September 2024

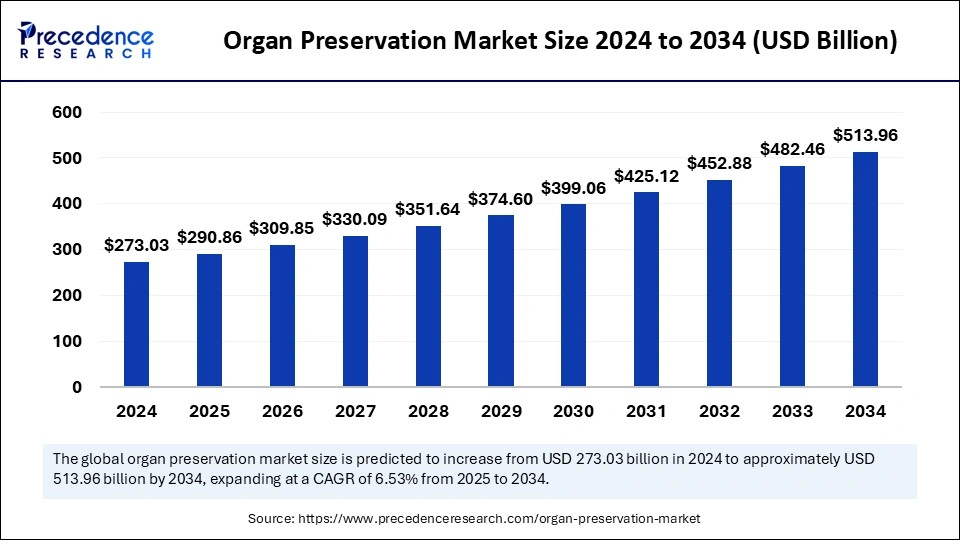

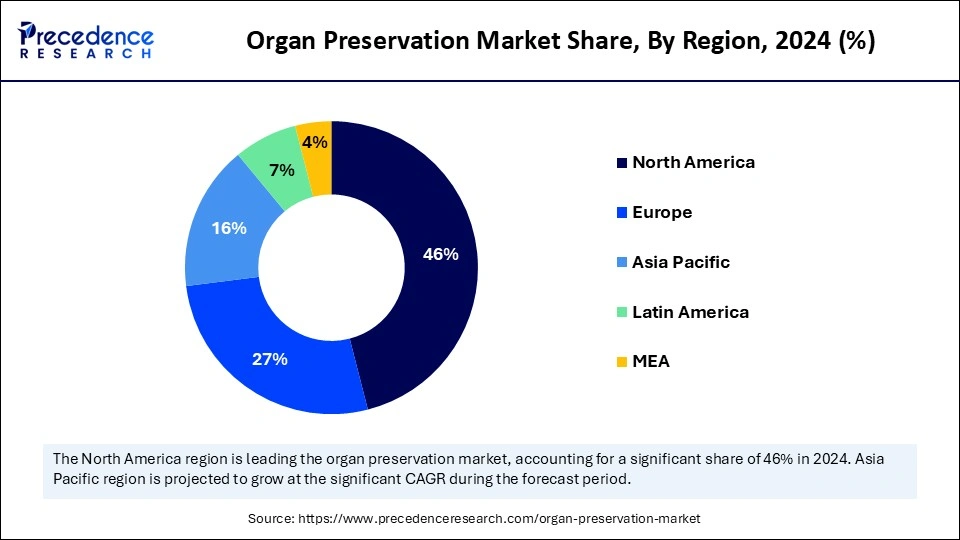

The global organ preservation market size is calculated at USD 290.86 billion in 2025 and is forecasted to reach around USD 513.96 billion by 2034, accelerating at a CAGR of 6.53% from 2025 to 2034. The North America market size surpassed USD 125.59 billion in 2024 and is expanding at a CAGR of 6.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global organ preservation market size was estimated at USD 273.03 billion in 2024 and is predicted to increase from USD 290.86 billion in 2025 to approximately USD 513.96 billion by 2034, expanding at a CAGR of 6.53% from 2025 to 2034. Rising government initiatives to support organ donation programs and advancements in technology drive the organ preservation market.

The integration of artificial intelligence and machine learning algorithms into organ preservation systems creates immense opportunities to manage organ rejection challenges and improve the efficiency and effectiveness of the transplant process. They analyze real-time data from organ preservation systems and optimize parameters like oxygen and temperature levels to enhance the viability of organs and reduce damage during transportation and preservation. AI algorithms can analyze patient data and increase organ compatibility during transplantation. They determine which organs benefit from the perfusion system and which may not be suitable for donation. Overall, AI optimizes organ preservation and transplantation processes by predicting the possibility of organ damage.

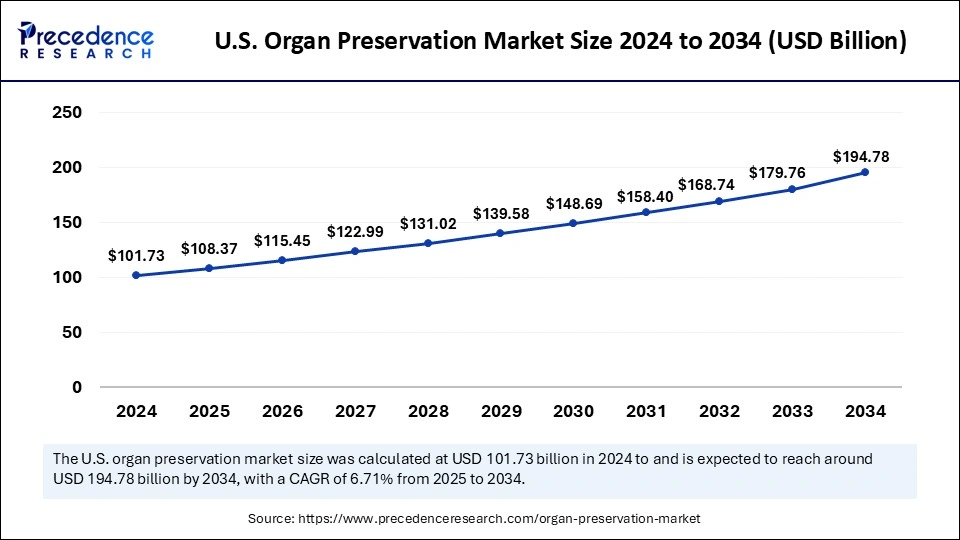

The U.S. organ preservation market size was exhibited at USD 101.73 billion in 2024 and is projected to be worth around USD 194.78 billion by 2034, growing at a CAGR of 6.71% from 2025 to 2034.

North America dominated the organ preservation market with the largest share in 2024. This is mainly due to the increased support from the federal government for organ preservation and transplantation. For instance, in August 2024, the Health Resources and Services Administration (HRSA) announced that for the first time in the 40-year history of the Organ Procurement and Transplantation Network (OPTN), the OPTN Board of Directors, the governing Board that develops national organ allocation policy, is now discretely incorporated and independent from the Board of long-time OPTN contractor, the United Network for Organ Sharing (UNOS). High organ donation and transplantation rates in North America are due to the increasing prevalence of chronic diseases, the aging population, and rising traumatic injury from motor vehicles.

In the U.S., there is a rapid development of novel preservation technologies for donor organs. In addition, the increased number of organ transplant procedures supported regional dominance. There were about 46,632 organ transplants performed by both living and deceased donors in 2023. This shows an 8.7% increase over 2022 and a 12.7% increase over 2021. This region is at the forefront of advanced healthcare facilities due to the strong presence of sophisticated healthcare technologies, contributing to regional market growth.

Asia Pacific is expected to witness the fastest growth in the coming years. The rising health awareness leads to increased demand for healthcare services, pressuring regional governments to increase funding to improve the healthcare system. The rising prevalence of chronic diseases and the growing aging population contribute to organ preservation market expansion. Governments of various Asian countries are launching programs to support organ donation and transplantation. For instance, India’s Transplantation of Human Organs & Tissues Act (THOTA) regulates the storage and transplantation of human organs and tissues for therapeutic purposes and for the prevention of commercial dealings in human organs and tissues.

The organ preservation market comprises products, technologies, and services used to preserve organs for extended period for transplantation. The market is experiencing rapid growth due to the rising demand for organ donation. People are becoming more aware of organ donation. Many health organizations are launching campaigns to spread awareness and acceptance of organ donation, leading to a large availability of donor organs.

The growing burden of chronic diseases worldwide is also contributing to market growth since some chronic diseases like diabetes, chronic kidney disease (CKD), and cancer lead to organ failure. As organ failure cases continue to increase due to chronic diseases, serious infectious diseases, and traumatic disorders, the demand for organ donation also increases, and so does the need for efficient preservation solutions. Moreover, governments worldwide are making efforts to improve organ preservation, supporting the market's growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 513.96 Billion |

| Market Size in 2025 | USD 290.86 Billion |

| Market Size in 2024 | USD 273.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Organ Type, Preservation Technique and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Government Initiatives

The rise in government initiatives to promote organ donation and transplantation drives the growth of the organ preservation market. Governments worldwide are implementing policies and providing funding to improve infrastructure for organ preservation. Higher funding allocations improve organizational facilities, transportation systems, and maintenance techniques, while regulatory reform streamlines legal frameworks to increase donor registration, approval processes, and participation. Governments worldwide are also launching programs, such as the National Organ Transplant Programme, Ayushman Bharat, Rashtriya Arogya Nidhi, and other state-specific schemes, to promote organ donation so that a large number of organs are made available for the treatment of patients suffering from the last stage of organ failure.

Governments of various nations are also launching training programs for surgeons and other healthcare professionals on organ preservation techniques. By providing specialized training, governments contribute to the development of a skilled workforce capable of handling delicate organs to improve transplant outcomes and address critical supply gaps.

For instance, in 2023, the Department of Health and Social Care, a ministerial department of the Government of the U.K., established an Organ Utilisation Group to collect and analyze evidence regarding the organ transplantation care pathway, make recommendations on how to reduce inequity of access and drive innovation in organ transplantation. The Organ Utilisation Group works together with colleagues from across the transplant community.

High Cost

High costs associated with organ preservation technologies hamper the growth of the organ preservation market. Since organ preservation systems are expensive, not every facility can afford them, especially those with budget constraints. These techniques are complex and require a skilled workforce to handle them, as even a slight change in parameters can cause organ damage. Therefore, the shortage of skilled workforce also hinders market growth. In addition, the shortage of available donor organs affects the market growth.

Advances in Preservation Techniques

Advancements in cryopreservation technology create lucrative opportunities in the organ preservation market by improving long-term storage and transportation efficiency. Innovations in preservation technologies are extending the viability of organs, leading to an increase in the number of successful transplants. The development of cryoprotectants enhances the success of cells, tissue, and organ preservation and ensures the viability of transplantation. Cryopreservation supports banking cells for human leukocyte antigen typing for organ transplantation. Advances in preservation technologies, such as static cold storage, organ machine perfusion, and cryobiology, are optimizing preservation conditions.

Furthermore, robotic systems, such as the Da Vinci surgical system, reduce complications and allow for complex surgeries with faster recovery. The recent advancements in portable organ preservation oxygenated machine perfusion devices extend the allowable preservation time, improving organ viability and expanding donor organ utilization. These modern systems actively perfuse organs with a cold, oxygenated solution, permitting the preservation of donor organs and enabling longer-distance transportation without compromising the viability of the organs.

The University of Wisconsin (UW) segment dominated the organ preservation market with the largest share in 2024. This solution has gained immense popularity due to its improved physiological function for organs compared to other solutions, which is a key factor that supported the segment’s dominance. UW provides excellent preservation solutions for kidneys and liver. UW preservation allows longer and safer storage of the kidneys (2 days) and liver (18 hours), with higher graft survival rates and a lower damage rate.

The perfadex segment is likely to expand at the highest CAGR during the projection period, as perfadex is the gold standard for lung preservation. This solution reduces the chances of organ damage. It has become a predominant maintenance solution for use in endothelium-rich organs.

The static cold storage segment accounted for the largest market share in 2024. This is mainly due to the increased adoption of this technique due to its ability to induce hypothermia, which reduces the kinetics of metabolic activities in organs. This technique also provides a simple and effective way to preserve and transport organs. Static cold storage is a cheaper alternative to other methods.

The normothermic machine perfusion segment is projected to expand at the fastest rate in the coming years. Normothermic sanguineous oxygenated perfusion is a superior preservation method compared to simple cooling of UW solutions. Furthermore, perfusion assesses the graft's vitality before organ transplantation.

The kidney segment dominated the organ preservation market by capturing the largest share in 2024. This is mainly due to the increased number of kidney transplants as a result of the increased number of cases of CKD. Kidney transplants extend and improve the lifespan of people with kidney disease in the final stages. Most patients enjoy a better quality of life, no longer need dialysis, and have higher energy levels and easier work and travel after the kidney transplantation.

The heart segment is expected to grow at the fastest rate during the forecast period. The growth of segment can be attributed to the rising prevalence of heart diseases. Some heart diseases like advanced heart failure, arrhythmia, and cardiomyopathy require heart transplants.

By Solution

By Organ Type

By Preservation Technique

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025