January 2025

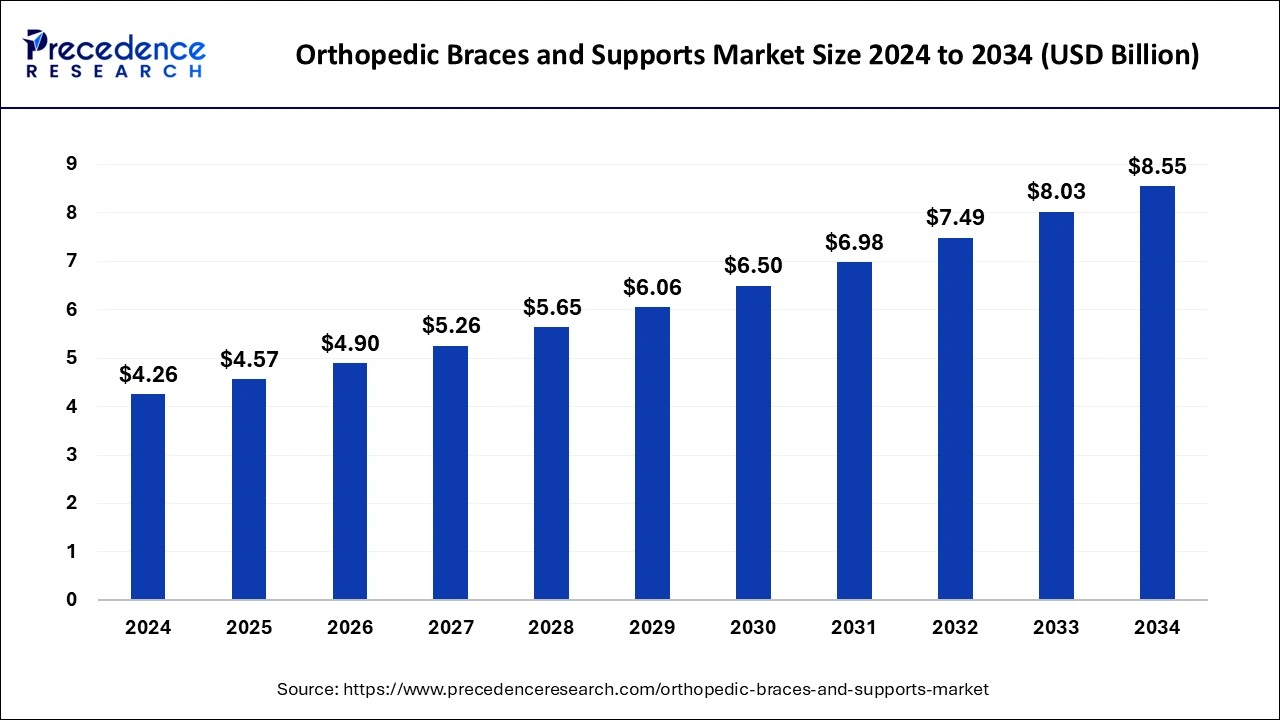

The global orthopedic braces and supports market size is calculated at USD 4.57 billion in 2025 and is forecasted to worth around USD 8.55 billion by 2034, accelerating at a CAGR of 7.22% from 2025 to 2034. The North America orthopedic braces and supports market size surpassed USD 1.79 billion in 2024 and is expanding at a CAGR of 7.25% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global orthopedic braces and supports market size was accounted for USD 4.26 billion in 2024, and is expected to reach around USD 8.55 billion by 2034, expanding at a CAGR of 7.22% from 2025 to 2034.

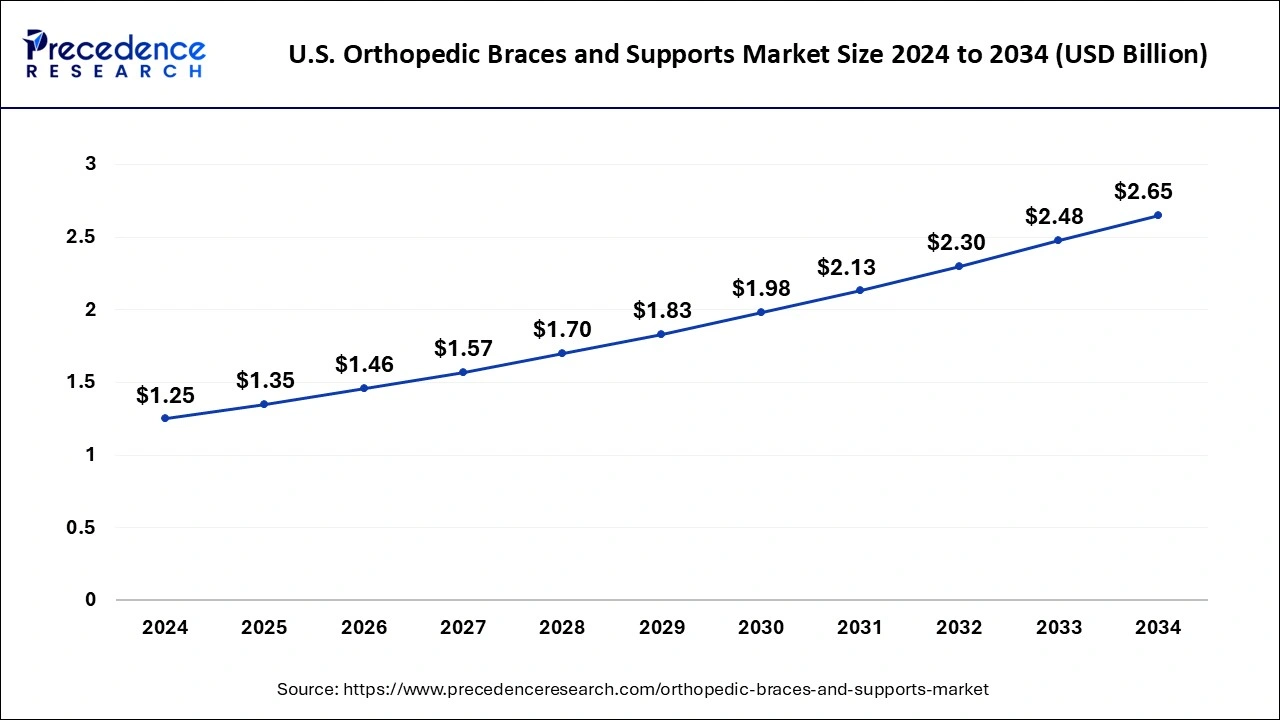

The U.S. orthopedic braces and supports market size was estimated at USD 1.25 billion in 2024 and is predicted to be worth around USD 2.65 billion by 2034, at a CAGR of 7.80% from 2025 to 2034.

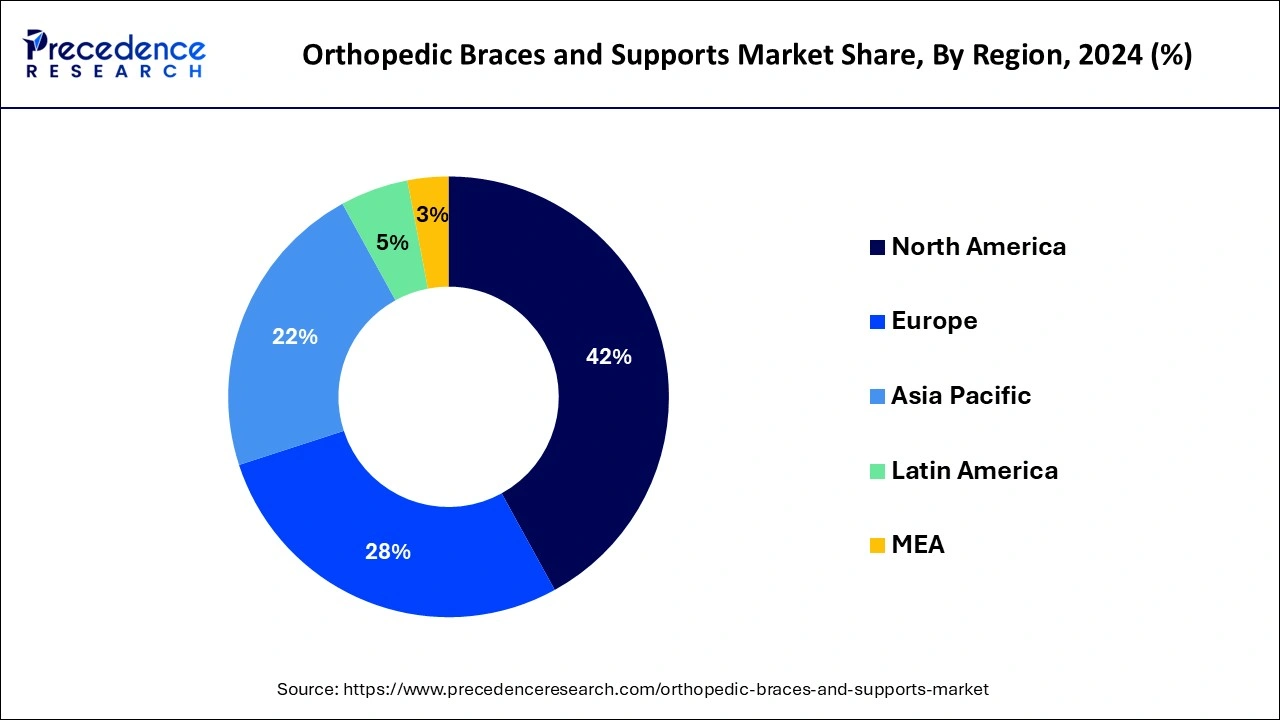

North America accounted revenue share of around 42% in 2024. This is due to the presence of key market players and technologically equipped hospitals in the U.S. and Canada. Europe held the second-highest market share after North America. This is owing to the rising aging population and prevalence of chronic disease in this region which in turn is leading to rising in the number of surgeries. According to the Federal Statistical Office, approximately 17.2 million surgeries were done in Germany in the year 2019, with spinal, intestinal, and hip implant surgeries, endoscopic, and others.

Asia-pacific is anticipated to be the fastest growing market during the forecast year. The demand for orthopedic braces and support in this region is rising due to the increasing geriatric and obese population along with the rising prevalence of orthopedic & diabetes-related diseases in this region and increasing healthcare expenditure in countries like India, China, Japan, and others.

The rising prevalence of orthopedic diseases and disorders, continuous commercialization of products, greater affordability of products and easy accessibility in the market, an increasing number of sports & accident-related injuries, and rising consumer awareness about preventive care and others are fueling the growth of orthopedic braces and supports market. Growing sales of online as well as off-the-shelf products, along with the development and promotion initiatives taken by the key market players, are likely to offer immense growth opportunities of growth for the market in terms of value sales.

Additionally, increasing amateur sports and activity levels, a growing geriatric population, and a rising number of elective orthopedic surgeries such as knee replacement and others are likely to propel the demand for high-end products including postoperative bracing solutions and unloader OA bracing products. The rising prevalence of osteoarthritis, the most common orthopedic ailment, is driving up the product demand in the market. It's the most prevalent type of arthritis, and it affects people of all ages.

According to The Centers for Disease Control and Prevention (CDC), about 78 million of U.S. adults above 18 years of age are likely to be diagnosed with arthritis by the year 2040.

The geriatric population is one of the largest contributors in accelerating the demand for orthopedic braces and supports in the market. Bones and connecting tissues, such as ligaments & cartilage, naturally become weak with age. This increases the chance of muscular injury, particularly in the knees and shoulders of the aging population.

The weakening of bones & tissues makes the joint's movement stiff, which risen the demand for braces and supports to enhance mobility. Sprains and tears of the anterior cruciate ligament (ACL) are also common among athletes who participate in high-demand sports including football, gymnastics, soccer, downhill skiing, and basketball. As the pandemic's movement restrictions were removed, incidences resulting from the potential consequence of detraining come out to be a major contributor to ACL injury.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.57 Billion |

| Market Size by 2034 | USD 8.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, End User, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By product, the braces & supports segment accounted largest revenue market share in 2024.

Knee braces and supports segment is expected to grow at the highest growth rate from 2025 to 2034 owing to the various benefits provided by the products which include medial & lateral support, minimized rotation of the knee, injury during motion, and protection against the post-surgical risk of injury.

Based on type, the orthopedic braces & supports market is divided into hard braces and supports, hinged braces and supports, and soft & elastic braces and supports. The soft & elastic braces and supports segment is anticipated to witness the highest growth rate during the forecast year. The increasing availability of improved products, increasing adoption & consumer preference for orthopedic braces in post-operative and preventive care, and supportive reimbursement scenario for the target products in the market are contributing towards the growth of the market in terms of value sales.

Based on application, the market is divided into ligament injury, preventive care, osteoarthritis, compression therapy, post-operative rehabilitation, and others. The ligament injury segment accounted for the highest market share in the year 2024. This is mainly attributable to the rising participation of individuals in sports & athletic activities, the rising number of accidents globally, and the increasing availability of medical reimbursement for ligament injuries which has increased the demand for orthopedic braces & supports in the market.

By Product

By Type

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

August 2024