July 2024

Orally Disintegrating Tablet Market (By Type: Anti-Psychotics Drug, Anti-Epileptics Drug, Others; By Application: CNS Disease, Gastrointestinal Disease, CVS Disease, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

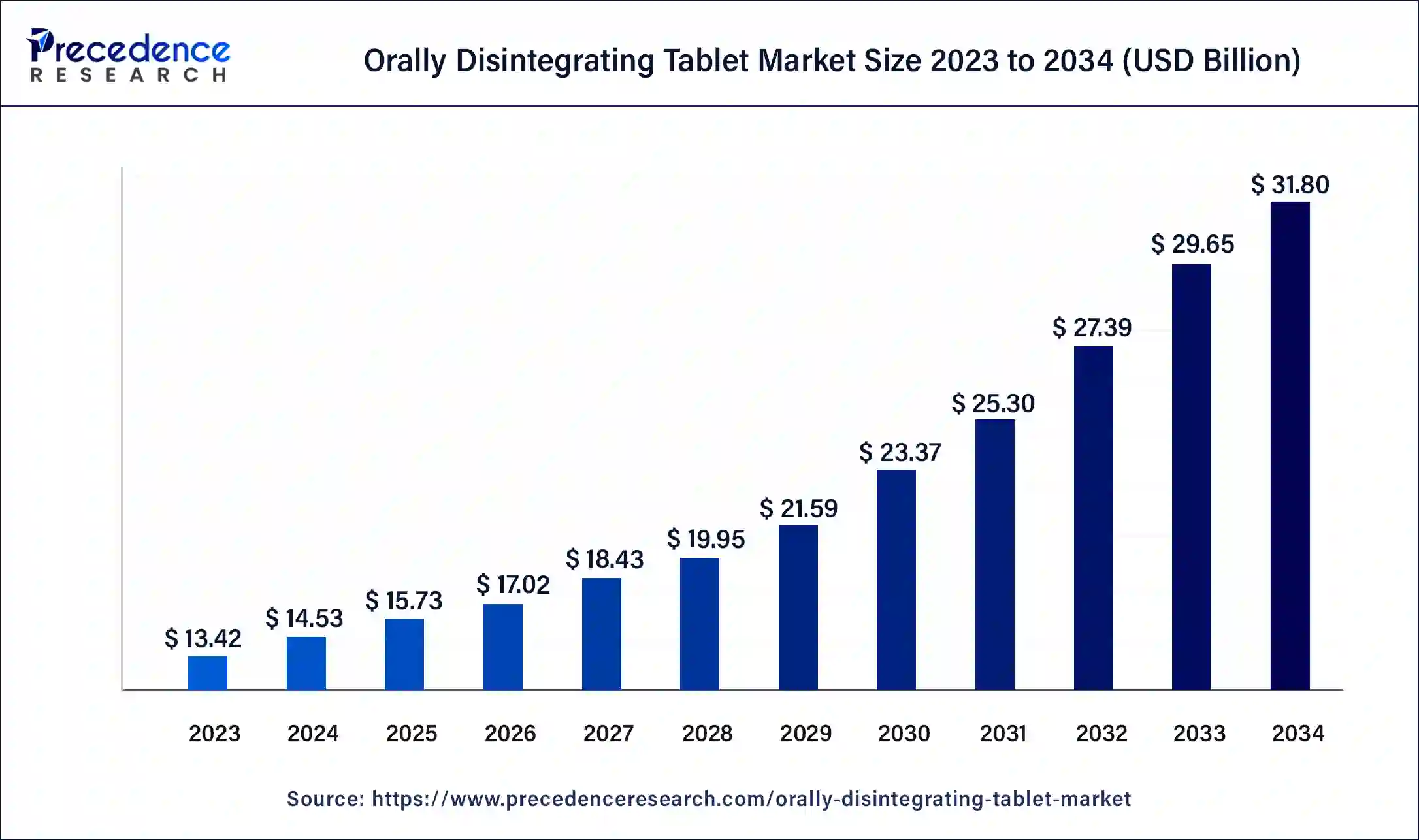

The global orally disintegrating tablet market size is estimated at USD 13.42 billion in 2024 and is anticipated to reach around USD 31.80 billion by 2034, growing at a CAGR of 8.1% from 2024 to 2034 Certain ODT formulations are intended to improve drug absorption in the body, increasing bioavailability and enhancing treatment outcomes.

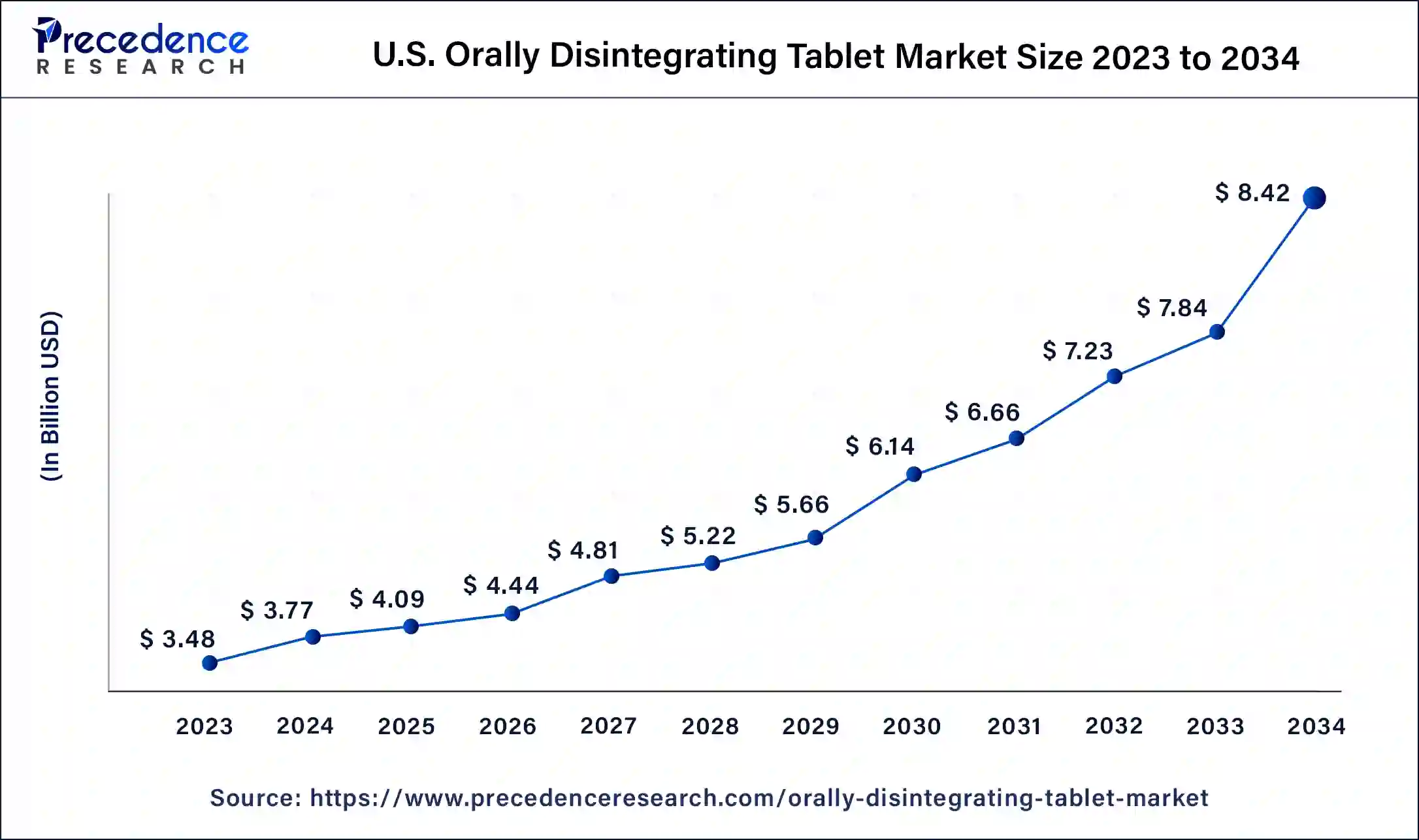

The U.S. orally disintegrating tablet market size reached USD 3.48 billion in 2023 and is expected to be worth around USD 8.42 billion by 2033 at a CAGR of 8.37% from 2024 to 2033.

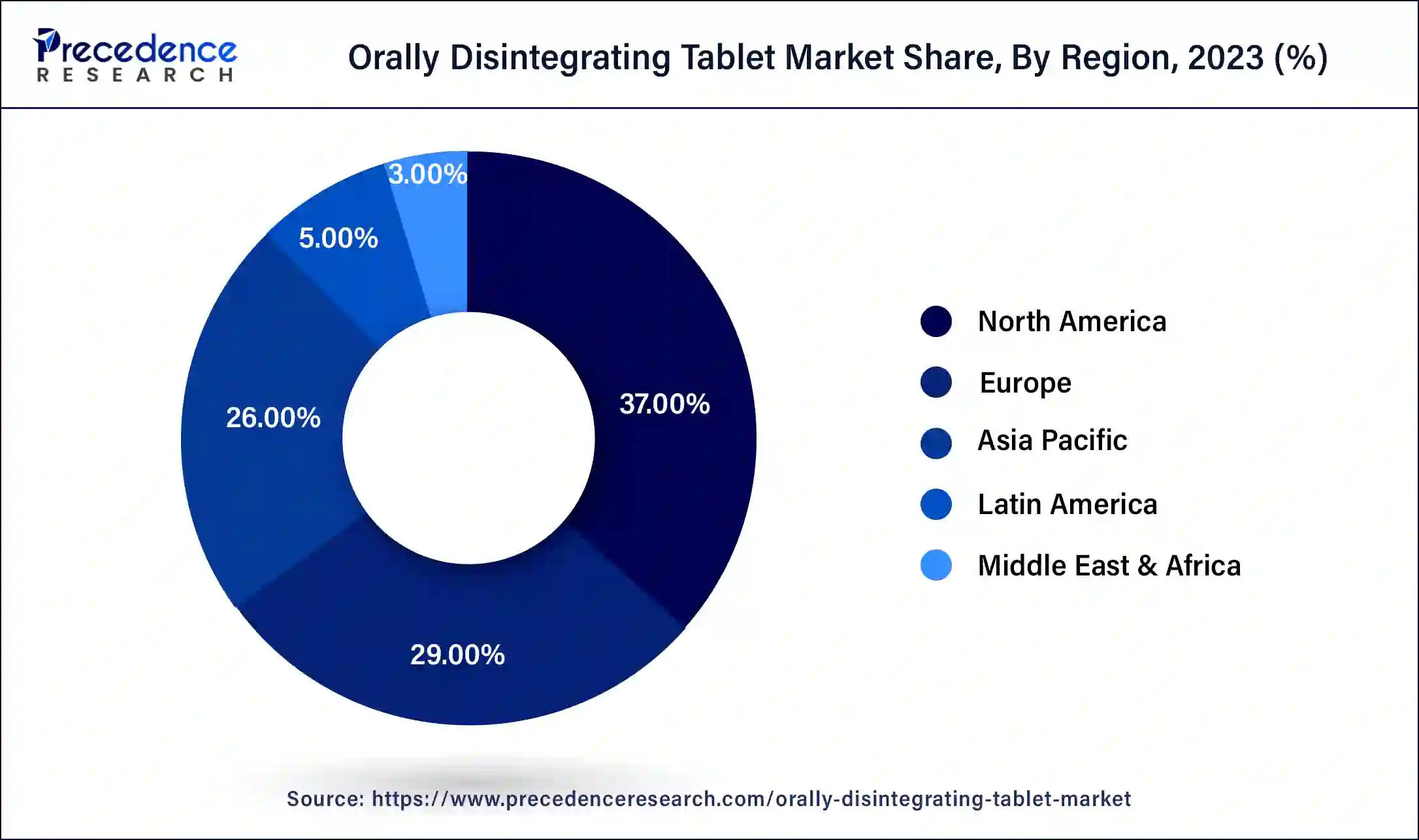

North America held the largest share of the global orally disintegrating tablet market. For people who have trouble swallowing regular tablets or capsules, ODTs are convenient. They are perfect for use while traveling because they dissolve quickly in the mouth without the need for water. In North America, the prevalence of long-term conditions like diabetes, heart disease, and problems of the central nervous system is rising. ODT formulations are increasingly common for drugs used to treat certain disorders.

Pharmaceutical companies are spending money on marketing and promotional campaigns to educate patients and healthcare professionals about ODTs and their advantages. Pharma firms have been encouraged to invest in this market segment by regulatory bodies like the FDA in the United States, which have supported the creation and approval of ODT formulations.

Asia Pacific is also expected to grow significantly during the forecast period. Convenient dose forms like ODTs are in greater demand as the prevalence of chronic ailments like diabetes, cardiovascular disease, and neurological disorders rises in Asia Pacific nations. More and more patients are looking for handy and easy-to-take drugs. Especially for older and pediatric patients, ODTs can increase drug adherence and provide a more convenient option to traditional tablets.

The pharmaceutical industry is growing quickly in Asia Pacific, where both local and international businesses are investing in the creation and production of new drugs. The orally disintegrating tablet market in the area is expanding as a result of the growing emphasis on patient-centric healthcare solutions.

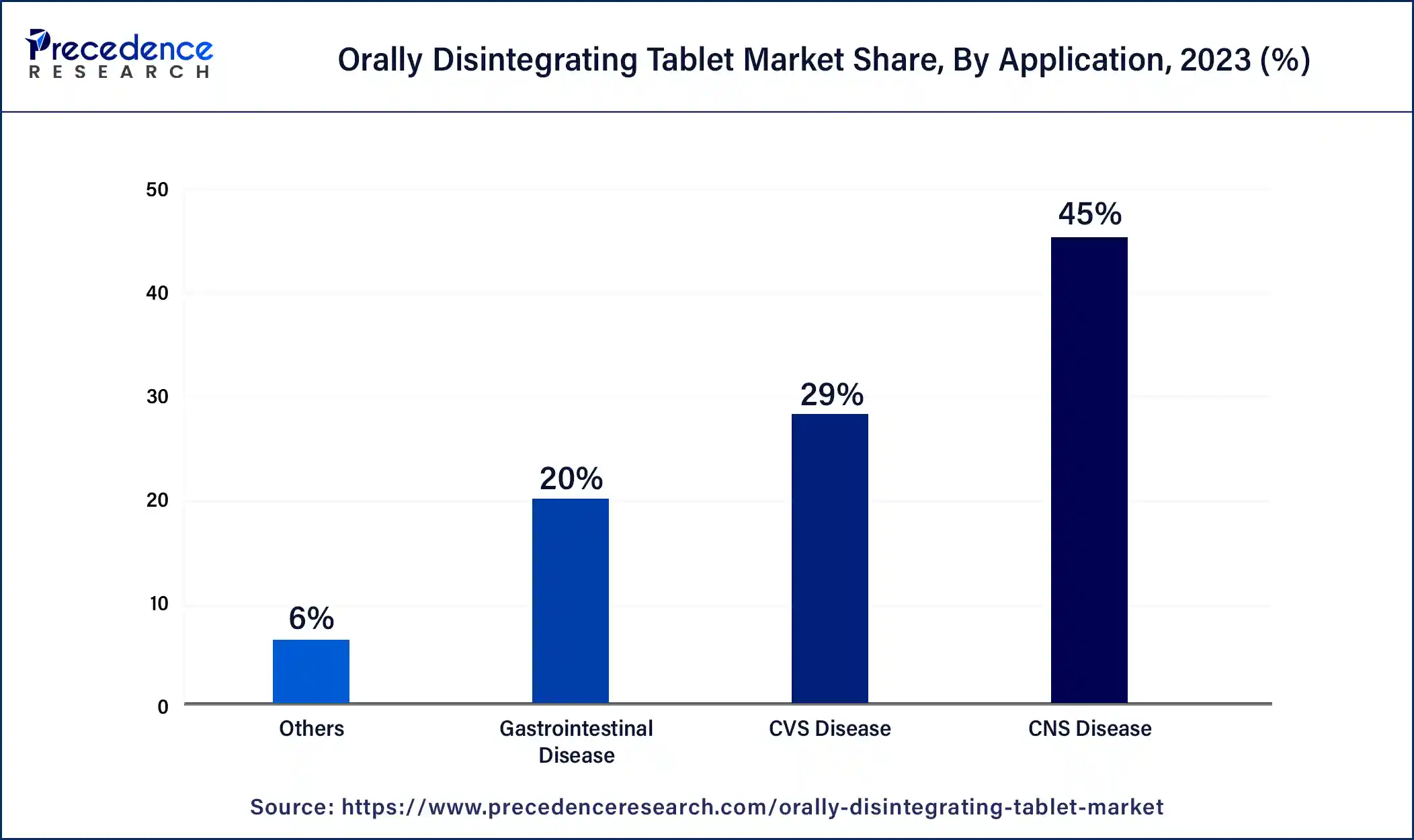

The need for patient-friendly dosage forms is expanding, and developments in formulation technologies have contributed to the steady growth of the orally disintegrating tablet market market. The market's growth has been significantly fueled by orally disintegrating tablet’s (ODT) convenience factor. ODTs are accessible for use in a number of therapeutic areas, such as gastrointestinal illnesses, allergies, cardiovascular diseases, and disorders of the central nervous system.

ODT formulations can be used for a variety of medical issues due to their adaptability. The goal of ongoing research and development is to enhance ODT formulations' taste, stability, and bioavailability. The orally disintegrating tablet market is growing as a result of advancements in formulation technologies, such as novel excipients and taste-masking strategies.

Regulatory organizations like the EMA in Europe and the FDA in the United States provide rules for the creation and approval of ODT products. Adherence to regulatory norms is essential for both market penetration and business prosperity. Regional differences can be seen in the ODT market's size, growth rates, and regulatory environments. Although historically, the two largest markets for ODTs have been North America and Europe, emerging markets in Asia Pacific and Latin America are attracting more attention and have the potential to grow.

The orally disintegrating tablet market is becoming more competitive as businesses look to set themselves apart from the competition with creative product formulations, strong branding, and tactical alliances. Competitive positioning also heavily depends on pricing policies and marketing initiatives.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.1% |

| Global Market Size in 2023 | USD 13.42 Billion |

| Global Market Size in 2024 | USD 14.53 Billion |

| Global Market Size by 2034 | USD 31.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Diverse therapeutic applications

ODTs are frequently prescribed drugs for illnesses like depression, bipolar disorder, schizophrenia, and epilepsy. ODTs are favored because patients with certain illnesses could have trouble swallowing tablets. ODTs can be used to administer bronchodilators and antihistamines, which can help treat respiratory disorders like asthma and allergic responses quickly.

For quick pain treatment, ODTs can be made with opioids, acetaminophen, or analgesics like ibuprofen. Patients who are unable to swallow or take regular medications because of pain or nausea will find them especially helpful. When using medication for gastrointestinal disorders like nausea, vomiting, and acid reflux, ODTs can be helpful. ODTs offer a practical substitute for patients who may have trouble swallowing medications due to these symptoms.

Limited drug compatibility

Due to the use of excipients in the tablet matrix, high temperatures, or the presence of moisture, certain medications may deteriorate quickly in the formulation of ODTs. This reduces the variety of medications that can be combined to create ODTs. In order to increase patient compliance, many medications have unpleasant or bitter tastes that need to be covered up in ODT formulations.

It is not possible to synthesize a wide variety of medications into over-the-counter formulations because of the limitations of taste-masking procedures. The drug substance's volume and concentration in the formulation may also have an impact on how well it works with ODTs. It can be difficult to manufacture some medications into tiny, quickly dissolving tablets because they have limited solubility or may require high dosages. This inhibits the growth of the orally disintegrating tablet market.

Patent expirations and generic competition

The price of ODTs usually decreases significantly when generic competitors enter the market. Because generic medications are typically less expensive than name-brand ones, both individuals and healthcare systems may benefit financially from using them. Patients who previously might not have been able to purchase the name-brand version now have easier access to ODTs thanks to lower prices. Better health outcomes and increased medication adherence may result from this. Because generic competition raises consumer knowledge and acceptance of the drug, it can also increase the size of the orally disintegrating tablet market overall. As a result, more people might receive ODT prescriptions for their ailments.

The anti-psychotics drug segment held the largest share of the orally disintegrating tablet market in 2023 and is expected to grow significantly during the forecast period. When combined with other drugs, the antipsychotic drug aripiprazole is used to treat depression, bipolar disorder, and schizophrenia. Patients who have trouble swallowing pills can find it easier to take because it comes in several forms, such as ODT. Another antipsychotic drug that is frequently used to treat bipolar disorder and schizophrenia is olanzapine.

An antipsychotic called quetiapine is used to treat major depressive disorder, bipolar disorder, and schizophrenia. Patients who might prefer or need a quick-dissolve alternative might have it with its ODT formulation. For schizophrenia that is not responding to treatment, clozapine is usually administered. Although less prevalent, ODT formulations tailored to certain patient needs or preferences might exist.

The anti-epileptics drug segment is expected to expand rapidly during the forecast period. Patients who have trouble swallowing regular tablets or capsules now have a simple choice in oral disintegrating tablets (ODTs). Easy-to-administer formulations of anti-epileptic medications (AEDs) are in high demand, particularly for patients who may have difficulty swallowing due to seizures or other problems.

An AED called lamotrigine is used to treat bipolar disorder and epilepsy. For patients who might have trouble swallowing, its oral disintegrating tablet formulation offers simplicity and ease of administration. Another AED that has been made into orally disintegrating tablets is levetiracetam. Its wide range of action and low number of drug interactions make it a popular choice for treating epilepsy.

The CNS disease segment dominated the global orally disintegrating tablet market. Diseases affecting the brain and spinal cord that fall under the category of central nervous system (CNS) disorders include neurological illnesses, mental disorders, and neurodegenerative diseases. There is a great deal of interest in creating ODT formulations for CNS drugs to increase patient compliance and outcomes. Patients with central nervous system disorders frequently need ongoing pharmaceutical therapy.

Because ODTs come in a handy dose form that doesn't require water, patients with cognitive or motor impairments may find them especially helpful. Those with CNS illnesses who are old or children may find it difficult to swallow regular tablets or capsules. With their ability to improve drug adherence and lower the danger of aspiration or choking, ODTs provide a useful alternative for these groups.

The gastrointestinal diseases segment is expected to gain a significant share during the forecast period. The ease of administration of ODTs is one of its main advantages, especially for patients with GI problems who can have esophageal difficulties or difficulty swallowing. In GI disorders like gastroesophageal reflux disease (GERD), where fast-acting drugs are frequently required to relieve heartburn and acid reflux symptoms, ODTs can be useful in treating symptoms.

Additionally, ODTs can be helpful in the management of nausea and vomiting related to a variety of GI illnesses, such as motion sickness, gastroparesis, and chemotherapy-induced nausea and vomiting (CINV). Pharmaceuticals have advanced significantly with the introduction of orally disintegrating tablets (ODTs), especially for patients who might have trouble swallowing conventional tablets or capsules.

Segment Covered in the Market

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024