January 2025

The global organic waste management solution market size is calculated at USD 19 billion in 2025 and is forecasted to reach around USD 37.70 billion by 2034, accelerating at a CAGR of 7.91% from 2025 to 2034. The North America market size surpassed USD 6.87 billion in 2024 and is expanding at a CAGR of 8.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global organic waste management solution market size accounted for USD 17.61 billion in 2024 and is predicted to increase from USD 19 billion in 2025 to approximately USD 37.70 billion by 2034, expanding at a CAGR of 7.91% from 2025 to 2034. The international priority on sustainability has resulted in increasing demand for effective organic waste disposal solutions. It is driven by the implementation of circular economy business models and reduced landfill reliance. The market will grow with advancing composting and waste-to-energy technologies.

Artificial intelligence is transforming the organic waste management solution market by automating processes, streamlining operations, and enhancing resource recovery. AI-driven robots and machinery utilize computer vision to sort recyclable materials out of waste streams efficiently, while intelligent collection systems utilize AI algorithms to streamline waste collection routes and schedules. Predictive analytics enable waste management firms to study waste generation patterns, predict future requirements, and determine areas of improvement.

AI technologies also track food production, distribution, and consumption to reduce waste. AI helps make the waste management system more sustainable by increasing recycling rates, decreasing landfill waste, and offering insights for data-driven decision-making. AI-based intelligent bins streamline waste collection routes, and real-time monitoring ensures compliance and detects inefficiencies in processing plants. AI also improves waste-to-energy conversion through the analysis of waste compositions and lowering contamination during composting processes.

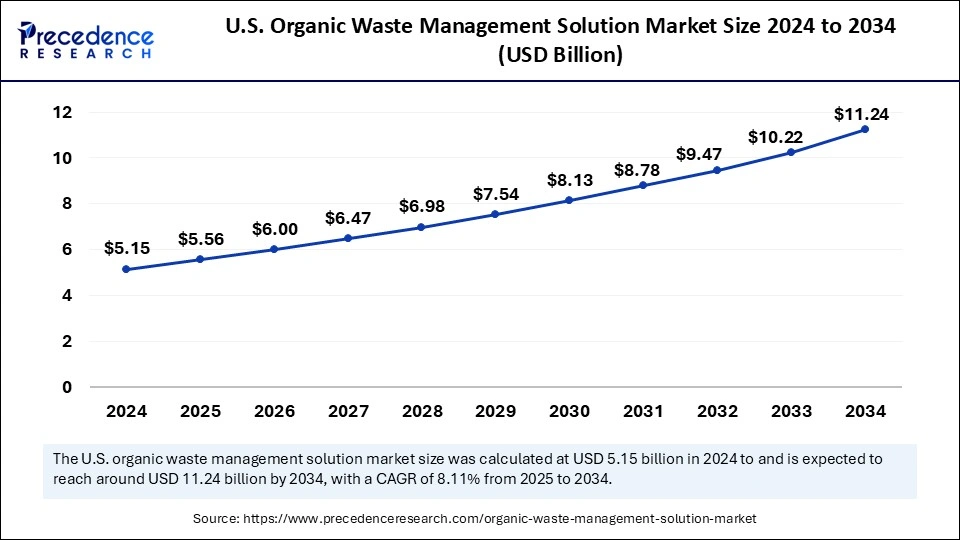

The U.S. organic waste management solution market size was exhibited at USD 5.15 billion in 2024 and is projected to be worth around USD 11.24 billion by 2034, growing at a CAGR of 8.11% from 2025 to 2034.

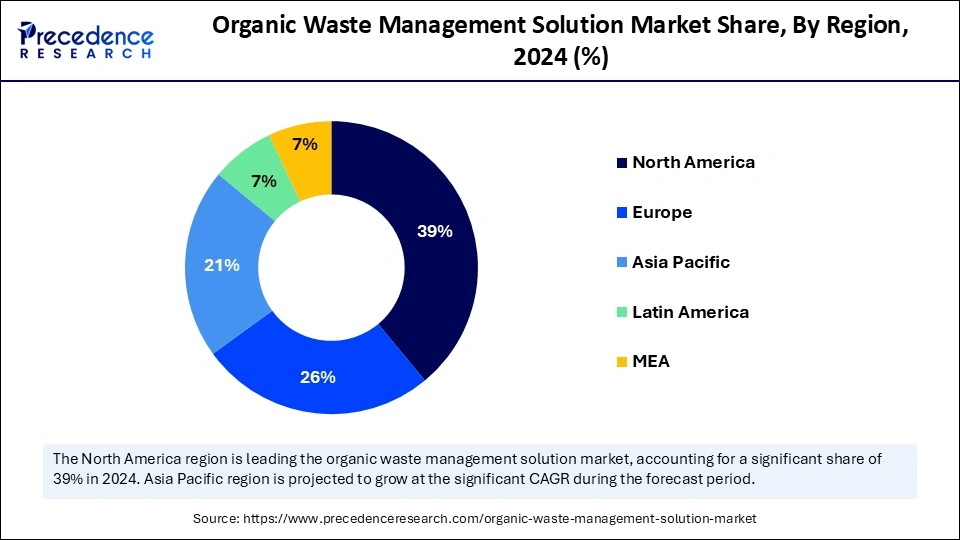

North America dominated the organic waste management solution market in 2024 due to its well-established waste management infrastructure and strict environmental regulations. Governments and regulatory agencies such as the EPA encourage organic waste recycling and composting to minimize landfill reliance and greenhouse gas emissions. Strong consumer awareness and extensive use of sustainable practices propel market growth. The sustainability of North America in waste management practices is exemplified through initiatives such as Edmonton and Alberta waste-to-energy plants.

North America leads due to advances in technology for waste treatment, large players in the market, and investments in new technologies. The dominant sectors, such as energy and agriculture, enjoy the emphasis placed on organic waste being transformed into useful products such as biogas and compost. The U.S. Department of Agriculture, FDA, and EPA initiated the National Strategy for Reducing Food Loss and Waste and Recycling Organics with the goal of cutting food wastage by 50% by 2030 and increasing organic recycling.

Europe is expected to host the fastest-growing organic waste management solution market during the forecast period of 2025 to 2034. This is due to the strict environmental regulations by the Union, including the Circular Economy Action Plan and Waste Framework Directive, which favor organic waste reduction, recycling, composting, and anaerobic digestion. These policies favor sophisticated waste management techniques, resulting in a high demand for innovative solutions.

Asia Pacific holds a significant presence in the organic waste management solution market globally, with its burgeoning urbanization and industrialization making it generate waste at a larger scale. Environmental regulations have also been put into place by economies such as China and India to alleviate waste management difficulties encouraging pioneering solutions such as smart waste management systems and energy from waste technologies.

Investments in waste management infrastructure and public-private partnerships are increasing waste management capacity, supported by increasing demand for sustainable practices. Governments are encouraging waste segregation, recycling, and composting to meet these challenges.

Asia Pacific is turning to waste-to-energy technologies such as biogas generation and anaerobic digestion to utilize organic waste as a renewable energy source. The region's increasing environmental consciousness and sophisticated waste treatment technologies place it at the forefront of the global market. Low labor and material costs facilitate the swift rollout of waste management infrastructure.

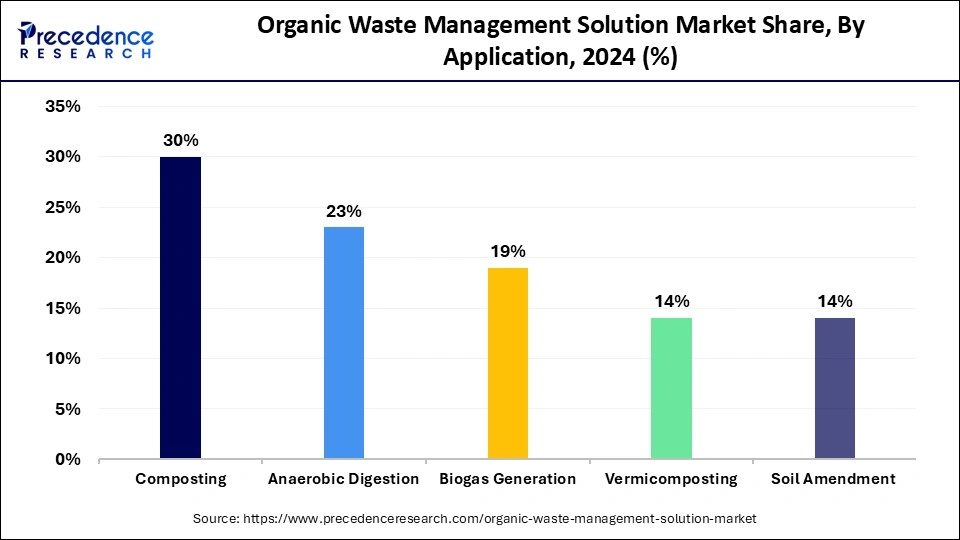

The organic waste management solution market is a worldwide market for systems, services, and technologies that are intended to process, recycle, and manage organic waste, such as food waste, agricultural residue, garden waste, and biodegradable municipal waste. The market encompasses techniques such as composting, anaerobic digestion, biogas production, and vermicomposting, which transform waste into useful resources such as biofertilizers, energy, and nutrient-rich soil amendments. The market is witnessing tremendous growth because of growing environmental issues and regulatory pressures.

The market provides economic advantages as organic waste can be processed into useful products such as biogas and biofertilizers, providing economic incentives for farmers and waste management companies. The solutions help minimize environmental pollution, ensure sustainable waste management practices, and recover valuable resources such as biogas, compost, and fertilizers. Organic waste management solutions such as composting, anaerobic digestion, incineration, and landfill diversion are becoming popular due to environmental consciousness, technology development, and government policies for global sustainability.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.70 Billion |

| Market Size in 2025 | USD 19 Billion |

| Market Size in 2024 | USD 17.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.91% |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Service Type, Application, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing focus on environmental sustainability

The key driver of the organic waste management solution market is the increasing focus on environmental sustainability fueled by strict government policies and regulations to minimize waste and reduce its environmental footprint. Increasing awareness of climate change, urbanization, and the need for resource recovery through circular economy efforts further drive demand for new-age waste management solutions. As public consciousness about sustainable practices increases and the economic value of waste-to-value technologies becomes more apparent, the market is set for explosive growth as industries and municipalities work to align with international sustainability objectives and regulatory compliance.

Inadequate infrastructure

The organic waste management solution market is severely challenged by poor infrastructure, such as waste sorting, collection, and processing facilities. This impedes effective waste treatment, raising environmental costs and lost economic opportunities. Proper infrastructure is essential for the upscaling of waste management operations, the integration of advanced technologies, and compliance with regulatory requirements. The lack of sound infrastructure constrains the potential of growth and, impinges the market on sustainable waste management measures' adoption and requires huge amounts of investment towards constructing and expanding waste management frameworks.

Waste-to-energy technology adoption

The market is set to experience tremendous growth with the use of waste-to-energy technologies. Anaerobic digestion and gasification are prominent technologies that transform organic waste into useful resources such as biogas and biofertilizers, minimizing landfill reliance and helping in sustainable energy production. This is in line with the global shift towards a circular economy providing both environmental and economic advantages.

Waste-to-energy technologies lower greenhouse gas emissions and generate renewable energy, which is vital as global energy needs grow. Governments are promoting waste management innovations, creating opportunities for firms to invest in these technologies and gain incentives and subsidies. Ongoing innovation in waste management technologies, including smart waste bins and AI recycling robots, increases efficiency and sustainability.

The organic waste bins segment led the global organic waste management solution market in 2024 because of its applicability across residential, commercial, and industrial segments. The bins allow for effective segregation of waste at the source, which is in line with international regulations encouraging sustainable waste management practices. Their cost-effectiveness, durability, and simplicity of use make them a popular option for households and businesses alike, leading to extensive adoption.

The composting systems segment will expand considerably over the forecast period of 2025 to 2034, fueled by rising demand for waste-to-compost solutions. The systems find extensive applications across industrial and domestic sectors to recycle organic waste as nutrient-rich compost. Growing recognition of the ecological advantages of composting, together with technological development, has supported their speedy growth.

The collection services segment held the highest organic waste management solution market share in 2024, collecting organic waste from different sources in a timely and efficient manner. They play a vital role in keeping the waste management process smooth, affecting waste processing, recycling, and disposal. Collection Services prevent waste accumulation, reduce environmental risks, and increase the efficiency of waste management systems. Governments and the private sector are investing in upgrading collection infrastructure to meet urbanization, increasing volumes of waste, and tighter regulations. Demand for professional, scalable, and sustainable collection services is fueling their market dominance.

The processing services segment will grow rapidly in the coming years, transforming organic waste into useful products such as compost, biogas, and biofertilizers. They minimize landfill reliance and tackle environmental issues. Improved technologies such as aerobic composting and anaerobic digestion improve their usage. Nevertheless, effective Collection Services are important to the seamless functionality of waste management systems since they guarantee the effective transformation of waste into useful resources.

The composting segment has the largest organic waste management solution market share in 2024 because of its effectiveness, low cost, and eco-friendliness. It turns organic waste into soil nutrient amendments, eliminates landfill waste and methane gas emissions, and aids in recycling nutrients. As urban areas expand, the use of compact composting machinery is implemented to ensure sustainable waste management practices. Composting assists in the promotion of circular economy concepts through nutrient recycling and lowered synthetic fertilizer demand. Its cost-saving nature makes it the first option for municipalities and farming communities. Favorable policy support and increased demand for organic production further drive the adoption of composting as an environmentally friendly waste management system.

The anaerobic digestion segment will show the highest CAGR in the forecast period of 2025 to 2034, providing environmentally friendly solutions to municipalities, industry, and agriculture. Anaerobic Digestion treats organic waste and turns it into biogas and nutrient-rich digestate, delivering energy and an organized strategy to manage waste. The development of Anaerobic Digestion is fuelled by government policies favoring renewable energy initiatives and investment in waste-to-energy facilities. UK start-up Dark Green revealed urban biogas production facilities in January 2025, showing its uptake for green waste management and renewable energy generation.

The residential segment dominated the organic waste management solution market with the highest share in 2024 because of its high rates of adoption of composting and organic recycling practices. This is caused by environmental consciousness and the need for green living. Composting is applied in recycling kitchen and garden waste, minimizing landfill waste and enhancing soil quality. Urban gardening activities also reinforce this trend, as compost is needed to enhance soil fertility and promote plant growth. Household composting bins and community-based programs are further driving this trend. Government incentives and regulations promoting the segregation of organic waste further fuel the adoption of composting. Increased awareness of the environmental effects of improper waste disposal reinforces the dominance of the residential sector.

The commercial segment will experience rapid growth in the forecast period of 2025 to 2034 because of strict regulations and efforts towards minimizing food waste. Companies, especially in the hotel industry, are embracing green practices to handle organic waste efficiently. This trend is prompted by increased recognition of the environmental advantages of good waste management, including minimizing landfill waste and creating renewable energy from techniques like anaerobic digestion and biogas production. The commercial market is rapidly growing due to its focus on corporate social responsibility and operational waste reduction.

By Product Type

By Service Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

October 2024

February 2025