January 2025

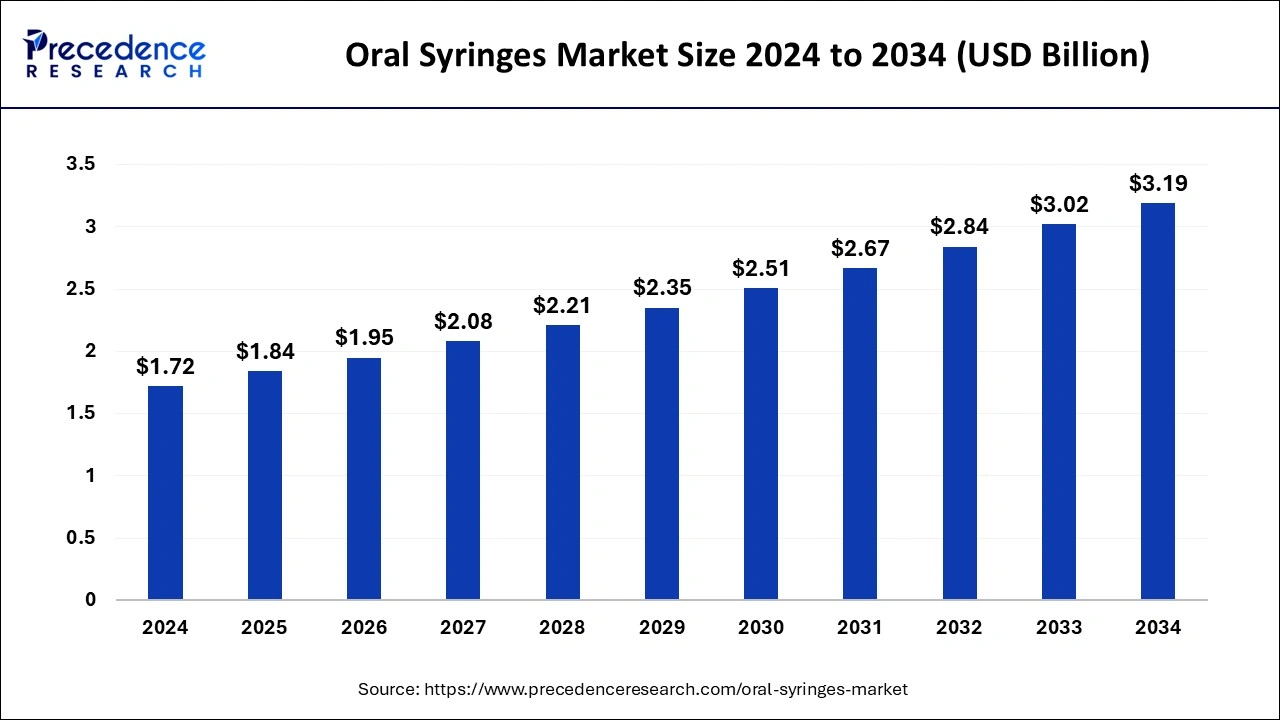

The global oral syringes market size is accounted at USD 1.84 billion in 2025 and is forecasted to hit around USD 3.19 billion by 2034, representing a CAGR of 6.37% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oral syringes market size was calculated at USD 1.72 billion in 2024 and is predicted to increase from USD 1.84 billion in 2025 to approximately USD 3.19 billion by 2034, expanding at a CAGR of 6.37% from 2025 to 2034. The development of disposable oral syringes could be an opportunity to the growth of the market.

The oral syringes market refers to an oral syringe as a measuring tool that is useful for precisely measuring liquid pharmaceutical dosages expressed in milliliters (ml). The oral syringes don’t have thread tips since the contents are squirted straight from the syringes into the mouth of the person or animal, eliminating the need for a needle or other devices to be screwed onto them. The oral syringes are marketed in various sizes, from 1ml to 10ml and larger. The most common sizes of oral syringes are 1ml, 2.5ml, 3ml, 5ml, and 10ml.

The oral syringes market is fragmented with multiple small-scale and large-scale players, such as Adelphi Healthcare Packaging, Schott AG, Gerresheimer AG, Becton, Dickinson and Company, West Pharmaceutical Services, Inc., DWK Life Sciences GmbH, Vetter Pharma International GmbH, Comar, LLC, Baxter International Inc., TOPAS Advanced Polymers, Inc., Dentsply Sirona, Septodont, Terumo Corporation, Merit Medical Systems, Inc., Plas-Tech Engineering, B. Braun Melsungen, Medtronic plc, Smiths Medical, Inc., NIPRO Corporation, Integra LifeSciences.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Market Size in 2025 | USD 1.84 Billion |

| Market Size in 2024 | USD 1.72 Billion |

| Market Size by 2034 | USD 3.19 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Capacity, Order Type, Sales Channel, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising pediatric population

The rising pediatric population may be the driving factor in the oral syringes market. The market for oral syringes has grown as a result of the increasing number of youngsters who frequently need precise and secure medicine administration, which oral syringes help with. As for administering medication to children, oral syringes are preferable because of their accurate dosage measurement, ease of use, and lower chance of spills as compared to alternative techniques. The need for oral syringes to satisfy the medical needs of children is growing along with the number of children.

As per a journal published by PubMed Central, the majority of children (87.5%) were familiar with oral syringes, yet administration of a different type of formulation (MPs) in an oral syringe was a new experience for both the children and their parents/caregivers.

Increasing incidence of chronic diseases in the geriatric population

The increasing incidence of chronic diseases in the geriatric population boosts the oral syringes market. Chronic diseases are long-term diseases that can endure for years or even a lifetime. So, the increasing incidence of chronic disease in the geriatric population frequently results in trouble in swallowing pills or tablets. The administration of medication with oral syringes is made simpler and safer, which can boost the market.

Risk of contamination and infection

The risk of contamination and infection caused by oral syringes can slow down the oral syringes market. This is due to rising concerns about patient safety and hygiene. The contamination may occur due to the syringe not being cleaned after use, which results in the chances of infections.

Development of disposable oral syringes

The development of disposable oral syringes could be an opportunity for the growth of the oral syringes market. This is because disposable oral syringes resolve concerns about contamination and infection risk, and their development offers a chance to expand the oral syringes market. The disposable syringes provide a practical and hygienic option by guaranteeing that a fresh, sterile syringe is used for each dosage. This may boost customer acceptability and confidence, increasing the need for oral syringes and propelling the market's expansion. The disposable syringes can simplify healthcare procedures and may result in lower expenses for healthcare providers by eliminating the need for washing and sterilization.

The large-volume syringes segment dominated the oral syringes market by capacity in 2024. The dominance of volume syringes is because they make it easier to measure and deliver medication accurately, especially for a patient who requires higher dosages or for caretakers managing several prescriptions. Large-capacity syringes are the market leader in oral syringes. In addition, they are preferred in a variety of healthcare settings since they frequently have features like measurement markers and simple-to-use plungers.

The medium-volume syringes segment is expected to grow at the highest CAGR in the oral syringes market during the forecast period. The market for oral syringes is anticipated to expand as a result of the medium-volume syringe’s adaptability and compatibility with a variety of drugs and dosages. For many patients and caregivers, they offer the perfect compromise between the ease of use of big-volume syringes and the accuracy of volumes. Furthermore, advanced medium-capacity syringes could result from development in technology and materials, which would increase their commercial acceptance.

The over-the-counter (OTC) segment dominated the oral syringes market by order type in 2024. The market is dominated by over-the-counter (OTC) oral syringes, mainly because of their accessibility and simplicity. OTC products are easily acquired in pharmacies, supermarkets, and internet sellers since they are easily accessible to customers without a prescription. This extensive accessibility is a factor in their market dominance, which is partly attributed to their extensive availability. Furthermore, a wider range of consumers are frequently served by over-the-counter oral syringes, including those who might not have access to prescription drugs or who would rather self-medicate for mild illnesses. Consequently, over-the-counter oral syringes garner a substantial market share in contrast to prescription-only substitutes.

The institutional sales segment dominated the oral syringes market by sales channel in 2024. This is because institutional sales involve bulk purchases by healthcare facilities, which include hospitals and clinics; they frequently control the market. Because this institution treats a huge number of patients, they are in great demand, which gives suppliers bargaining strength and economies of scale. Institutional sales often place a high priority on safety, dependability, and standardized products, which may favor well-known suppliers and companies with a track record of success.

The retail sales segment is expected to grow at the highest CAGR in the market during the forecast period. This is because as consumers gain more knowledge about healthcare goods, they look for dosing alternatives that are accurate and convenient for both themselves and their families. The more retail sales drugs become available, the more customers need dependable and easy-to-use dosage tools like oral syringes, which are expected to grow the oral syringes market.

The dental procedures segment dominated the oral syringes market by application in 2023. Because dental operations frequently call for exact measurement and administration of drugs or solutions directly into the mouth cavity—a function that oral syringes are intended to enable—they dominate the oral syringe market. These operations involve the delivery of periodontal disease drugs, The application of fluoride treatments, the administration of local anesthetics, and more. Because they provide convenience, control, and accuracy, oral syringes are indispensable instruments in dentistry.

The post-surgery/critical care segment is expected to grow to the highest CAGR in the oral syringes market during the forecast period. Following surgery, dental care and the delivery of medications such as painkillers, antibiotics, and other treatments are common post-operative procedures. In particular, oral syringes are essential for precisely and comfortably administering these medications to individuals who may have restricted mouth sensitivity or mobility following surgery. The need for oral syringes to provide accurate and efficient medicine distribution is anticipated to increase as surgical techniques progress and post-operative care becomes more important, which will fuel the market's growth.

Asia Pacific dominated the oral syringes market by region in 2023. This is because so many people in the world reside in Asia-Pacific, and there is an increased need for medical supplies and equipment, such as oral syringes.

Asia Pacific economies are expanding, which is driving up the cost of healthcare. This fuels the need for cutting-edge medical equipment, such as oral syringes. The region is seeing an increase in the prevalence of chronic illnesses like diabetes and cardiovascular disease. Patients with these illnesses frequently receive medication by oral syringes, which fuels market expansion.

North America is expected to grow to the highest CAGR in the oral syringes market during the forecast period. The reasons behind this are the aging population, the rising need for oral drugs, improvements in healthcare infrastructure, and an increase in chronic diseases requiring exact dosage administration, which are driving the growth of the market in North America. Additionally, the growth of the market is also supported by the region’s growing pharmaceutical sector and increased healthcare spending.

By Capacity

By Order Type

By Sales Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

December 2024