounds, predict certain bacterial resistance trends, and improve drug design. Using AI, scientists can help delineate the interaction of antibiotics with bacteria to develop more effective treatment strategies.

SyntheMol, an AI system developed by Stanford Medicine in March 2024, designs and provides synthesis protocols for new drugs that target antibiotic-resistant bacteria. SyntheMol produced structures and chemical protocols for six new drugs for treating A. baumannii, illustrating the potential of using AI to streamline drug design and production. In addition, AI studies on drug repurposing can recognize previously discovered compounds/medications that have antibacterial properties, which accelerates the discovery of new treatment plans.

Oral antibiotics are drugs that are taken by mouth for the treatment of bacterial infections. Shortboard oral antibiotics treat bacterial infections by stopping the growth of bacteria or killing bacteria, and are effective for infections that range from lung and urinary tract infections to skin infections and infections of the gut. The oral antibiotics market is a growing and important sector of the overall pharmaceutical market that includes a variety of drug classes such as penicillins, cephalosporins, macrolides, and fluoroquinolones.

The oral antibiotics market is affected by the continued development of new drugs, updated treatment recommendations, and whether to treat an infection with a broad-spectrum antibiotic or a narrow-spectrum antibiotic targeting a specific infection. Innovations in oral antibiotic formulation, such as extended-release formulations or in combination with other antibiotics, can enhance the effectiveness and patient adherence. The impact of antibiotic resistance has resulted in a notable increase in research and development of next-generation antibiotics and alternative approaches such as bacteriophage therapy and microbiome-based therapies.

| Report Coverage | Details |

| Market Size by 2034 | USD 30.89 Billion |

| Market Size in 2025 | USD 24.43 Billion |

| Market Size in 2024 | USD 23.8 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.64% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Class, Spectrum of Activity, Drug Origin, Drug Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising prevalence of bacterial infections

The global rise in bacterial infections has greatly stimulated the global oral antibiotic market. Respiratory tract infections, urinary tract infections (UTIs), and skin infections are still considered some of the bacterial diseases most often treated with appropriate antibiotics. For example, UTIs affect a considerable portion of the population, especially women. As a result, in October 2024, the U.S. FDA provided approval for Orlynvah(a) from Iterum Therapeutics, a new oral antibiotic treatment option for uncomplicated UTIs in adult women with limited treatment backgrounds.

Moreover, with the emergence of AMR (antimicrobial resistance), the importance of developing new antibiotics is increasing. The WHO flagged AMR as one of the biggest public health threats. Pharmaceutical companies are working on the next generation of antibiotics, for example, Blujepa, used in adult uncomplicated UTIs, even when there are resistant strains to standard antibiotic treatments. The burden of infections globally continues to support oral antibiotics and will foster innovation and investment into developing effective targeted therapies.

Antibiotic resistance

The escalating crisis of antibiotic resistance is a significant restraint in the oral antibiotic market. As a result of inappropriate and excessive use of antibiotics, drug-resistant bacteria are emerging, making the treatment of infections with previously effective agents less efficacious. Organizations like the FDA and WHO are adopting more restrictive measures to limit the prescription or use of antibiotics to mitigate resistance threats. It is estimated that improved access to healthcare and antibiotics could avert 92 million deaths between 2025 and 2050.

According to the CDC, resistance is increasing in bacteria such as E. coli and Streptococcus pneumoniae are lowering the efficacy of standard treatment options. In addition to increasing AMR, high costs of research and development, and low profitability, pharmaceutical companies are not incentivized to develop new antibiotics. To sustain increasing demand long-term, the industry must focus on alternative therapies and/or develop new antibiotics.

New oral antibiotics approved for UTIs and chronic infections

The rising incidence of urinary tract infections (UTIs) and infections associated with chronic diseases continues to push pharmaceutical companies to develop and pursue regulatory approval for new oral antibiotics. Recent developments include the approval of Orlynvah from Iterum Therapeutics and Blujepa from GSK, and other developments from companies like Pfizer. Development and approval of new oral antibiotics like Orlynvah and Blujepa increase the number of treatment options available to patients, reflecting continued advances against infections that are antibiotic-resistant.

The beta-lactam and beta-lactamase inhibitors segment captured the biggest oral antibiotics market share in 2024 due to their clinical efficacy in a broad range of standard indications. When combined with beta-lactamase inhibitors, their bioactivity is often substantially increased in the context of resistant bacteria. Because they comprise such a high proportion of medications in the treatment of respiratory, urinary, and skin infections, and with excellent reimbursement policies, beta-lactam antibiotics hold the predominant position.

The Quinolones segment is expected to grow at a notable CAGR over the projected period due to their activity against multidrug-resistant bacteria. Their broad spectrum of activity, efficacy in complicated UTIs, and ability to act as rapid bactericidal agents provide substantial opportunity for increased usage. With the growing burden of antimicrobial resistance (AMR) and methods, it's necessary to research and promote alternative therapies, which will be the follow-up area of growth for quinolones.

The semisynthetic segment captured the biggest oral antibiotics market share in 2024 because of their enhanced pharmacokinetics, stability, and specific activity against resistant pathogens. With the advantages of better tolerability, fewer side effects, and a longer half-life than natural antibiotics, semisynthetic antibiotics are the preferred option. Regulatory approvals and ongoing innovation in drug formulations have also contributed to their market share.

The synthetic segment is expected to grow at a notable pace over the projected period as it demonstrates broad-spectrum activity with a lower likelihood of developing bacterial resistance, along with lower production costs. Synthetic antibiotics are often the product of rational drug design and show improved stability and ease of mass production. As increasing efforts are made to reduce antimicrobial resistance, pharmaceutical companies will focus on investment in novel synthetic compounds, leading to an anticipated increase in medications in this category.

The broad-spectrum antibiotics segment captured the biggest oral antibiotics market share in 2024 because they can treat various bacterial infections without prior identification of the pathogen. This segment is also experiencing significant demand in the marketplace as they are widely used in empirical therapy, emergency medicine, and primary care. An increase in hospital-acquired infections and oral combination antibiotic therapy are additional contributors to its market dominance.

The mid/narrow-spectrum antibiotics segment will expand at a notable CAGR over the projected period as targeted therapy is becoming favourable to limit antibiotic resistance. These antibiotics are an important component in antimicrobial stewardship programs because they minimize the unnecessary exposure to broad-spectrum antibiotics. Advances in diagnostic technology for more precise identification of the bacterial pathogen(s) are contributing to this phenomenon and the market growth.

The branded segment captured the biggest oral antibiotics market share in 2024 because of large R&D investments, effectiveness, and clinician belief in their products. Pharmaceutical companies are actively developing new formulations, extended-release products, and combination products to fulfill the ongoing needs of the market. Brand name antibiotic products can continue to grow due to the relationships between higher price points, a lack of clinical equivalence, limited entry during exclusivity periods, and pricing structures that include value-added innovations and new formulations.

The generic segment will expand rapidly over the projected period as a result of its lower prices, increasing regulatory support, and the patent expirations of branded drugs. Cost-containment policies established by healthcare systems, most disruptive in emerging markets, will enable even more generic use. Increased government pressures for healthcare practitioners to prescribe generics, alongside the growth in pharmaceutical manufacturing, could establish this segment for considerable growth over the foreseeable future.

The urinary tract infections (UTIs) segment held the largest oral antibiotics market share in 2024 primarily attributed to the very high incidence, particularly in women and diabetic patients. UTI etiologies account for a significant number of the global antibiotic prescribing population of UTIs, causing recurrent infections requiring subsequent treatment to occur. Broad-spectrum antibiotic agents, including beta-lactams, fluoroquinolones, and nitrofurantoin, are the agents for empirical therapy, indicating they are frequently prescribed by practitioners, which indicates a continued demand for oral antibiotics in the marketplace. The increasing occurrence of catheter-associated infections and hospital-acquired UTIs is further driving the market and continuing to dominate this market segment.

The community-acquired respiratory tract infections (CARTIs) segment is anticipated to grow at a remarkable rate between 2025 and 2034 due to the increasing air pollution, aging population, and increasing antimicrobial resistance. Macrolides and fluoroquinolones are frequently prescribed for CARTI infections because they successfully encompass activity against common respiratory pathogens. Seasonal illness outbreaks and the post-pandemic focus on respiratory health will continue to drive market demand. In addition, improvements in diagnostic methodologies allowing for early detection of infection have led to increased prescriptions of antibiotics, which will further hasten the expansion of this segment.

North America: The Dominating Region in the Functional Endoscopic Sinus Surgery Market

North America remains the leader in the global oral antibiotics market, with healthcare systems and positive government initiatives driving the market. North America's commitment to tackling antimicrobial resistance (AMR) is manifested in policies like the National Action Plan for Combating Antibiotic-Resistant Bacteria (CARB) 2023-2028, which aims to reduce inappropriate antibiotic prescribing and advance antimicrobial stewardship. Legislative initiatives, such as the PASTEUR Act, are designed to encourage the development of new antimicrobial drugs. Recent trade initiatives, including proposed tariffs on pharmaceutical importation, may impact drug access and drug costs, potentially changing market dynamics in the near future.

The United States will remain the key driver of the North American oral antibiotics market, but antibiotic use has changed over time. Antibiotic use declined nearly 19.8% from 2010 to 2020. However, the need for antibiotics still remains due to recurring infectious disease cases and government initiatives to manage inappropriate antibiotic use. In 2025, the U.S. government imposed a 10% tariff on pharmaceuticals from China, which impacts over-the-counter antibiotics and renews concerns of drug shortages. Potentially worsening this situation, proposed 25% tariffs on pharmaceuticals coming from Mexico and Canada may further inhibit supply chains and underscore the need for more domestic production to protect the North American oral antibiotic market stability.

Asia-Pacific: The Epicentre of Rapid API Growth and Innovation

The oral antibiotics market in Asia Pacific is growing rapidly due to the combination of government support and collaborative efforts to manage antimicrobial resistance (AMR). For example, Japan and South Korea launched joint research programs in January 2024 to develop new "next-generation" antibiotics to fight rising resistance cases. Likewise, China is increasing investments in biotech ventures focused on new antimicrobials. Increasing healthcare spending in the region, along with growing awareness and concern about AMR, is driving demand for new antibiotics, as various countries strengthen their regulations and guidelines for antibiotic use and prescribing practices.

India is becoming the fastest-growing market in the APAC oral antibiotics market as a result of its strong pharmaceutical base and ongoing regulatory changes. The Indian government has announced a mandate indicating that prescription instructions must include specific indications for antibiotics, which should help address the issue of antibiotic misuse. In February 2025, Indian pharmaceutical manufacturers requested government policies to support reducing their dependence on Chinese raw materials, as over 80% of active pharmaceutical ingredients (API) still need to be imported from China. While this initiative is helping increase self-sufficiency, more policy and logistical efforts are needed to build India’s resilience in pharmaceutical supply chains and reduce dependency on foreign APIs.

Europe’s Oral Antibiotics Market Expands Amid Efforts to Reduce Foreign Dependence!

Europe is anticipated to witness notable growth in the global market, spurred by heightened awareness of AMR and efforts surrounding diversification of drug supplies. In March 2025, health ministers from 11 EU countries noted a suggestion to reduce reliance on a small number of countries, especially China and countries in Asia, that currently produce 80-90% of antibiotics. This suggestion was noted to come before the EU Commission's suggested Critical Medicine Act (CMA), meant to encourage local production and centralized placement of required medicines.

Germany is emerging as an important country within the growing market in Europe. As one of the signatories in advocating diversified drug supplies, Germany signifies the importance of reducing reliance on outside countries in order to bolster health security within Europe. With a strong pharmaceutical industry and a desire to produce locally, Germany is in a central position to enact initiatives that would provide secure antibiotic supplies. Further, Germany's goal to better incorporate pharmaceuticals into a more broadly defined security framework shows it is well aware of vulnerabilities in the healthcare supply chain.

By Class

By Spectrum of Activity

By Drug Origin

By Drug Type

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

December 2024